Category Archive: 6a) Gold & Monetary Metals

Bitcoin – Die Tulpenknolle des Computerzeitalters

Von 10 auf 100 auf 1’000 auf 10’000 Dollar. Das ist die Kursentwicklung von Bitcoins in den wenigen Jahren seit ihrem Bestehen bis gestern früh. Der Vergleich mit der Tulpenmanie in der Hochblüte Hollands ist nicht mehr fern. Der Preis einer kostbaren Tulpenzwiebel stieg im 17. Jahrhundert in Holland auf das über 60-fache eines durchschnittlichen damaligen Jahressalärs.

Read More »

Read More »

Is Marc Faber a Racist?

Taken as a excerpt from the One Road Podcast’s full length interview with Marc Faber, this 18 minute clip has Marc directly address the allegations that he is a racist. What do you think about his answer? To see the full length video, click here: To instead listen to the full podcast, check out our … Continue reading »

Read More »

Read More »

On the Road with Marc Faber Full video!

The One Road Podcast, broadcasting financial streams of consciousness For this special episode of the One Road podcast, we have a video recording of the entire Marc Faber interview. If you are looking for just the audio or download, please see the links below. Marc gets right down to brass tax and addresses the controversy …

Read More »

Read More »

Bitcoin Facts

When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to address some of the objections to Bitcoin’s fitness as...

Read More »

Read More »

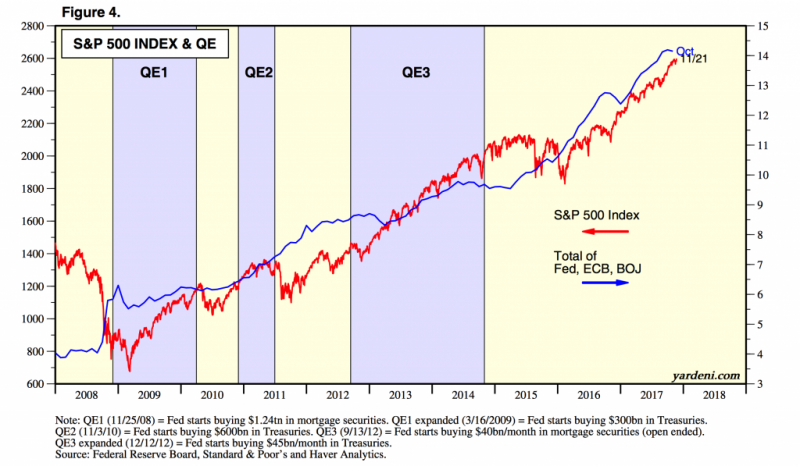

Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making. Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’. Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’. Members seem oblivious to impact of inflation on households and savings. Physical gold and silver remain the only assets for real diversification and...

Read More »

Read More »

Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

Geopolitical risk highest “in four decades” should push gold higher – Citi. Elections, political and macroeconomic crises and war lead to gold investment. Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank. “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank. Reduce counter party risk: own safe haven allocated and...

Read More »

Read More »

Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en procurer.

Read More »

Read More »

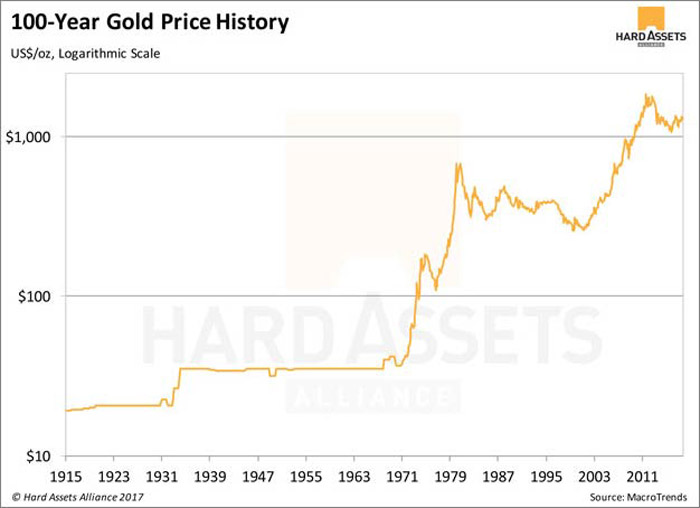

Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

Gold versus Bitcoin: The pro-gold argument takes shape. Why cryptocurrencies will not replace gold as a store of value. Similarities between crypto and gold but that does not make them substitutes. Gold remains a highly liquid market, cryptocurrencies continue to be fragmented and difficult to spend. Bitcoin does not make it an effective hedge against stocks

Read More »

Read More »

Brexit Budget – Grim Outlook As UK Economy Downgraded

Brexit budget – Grim outlook as UK economic forecasts downgrade. UK Chancellor uses housing market policy as smoke-screen for deteriorating economy. UK budget matters more than ever due to BREXIT risks. Policy on stamp duty will fail to aid worsening housing market. Real GDP expected to grow by just 1.5%, 40% less than projections 2 years ago. Households now face an unprecedented 17 years of stagnation in earnings. Critics claim Budget failed to...

Read More »

Read More »

Ed Steer: Gold/Silver Price Management Scheme Will End ‘Spectacularly & Suddenly’

Read the full transcript here: https://goo.gl/1AMVLS Gold Price Chart: https://www.moneymetals.com/precious-metals-charts/gold-price Ed Steer of Ed Steer’s Gold and Silver Digest and also board member at GATA talks about a strategy that many mining companies are employing today that will have a long term and detrimental impact on the future supply of gold and silver. Visit Ed …

Read More »

Read More »