Category Archive: 9a.) Real Investment Advice

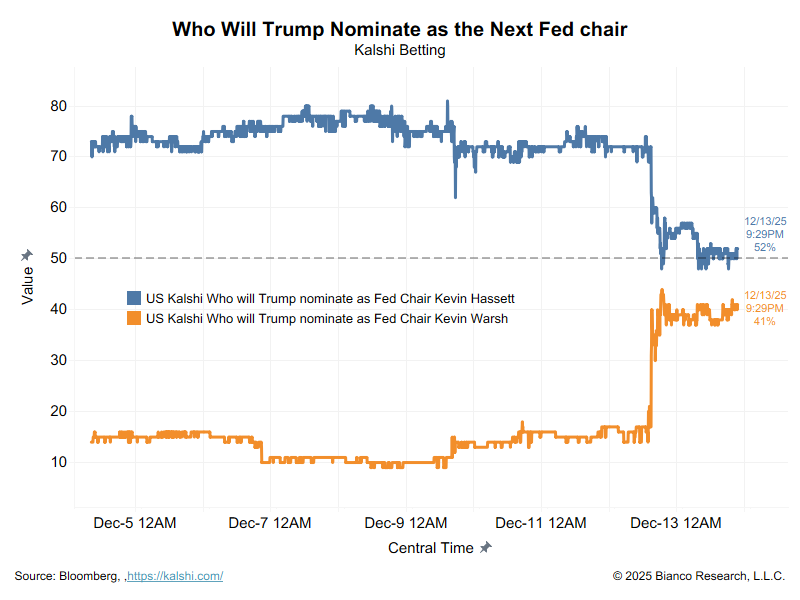

Warsh Is In The Race: Fed Chair Odds In Flux

Over the last few weeks, it seemed all but a done deal that Kevin Hassett would replace Jerome Powell as the next Fed Chair. That changed this past weekend as President Trump added Kevin Warsh alongside Hassett as his top Fed contenders. It's likely that there are a couple of factors leading Trump to add … Continue reading »

Read More »

Read More »

12-25-25 Christmas Day Q & A

Our Christmas Day Best-Of episode revisits some of the most important investing and financial planning discussions of the year.

Lance Roberts, Danny Ratliff, & Jonathan Penn examine whether the traditional 60/40 portfolio still serves its original purpose of reducing volatility, and what the three legs of investing mean in today’s market environment; whether the Federal Reserve has shifted away from its inflation mandate, how to interpret 2-...

Read More »

Read More »

1-2-26 Trump Accounts: Smart Planning or Marketing Hype?

“Trump Accounts” are being discussed as a new way to help children and young adults invest for the future—but are they a meaningful planning tool or simply clever branding?

Richard Rosso & Sarah Buenger break down how Trump Accounts are structured, how they differ from traditional retirement and custodial accounts, and why return assumptions deserve careful scrutiny. We also discuss funding mechanics, diversification considerations, and what...

Read More »

Read More »

Bull Market Genius Is A Dangerous Thing

During extended upward-trending markets that reward risk-takers and punish caution, everyone is a "bull market genius." That dynamic flips investor psychology and, over time, creates a false sense of control. As the market continues to climb, risk appears to vanish, and investors believe that nothing can go wrong, leading them to take on increasing levels …

Read More »

Read More »

SpaceX: A Financial And Strategic Windfall For Google

In 2015, Google wrote a $900 million check to SpaceX for a roughly 7.5% stake in Elon Musk's budding aerospace/rocket company. At the time, SpaceX was valued at $12 billion. Ten years later, Google’s early investment in SpaceX is now being framed as a great trade, not just because of the massive profit it will …

Read More »

Read More »

12-13-25 Why This Market Is One Disappointment Away From Trouble

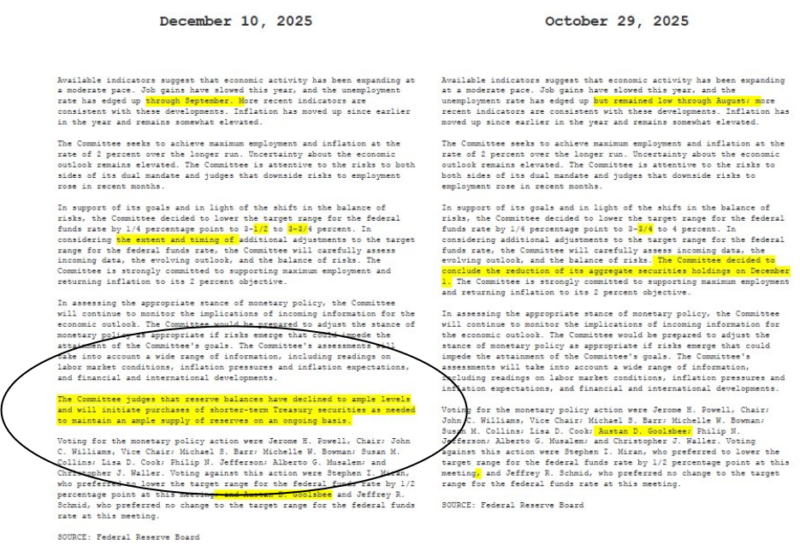

The Fed can call it reserve management purchases, but the mechanics are the same: they are adding liquidity, expanding the balance sheet, and supporting financial markets.

In this short video, Michael Lebowitz and I discuss why the terminology matters less than the market impact.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

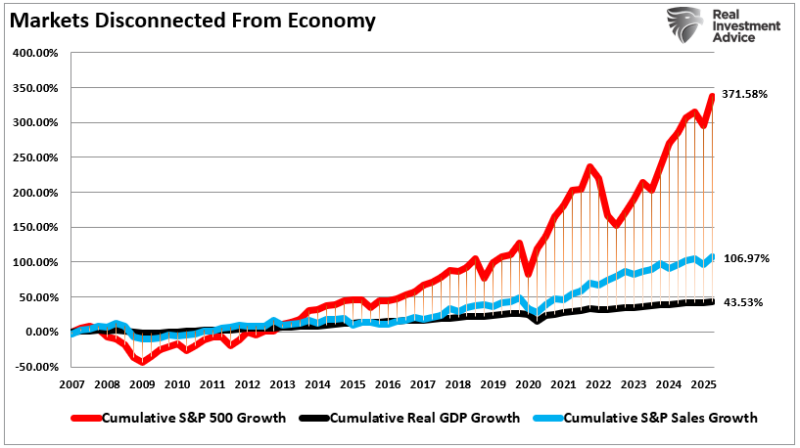

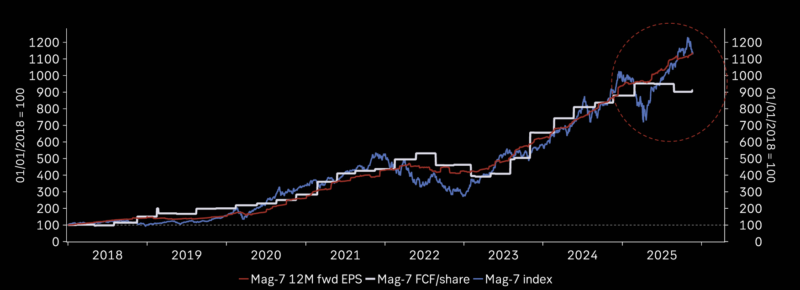

The “Double Bubble”

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

12-12-25 QE or Not QE? That Is the Question

The Fed can call it reserve management purchases, but the mechanics are the same: they are adding liquidity, expanding the balance sheet, and supporting financial markets.

In this short video, Michael Lebowitz and I discuss why the terminology matters less than the market impact.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-26-25 Legacy Conversations for the Holidays

The holidays bring families together—but they also create a rare opportunity to talk about something that truly matters: legacy.

Richard Rosso & Sarah Buenger explore how thoughtful, well-framed conversations about money, wishes, and values can become one of the greatest gifts you give your family. Research shows that nearly 70% of parents have never discussed inheritance with their children, often leaving confusion, conflict, or unresolved...

Read More »

Read More »

12-24-25 The Fed at a Crossroads – Joseph Wang Interview

The Federal Reserve is entering a pivotal phase, and the decisions it makes now will define the next era of monetary policy. Lance Roberts and The Fed Guy, Joseph Wang, examine the structural forces putting the Fed at a crossroads—from rate cuts and shifting labor-market dynamics to the long-term impact of AI, tariff-driven inflation, and changes in the Fed’s balance-sheet strategy.

We explore why markets appear bullish on economic growth despite...

Read More »

Read More »

12-12-25 Facing Your Financial Ghosts

Everyone has financial ghosts—old decisions, forgotten expenses, or long-ignored habits that creep back into the present and shape our financial lives. In this episode, we explore three practical strategies to tackle your financial ghosts, reduce money stress, and build a healthier long-term financial foundation.

Richard Rosso & Jonathan McCarty break down how to evaluate your household debt-to-income ratios, identify where spending silently...

Read More »

Read More »

Does AI Capex Spending Lead To Positive Outcomes?

As someone who views corporate finance through a pragmatic lens, I’ve been closely watching the current surge in capital expenditures (capex) tied to artificial intelligence (AI). The question I’m addressing here is this: when a company spends massive amounts of free cash flow and takes on increasing debt, in this case for AI CapEx, does …

Read More »

Read More »

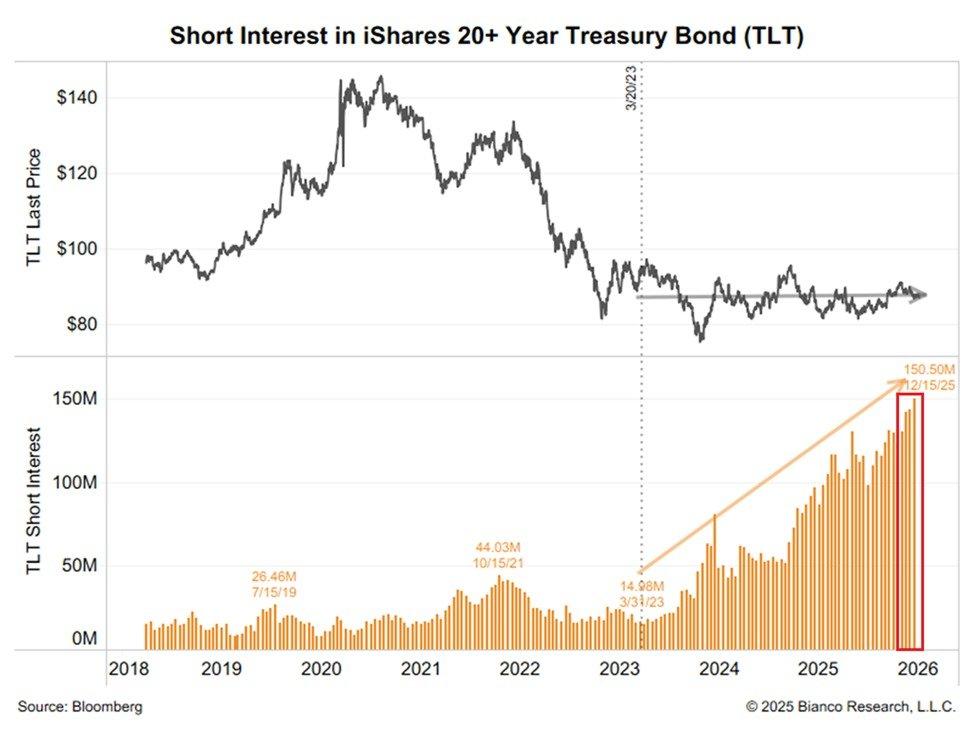

A Third Of US Debt Matures In 2026

We received the following question from a client: "I was at a conference where they showed that roughly a third of the currently existing US Government debt is set to mature in the next few years. How can we pay it back?" A third of the approximately $30 trillion in US Treasury debt equates to … Continue reading »

Read More »

Read More »

12-11-25 The Fed’s Surprising ‘Dovish Cut’ Explained

➢ Listen daily on Apple Podcasts: The Fed delivered a far more dovish cut than markets expected.

In this short video, Michael Lebowitz and I discuss why Powell’s tone shifted, what he revealed about jobs and inflation, and why this matters for markets now.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-11-25 Bifurcated Fed Cuts Rates: What’s Next?

The Federal Reserve cut rates by a quarter point Wednesday, but the real story is the division behind the decision. For the first time since 2021, three Fed governors dissented--an uncommon break in policy unity that raises new questions about inflation progress, economic risk, and the path of monetary policy into 2026.

Lance Roberts & Michael Lebowitz explain why the Fed cut now, what the dissent signals, and how a split vote may affect...

Read More »

Read More »

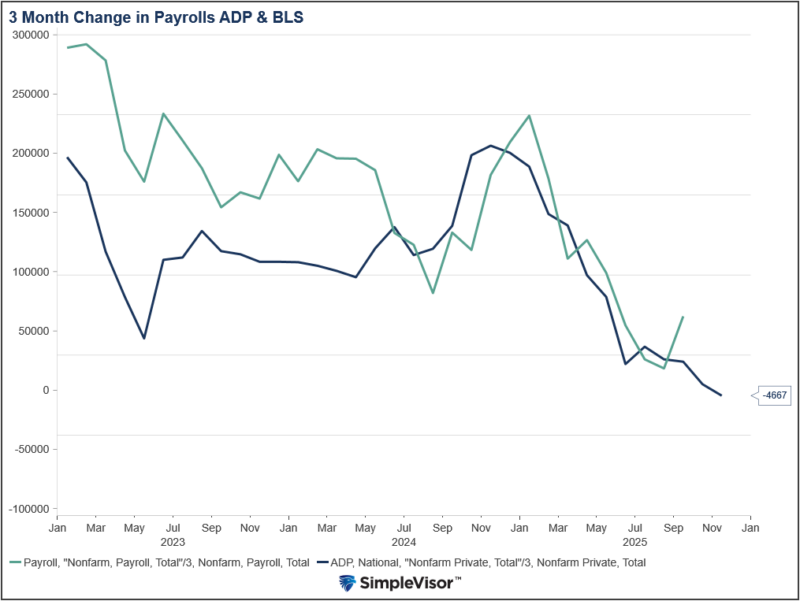

Hawkish Or Less Dovish? QE Or Not QE?

There is a growing divergence of views among FOMC members. Some remain dovish, favoring more rate cuts. Their argument is based on a belief that inflation will continue to move toward the 2% target and that the weakening labor market benefits from lower interest rates. On the other side of the aisle are hawkish views. … Continue reading...

Read More »

Read More »

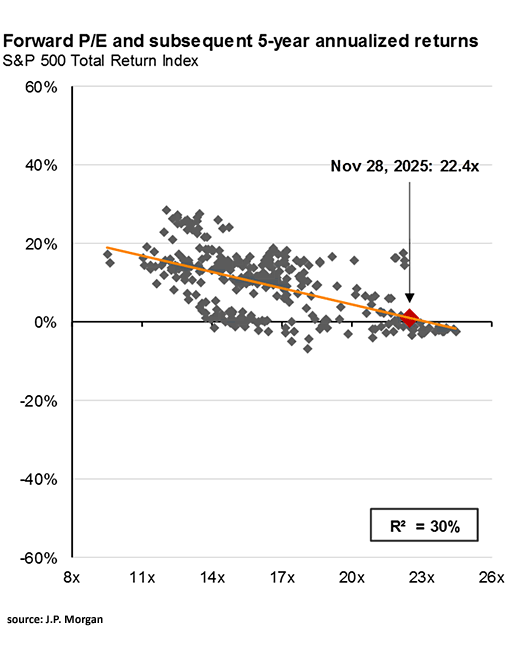

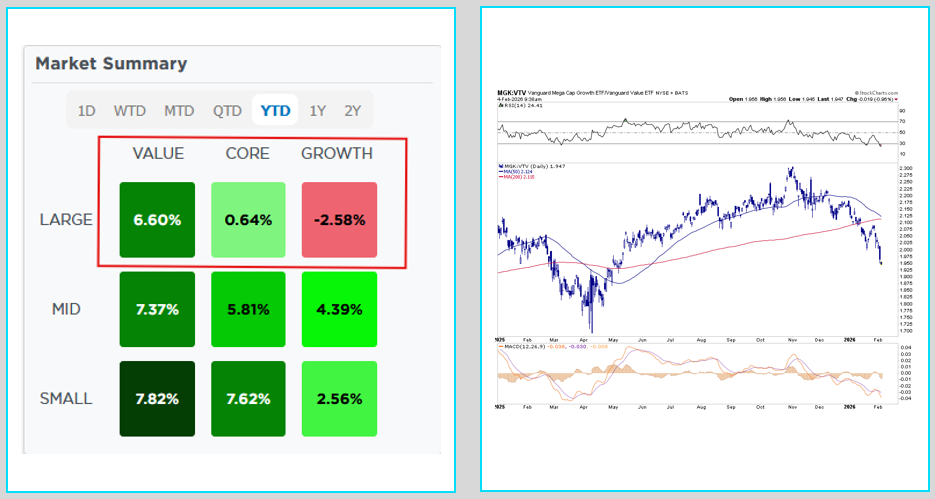

12-10-25 2026: A Tale of Two Markets—Bull Then Bear?

Next year may unfold as a tale of two markets: strength early fueled by liquidity and momentum, followed by potential weakness as valuations and credit risks emerge.

In this short video, Lance Roberts explains why a balanced approach with defensives, cash, and flexibility is the smartest way to navigate 2026.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-10-25 Market Sloppiness, Bitcoin Signals & Fed Week: Live Q&A

It’s Fed Day, and today’s Live Q&A covers what investors should expect as markets position around the announcement, why volatility may pick up afterward, and how this week’s action shapes the potential for a Santa Claus Rally. We also discuss whether the Fed has stepped back from its inflation mandate, what that means for long bonds, and how Treasury supply-and-demand dynamics factor into portfolio risk.

Lance Roberts & Danny Ratliff...

Read More »

Read More »

Affordability Crisis: Michael Green Challenges The Poverty Line

Michael Green, Chief Strategist and Portfolio Manager at Simplify Asset Management, wrote a provocative Substack essay, Part 1: My Life Is A Lie, that is sparking a debate among economists and raising awareness of the affordability crisis. It's not just the wonky economists debating the merits of his article; The Washington Post, CNN (News Central), …

Read More »

Read More »

Hassett To Replace Powell: Betting Markets Are Confident

Based on comments from President Trump and the odds on the Kalshi betting site, shown below, Kevin Hassett is the likely nominee to replace Jerome Powell when his term as Fed Chair ends in May. While still half a year away, the market is beginning to price in what a Hassett leadership might mean for … Continue reading »

Read More »

Read More »