Category Archive: 6a) Gold and its Price

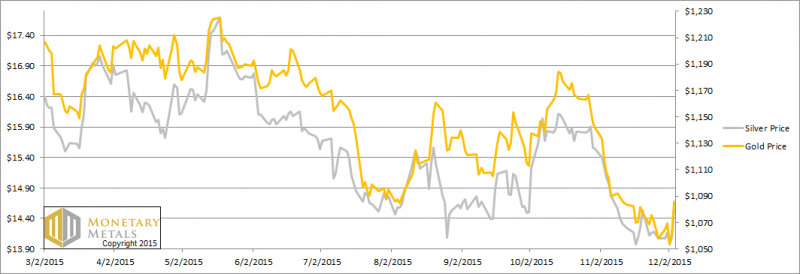

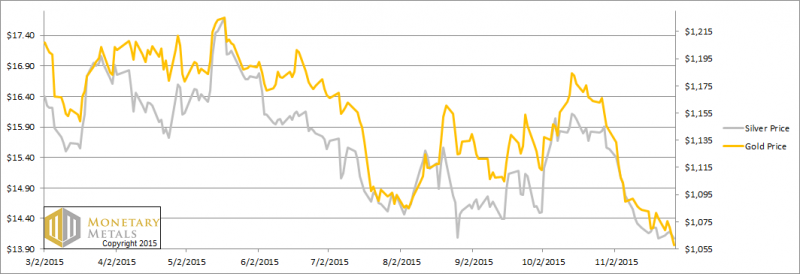

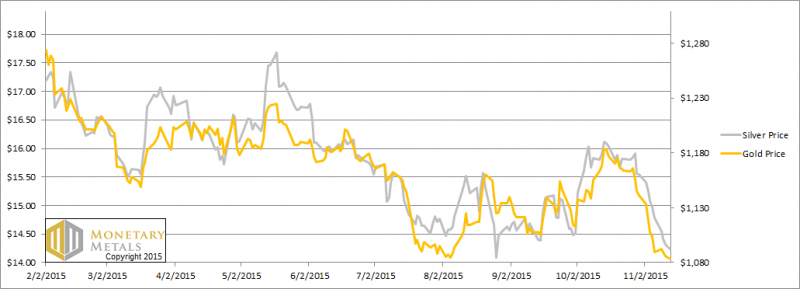

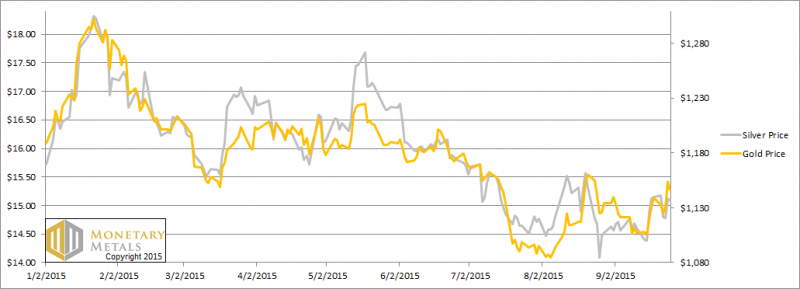

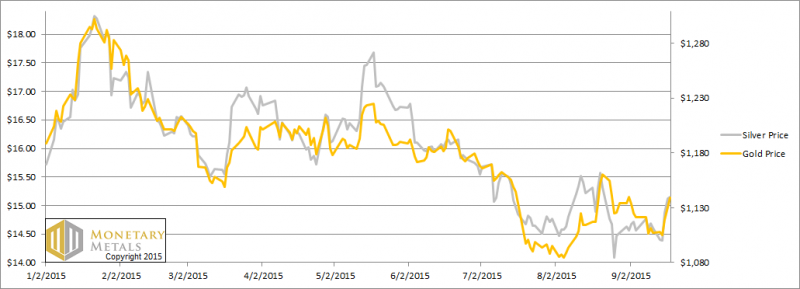

Silver Rocket Report 6 Dec, 2015

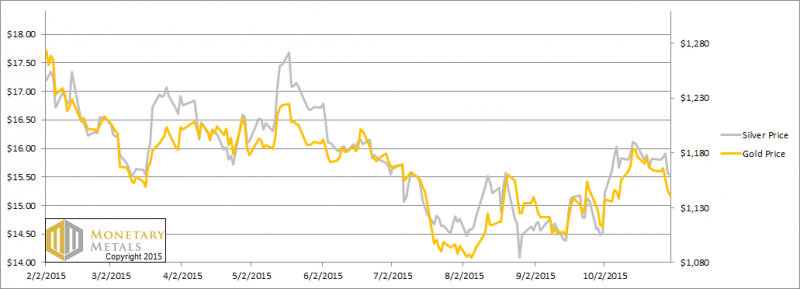

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.) From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly...

Read More »

Read More »

Light Thanksgiving Week Report 29 Nov, 2015

In this holiday-shortened week (Thanksgiving), the price of gold dropped $20 and silver 10 cents. Friday, when the price dropped the most, could not have had much liquidity as most Americans were out of work shopping or partying. Whatever they may ha...

Read More »

Read More »

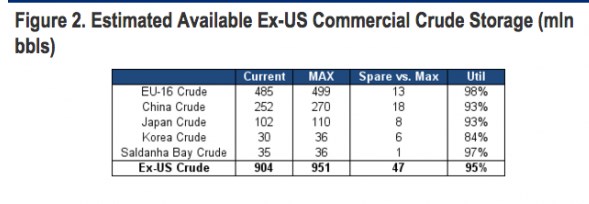

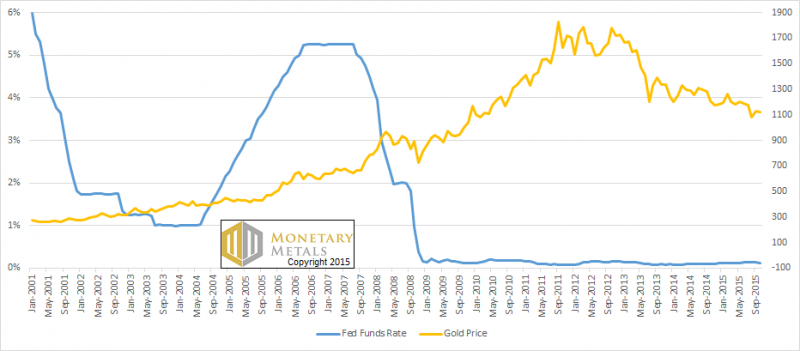

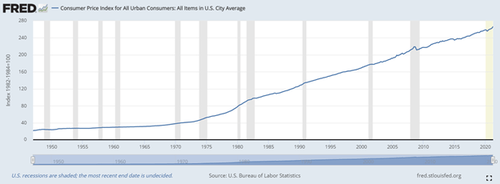

Trust and Oil

First, there’s a word for someone who buys gold in the hope its price will rise. This word is not investor, but speculator. Second, statistical anomalies cannot be asserted as proof of manipulation. Also, the article is giving the reader the blueprin...

Read More »

Read More »

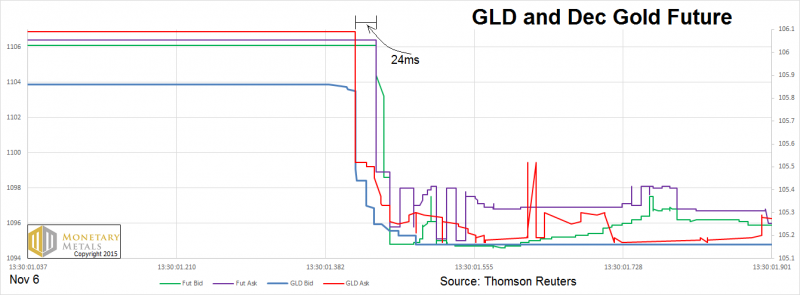

Another Look at the Gold Price Drop of 6 November

The prevailing view in the gold community is that banks are speculators who bet on a falling price. To begin, they commit the casino faux-pas of betting on Do Not Pass at the craps table. When everyone wants the price to go up, the banks seem to want...

Read More »

Read More »

Is a 13 or 15 Handle Next for Silver? 22 Nov, 2015

The price of gold dropped six bucks, and silver seven cents. Without much price action, let’s look a few other angles to gain some perspective. First, here’s the chart of both silver and the decidedly not-monetary metal copper.

Read More »

Read More »

A 14 Handle on Silver for Now. 15 Nov, 2015

In gold terms, the dollar went up a small 0.15 milligrams gold. The price of the dollar in silver went up considerably more as a percentage, 0.08 grams to 2.18g. Most people would say that gold went down and silver went down (though we continue to as...

Read More »

Read More »

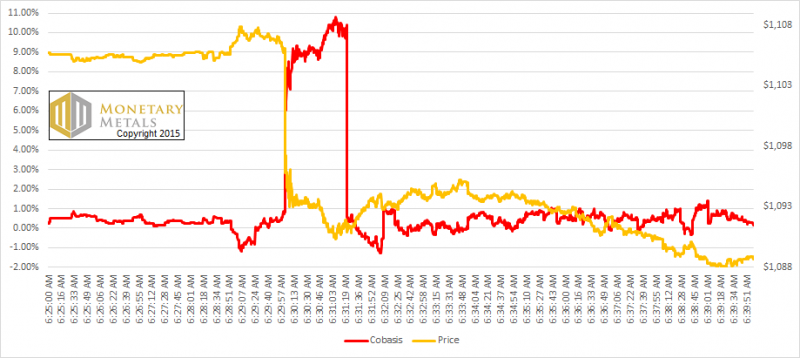

Gold Price Drop of 6 Nov: Drilling Down

The price of gold dropped abruptly Friday morning (Arizona time). How much of a drop? $10.30, as measured by the bid on the December future. How abruptly? That move happened in under a second. At first, the price of gold in the spot market did not react. This caused what looks like a massive backwardation...

Read More »

Read More »

A 14 Handle on Silver. Again. 8 Nov, 2015

What’s the difference between the Supply and Demand Report 1 November and the Supply and Demand Report 8 November? Just a minor punctuation change. Last week, we asked (rhetorically) if silver would have a 14 handle again.

This week, the ...

Read More »

Read More »

Bron Suchecki @bronsuchecki Perth Mint: All that Glitters

Bron says , “The mint produces collectables like the Star Wars coins to attract collectors and people with an interest in the films. I don’t buy into the paper gold conspiracy to drive prices down. Of course there is manipulation, but not just on declines it happens during advances too. I don’t believe Chinese gold …

Read More »

Read More »

Live Analysis Room Show 554th + interview Bron Suchecki

Join us for a unique Forex experience in the FXStreet Live Analysis Room. The #FXroom is being hosted by Dale Pinkert, long time and popular contributor on FXStreet. Trading in community. Know our Mastermind concept as we all edify each other 1+1=11 at http://www.fxstreet.com/webinars/live-analysis/ and chat with experts and traders. Don’t miss the interview with …

Read More »

Read More »

A 14 Handle On Silver Again?! 1 Nov, 2015

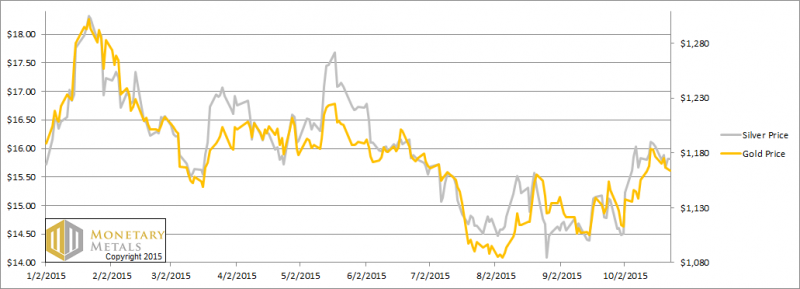

The prices of the metals dropped by 20 bucks and 20 pennies this week. In other words, the dollar went up ½ milligram gold or 30 mg silver. It wasn’t the euro, which ended the week unchanged. It wasn’t the US stock market, which ended up seven bucks.

What was it? ...

Read More »

Read More »

Little Change to Supply and Demand Report 25 Oct, 2015

At the risk of being boring, there’s not a lot to say about the markets for gold and silver this week (and frankly being on a challenging travel itinerary, flying from Vienna to Sydney to give a keynote at the Gold Symposium this week, is part of it). There was a modest drop in the prices of the metals, $13 in ....

Read More »

Read More »

Hedging in the Gold Miners

There are two ways to run a gold mining company. One respects the simple fact that it is producing money. It is not eager to trade its the money it produces for government paper, legal tender laws be damned. It keeps its books in gold, and produces and trades to earn more money (i.e. gold).

This article is about the...

Read More »

Read More »

And Then There Was None (Backwardation) 18 Oct, 2015

The dollar dropped about half a milligram gold, and 50mg silver.

But who wants to read about the universal currency falling, failing? Few people are so barbarous as to think of the dollar’s value as being priced in terms a monetary metal. As all right thinking folks know, the value of these commodities ...

Read More »

Read More »

Gold Bullion’s Outlook, Currency Reset & Asset Allocation with John Butler

Register Now for Webinar next Thursday and have your question answered by John Butler: https://attendee.gotowebinar.com/register/2239182188163807746 Gold’s Outlook For Year End 2015 and In 2016 Gold’s Performance in the Coming Years: 2016-2020 Coming Global Currency Reset Asset Allocation – How Much Gold? Owning Gold – How and Where?

Read More »

Read More »

The Decline and Fall of Silver Backwardation 11 Oct, 2015

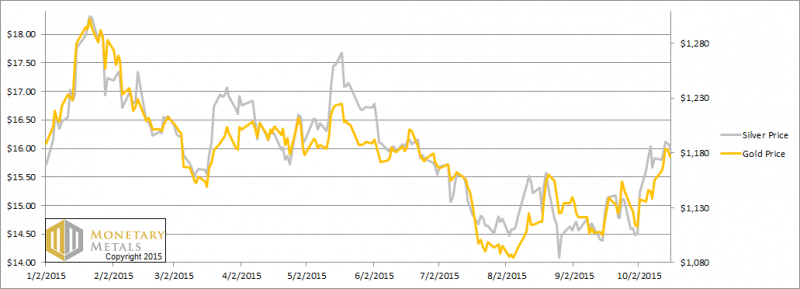

The gold price moved up $18. However, the silver price moved up 60 cents which is a much bigger percentage. The silver community is getting pretty excited.

A market trend will often begin when a small number of traders learn something new. As they begin buying (or selling), the price begins to move. Others become aware of the ....

Read More »

Read More »

Silver Price Spikes, But What Demand 4 Oct, 2015

For a few frenzied minutes, while everyone was sleeping, the price of silver spiked 56 cents. Well, at least the West Coast of America was sleeping. It began at 8:30 in New York, where presumably most traders were not sleeping. And of course, it was afternoon here in London (where Monetary ....

Read More »

Read More »

Pure Gold and Soggy Dollars

We’re going to be introducing some new formats. One of them is quick article links, with the good ones labelled Pure Gold and the bad ones labelled Soggy Dollars.

Pure Gold

When a Fed-induced boom turns to bust: “In the lynch-mob....

Read More »

Read More »

Prediction: Gold and Ratio Up, Stocks Down 27 Sep, 2015

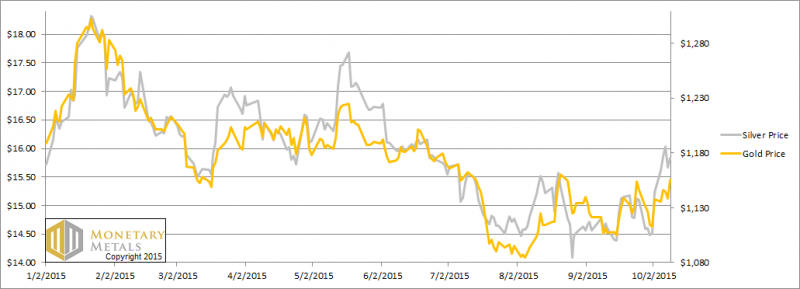

The price of gold moved up moderately, and the price of silver moved down a few cents this week. However, there were some interesting fireworks in the middle of the week. Tuesday, the prices dropped and Thursday the prices of the metals popped $23 and $0.34 respectively.

Everyone can judge the sentiment prevailing in gold...

Read More »

Read More »

Price Moves and Term Structures 20 Sep, 2015

The prices of the metals moved up a bunch this week, with gold + $32 and silver +$0.55. We have seen some discussion of gold backwardation in the context of scarcity, and hence setting expectations of higher prices. That’s good, as the swings from contango to backwardation and back ....

Read More »

Read More »