Category Archive: 6a) Gold & Monetary Metals

Arizona Governor Ducey Vetoes Gold

Unpersuaded by either the plight of the pensioners or the prospect of business growth in Arizona, Ducey vetoed gold. This is his second time to shoot down gold.

Read More »

Read More »

Keith Weiner: Gold Standard etc.

The Gold Standard Institute starts posting on snbchf.com. It is based in Phoenix AZ, is a 501(c)3 tax-exempt educational organization dedicated to spreading awareness and knowledge of gold, and to promoting the use of gold as money.

Read More »

Read More »

Commodities – Will the Rally Continue?

Pros and Cons The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to c...

Read More »

Read More »

Paper Gold Is Rising

The Metals Take Off The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if...

Read More »

Read More »

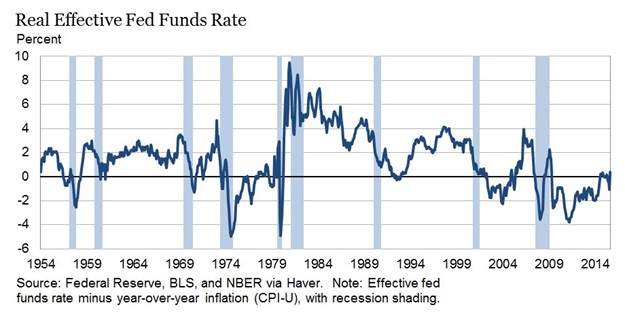

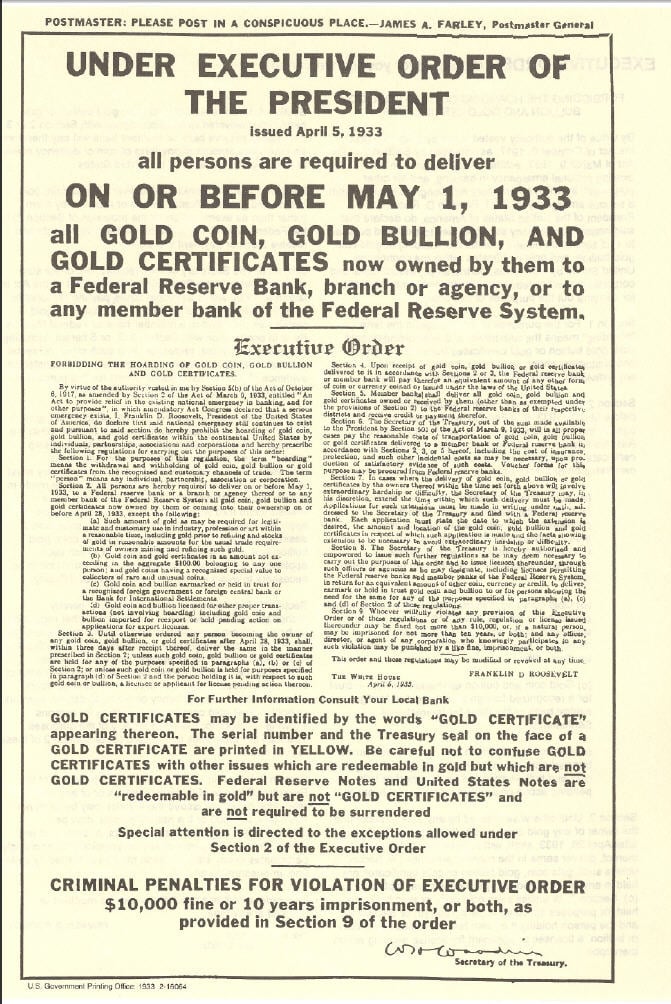

How Unsound Money Fuels Unsound Government Spending

Stefan Gleason shows the major slides that may predict a collapse of the dollar. The Trade Deficit after the abandonment of gold, the explosion of entitlements like social security, Medicare, Obamacare, subsidies and the explosion of the federal deficit to 1 trillion in 2022. The reason: Unsound money.

Read More »

Read More »

Making Sense of China’s Gold Fix and Hungary’s Dim Sum Offering

Earlier today, China launched its first gold fix. It will offer a fixing twice a day going forward yuan. The Shanghai Gold Exchange established the fix the same way it is done in London and New York, by prices submitted by financial institutions. In China’s case, 18 institutions, including two foreign banks, participate in the …

Read More »

Read More »

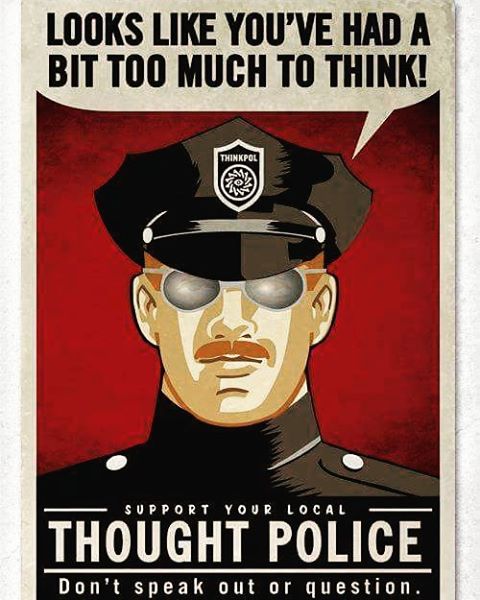

Cultural Marxism and the Birth of Modern Thought-Crime

What the Establishment Wants, the Establishment Gets If a person has no philosophical thoughts, certain questions will never cross his mind. As a young man, there were many issues and ideas that never concerned me as they do today. There is one que...

Read More »

Read More »

Who Lends to the Fed?

This leads to our present question. To speak of borrowing and a ready market in which the Fed can borrow, means there is a lender. Who is the lender to the Fed?

Read More »

Read More »