Category Archive: 6a.) Monetary Metals

Episode 12: The Yield Purchasing Power Paradigm

Most people think in terms of purchasing power: how much can one’s cash buy? In this week’s episode, CEO Keith Weiner & John Flaherty discuss an alternate perspective. Instead of spending your capital, what if you invested it to earn a return? What can that return buy?

Read More »

Read More »

Episode 11: The Common Ground Between Bitcoin & Gold

Is there common ground the among proponents of gold and bitcoin? John Flaherty and CEO Keith Weiner take on that question in this episode.

Read More »

Read More »

Monetary Metals Renews Financing to Investopedia’s Best Online Gold Dealer

Scottsdale, Ariz, February 5, 2021—Monetary Metals® announces the renewal and expansion of its gold, silver & platinum leases to Money Metals Exchange, to finance the Idaho-based business’ bullion inventory.

Read More »

Read More »

Reddit Residue on Silver, 3 February

The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal.

Read More »

Read More »

Ruh Roh Silver

Sometimes you can count on the manipulation conspiracy theorists to get it exactly wrong. Not just a little bit wrong, nor halfway wrong. Not even mostly wrong. Totally wrong, backwards.

Read More »

Read More »

Monetary Metals Issues World’s First Gold Bond Since 1933

Monetary Metals® is pleased to announce the issuance of a bond paying principal and interest in gold. The term is one year, and the interest rate on invested gold is 13%. According to company CEO Keith Weiner, Ph.D., it is the first proper gold bond in 87 years.

Read More »

Read More »

Reflections Over 2020

Wow, it has been a heckuva year! One thought leads to another on this sunny-but-cool January 1. Having watched a few seasons of Forged in Fire, I’ve gained an appreciation of how difficult it is to pound and grind a lump of steel into a blade, even with power tools. There are many ways for it to go wrong.

Read More »

Read More »

That Precious Metals Rumor Mill, 30 November

We are hearing rumors this week of a shortage of the big silver bars, the thousand-ouncers. No, we don’t refer to bullion banks saying this. Nor big dealers, who are happy to sell us as many of these as we can buy. Nor our peeps in high places (we don’t claim to have any such peeps).

Read More »

Read More »

The Great Reset, 23 November

There are now two entirely different notions of a coming “reset”. One has been popular among those who speculate on the gold price. They expect a revaluation of the dollar.

Read More »

Read More »

Yes, Virginia, There Is An Alternative, 11 November

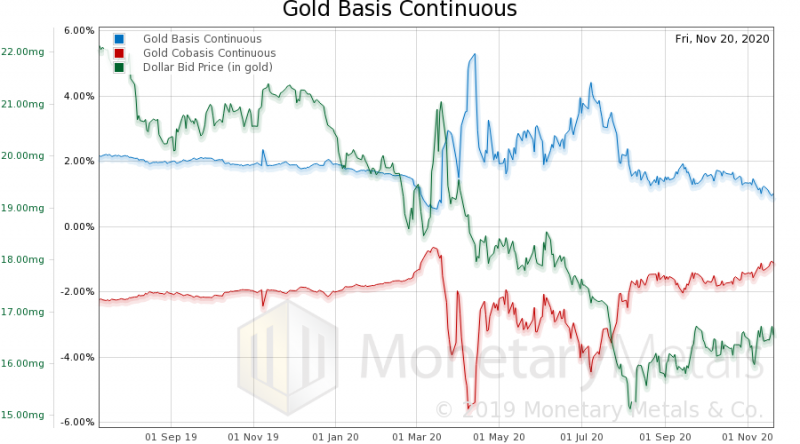

On Monday the dollar had a ferocious rally, moving up from 15.87mg gold to 16.77mg and from 1.21g silver to 1.32g. In mainstream terms, the price of gold dropped about a hundred bucks, and the price of silver crashed $2.20.

Read More »

Read More »

Recovery: GDP vs MPoD, 2 November

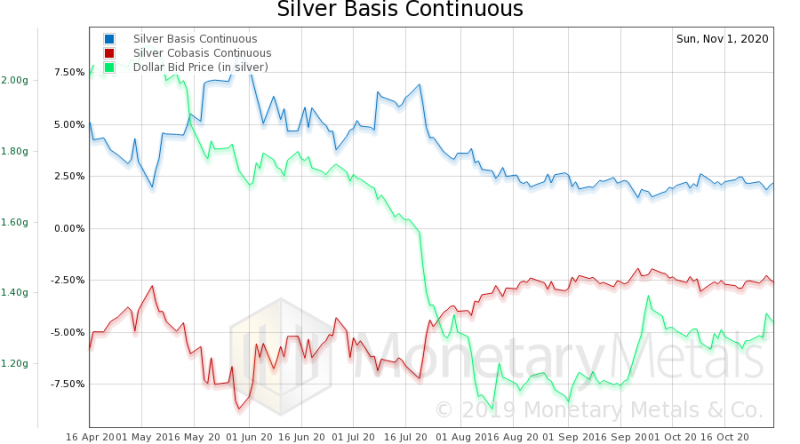

On Wednesday last week, the price of silver dropped from over $24.25 to just a bit over $23 before bouncing back to around $23.50. The next day, the price dropped again, briefly to around $22.60 before mostly recovering (but a dime to a quarter down).

Read More »

Read More »

Why These Gold Standardites Are Wrong, 13 October

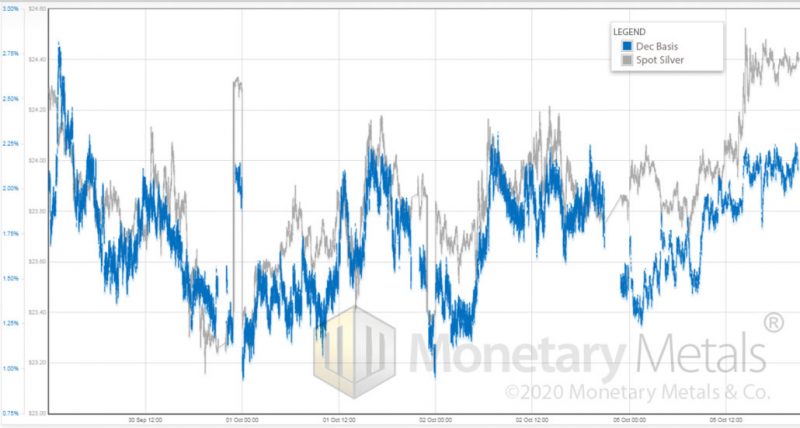

On Friday, the price of silver went up from $24.25 to $25.20, or +4%. Let’s look at the graph of the price and basis (i.e. abundance) action. For the first part of the day, the action is from speculators, for the most part.

Read More »

Read More »

Silver Falls, We’ve Got #$*&! Mail

There was a big drop in the price of silver last Wednesday. Then the price moved up, and down, but mostly up. Let’s look at a graph of the silver price and basis showing Sep 30 through Oct 5, with intraday resolution.

Read More »

Read More »

Silver Rises, JP Morgan Manipulates!

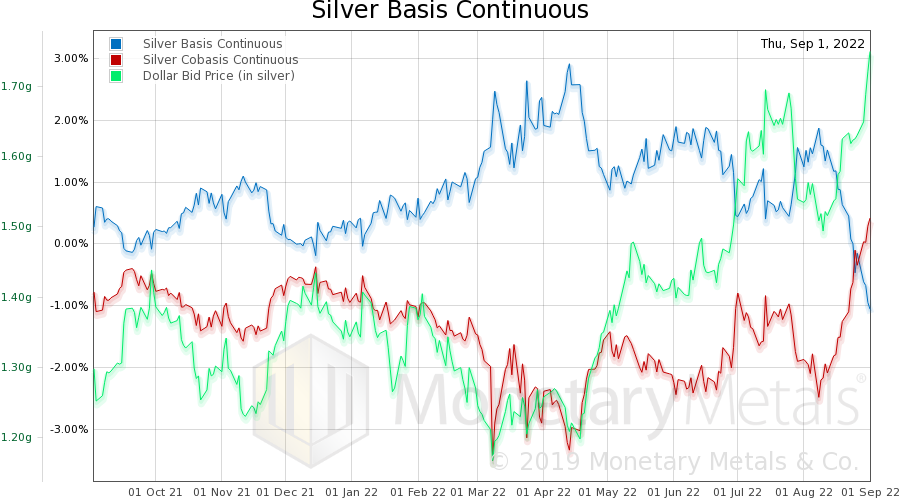

While the silver price was dropping recently, we published analyses here and here. At that time, we saw a basis that fell with price, but which recovered during “off” days. In short, there was not much of a decrease in abundance of the metal to the markets commensurate with the price drops.

Read More »

Read More »

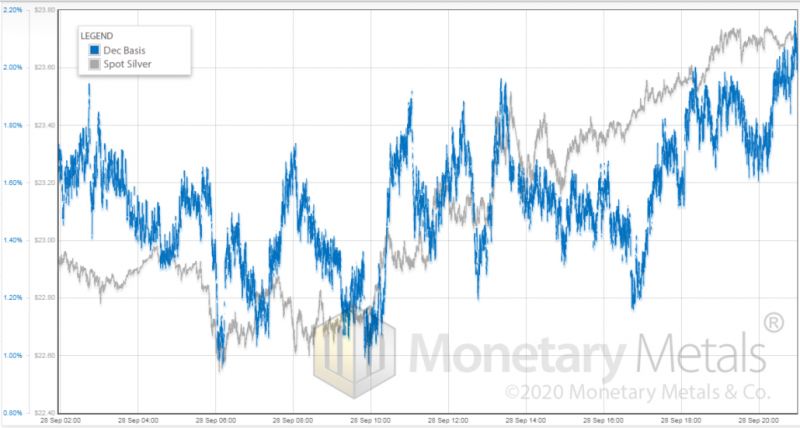

And Silver Crashes Some More! 24 Sept

A few days ago, we wrote about a big silver crash. The price dropped around 7.5%. And the basis dropped from around 2% to 0.6%. At the end, we said: “The key question is: what is the follow-through? If the price stays down and the basis goes back up, that will be a bearish signal. If the basis stays down, that means the silver market is markedly tighter at $24.50 than it was at $26.75.”

Read More »

Read More »

Keith Weiner on Wall Street and Main Street

2020-09-23

by Keith Weiner

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

12 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Gold has no counterparty risk.

Gold has no counterparty risk. -

Was wir über Corona nie wissen sollten

Was wir über Corona nie wissen sollten -

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell -

Swiss wine growers seek to limit European imports

Swiss wine growers seek to limit European imports -

Swiss farmers hold greater sway than ever

Swiss farmers hold greater sway than ever -

Phänomen Luxus-Armut: Warum wir alles haben, aber nichts besitzen

Phänomen Luxus-Armut: Warum wir alles haben, aber nichts besitzen -

Lohnt sich ein Studium noch?

Lohnt sich ein Studium noch? -

What Took Gold To $5,000

What Took Gold To $5,000 -

When bond markets become political, gold doesn’t become fashionable it becomes logical.

When bond markets become political, gold doesn’t become fashionable it becomes logical. -

Kommst du auf 7 Stunden Schlaf?

Kommst du auf 7 Stunden Schlaf?

More from this category

- Monetary Metals Welcomes Ronald-Peter Stöferle and Mark Valek to Advisory Board

23 Sep 2024

- Monetary Metals Achieves SOC 2 Certification

2 Sep 2024

Bryan Caplan: Why Housing Costs DOUBLED

Bryan Caplan: Why Housing Costs DOUBLED11 Jun 2024

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Is gold an inflation hedge?

Is gold an inflation hedge?12 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

- Monetary Metals Publishes Eighth Annual Gold Outlook Report

12 Mar 2024

- Money versus Monetary Policy

17 Feb 2023

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle

Ep 52 – Jeff Snider: Solving the Eurodollar Puzzle24 Jan 2023

Evidence Of A Declining Economy

Evidence Of A Declining Economy10 Jan 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice

Ep 51 – Bryan Caplan: Economic Principles for Genuine Justice17 Dec 2022

Why Invest in Gold if the Dollar is Strong?

Why Invest in Gold if the Dollar is Strong?15 Dec 2022

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?

Ep 50 – Brent Johnson: Has the Dollar Milkshake Spilled or Just Begun?6 Dec 2022

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal

Monetary Metals Ramps Up its Gold Bond Program with Akobo Minerals Deal18 Nov 2022

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification

Ep 45 – Danielle Lacalle: The Case for the People’s Zombification28 Oct 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022