Category Archive: 6a) Gold & Monetary Metals

Sprott Money News Ask the Expert – November 2017 Danielle DiMartino Booth

Author and analyst Danielle DiMartino Booth joins us for a discussion of central bank policy and economics.

Read More »

Read More »

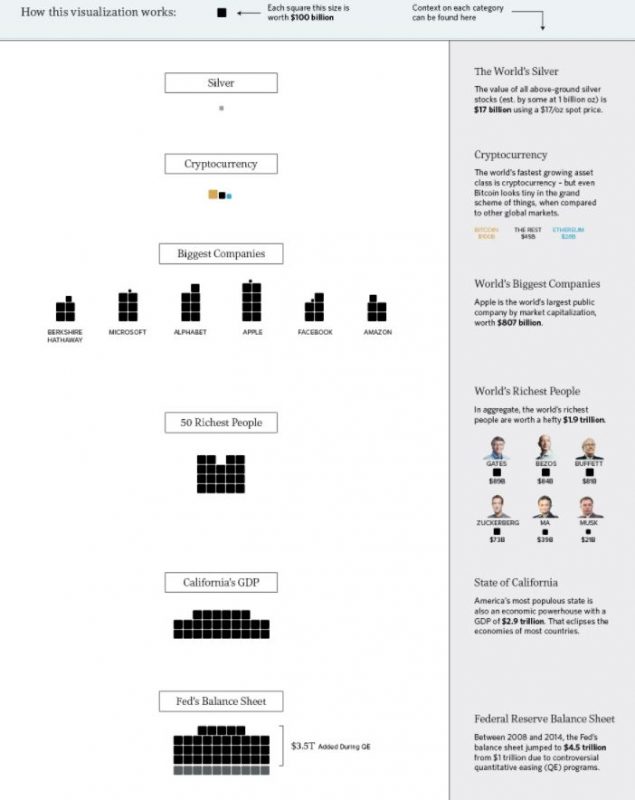

Money and Markets Infographic Shows Silver Most Undervalued Asset

Money and Markets Infographic Shows Silver Most Undervalued Asset. Silver remains severely under owned and under valued asset. Entire silver market worth tiny $100 billion shown in one tiny square. “All of the World’s Money and Markets in One Visualization”. Must see ‘Money and Markets’ infographic shows relative size of key markets: silver bullion, gold bullion, cryptocurrencies/ bitcoin, largest companies, 50 richest people, Fed balance sheet,...

Read More »

Read More »

Urban Meyer discusses Ohio State’s 52-14 win over Illinois | 11/18/2017

Ohio State scored on its first six possessions — including J.T. Barrett's 100th career touchdown pass — as the Buckeyes routed Illinois 52-14 on Saturday and clinched the Big Ten East title.

Barrett, playing in his last game at Ohio Stadium, threw for two touchdowns and ran for another as the Buckeyes (9-2, 7-1, CFP No. 9) dominated from the opening kick. Barrett became the Ohio State leader in rushing yards among quarterbacks (3,070), eclipsing...

Read More »

Read More »

Buckeyes team meet President Trump

Indoors and out, the White House was overrun with school spirit Friday as President Donald Trump welcomed college sports champions including the Ohio State men's volleyball team

-----------------------------------------------------

Thanks for Watching!!!!!

Read More »

Read More »

Buckeye fan gets Make a Wish dream at Ohio State

Aidan Arquette is a 9-year-old born with half-a-heart,but is "wholeheartedly" a Buckeye fan. Make-A-Wish America helped make his Ohio State University Football dream come true.

-----------------------------------------------------

Thanks for Watching!!!!!

Read More »

Read More »

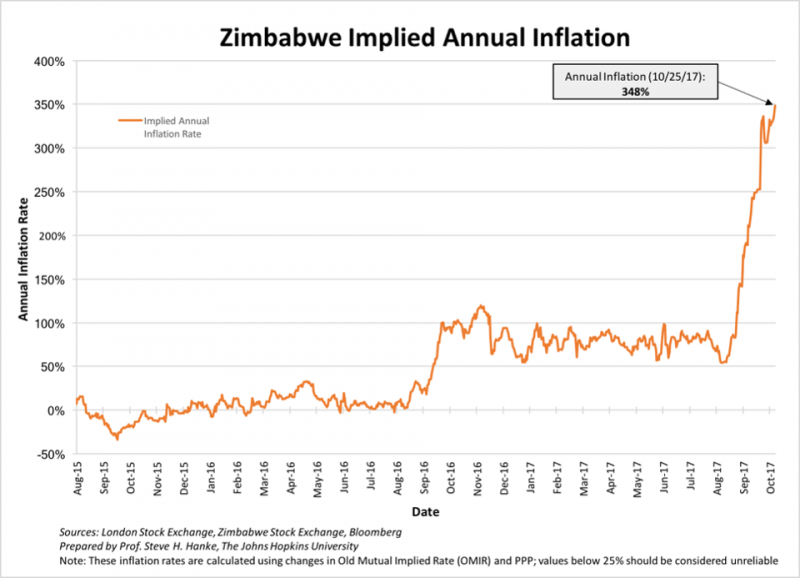

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

UK debt crisis is here – consumer spending, employment and sterling fall while inflation takes off. Personal debt crisis coming to fore – litigation cases go beyond 2008 levels. October consumer spending fell by 2% in October, the fastest year-on-year decline in four years. Britons ‘face expensive Christmas dinner’ as food price inflation soars. Gold investors buying physical gold due to precarious UK and US outlook

Read More »

Read More »

Protect Your Savings With Gold: ECB Propose End To Deposit Protection

Protect Your Savings With Gold: ECB Propose End To Deposit Protection. New ECB paper proposes ‘covered deposits’ should be replaced to allow for more flexibility. Fear covered deposits may lead to a run on the banks. Savers should be reminded that a bank’s word is never its bond and to reduce counterparty exposure. Physical gold enable savers to stay out of banking system and reduce exposure to bail-ins

Read More »

Read More »

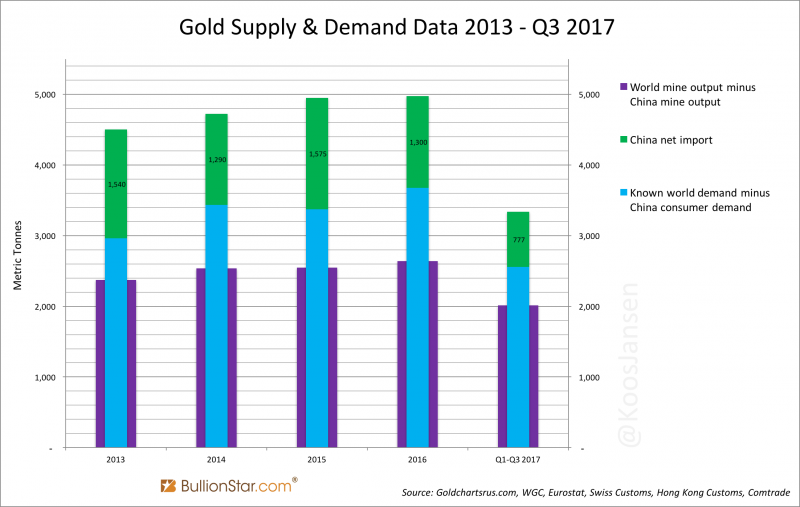

China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day.

Read More »

Read More »

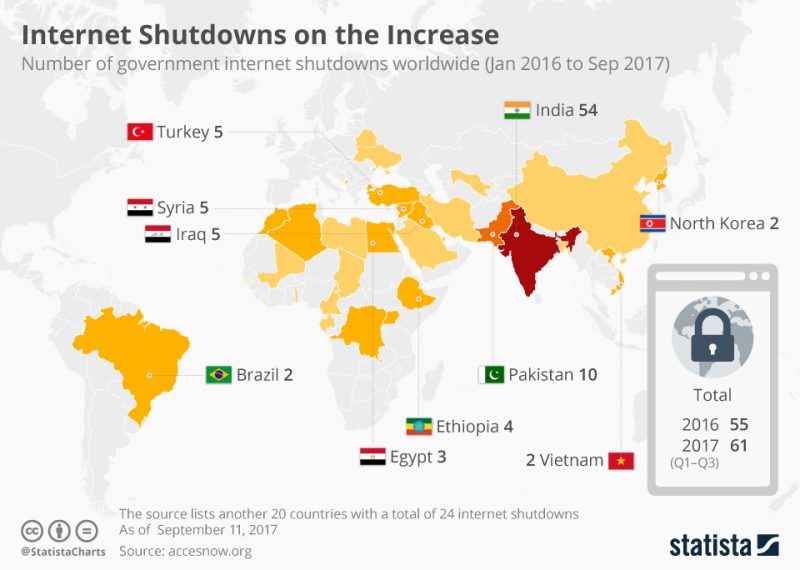

Internet Shutdowns Show Physical Gold Is Ultimate Protection

Internet shutdowns (116 in two years) show physical gold is ultimate protection. Number of internet shutdowns increased in 2017 as 30 countries hit by shutdowns. Democratic India experienced 54 internet shutdowns in last two years; Brazil 2. EU country Estonia, a technologically advanced nation, experienced a shutdown. Gallup poll shows Americans more worried about cybercrime than violent crime. Governments use terrorist threat as reason for...

Read More »

Read More »

76: Marc Faber – Is 2018 Heading for Gloom, Boom, or Doom?

Dr. Marc Faber is a Swiss investor based in Thailand. He publishes a widely read monthly investment newsletter “The Gloom Boom & Doom Report” which highlights investment opportunities. He is also a published author and a regular contributor to several leading financial publications around the world. When it comes to investing your hard-earned money, he …

Read More »

Read More »

Gold Coins and Bars Saw Demand Rise 17percent to 222T in Q3

Gold coins and bars saw demand rise 17% to 222t in Q3, driven largely by China. Chinese investors bought price dips, notching up fourth consecutive quarter of growth. Jewellery, ETF demand fell while gold coins and bars saw increased demand. Central banks bought a robust 111t of gold bullion bars (+25% y-o-y). Russia, Turkey & Kazakhstan account for 90% of 111t of central bank demand. Turkey increased gold purchases and saw broad based physical...

Read More »

Read More »

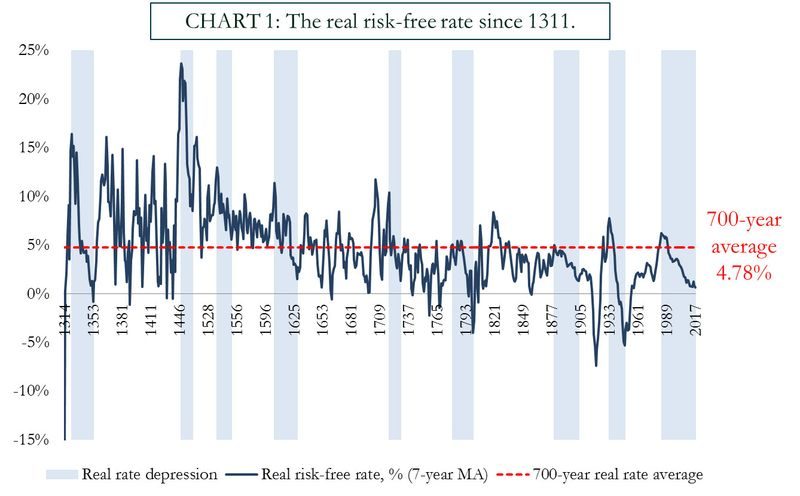

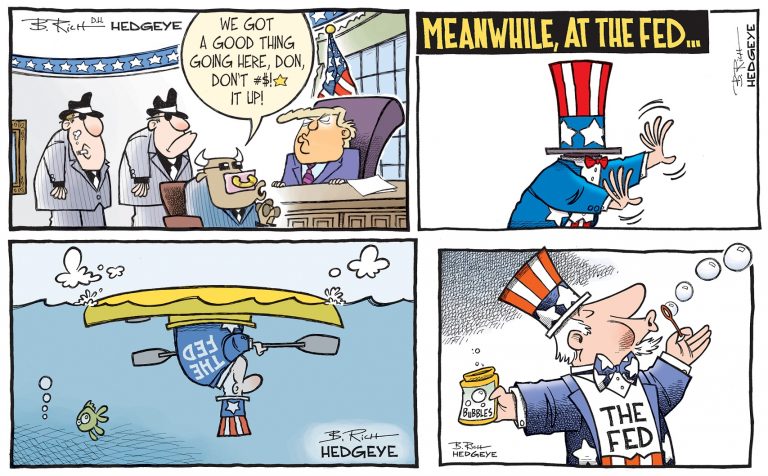

Prepare For Interest Rate Rises And Global Debt Bubble Collapse

Diversify, rebalance investments and prepare for interest rate rises. UK launches inquiry into household finances as £200bn debt pile looms. Centuries of data forewarn of rapid reversal from ultra low interest rates. 700-year average real interest rate is 4.78% (must see chart). Massive global debt bubble – over $217 trillion (see table). Global debt levels are building up to a gigantic tidal wave.

Read More »

Read More »

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week.

Read More »

Read More »

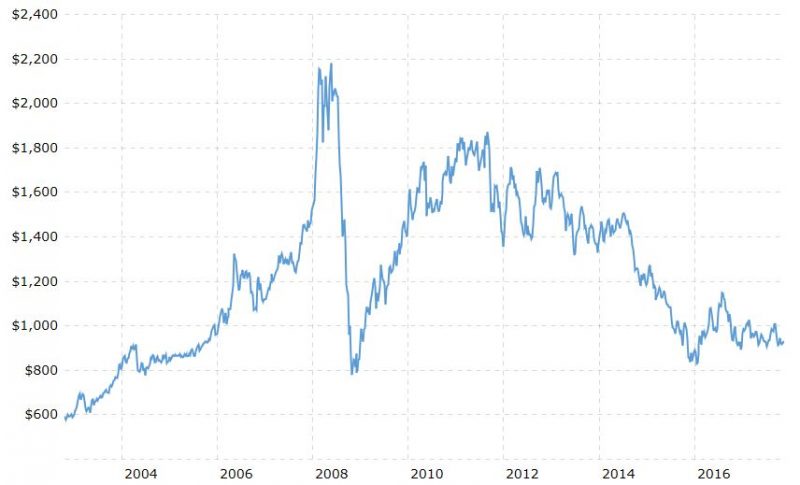

How Will Bitcoin React in a Financial Crisis Like 2008?

Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other cryptocurrencies are in a tulip-bulb type bubble, while the other camp is equally confident that we ain't seen nuthin' yet in terms of bitcoin's future valuation.

Read More »

Read More »

Stumbling UK Economy Shows Importance of Gold

UK economy outlook bleak amid Brexit, debt woes and rising inflation. Confidence in UK housing market at five-year low. UK high street sales crash at fastest rate since 2009. Number registering as insolvent in England and Wales hit a five-year high in Q3. UK public finance hole of almost £20bn in the public finances set to grow to £36bn by 2021-22. Protect your savings with gold in the face of increased financial woes in UK.

Read More »

Read More »