Category Archive: 6a) Gold and its Price

Cashless Society – Good or Bad? MoneyConf 2018

– Cashless society or ‘Lesscash’ society? – Do you carry cash and how much? – When might we see the world’s first completely cashless society? – Who wins the payments battle – Apple, Google, WeChat, Alipay? – Privacy, bank, electricity, wifi, tech and systemic risk underlines importance of cash – What do you think?

Read More »

Read More »

Do We Still Need Banks? – Moneyconf 2018

Moneyconf 2018 – Do we still need banks in the fintech age? Mark O’Byrne, Director of Research at GoldCore.com looks at the changing attitude towards banks in the modern world of fintech (Financial Technology), and looks at the responses to a poll run at #MoneyConf 2018

Read More »

Read More »

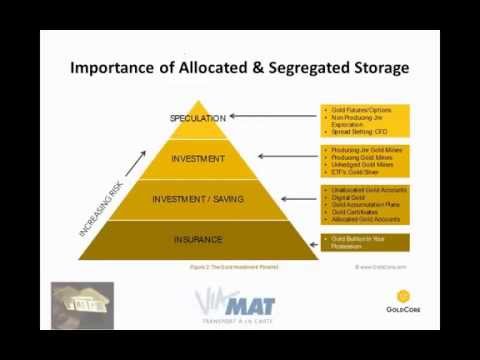

Not All Gold is Equal – Goldnomics Ep 4

Is all gold equal? The tangible quality of gold bullion is one of the key factors which contributes to gold’s ability to act as a form of financial insurance for investments, savings and wealth, throughout history and again in recent months and years throughout the world. Listen to the full episode or skip directly to … Continue...

Read More »

Read More »

‘Welsh Gold’ Hype Due To Royal Wedding?

Welsh gold and the misconceptions surrounding it – GoldCore speak to Reuters China Central Television (CCTV). Welsh gold mired in misconceptions, namely that it is the ‘rarest’ and most ‘sought after’ gold in the world Investors need to be reminded that all mined gold is rare and homogenous

Read More »

Read More »

Bron Suchecki – What GOFO and Backwardation Says About the Gold Market

Bron Suchecki of Monetary Metals (https://monetary-metals.com) joins us on the channel to shed light on the Gold Forward Offered Rate (GOFO), the implications when the gold market goes into backwardation and usefulness of GOFO as an indicator of the market. Bron also shares his outlook for gold and silver in 2018. Discussed in the interview: …

Read More »

Read More »

Goldnomics Podcast (Episode 3) Is The Gold Price Going to $10,000?

In this the third episode of the Goldnomics podcast we ask the question; “Is the gold price going to $10,000?”. GoldCore CEO Stephen Flood and GoldCore’s Research Director and world renowned precious metals commentator Mark O’Byrne in discussion with Dave Russell. We discuss what will drive gold to new record highs over the coming months …

Read More »

Read More »

Goldnomics Podcast (Episode 2) Is This The Greatest Stock Market Bubble In History?

In this the second episode of the Goldnomics podcast we ask the question; “Is this the biggest stock market bubble in history?” GoldCore CEO Stephen Flood and GoldCore’s Research Director and world renowned precious metals commentator Mark O’Byrne in discussion with Dave Russell. We discuss what is really driving the markets to new record heights, …

Read More »

Read More »

Goldnomics Podcast – Gold, Stocks, Bonds, Bitcoin in 2018. Everything Bubble Bursts? (Episode 1)

In this our first GoldNomics podcast we take a look at the major financial market themes of 2017 and delve into the outlook in 2018. GoldCore CEO Stephen Flood and GoldCore’s Research Director and world renowned precious metals commentator Mark O’Byrne are interviewed by Dave Russell. Touching on a wide range of macro-economic and geo-political …

Read More »

Read More »

Fear and Loathing In the Age of QE..AI

GoldCore CEO Stephen Flood discusses various markets themes for 2018 and beyond. Fear and Loathing in the age of QE ..AI is named as a parody for a global capital market swamped in printed money, comparing it to the drug-fueled binge of Hunter S Thompson in Las Vegas. How to buy gold as a hedge, … Continue reading »

Read More »

Read More »

Gold: The Kardashian of Commodities?

Is Gold the “Kardashian” of Commodities? Double Down asks Jan Skoyles, of www.Goldcore.com, if there is enough gold in the world to hedge against a President Trump. U.S. Election – Trump and Clinton most hated Presidential candidates in history. Goldman Sachs says that gold is a ‘good hedge against politicians’.

Read More »

Read More »

BullionStar Perspectives: Bron Suchecki – Intricacies between the Physical and Paper Gold Market

Bron Suchecki shares his insights on how some gold is flowing back to the West in early 2016 and clarifies the nuances of the relationship between the physical gold market and the paper gold market.

Read More »

Read More »

BANK BAIL-INS – with Goldcore.com Mark O’Byrne

Bank Bail-Ins are coming and people need to prepare by owning bullion outside the banking system. They will be counterproductive and could lead to financial collapse. “Unfortunately, we don’t learn the lessons of history to our own downfall!”. For more information http://www.GoldCore.com

Read More »

Read More »

Why Silver Bullion Is Set To Soar – GoldCore Interview

Jan Skoyles presents a Get REAL special on silver. She talks to Mark O’Byrne of www.GoldCore.com about how silver bullion is set to soar and the importance of owning physical silver coins and bars. GoldCore now offer silver coins VAT free in the UK and throughout the EU.

Read More »

Read More »

GoldCore on What Driving Gold Prices Up Now

www.GoldCore.com give detailed insight on the gold bullion coin and bar market, answering questions about sudden rise of physical gold prices, the British Economy in the run up to Brexit Referendum and it’s influence on the gold bullion market. Sign Up For News, Research & Special Offers from GoldCore Here – http://info.goldcore.com/goldcore_email_subscription_preferences

Read More »

Read More »

Bail-In Regimes Are “Insane” – GoldCore Warn On Bail-Ins

Mark O’Byrne, founder of the hugely successful Irish bullion broker GoldCore recently spoke to WAM’s Josh Sigurdson and John Sneisen about the value of silver & gold bullion as well as the many problems with central banks and the printing of worthless IOU note currency. During the 40 minute interview, Mark spoke about the coming …

Read More »

Read More »

Gold Bullion Demand From China Causing Paradigm Shift – GoldCore.com

Gold bullion coins and bars surging demand and the ongoing paradigm shift that is China’s gradual move to become a dominant player, if not the dominant player, in the global gold market continues according to www.GoldCore.com. China was the largest buyer of gold in the world again in 2015. Sign Up For News, Research & …

Read More »

Read More »

Bron Suchecki @bronsuchecki Perth Mint: All that Glitters

Bron says , “The mint produces collectables like the Star Wars coins to attract collectors and people with an interest in the films. I don’t buy into the paper gold conspiracy to drive prices down. Of course there is manipulation, but not just on declines it happens during advances too. I don’t believe Chinese gold …

Read More »

Read More »

Live Analysis Room Show 554th + interview Bron Suchecki

Join us for a unique Forex experience in the FXStreet Live Analysis Room. The #FXroom is being hosted by Dale Pinkert, long time and popular contributor on FXStreet. Trading in community. Know our Mastermind concept as we all edify each other 1+1=11 at http://www.fxstreet.com/webinars/live-analysis/ and chat with experts and traders. Don’t miss the interview with …

Read More »

Read More »

Gold Bullion’s Outlook, Currency Reset & Asset Allocation with John Butler

Register Now for Webinar next Thursday and have your question answered by John Butler: https://attendee.gotowebinar.com/register/2239182188163807746 Gold’s Outlook For Year End 2015 and In 2016 Gold’s Performance in the Coming Years: 2016-2020 Coming Global Currency Reset Asset Allocation – How Much Gold? Owning Gold – How and Where?

Read More »

Read More »

How to Buy Gold Bullion Today and When To Sell Gold

Receive Our Award Winning Free Research Here: http://info.goldcore.com/goldcore_email_subscription_preferences – Gold Bullion Seminar – The Outlook For Gold Today – When To Sell Your Gold Coins and Bars – Questions & Answers.

Read More »

Read More »