Category Archive: 9a.) Real Investment Advice

Hasbro, Target, Wal-Mart’s Inventory Surpluses

(7/21/22) Will the Fed cave to inflation and pivot on its interest rate hike course--and what will the effects be on markets? Will Markets' recent bottoms hold? Negative sentiment prevails--much of the recent rally has been driven by short-selling.

Read More »

Read More »

Have We Reached the Bottom Yet? | 3:00 on Markets & Money

(7/20/22) We haven't seen investors THIS negative since 2008--does this suggest we're nearing a market bottom? This is not then: We're running the highest inflation rate in 40-years, the Fed is tightening its balance sheet AND hiking interest rates.

Read More »

Read More »

Could Millennials Sink the Mortgage Market?

(7/20/22) Mortgage eman is at a 22-year low; that's not the only reason house prices are falling; technical charts on't lie. The market is own less than 20% for the year; has FOMO become FOBO--the fear of missing the bottom?

Read More »

Read More »

Apple Announces Hiring Freeze–Others to Follow? | 3:00 on Markets & Money

(7/19/22) Stocks were poised to break above the downtrend, but Apple's announcement to freeze hiring killed market momentum. Hiring freezes are the first step before layoffs--because the economy is slowing down.

Read More »

Read More »

Why Home Ownership is Warped By Lending Gimmicks

(7/19/22) Monday's rally fails (thanks, Apple); things are so negative, it's positive. Investors' "fear of missing out (FOMO)" has become a "fear of missing the bottom (FOBO);" this market performance isn't as bad as post 2008 or post-Lehman markets; the "American Dream" of home ownership has been warped by lending gimmicks; Markets' reaction to Apple hiring freeze--there's bad news and not-as-bad news.

Read More »

Read More »

Earnings Season Has Arrived–More Disappointments Ahead? | 3:00 on Markets & Money

(7/18/22) Earnings season gets underway in earnest as most S&P 500 companies report; the Big Question is whether analysts have adjusted estimates enough--or are there more disappointments ahead? Forward-looking outlooks will be a big driver of prices.

Read More »

Read More »

Why There is No Middle Class in Italy

(7/18/22) Lance returns from Vacation: No Market crash while he was away! Why Markets are ripe for a Rally; Investors' FOMO is aimed at a Market Bottom. Earnings Season continues apace: Q1 Estimates becoming Q2 Results: Watch changes in valuation from start of Quarter to the end of Quarter;

Read More »

Read More »

Higher Taxes are Coming: What You Can Do About it Now

Are we in an Earnings Recession? With sticky price-inflation, is 2% inflation even achievable? How people are changing habits; the recovery will likely take longer this time. Where should you park your money?

Read More »

Read More »

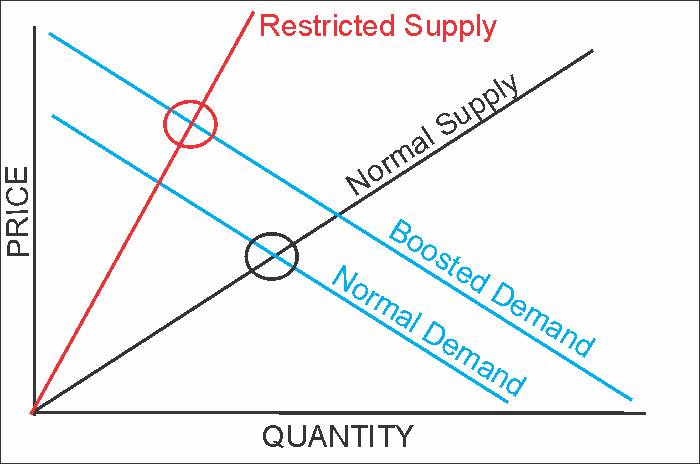

Giant Corporations Are Causing Inflation?

“Giant corporations are using inflation as cover to raise their prices & boost their profits. In industry after industry, we have too little competition & companies have too much power to increase prices. I’ve been calling out this corporate profiteering & price gouging” – Sen. Elizabeth Warren

Read More »

Read More »

Is It Time to Shop in Thrift Stores?

(7/14/22) Richard Rosso's West Texas ERCOT Ditty; Inflation reality and Nana Clara's recipe for saving money; Demand destruction + Supply Disruption; shopping at Thrift Stores; the significance of JPMorgan's share buyback suspension; dealing with inflation on all levels. Let's put Salma Hayek on the $100-dollar bill; the similarities and differences of JPMorgan and Morgan Stanley's estimate misses; what late filings may mean.

1:37 - The Fed's 2%...

Read More »

Read More »

How to Look at Your 401k Without Freaking Out

(7/13/22) COVID fallout continues around the world: Travel delays and limitations at London Heathrow; what will Fed rate hikes mean for small businesses? Legislative changes for employee benefits; what are the benefits of Benefits?

Read More »

Read More »

What If the Fed Doesn’t Bail Out Investors, Pt-2

(7/12/22) The saga of Twitter vs Elon Musk continues; there's not enough fear in the markets, yet; true Bear Markets are a process; The Inflation Nation ditty; Ice Pops allow you to "eat the rich;" Red States outperforming in Jobs recovery; Luling BBQ & Melon Thump;

Read More »

Read More »

What If the Fed Doesn’t Bail Out Investors, Pt-1

(7/12/22) There's not enough fear in the markets, yet; true Bear Markets are a process; Is Jerome Powell really serious about the next rate hike; the worst performance of a 60/40 portfolio, ever.

Read More »

Read More »

How to Survive in a Down Market

(7/11/22) Lance remains on vacation; Elon Musk vs. Twitter, this week's economic preview: Down market Survival Guide; Optimism for Opportunity; CPI preview; retirement expenses & five surprises you don't want to have; inflation and housing expenses; healthcare expenses; the "Retirement Smile."

Read More »

Read More »

Lance is on Vacation this week!

Sometimes you've just gotta get away! Lance & Brent are on vacation for the week of July 4-8, but we've cooked up some Best-of segments for your review and enjoyment.

Read More »

Read More »

American Epidemic: Living Beyond our Means

Remember the 1970's--things were so much simpler then, right? Is this really a bear market, about which we're in denial? The Truth Comes from the Data. The Fed is raising rates so they can lower them again; Richard Rosso's Summer Reading List (preview); who's living paycheck-to-paycheck now?

Read More »

Read More »

Could You Be the Millionaire Next Door?

(7/8/22) Tire Terrorists are on the loose! How much have you saved for retirement: We break it down by demographics. Best book on frugality remains "The Millionaire Next Door;" what ever happened to the E*Trade Baby?

Read More »

Read More »

Is Becoming an Ex-Pat the Best Way to Blunt Inflation?

(7/7/22) More Americans are choosing to move to less-expensive climes to avoid the averse effects of inflation--like Mexico; the climate crsis and the consequences of politics: The root is Economic Equality. Inflation vs Deflation--caused by a mindset, which the Fed cannot manage or control.

Lance & The Crew are taking the week off, and will return return to live programming next week (7/11/22). Here is an encore segment from a recent episode...

Read More »

Read More »

Will the Second-Half of 2022 Be Better than the First? | 3:00 on Markets & Money

(6/30/22) Markets have chalked up the worst first-half of the year on record; history shows that stocks tend to do better in the second-half of the year...outside of a recession. Much of the recent economic data does not bode well for the economy heading into July, with the risk of recession increasing by the Fed's rate hikes and balance sheet reduction. Historically, if a recession hits, markets dip lower. And even though markets are down this...

Read More »

Read More »

Inflation’s 3% Pay Cut

(6/30/22) Markets have worst start to the year since dirt; will the second half be any better? What does it mean when 31% of persons working in the Financial sector today have never witnessed a bear market; what separates a bad start from a bear market? Why loss aversion can lose worse than the loss you're trying to avoid; what makes for YouTube success; what happens when the Fed hits the brakes (their foot is on the pedal now)? Don't fight the...

Read More »

Read More »