Category Archive: 6a) Gold and its Price

Main Author Keith Weiner

Bitcoin: Tragedy of the Speculations

The Instability Problem. Bitcoin is often promoted as the antidote to the madness of fiat irredeemable currencies. It is also promoted as their replacement. Bitcoin is promoted not only as money, but the future money, and our monetary future. In fact, it is not. Why not? To answer, let us start with a look at the incentives offered by bitcoin.

Read More »

Read More »

Precious Metals Supply and Demand

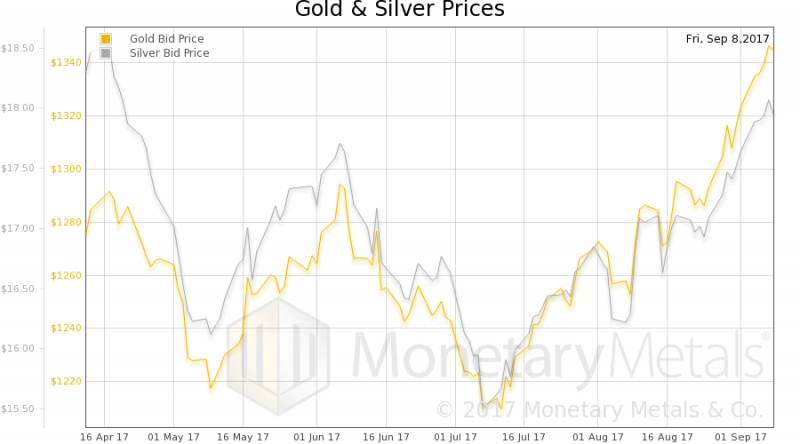

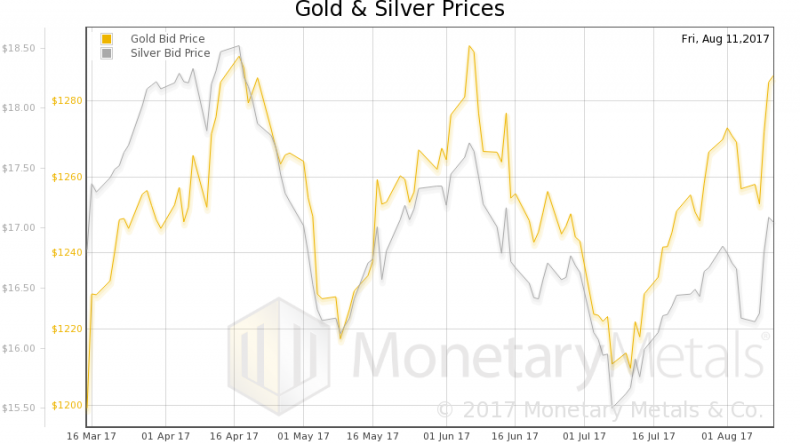

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Le retour de l’or sur la scène monétaire mondiale?

Mars 2009, le gouverneur de la Banque populaire de Chine M Zhou Xiaochuan revint dans le cadre d’une conférence intitulée Reform the international Monetary System sur la vision de Keynes au sujet du bancor.Pour lui, le système centré sur le dollar américain et les taux de changes flottants, plus ou moins librement, devrait être repensé.

Read More »

Read More »

Six Banks Join UBS’s “Utility Coin” Blockchain Project

Here’s a piece of news that the remaining human members of Wall Street’s FX sales and trading desks probably don’t want to hear. According to the Financial Times, six of the world’s largest banks have decided to join a blockchain project called “utility coin” that will allow banks to settle trades in securities denominated in different currencies without a money transfer.

Read More »

Read More »

Precious Metals Supply-Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

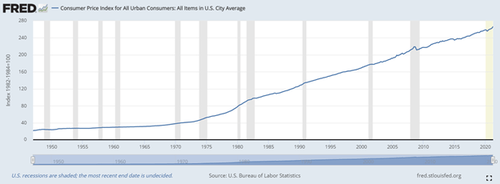

Bad Ideas About Money and Bitcoin

How We Got Used to Fiat Money

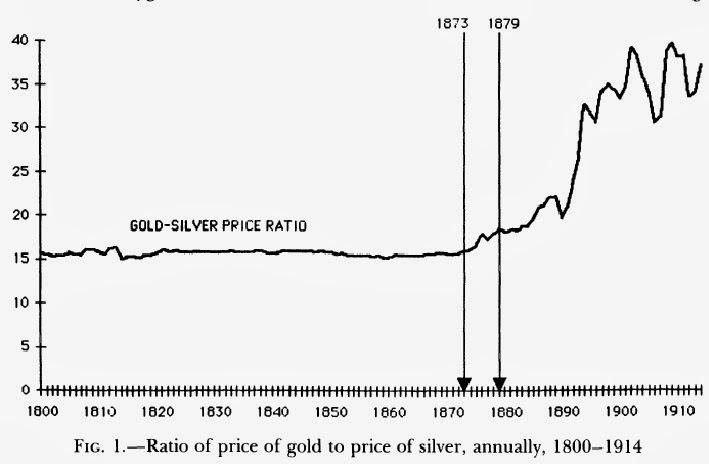

Most false or irrational ideas about money are not new. For example, take the idea that government can just fix the price of one monetary asset against another. Some people think that we can have a gold standard by such a decree today. This idea goes back at least as far as the Coinage Act of 1792, when the government fixed 371.25 grains of silver to the same value as 24.75 grains of gold, or a ratio of 15 to 1.

Read More »

Read More »

Precious Metals Supply and Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Don't let "traditional biases" stop you from diversifying into gold - Dalio on Linkedin. “Risks are now rising and do not appear appropriately priced in” warns founder of world's largest hedge fund. Geo-political risk from North Korea & "risk of hellacious war". Risk that U.S. debt ceiling not raised; technical US default. Safe haven gold likely to benefit by more than dollar, treasuries.

Read More »

Read More »

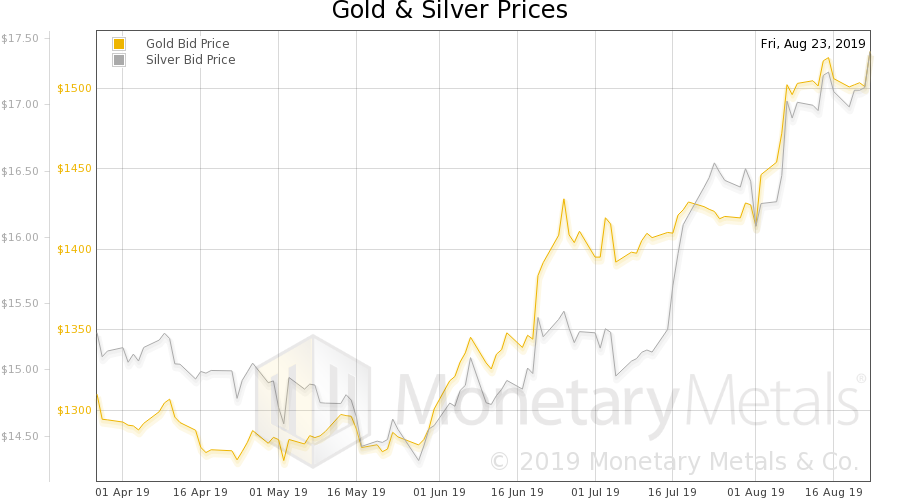

Bitcoin Has No Yield, but Gold Does – Precious Metals Supply and Demand Report

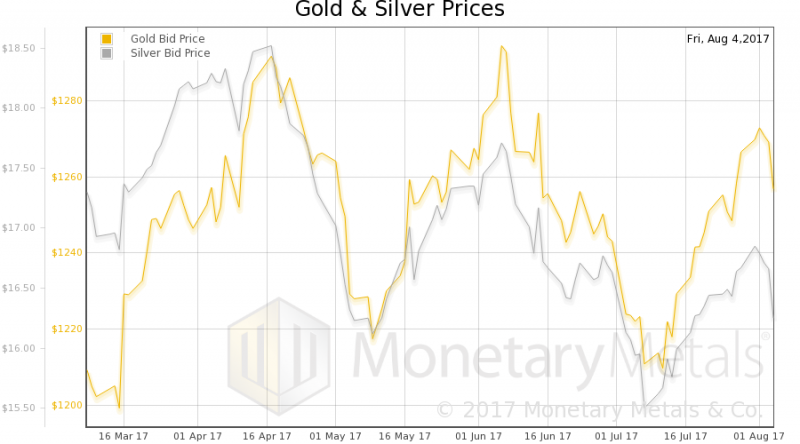

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Bitcoin Forked – Precious Metals Supply and Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Bitcoin, Gold and Silver

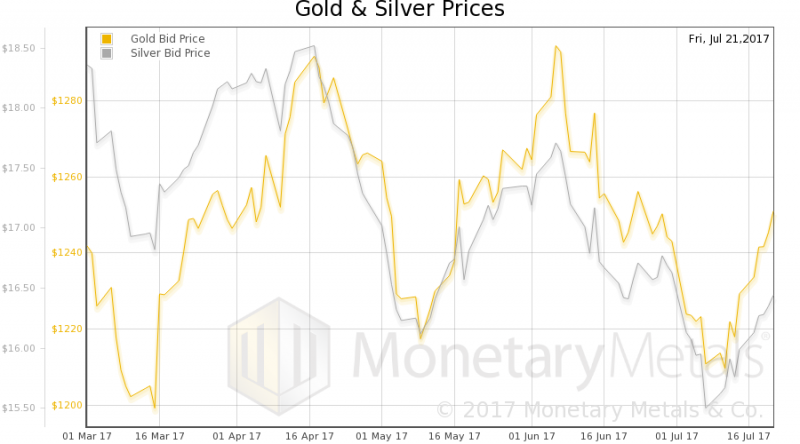

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Against Irredeemable Paper – Precious Metals Supply and Demand

Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal.

Read More »

Read More »

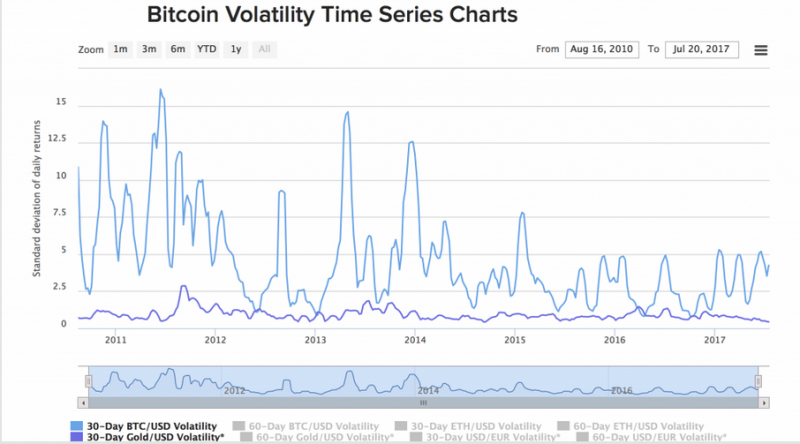

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

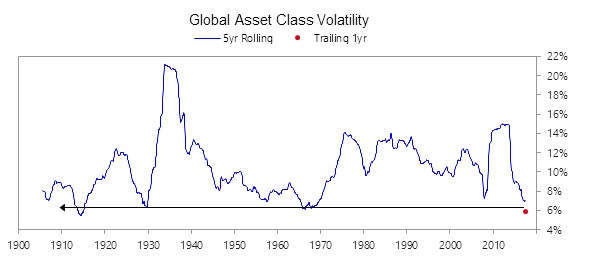

Bitcoin volatility shows not currency or safe haven but speculation. Volatility still very high in bitcoin and crypto currencies (see charts). Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900. Bitcoin least volatile of cryptos, around 75% annualised volatility. Gold much more stable at just 10% annualised volatility.

Read More »

Read More »

Stockholm Syndrome – Precious Metals Supply and Demand

Stockholm Syndrome is defined as “…a condition that causes hostages to develop a psychological alliance with their captors as a survival strategy during captivity.” While observers would expect kidnapping victims to fear and loathe the gang who imprison and threaten them, the reality is that some don’t.

Read More »

Read More »

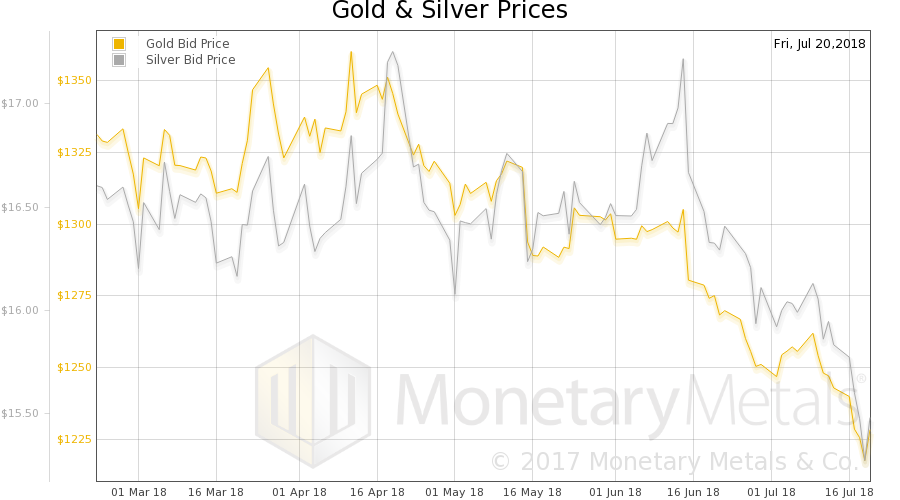

Putting the Latest Silver Crash Under a Lens

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold and Silver Capitulation – Precious Metals Supply & Demand Report

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

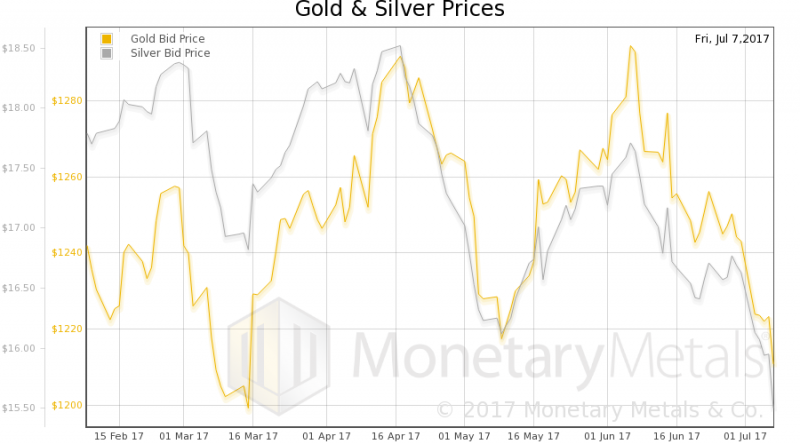

A Look at the Gold and Silver Price Drop of 3 July, 2017

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

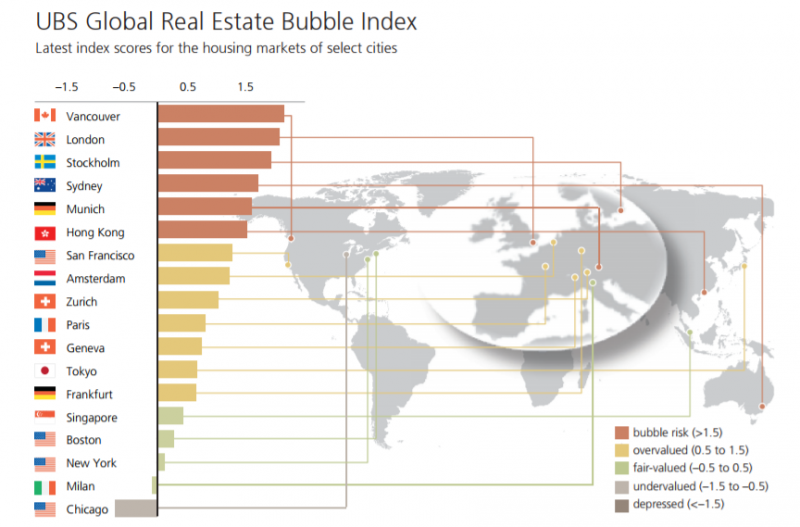

Buy Gold Near $1,200 “As Insurance” – UBS Wealth

Yesterday North Korea sent the US a ‘package of gifts’ for Independence Day. Unsurprisingly the successfully tested and launched intercontinental ballistic missile (ICBM) was not well received. US Secretary of State Rex Tillerson called the move a “new escalation of the threat” to the U.S. and its allies and that “global action is required to stop a global threat.”

Read More »

Read More »

What Really Happened When Gold Crashed, Monday June 26?

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April.

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: decreased by 4.3 billion francs compared to the previous week

6 days ago -

USD/CHF stays above 0.9100 nearing the highs since October

2024-04-16 -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

2024-04-15 -

Canadian Dollar remains vulnerable after strong US Retail Sales

2024-04-15 -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

2024-04-09

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 4.3 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Reading, Teaching, and Quoting Mises

-

Human Action: Foundations for the Modern Austrian School

-

The Challenge of Praxeological Realism

-

Economics as a Universal Science

-

6 Monate ohne Gehalt leben? Für die meisten Deutschen kein Problem! #gehalt

6 Monate ohne Gehalt leben? Für die meisten Deutschen kein Problem! #gehalt -

How Human Action Guided My Teaching and Research Career

-

How Nations Escape Poverty – Vietnam & Capitalism

How Nations Escape Poverty – Vietnam & Capitalism -

There’s Many a Slip ’twixt Cup and Lip

-

Calculation and Environmental Policy: Lessons from Human Action

-

Spektakulärer Aussetzer! Als Helge Lindh (SPD) die Nerven verlor!

Spektakulärer Aussetzer! Als Helge Lindh (SPD) die Nerven verlor!

More from this category

Gold’s Middle Finger To Lying Currencies

Gold’s Middle Finger To Lying Currencies2 Jun 2021

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies, & Gold29 Mar 2021

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul5 Sep 2019

Directive 10-289, Report 25 Aug

Directive 10-289, Report 25 Aug26 Aug 2019

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran15 May 2019

Is Lending the Root of All Evil? Report 24 Feb

Is Lending the Root of All Evil? Report 24 Feb25 Feb 2019

Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU15 Feb 2019

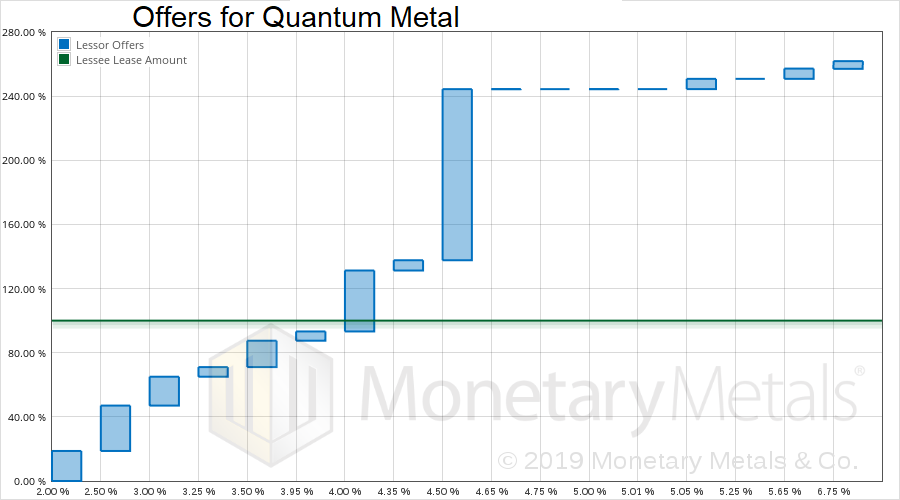

Quantum Metal Lease #1 (gold)

Quantum Metal Lease #1 (gold)13 Feb 2019

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week29 Jan 2019

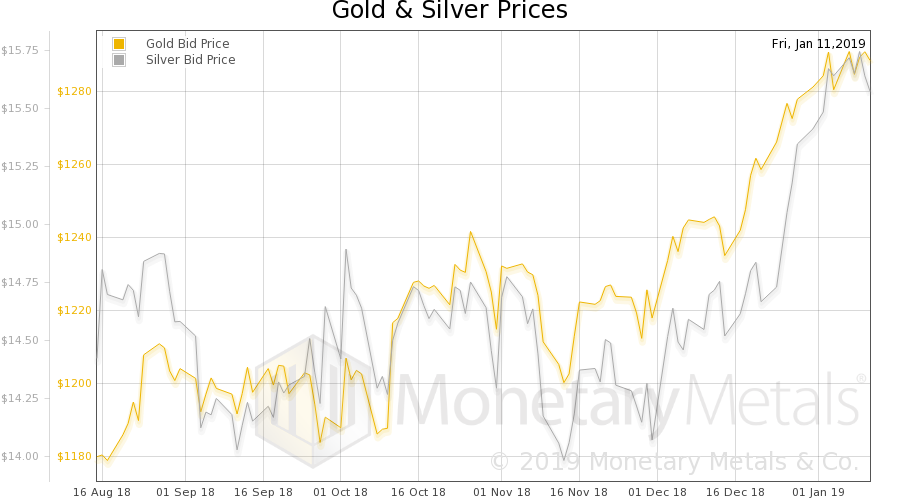

Rising Interest and Prices, Report 13 Jan 2019

Rising Interest and Prices, Report 13 Jan 201914 Jan 2019

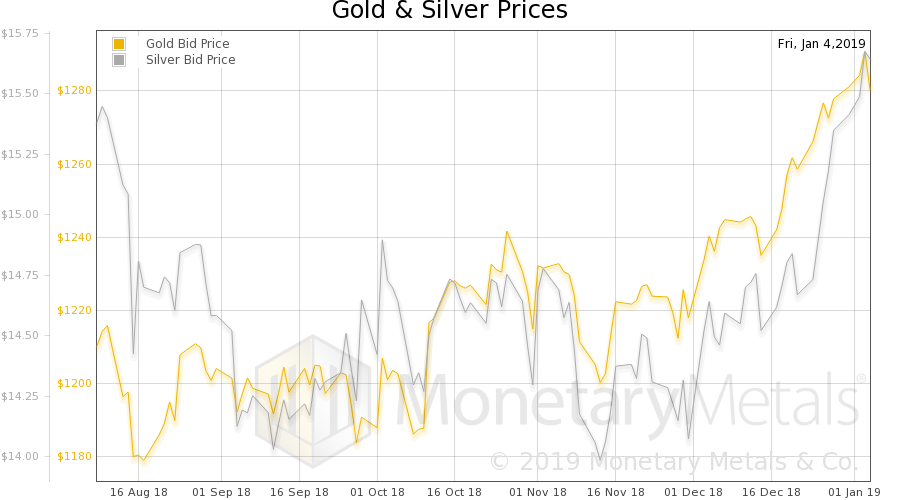

Surest Way to Overthrow Capitalism, Report 6 Jan 2019

Surest Way to Overthrow Capitalism, Report 6 Jan 20197 Jan 2019

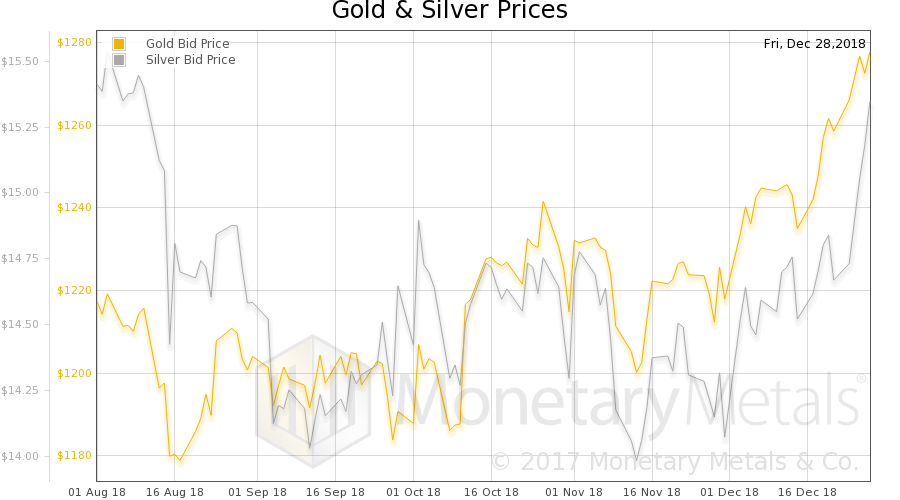

Change is in the Air – Precious Metals Supply and Demand

Change is in the Air – Precious Metals Supply and Demand2 Jan 2019

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents11 Dec 2018

What Can Kill a Useless Currency, Report 28 Oct 2018

What Can Kill a Useless Currency, Report 28 Oct 201829 Oct 2018

Yield Curve Compression – Precious Metals Supply and Demand

Yield Curve Compression – Precious Metals Supply and Demand3 Oct 2018

Another Gold Bearish Factor, Report 26 August 2018

Another Gold Bearish Factor, Report 26 August 201827 Aug 2018

Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand18 Aug 2018

Crying Wolf, Report 22 July 2018

Crying Wolf, Report 22 July 201823 Jul 2018

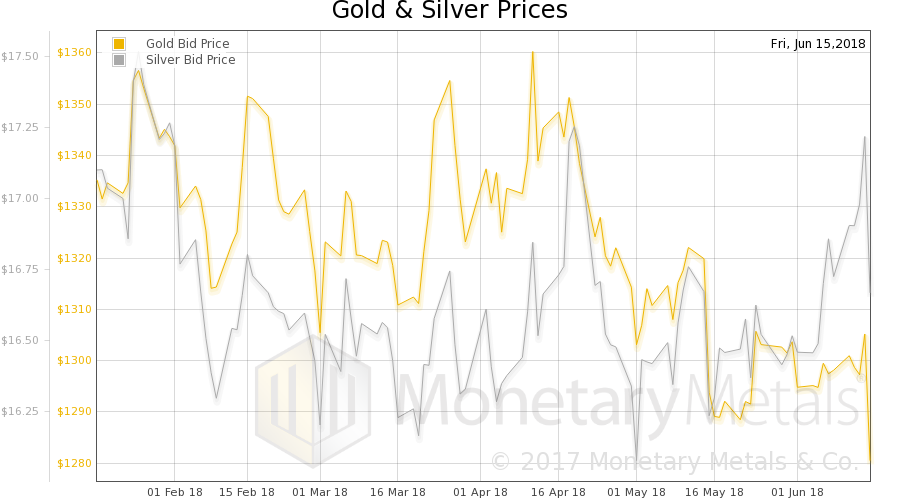

Lift-Off Not (Yet) – Precious Metals Supply and Demand

Lift-Off Not (Yet) – Precious Metals Supply and Demand19 Jun 2018

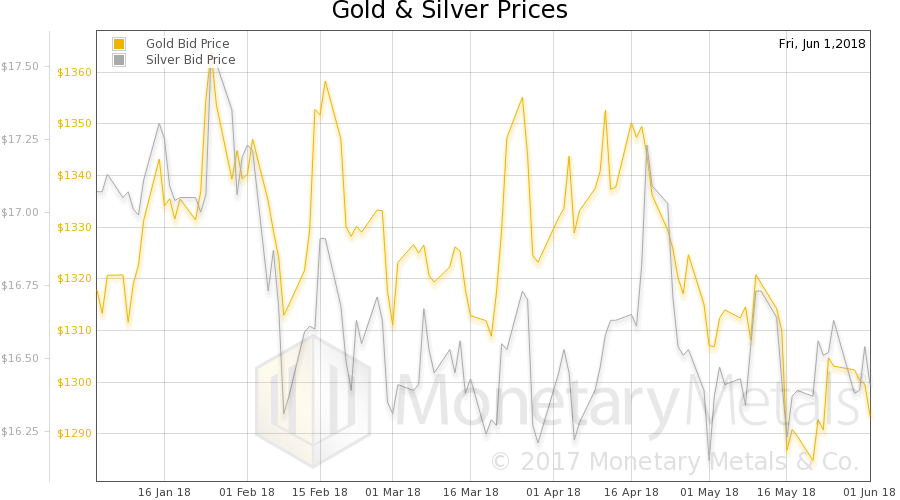

Industrial Commodities vs. Gold – Precious Metals Supply and Demand

Industrial Commodities vs. Gold – Precious Metals Supply and Demand6 Jun 2018