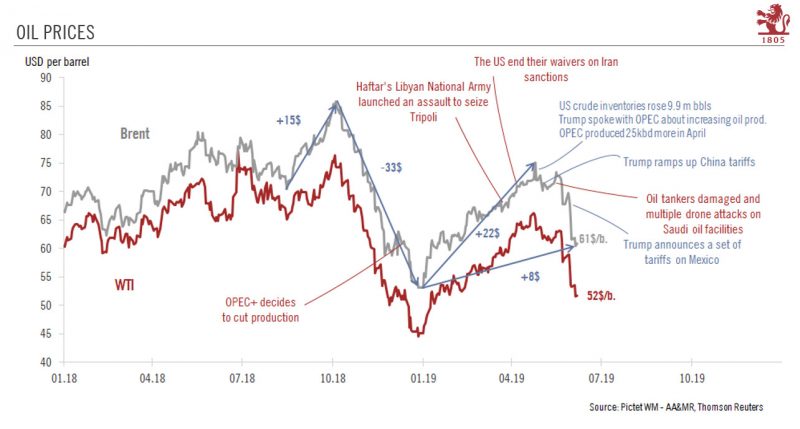

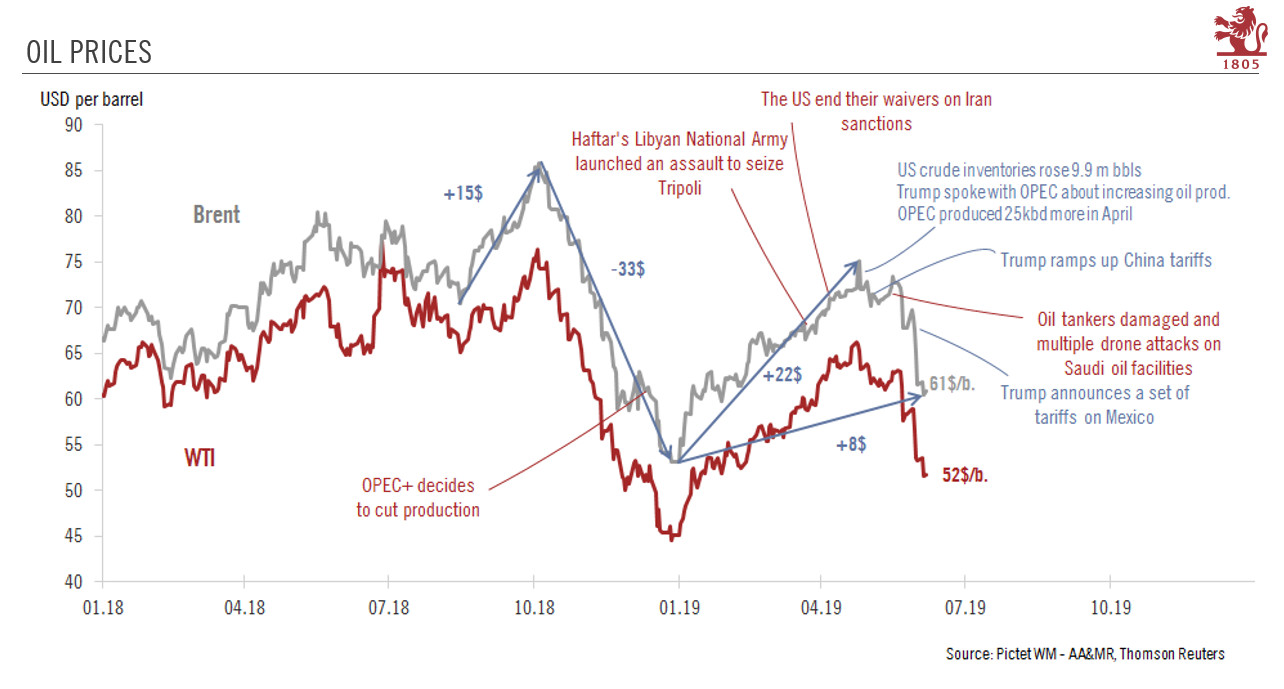

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.

Read More »

Category Archive: 7c) Oil & Commodities

Oil Supply Globally: Market Price Compared to Production Costs

Mainstream media often speaks of the great shale gas/oil revolution and how it makes the United States more productive and a net exporter of oil. We wanted to go into more details,we compare oil production costs for US shale and global oil producers. As reason for the cheap oil we see the combination of two effects:

Demand: Cheap US money supported a Chinese investment boom in factories and housing until 2012. The over-investment phase is...

Read More »

Read More »

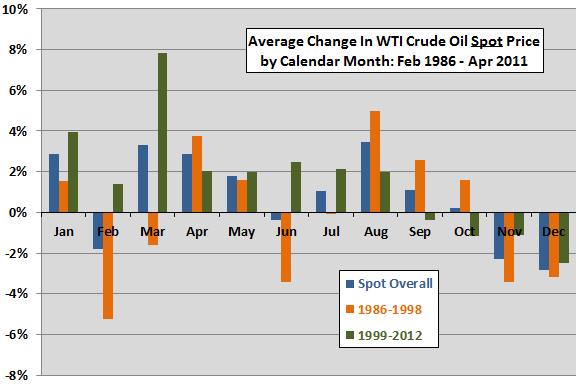

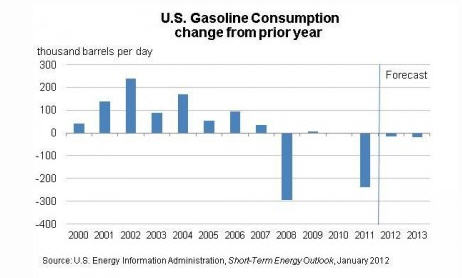

Seasonal Factors on Oil

Evidence from simple tests supports perhaps some belief that crude oil tends to have strong and weak months of the year, Q4 is often the weakest quarter and Q1 and Q2 the best.

Read More »

Read More »

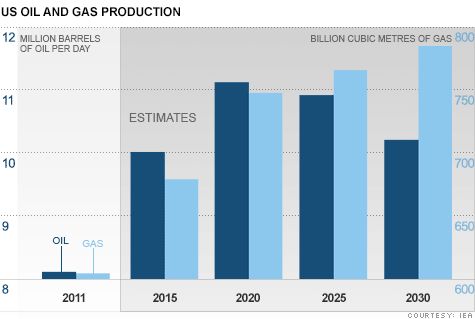

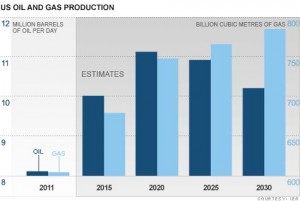

Before getting too excited about the IEA’s forecast of US oil production leadership…

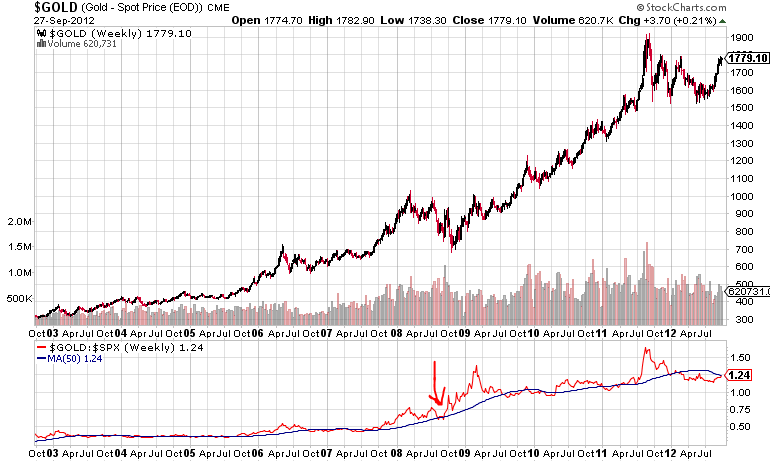

Saxo Bank, recently called for quitting long Gold and "being scared" trades.

For them shale gas & oil is the game changer for the United States. It should make the US the leader for global growth in the next years. The International Energy Association (IEA) declared that the US would be energy-independent by 2030.

Today a nice article...

Read More »

Read More »

Marc Faber: Assets are overpriced, we short metals and Brent now

As we predicted on October 5 or one day later on DailyFX, metals have started their descent, silver lost one dollar, from levels around 35$ last week to 34$ now. Marc Faber joins our view and says that asset prices are quite vulnerable. “I’m not 100% in cash, for the simple reason that I could … Continue reading »

Read More »

Read More »

Marc Faber argues against Jim Rogers

The most famous investors Marc Faber and Jim Rogers were in a common interview on CNBC. Marc Faber is of our position, whereas Jim Rogers is still bullish on commodities. Marc points out that China’s bench mark stock index the Shanghai Stock Exchange Composite Index was at 6100 in 2007 even as it … Continue reading...

Read More »

Read More »

Die Wirtschaftskommission hat den Goldfranken abgelehnt, jetzt kommt die Volksinitiative

Zwei Initiativen für Kleinanleger um das Geld/Gold vor den Mächtigen zu retten Der Ökonom Detlev Schlichter der “Österreichischen Schule” hat einen Vortrag beim “Verein Goldfranken” gehalten. Hier der äquivalente Vortrag auf Englisch beim Adam-Smith-Institut in den USA. Die Kritik an der Boom und Bust Politik der Nationalbanken.

Read More »

Read More »

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »