Category Archive: 6a) Gold & Monetary Metals

Gold & Silver Mines Shuttered; Physical Silver “Most Undervalued” Asset

Full transcript ?: https://www.moneymetals.com/podcasts/2020/04/03/gold-and-silver-supply-and-demand-crashing-002003

Gold & Silver Prices ??: https://www.moneymetals.com/precious-metals-charts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤...

Read More »

Read More »

Gold & Silver Mines Shuttered; Physical Silver “Most Undervalued” Asset

Full transcript ?: https://www.moneymetals.com/podcasts/2020/04/03/gold-and-silver-supply-and-demand-crashing-002003 Gold & Silver Prices ??: https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up -4.3.20

Eric Sprott discusses the devastating impact of the coronavirus and how central bank reactions will affect precious metal prices in the months ahead.

Read More »

Read More »

Sprott Money News Weekly Wrap-up -4.3.20

Eric Sprott discusses the devastating impact of the coronavirus and how central bank reactions will affect precious metal prices in the months ahead.

Read More »

Read More »

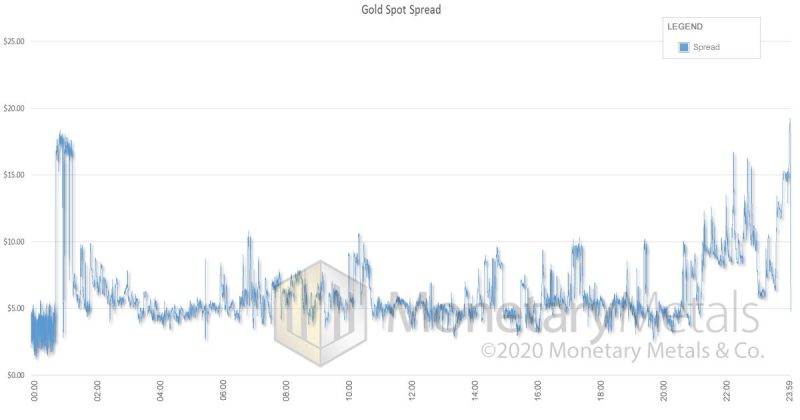

Gold & Silver Coin and Bar Premiums – What’s Going on?

◆ Gold and Silver Coin and Bar Premiums – What Is Happening? GoldCore Live Video Update

◆ Premiums are higher on gold and silver coins and bars, both when you buy and when you sell, and may stay higher in the “new normal.”

◆ Bullion coin and bar premiums are not commissions and brokers only make a small component of the premium in what is a very low margin business.

◆ Beware of aggressive pricing strategies on coins and bars and always focus on...

Read More »

Read More »

Gold & Silver Coin and Bar Premiums – What’s Going on?

◆ Gold and Silver Coin and Bar Premiums – What Is Happening? GoldCore Live Video Update ◆ Premiums are higher on gold and silver coins and bars, both when you buy and when you sell, and may stay higher in the “new normal.” ◆ Bullion coin and bar premiums are not commissions and brokers only … Continue reading...

Read More »

Read More »

Value of Gold in a Stock Market Collapse. Marc Faber – April 1, 2020

Gold Instruments and Gold Shortages Guest’s website: https://www.gloomboomdoom.com/ Produced by https://www.HoweStreet.com Don’t miss out – Stay Informed! Receive the HoweStreet.com Weekly Recap with thought provoking podcasts, radio and articles delivered to your inbox. Sign up for the HoweStreet.com Weekly Recap on the homepage at https://www.HoweStreet.com #MarcFaber #Gold #GoldStocks

Read More »

Read More »

Marc Faber Says “Dollar Will Go Down Massively Sooner or Later”.

#stockmarket #investing #gold #realestate #economy #stimulus #dollar Today I have the pleasure of speaking with Marc Faber, editor and publisher of “The Gloom, Boom and Boom Report”. We cover subjects raging form the economy, central banking, government, investing, precious metals and currencies. Marc Faber’s website: https://www.gloomboomdoom.com/ Use promo code maneco64 to get a 0.5% discount …

Read More »

Read More »

Alasdair Macleod Gold Silver Supply Chain Will Be Broken For Months

The Daily Coin.org

Subscribe, Re-Subscribe, Share and Like - thanks for watching and listening.

Over the past few days the entire the precious metals markets has completed changed. These changes are not likely to revert in any short order. We have three of the top gold refineries in the world completely shuttered, there is a fourth gold refinery, Rand, while not shut down it has cut production by close to half. This means instead of the world...

Read More »

Read More »

Alasdair Macleod: Gold / Silver Supply Chain Will Be Broken For Months

Subscribe, Re-Subscribe, Share and Like - thanks for watching and listening.

Over the past few days the entire the precious metals markets has completed changed. These changes are not likely to revert in any short order. We have three of the top gold refineries in the world completely shuttered, there is a fourth gold refinery, Rand, while not shut down it has cut production by close to half. This means instead of the world processing gold...

Read More »

Read More »

Corona-Krise – Eine machbare, vertretbare Lösung

Nachdem ich mich systematisch mit den verschiedenen Teilproblemen beschäftigt habe, bin ich nun überzeugt, eine machbare, vertretbare und rasche Lösung für das Corona-Problem gefunden zu haben.

Read More »

Read More »

Missed Payments In Production Chains Will Collapse System: Alasdair Macleod

Subscribe, Re-Subscribe, Share, Like. Thanks for watching / listening.

I sat down with Alasdair Macleod, Head of Research for Gold Money - https://wealth.goldmoney.com - to get an update on the FMQ (Fiat Money Quantity) since there has been about a dozen cargo ships filled with digital dollars spewed all around the world. Well, it turns out that not only is this a massive problem that we've all known is a problem, but there is another, even...

Read More »

Read More »