Category Archive: 6a) Gold & Monetary Metals

Congressman Demands CFTC Explain Its Failure to Find Silver Market Manipulation Where DOJ Did

Washington, DC (February 5, 2018) – A member of the U.S. House Financial Services Committee today pressed the Commodities Futures Trading Commission (CFTC) on its conspicuous failure to uncover the very silver market manipulation now being prosecuted by the U.S. Department of Justice.

Read More »

Read More »

Tennessee Considers Removing Tax on Gold and Silver

Several bills introduced in the Tennessee legislature would eliminate sales and use tax against gold, silver, platinum, and palladium. Introduced by Representative Ron Gant (R-Rossville), House Bill 212 removes sales and use tax against platinum, gold and silver bullion, some numismatic coins, and numismatic coins sold at trade show.

Read More »

Read More »

Sprott Money News Ask the Expert January 2019 – Lorne Whitmore

Lorne Whitmore, acting Vice President of Sales for Royal Canadian Mint answers questions regarding how RCM combats counterfeiting and why responsible sourcing is important.

Read More »

Read More »

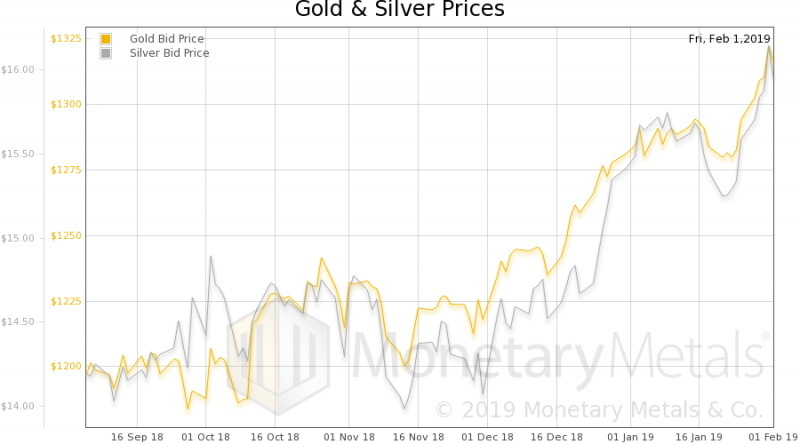

Sprott Money News Weekly Wrap-up – 2.1.19

Eric Sprott discusses how surging physical demand for gold and silver will impact prices in the year ahead.

Read More »

Read More »

New Crypto Valley Association President seeks to heal divisions

The new President of the Crypto Valley Association has vowed to turn around the divided organization. Daniel Haudenschild was elected on Thursday evening together with a new board following months of unrest. Speaking to swissinfo.ch two days after his shock departure from Swisscom Blockchain, Haudenschild said his priorities are to heal divisions, build bridges between other blockchain groups in Switzerland and bring international business and...

Read More »

Read More »

7 Financial Truths in an Uncertain 2019

7. Diversify, diversify, diversify – Truly balance your wealth 6. Avoid leverage and speculation and focus on saving and owning quality assets 5. Don’t make money the guiding principle for what you have or do 4. Own gold/ silver (in safest ways possible) & focus on value rather than price in $, €, £ etc … Continue...

Read More »

Read More »

Swisscom Blockchain head departs abruptly

Daniel Haudenschild has stepped down as Chief Executive Officer of Swisscom Blockchain with immediate effect. The state-owned telecommunications group gave no reason for the shock move by the top manager and shareholder of its blockchain advisory unit. News of Haudenshild’s departure clearly came out of the blue for the Swiss blockchain sector.

Read More »

Read More »

Buy Bitcoin or Gold? Bitcoin Buyers Investing In Gold In 2019

Buy bitcoin or gold? Bitcoin buyers are investing in gold in 2019. Poll of 4,000 bitcoin buyers shows their No 1 investment in 2019 is gold. “Gold lost to bitcoin and now it’s going the other way…” says ETF strategist.

“Gold is a store of value and there’s no disputing that…”

Read More »

Read More »

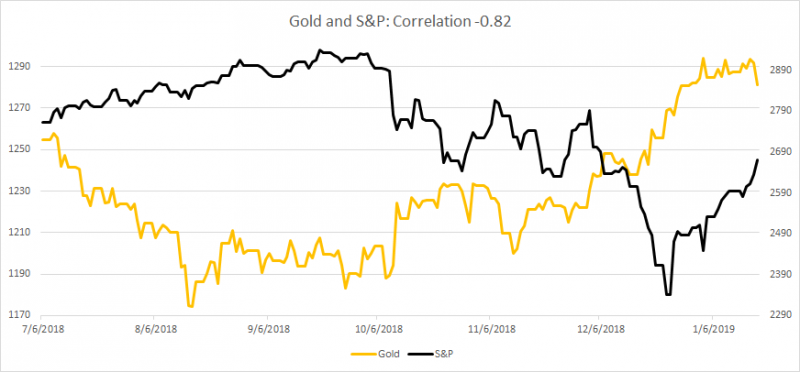

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC.

Read More »

Read More »

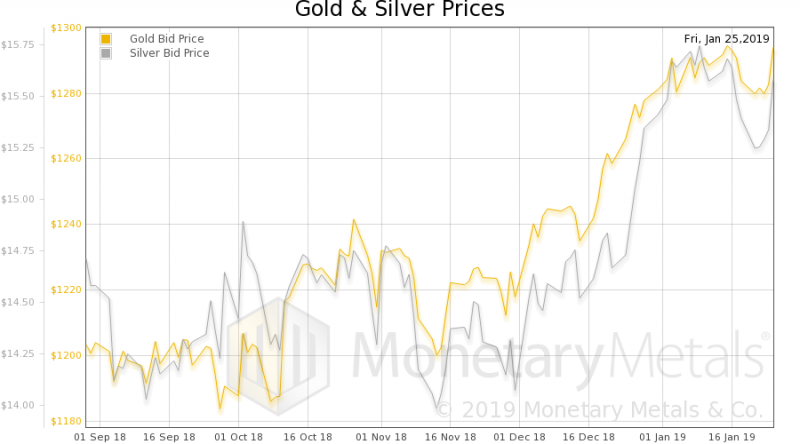

Sprott Money News Weekly Wrap-up – 1.25.19

Eric Sprott discusses factors that are currently influencing the precious metals markets and looks ahead to an interesting year for the mining shares.

Read More »

Read More »

Brexit – The Pin That Bursts London Property Bubble

Brexit – The Pin That Bursts London Property Bubble – Investors need a ‘Plan B’ to protect against Brexit, currency and many other risks – Brexit uncertainty is impacting Irish and UK consumers, companies and economy – London home asking prices slump and drop below £600,000: Lowest since 2015 but still very over valued – …

Read More »

Read More »

Xapo shifting services from Hong Kong to Switzerland

Bitcoin services provider Xapo is winding down activities at its Hong Kong base and transferring key operations to Switzerland. Xapo president Ted Rogers said the move has been driven by Switzerland’s friendlier regulatory environment. “It was once thought that Hong Kong was the holy grail of crypto regulations,” Rogers told swissinfo.ch at the World Web Forum in Zurich. “But it has become more opaque.”

Read More »

Read More »

David Morgan: Gold & Silver Outlook for 2019

Read the full transcript here: https://goo.gl/6FdXyy Check live silver prices here: https://goo.gl/nKBsLZ Interview starts: 5:58 Coming up our good friend David Morgan of The Morgan Report joins me for a conversation on a range of topics, including his 2019 outlook for a number of different asset classes, most notably gold and silver. Don’t miss a …

Read More »

Read More »

Marc Faber: Default and/or Hyperinflation within 10 years?

An excerpt from a longer discussion with Dr. Marc Faber, on what he sees for the world economy over the next 10 years. Full Conversation: https://youtu.be/Vme4_V_7K_o More from John: TWITTER: https://twitter.com/johnkvallis INSTAGRAM: https://www.instagram.com/johnkvallis/ STEEMIT: https://steemit.com/@johnkvallis/ FACEBOOK: https://www.facebook.com/johnkvallis MEDIUM: https://medium.com/@johnkvallis

Read More »

Read More »

Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures. Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S.

Read More »

Read More »

Sprott Money News 1 18 19

Eric Sprott discusses the start of the year for gold and silver and looks ahead to what should be a very interesting 2019.

Read More »

Read More »