Category Archive: 6a) Gold & Monetary Metals

Interview with Dr. Marc Faber

Marc Faber joins us as a special guest on this show, and it makes for a great conversation on markets, the economy, why the rent is too high in California, his advice for millenials, and his unusual sleep schedule. Marc writes great newsletter the Gloom Boom & Doom Report which can be found on http://gloomboomdoom.com … Continue reading...

Read More »

Read More »

“Without Gold I Would Have Starved To Death” – ECB Governor

– “Without gold I would have starved to death” – Ewald Nowotny, governor of Austrian central bank and member of ECB’s governing council

– “I was born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins…”

– “When the going gets tough, gold becomes the ultimate money” reports Die Presse

Read More »

Read More »

Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars. The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest.

Read More »

Read More »

Not All Gold is Equal – Goldnomics Ep 4

Is all gold equal? The tangible quality of gold bullion is one of the key factors which contributes to gold’s ability to act as a form of financial insurance for investments, savings and wealth, throughout history and again in recent months and years throughout the world. Listen to the full episode or skip directly to … Continue...

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 6 8 18

Eric Sprott discusses the week that was and looks ahead to what will be a very interesting and volatile week next.

Read More »

Read More »

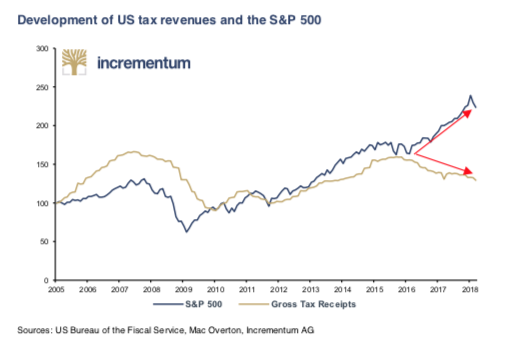

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later. Guest post by Dominic Frisby of Money Week. This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…

Read More »

Read More »

Sprott Money Weekly Wrap-Up 6 1 18

Bob Thompson of Raymond James in Vancouver sits in for Eric this week as we discuss Friday’s US jobs report, the upcoming FOMC meeting and the impact on gold, silver and the mining shares.

Read More »

Read More »

Gold And Silver Bullion Obsolete In The Crypto Age?

What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? Fresh insights as CrushtheStreet.com interview Mark O’Byrne who gives his diagnosis on the outlook for gold in 2018, and looks at the long-term relevance of precious metals in the digital age of crypto and the blockchain alongside Bitcoin’s emergence as a potential digital store of value.

Read More »

Read More »

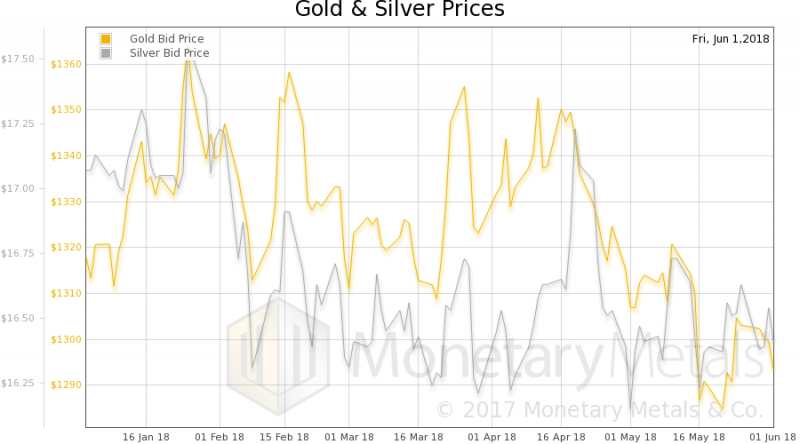

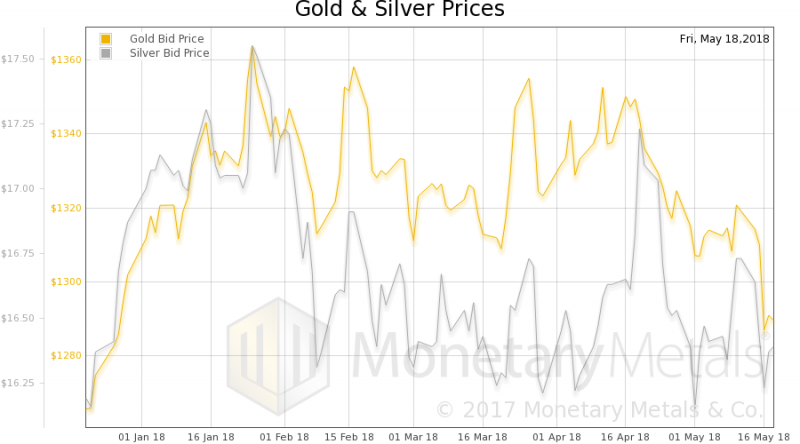

Gold Back Above $1300 – Trump Cancels Historic Summit – Silver “Ready To Breakout”

– Trump Cancels Historic Summit with North Korea. – US 10-Year Falls Below 3%, Gold Jumps Back Above $1300. – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes. – Gold Demand in Turkey as Lira falls sharply, true inflation near 40%. – EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’. – Silver Trading in Tight $1 range, Pressure Building for a Breakout.

Read More »

Read More »

‘Nightmare Scenario’ For EU Bond Markets As Anti-Euro Italian Goverment Takes Power

Firebrand populists of Left and Right are poised to take power in Italy, forming the first “anti-system” government in a major West European state since the Second World War. Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the “nightmare scenario” feared by foreign investors and EU officials in equal measure.

Read More »

Read More »

Gold Looks A Better Bet Than UK Property

Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar.

Read More »

Read More »

Sprott Money News weekly Wrap-Up – 5 25 18

Eric Sprott recaps a very interesting week in the precious metals and looks ahead to what promises to be an eventful summer.

Read More »

Read More »

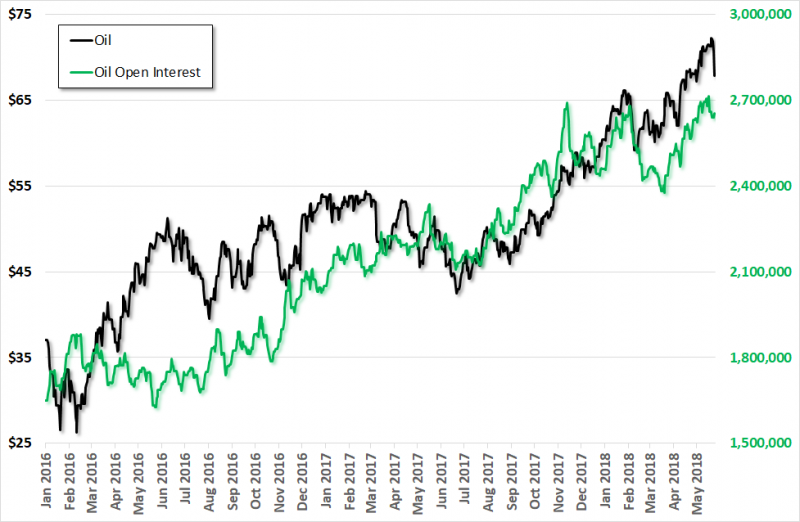

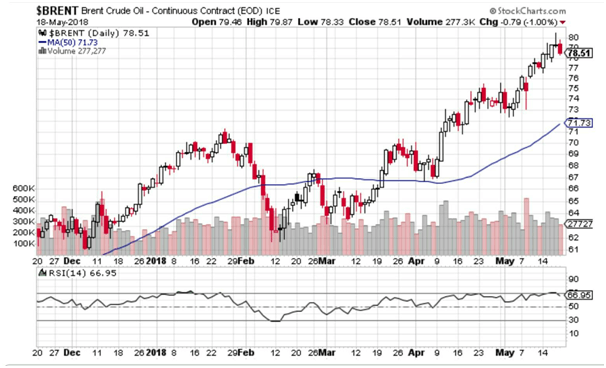

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

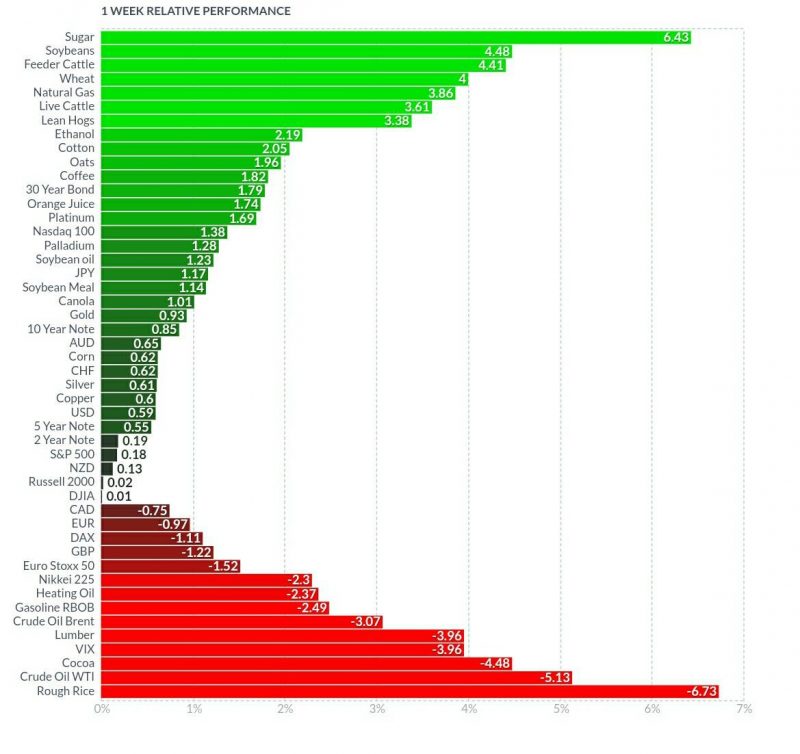

US 10-Year Yields Top 3%, US Dollar Pushes Higher. Brent Hits $80, Highest in 4 years. Emerging Market Chaos, the Lira and Peso in Freefall. Italy’s New Coalition Signal Their Plans, Yields Jump. Japanese Economy Contracts, GDP Worst Since 2015. And Where Next for Gold?

Read More »

Read More »

Sprott Money News weekly Wrap-Up – 5 18 18

This week, Eric Sprott discusses the ongoing selloff in gold prices but also looks ahead to the issues caused by the rising US dollar and higher US interest rates.

Read More »

Read More »

Welsh Gold Being Hyped Due To The Royal Wedding?

Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV). Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world. Investors to be reminded that all mined gold is rare and homogenous. Nothing chemically different between Welsh gold and that mined elsewhere. Investors led to believe Welsh gold is more valuable, despite lack of authenticity in some Welsh gold...

Read More »

Read More »