Category Archive: 6a) Gold and its Price

Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold

◆ Gold is flowing to strong hands in safer forms of gold ownership, in safer jurisdictions

◆ Gold and silver bullion coins and bars owned by GoldCore’s clients have been moved from Hong Kong to Singapore

◆ Central bank and institutional gold rush is beginning as prudent money diversifies fx reserves by buying gold & repatriates their gold from London and New York

◆ Central banks are repatriating gold and buying gold as never before due to...

Read More »

Read More »

Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold

◆ Gold is flowing to strong hands in safer forms of gold ownership, in safer jurisdictions ◆ Gold and silver bullion coins and bars owned by GoldCore’s clients have been moved from Hong Kong to Singapore ◆ Central bank and institutional gold rush is beginning as prudent money diversifies fx reserves by buying gold & …

Read More »

Read More »

Gold Bullion Moved From Hong Kong by GoldCore – Shows Importance Of Being Able To Easily Move Gold

GoldCore directors have been monitoring the political and economic situation in Hong Kong for the last year. It has clearly deteriorated in the last two weeks and we are now erring on the side of caution in terms of our client's who store assets there.

We have emailed and phoned all GoldCore Secure Storage clients with assets in Hong Kong and strongly encouraged them to move their assets to Singapore.

GoldCore have also suspended trading of all...

Read More »

Read More »

Gold Bullion Moved From Hong Kong by GoldCore – Shows Importance Of Being Able To Easily Move Gold

GoldCore directors have been monitoring the political and economic situation in Hong Kong for the last year. It has clearly deteriorated in the last two weeks and we are now erring on the side of caution in terms of our client’s who store assets there. We have emailed and phoned all GoldCore Secure Storage clients …

Read More »

Read More »

Has Germany Increased Its Gold Reserves For The First Time In 21 Years?

◆ Has Germany increased it's gold reserves for the first time in 21 years?

◆ Important story of how Bloomberg reported that Germany had added to its gold reserves and that “Germany’s reserves climbed to 108.34m oz in September, the first increase since 1998” and then "corrected the story"

◆ A screen grab of the original Bloomberg story (only covered by Bloomberg via the Bloomberg terminal) on October 23rd can be seen in our video and in...

Read More »

Read More »

Has Germany Increased Its Gold Reserves For The First Time In 21 Years?

◆ Has Germany increased it’s gold reserves for the first time in 21 years? ◆ Important story of how Bloomberg reported that Germany had added to its gold reserves and that “Germany’s reserves climbed to 108.34m oz in September, the first increase since 1998” and then “corrected the story” ◆ A screen grab of the …

Read More »

Read More »

Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World

◆ GOLDNOMICS PODCAST - Episode 13 - Lucky for some !

◆ Why is nobody talking about the real risk of contagion to investors, savers & companies?

◆ "Contagion will impact stocks, bonds and deposits and both investments and savings across the spectrum"

◆ While all the focus in the UK, Ireland and the EU is on Brexit, the risk of another debt crisis looms as companies, banks, governments and the global economy grapple with massive levels...

Read More »

Read More »

Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World

◆ GOLDNOMICS PODCAST – Episode 13 – Lucky for some ! ◆ Why is nobody talking about the real risk of contagion to investors, savers & companies? ◆ “Contagion will impact stocks, bonds and deposits and both investments and savings across the spectrum” ◆ While all the focus in the UK, Ireland and the EU …

Read More »

Read More »

Focus On Gold’s Safe Haven Value, Not Gold $16,000 and Silver $700 Prices !

◆ Important to focus on safe haven value of gold and not the coming record high prices

◆"Nobody has a crystal ball and you should not be buying these assets based on anybody's price predictions"

◆ "The possibility of gold over $16,000 per ounce and silver over $700 per ounce ... I hear people gasp in dismay when I say those figures and I will qualify them"

◆ "You would wonder if the criminal enterprises are continuing?...

Read More »

Read More »

Focus On Gold’s Safe Haven Value, Not Gold $16,000 and Silver $700 Prices !

◆ Important to focus on safe haven value of gold and not the coming record high prices ◆”Nobody has a crystal ball and you should not be buying these assets based on anybody’s price predictions” ◆ “The possibility of gold over $16,000 per ounce and silver over $700 per ounce … I hear people gasp …

Read More »

Read More »

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

Where Does Gold Go From Here? — Ron Paul’s “Cautious” Prediction. “Gold is an ‘insurance policy’ as the dollar will continue go down in value as it is printed” and it will end in a monetary “calamity”. “Gold is not money due to any man-made laws. Gold is money despite man-made laws, and is a product of the voluntary marketplace”.

Read More »

Read More »

Gold $5,000, Bank & Digital Risk, Bitcoin & Cryptos, Storing Gold In Switzerland & GoldCore’s Story

◆“Don’t just count your bullion coins and bars … count your blessings”

◆ Dale Pinkert of Forexanalytix.com interviews Mark O’Byrne about GoldCore, gold’s outlook, bank and electronic risk, bitcoin and cryptos and Swiss storage

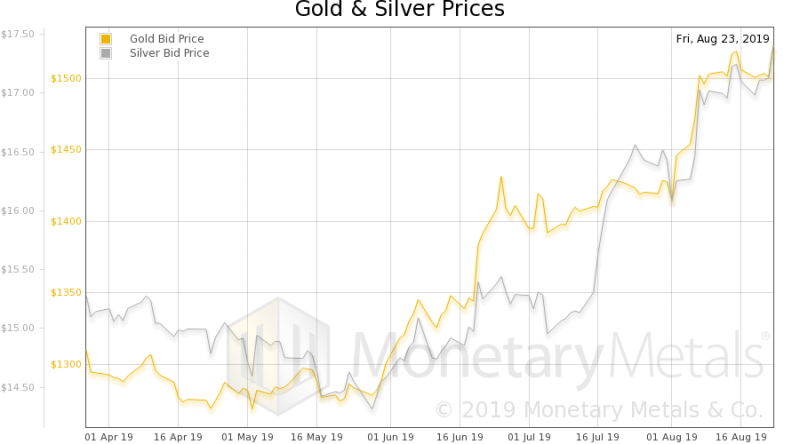

◆ Gold is 20% higher year to date and the best performing asset in the world

◆ Gold is 8% higher in August and may correct in the short term so cost average

◆ Deutsche Bank is a “basket case” and share price has collapsed to...

Read More »

Read More »

Gold $5,000, Bank & Digital Risk, Bitcoin & Cryptos, Storing Gold In Switzerland & GoldCore’s Story

◆“Don’t just count your bullion coins and bars … count your blessings” ◆ Dale Pinkert of Forexanalytix.com interviews Mark O’Byrne about GoldCore, gold’s outlook, bank and electronic risk, bitcoin and cryptos and Swiss storage ◆ Gold is 20% higher year to date and the best performing asset in the world ◆ Gold is 8% higher …

Read More »

Read More »

Directive 10-289, Report 25 Aug

Everyone must ask himself the question. Do you want the world to move to an honest money system, or do you just want gold to go up (we italicize discussion of apparent moves in gold, because it’s the dollar that’s moving down—not gold going up—but we sometimes frame it in mainstream terms).

Read More »

Read More »

Jim Rogers: Buy Gold Coins and Silver Coins as Global Crisis Is Coming

◆ “Get knowledgeable and get prepared as this crisis is going to be the worst in my life time”

◆ “I own physical gold and silver coins … everyone should own them”

◆ "I own Chinese, Russian, American, Australian, Austrian silver coins" and "I own UK gold coins and I own a lot of gold coins from various places"

◆ "Singapore has been and is a very safe location for storage, Switzerland is too, Austria is too, Liechtenstein is...

Read More »

Read More »

Jim Rogers: Buy Gold Coins and Silver Coins as Global Crisis Is Coming

◆ “Get knowledgeable and get prepared as this crisis is going to be the worst in my life time” ◆ “I own physical gold and silver coins … everyone should own them” ◆ “I own Chinese, Russian, American, Australian, Austrian silver coins” and “I own UK gold coins and I own a lot of gold …

Read More »

Read More »

Gold and Silver Are “Safe Haven Money” and Have Never Failed Throughout History – Silver Guru

- "I feel called to this ... I feel it is my duty to educate as many people as possible"

- The Fed is engaged in "extend and pretend" but we are in the "end game"

- The gold silver ratio is headed "much much lower" - likely back to 30:1

- Only some $16 billion worth of above ground investment grade silver

- U.S. bonds are no longer safe due to negative yields and the risk of massive currency depreciation

- A...

Read More »

Read More »

Gold and Silver Are “Safe Haven Money” and Have Never Failed Throughout History – Silver Guru

– “I feel called to this … I feel it is my duty to educate as many people as possible” – The Fed is engaged in “extend and pretend” but we are in the “end game” – The gold silver ratio is headed “much much lower” – likely back to 30:1 – Only some $16 …

Read More »

Read More »

Is Your Gold and Silver Bullion S.A.F.E. ?

The Gold S.A.F.E. TEST - Goldnomics Episode 12

- It is now time to move to own actual physical gold coins and bars

- Become your own central bank and avoid ETF and online gold

- Take delivery and own gold and silver bullion in the S.A.F.E. way

Is Your Gold and Silver Bullion S.A.F.E. ?

Are your precious metals Segregated, Actionable, Flexible and what are the total Expenses?

- Are your gold and silver bullion Segregated (Fully segregated &...

Read More »

Read More »

Is Your Gold and Silver Bullion S.A.F.E. ?

The Gold S.A.F.E. TEST – Goldnomics Episode 12 – It is now time to move to own actual physical gold coins and bars – Become your own central bank and avoid ETF and online gold – Take delivery and own gold and silver bullion in the S.A.F.E. way Is Your Gold and Silver Bullion S.A.F.E. … Continue reading...

Read More »

Read More »