Category Archive: 6a) Gold & Monetary Metals

New Collectible Coins in the House – Sprott Money Collectibles

New Coins in the House

Explore a range of new coins just added to the collection from various mints across the world. The designs are truly masterful. The adorable Quokka from the Perth Mint; fascinating Solar System featuring the Sun, Planets and the Milky Way from Royal Canadian Mint; beautiful heart-shaped coin with Belle in front of the Beast, smiling as he gently holds her hands, and more of your favorites.

Hurry before they sell out!...

Read More »

Read More »

Blue Skies Ahead for Precious Metals – Sprott Money Precious Metals Monthly Projections – June 2021

We’ve seen some big rallies in gold over the last few months, and as we wrap up the month of May, the long-term charts are looking good. Host Craig Hemke sits down with Chris Vermeulen of the Technical Traders to break down all the gold and silver charts you need to prepare for the month ahead.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Check out https://www.sprottmoney.com, or to learn...

Read More »

Read More »

Wedding 2021 Silver Proof Coin

Sprott Money Collectibles Wedding 2021 Silver Proof Coin - The Perth Mint

A wedding is the most wonderful opportunity for a happy couple to share their love for one another in front of the most significant people in their lives. This beautiful silver wedding coin is a unique gift to celebrate newlyweds in 2021.

The coin features depict a bride and groom embracing on their wedding day with two intertwined gold wedding rings. The design includes...

Read More »

Read More »

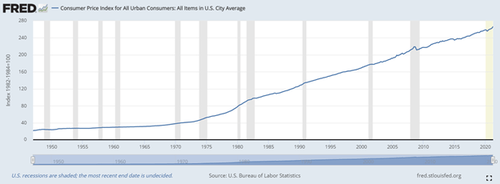

Gold’s Middle Finger To Lying Currencies

Authored by Matthew Piepenburg via GoldSwitzerland.com,Sensationalism, like central bankers and policy makers, has many faces, views and voices.This may explain why so many want to hold their ears, hug their knees and beg the heavens for a beacon of guiding light amidst a 24/7 fog of info-cycle pablum masquerading as information.

Read More »

Read More »

It´s flip a coin day!

It's Flip a Coin Day Today!

The tradition of flipping a coin to make decisions dates back to Julius Caesar, of course he had his face on the coin. :D

Let's flip a coin and make some memories with your friends, family and loved ones. Record and share your flip a coin tricks or funny moments. We would love to know and share with others.

#flipacoinday #flipacoin #heads #tails #headsortails #itstuesday #sprottmoneycollectibles #sprottmoney #coins...

Read More »

Read More »

Why Now is a Good Time to Buy Gold – Dominic Frisby

Is it Good to Buy Gold Now? - Dominic Frisby

Dominic Frisby, a well-known financial writer, author, comedian, and voice actor joins Dave Russell in this episode of GoldCoreTV and asks – is it a good time to buy #gold now?

In this episode, they also examine whether environmentalists are unfairly targeting #Bitcoin and whether massive money printing has painted central banks into a corner. What does this mean, for stocks, bonds, cryptocurrencies,...

Read More »

Read More »

Silver to Benefit Greatly from Global Electrification Push

Precious metals markets are making modest advances in this final trading week of May. U.S. markets will be closed on Monday in observance of Memorial Day.

Read More »

Read More »

Gold and Silver Ready for Summer – Weekly Wrap Up 5.28.21

Bob Thompson of Raymond James in Vancouver joins us to discuss inflation, Fed policy and gold. He also shares some information on the areas where Eric Sprott is currently focusing his efforts.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

Sprott Money Collectibles – Triumphant Dragon 2021 Pure Gold Coin – Royal Canadian Mint

Jumpstart your success with Triumphant Dragon 2021 Pure Gold Coin.

Dragon is an auspicious symbol of power, strength and good fortune. The design of this coin is inspired by the legend of the Carp and the Dragon Gate and influenced by the tale of Chi Wen, the second son of the Dragon King. This coin is yours to keep or share, but anyone can find inspiration in the story of the carp that persevered in the face of impossible obstacles and became a...

Read More »

Read More »

Max Otte als Mensch: Im Gespräch mit dem Publizisten Martin Lohmann

Im Gespräch mit dem Publizisten Martin Lohmann spricht Max Otte über sich und stellt sich auch sehr persönlichen Fragen.

Read More »

Read More »

Gold to hit $3,000, Bitcoin to $20,000 Chart Warning Signals!

Gold to hit $3,000, Bitcoin to $20,000 Chart Warning Signals!

With the latest reports of a sharp drop in bitcoin and investors returning to gold as a safe haven, Today on #GoldCoreTV, we have Gareth Soloway, Chief Market Strategist of InTheMoneyStocks.com, to share some insightful charts that help to understand the recent developments in the #Bitcoin, #Gold, and #Silver markets, as well as the S&P500 and bond markets.

Gareth predicted the...

Read More »

Read More »

Sprott Money Collectibles wishes Happy Victoria Day!

Sprott Money Collectibles wishes you a very Happy Victoria Day.

Victoria Day is the day to celebrate the birthday of Queen Victoria, the personification of greatness.

Let us remember the glory and magnum of the queen who ruled our hearts.

With great enthusiasm, we pay tribute to the Queen.

-

-

-

#sprottmoneycollectibles #sprottmoney #coins #collectorcoins #numismatics #collectibles #rarecoins #coincollection #victoriaday #canada...

Read More »

Read More »

Sprott Money News Ask The Expert – May 2021, Rob Kirby

Market analyst Rob Kirby joins us this month to answer your questions about Fed policy, inflation and the precious metals.

Topics

0:00 - Introduction

1:40 - Inflation, transitory inflation and deflation

7:24 - Canadian Dollar hitting multi-year high vs. USD

10:17 - #SilverSqueeze movement's impact on the pricing system

12:15 - Will Imposition of BaselIII impact gold and silver pricing?

16:35 - FED announcing QE Taper Plan

18:22 - Will gold...

Read More »

Read More »

Gold & Silver Quietly Gather Strength as Other Assets Gyrate

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Fears of a crackdown in China, combined with remarks by Elon Musk announcing Tesla will no longer accept Bitcoin, seemed to trigger the volatility. A selling spree caused Bitcoin to suffer a 25% mini-crash this week before prices turned back up sharply.

Read the Full Transcript Here:...

Read More »

Read More »

End of a Really Good Week for COMEX Gold and Silver – Weekly Wrap Up 5.21.21

Legendary precious metals trader and wholesaler Andrew Maguire joins us to discuss the present state of the precious metals markets and what to expect ahead of June option expirations next week.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Visit our website https://www.sprottmoney.com for more news.

Read More »

Read More »

Graduation Day Gift Ideas

Congratulate your graduate for their impressive achievement with a unique gift.

A gift of a timeless beautiful coin will make them feel proud and motivate them to more successful moments in the future.

Order Now: https://www.amazon.ca/s?k=sprott+money&i=toys&fbclid=IwAR1ZEPp-gRP-wzVxEAulHkJ0xJy7v3aKAYIg4d2SX99nXPJEWgToZns0Puc&ref=nb_sb_noss

-

-

-

#sprottmoneycollectibles #sprottmoney #coins #collectorcoins #numismatics...

Read More »

Read More »

In Conversation with Dr. Marc Faber.

Dr Marc Faber was born in Zurich, Switzerland. He went to school in Geneva and Zurich and finished high school with the Matura. He studied Economics at the University of Zurich and, at the age of 24, obtained a PhD in Economics magna cum laude.

Read More »

Read More »

Alasdair Macleod Banking Crisis & This Can Happen To GOLD During Currency Reset

Alasdair Macleod writes, “Basel 3 is on course to regulate the LBMA out of existence. And with it will go all the associated arbitrage business and position-taking on Comex, because most bullion bank trading desks will cease to exist.

Read More »

Read More »

Alasdair Macleod: The Currency Will Collapse Silver & Gold Will Go Up 10x !!What Happens Next?

stock market crash 2021, stock market news, economic crisis 2021, economic crisis, economic collapse, economic collapse 2021, economic collapse us 2021, financial crash 2021, financial crisis 2021, financial crisis, financial crisis explained, financial collapse us, furlough extended us, furlough,

Read More »

Read More »