Category Archive: 9) Personal Investment

The Bull Market – Could It Just Be Getting Started?

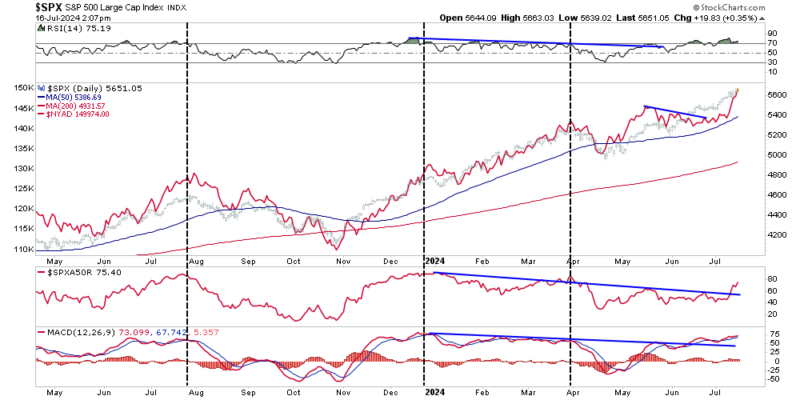

We noted last Friday that over the previous few years, a handful of “Mega-Capitalization” (mega-market capitalization) stocks have dominated market returns and driven the bull market. In that article, we questioned whether the dominance of just a handful of stocks can continue to drive the bull market. Furthermore, the breadth of the bull market rally has remained a vital concern of the bulls.

Read More »

Read More »

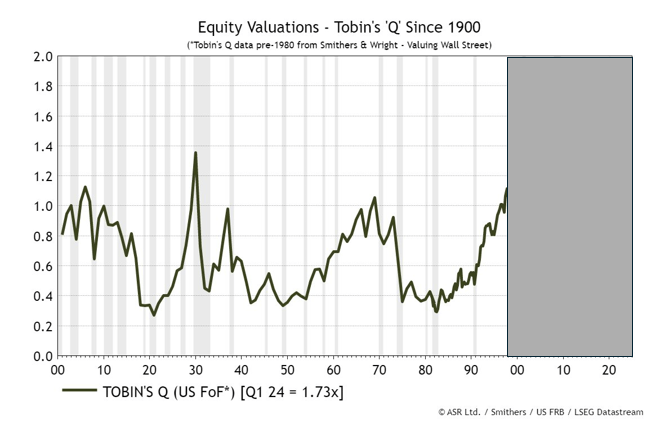

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

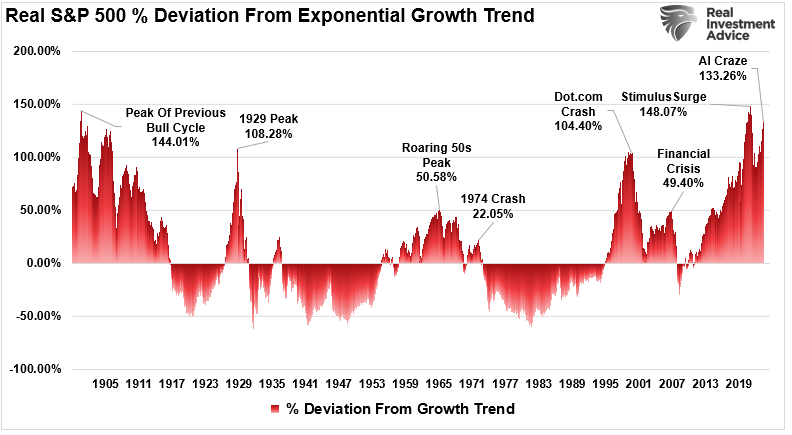

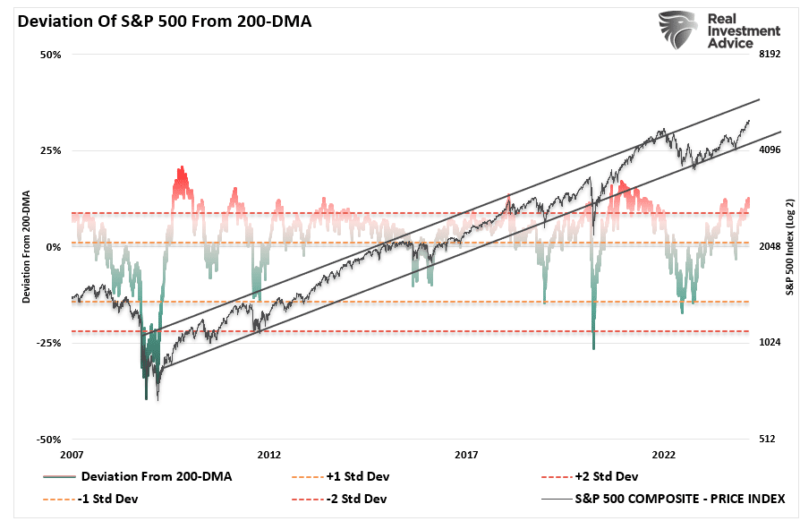

Deviations From Long-Term Growth Trends Back To Extremes

In 2022, we discussed the market’s deviations from long-term growth trends. That discussion centered on Jeremy Grantham’s commentary about market bubbles.

Read More »

Read More »

Wichtige Trends für Schweizer Investoren

Die Finanzmärkte durchlaufen derzeit eine Phase beträchtlicher Veränderungen, die von verschiedenen globalen und lokalen Faktoren beeinflusst werden. Wirtschaftliche Unsicherheiten und geopolitische Spannungen haben die Märkte volatiler gemacht, was sowohl Risiken als auch Chancen für Investoren mit sich bringt. Insbesondere die Schweizer Wirtschaft, bekannt für ihre Stabilität und Robustheit, muss sich an diese neuen Herausforderungen anpassen, um...

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

Immigration And Its Impact On Employment

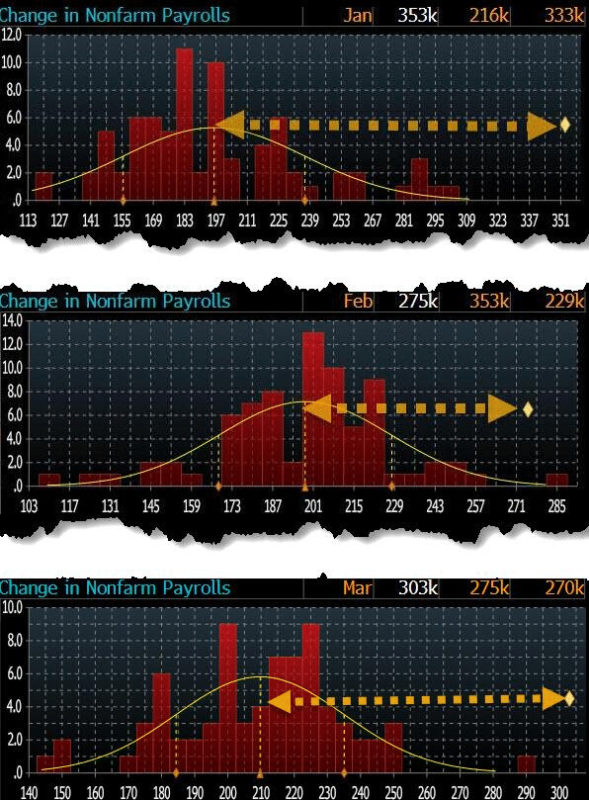

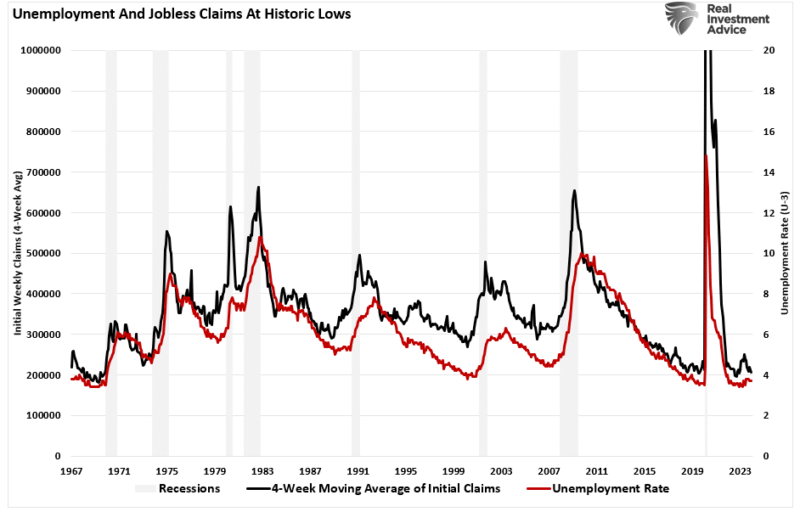

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer, measuring the level of anxiety in the economy, inflation, currency, and geopolitics.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

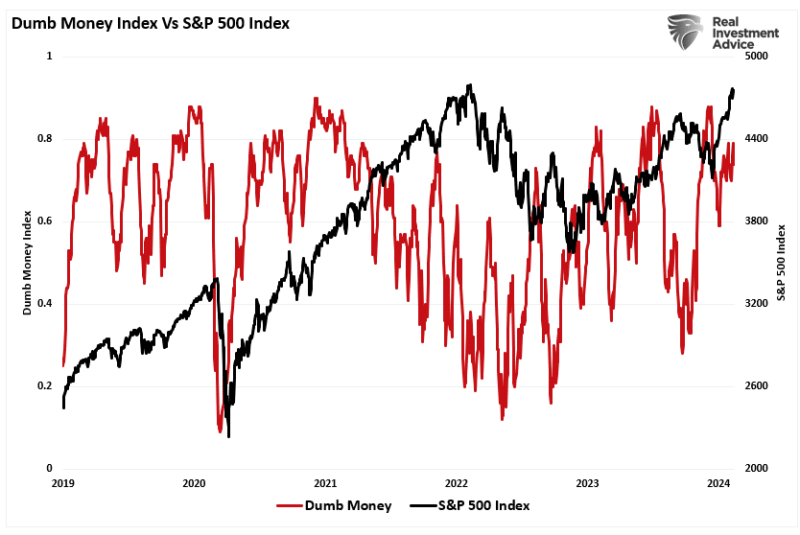

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

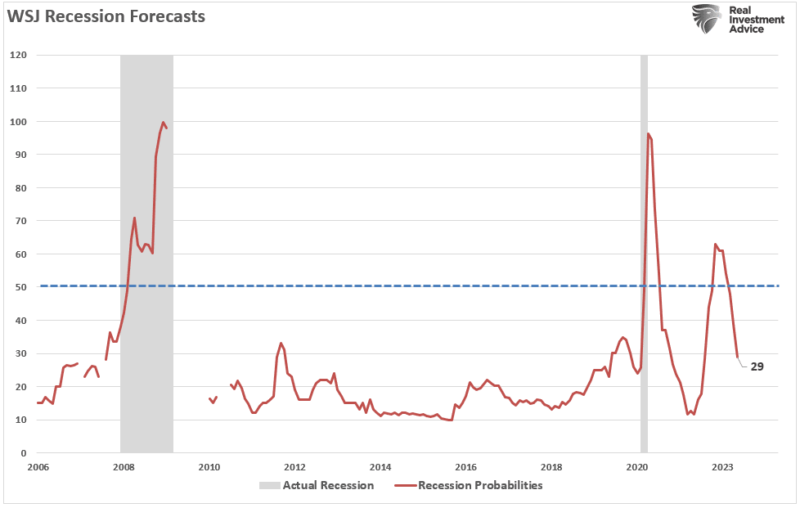

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

Valuation Metrics And Volatility Suggest Investor Caution

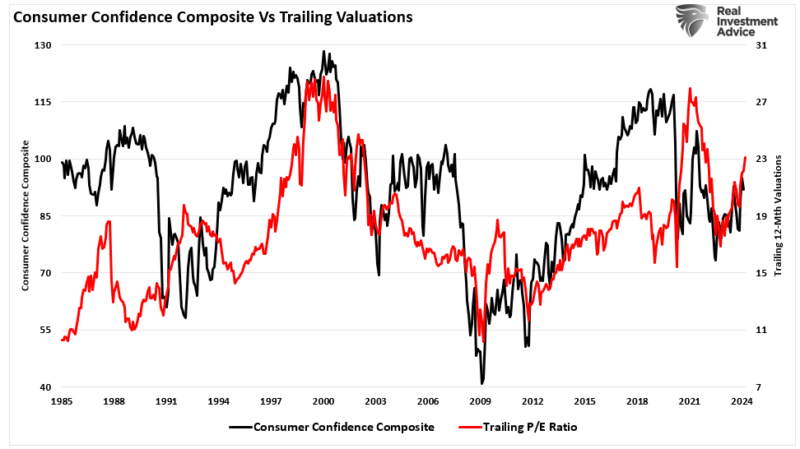

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

Navigating Financial Frontiers: A Deep Dive into the World of Private Credit

Investors constantly seek new avenues for diversification and higher returns in the ever-evolving finance landscape. One such frontier that has gained significant attention in recent years is private credit. This alternative asset class offers unique opportunities and challenges, attracting institutional investors, high-net-worth individuals, and fund managers. In this comprehensive guide, we’ll explore the intricacies …...

Read More »

Read More »

Tax Refunds Delayed? Here’s How an Emergency Loan Can Help

For many, tax refunds feel like a mini-windfall—a delightful surprise at the beginning of the year. A chance to cover old debts, splurge on something desired, or simply bolster savings. But what happens when this eagerly anticipated money doesn’t arrive on time? Delays can, unfortunately, throw a wrench in your financial plans, causing unnecessary stress. …

Read More »

Read More »

Geld sparen bei der Stromrechnung – so geht’s

Wahrscheinlich ist Ihnen schon aufgefallen, dass Ihre Gas- und Stromrechnungen teurer sind als früher. Falls Sie nach Möglichkeiten suchen, Ihre Stromkosten zu senken, gibt es viele einfache Maßnahmen, die Sie ergreifen können, um Ihre Energierechnungen zu senken – vom Ausschalten des Lichts bis hin zum kosteneffizienten Wäschewaschen. Hier finden Sie die 23 besten Möglichkeiten, …

Read More »

Read More »

Exploring Self-Directed IRAs for Diversification

Finding the right retirement portfolio balance is an individual journey, especially in today’s ever-evolving environment. No two individuals are alike when it comes to investing and planning for financial security in retirement, which can make it daunting to find a suitable option that provides protection yet also offers growth potential. One less conventional …

Read More »

Read More »

Maximizing Tax Benefits with Life Insurance for Small Business Owners

As a small business owner, there are numerous benefits to taking advantage of the tax incentives associated with life insurance. It can provide you and your loved ones financial security and help you maximize profits for your business in the long run. This article will explain the basics of life insurance for small business …

Read More »

Read More »

Three Ideas to Tackle Financial Ghosts.

Is money distress part of your life? Do the dollars & cents of poor decisions past sneak up on you and rattle around your house like chains? What if I could provide three ideas to tackle 2022’s financial ghosts and put them at rest for good?

Read More »

Read More »

Employees Want Paychecks for Life: Pros and Cons of Guaranteed Lifetime Income

Annuities and similar products may help address retirement readiness in an aging workforce. People are living longer, which means they may need their retirement savings to last decades. As a result, nearly half (48%) of participants are concerned about outliving their retirement savings.

Read More »

Read More »

How Could Inflation Impact Corporate Retirement Plans?

Increasing prices may put pressure on employers and delay workers from retiring. Inflation is the increase in the general price of goods and services, which can decrease the purchasing power of American workers. So how does this recent upward trend affect your workplace benefits, employees and retirement plan?

Read More »

Read More »