Category Archive: 5.) The United States

Technology Is Not Just Disruptive, It’s Disastrously Deflationary

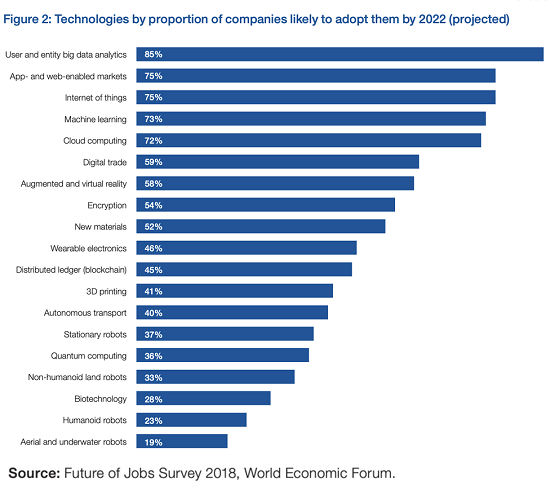

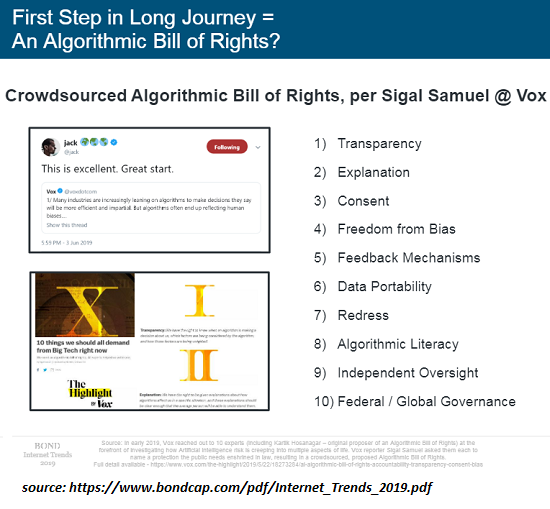

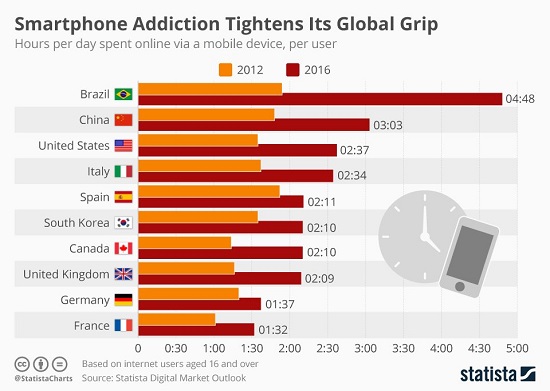

Deflation eats credit-dependent, mass-consumption economies alive from the inside. While AI (artificial intelligence) garners the headlines, the next wave of disruptive technologies extend far beyond AI: as the chart of technologies rapidly being adopted shows, this wave includes new materials and processes as well as the "usual suspects" of machine learning, natural language processing, data mining and so on.

Read More »

Read More »

Two Intertwined Dynamics Are Transforming the Economy: Technology and Financialization

If you want to understand how the economy is being transformed, look at the intersection of Big Tech, financialization and the central state. The two dynamics transforming the economy--technology and financialization--are intertwined yet widely viewed as unrelated. Critics and proponents of each largely ignore the other dynamic: critics of institutionalized fraud and other manifestations of financialization implicitly assume the economy will return...

Read More »

Read More »

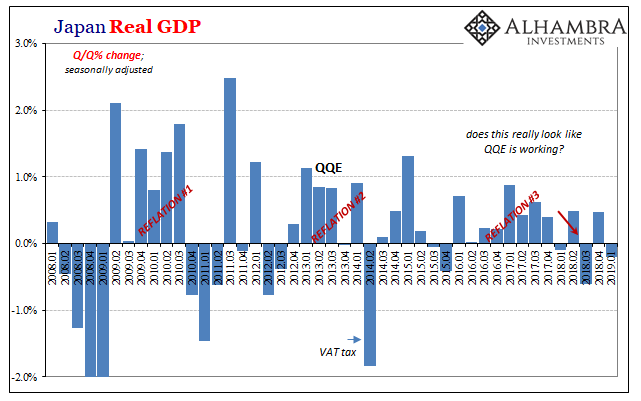

Japan’s Surprise Positive Is A Huge Minus

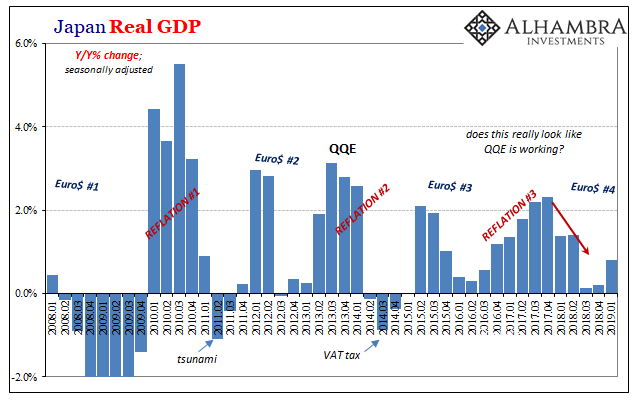

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five.

Read More »

Read More »

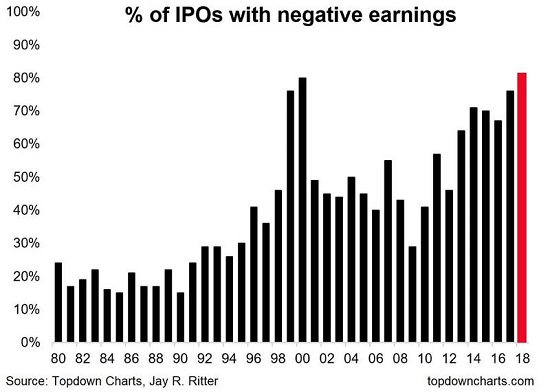

The Normalization and Institutionalization of Fraud

Normalizing and institutionalizing fraud undermines the foundations of the economy and the financial system. I am indebted to Manoj Samanta (twitter: @flation_debate) for the insightful concept the commoditization of fraud. The first step in the commoditization of fraud is to normalize fraud as Business as Usual (BAU) to the point that it's no longer viewed as "wrong," destructive or an aberration of evil-doers but as an accepted way to maximize...

Read More »

Read More »

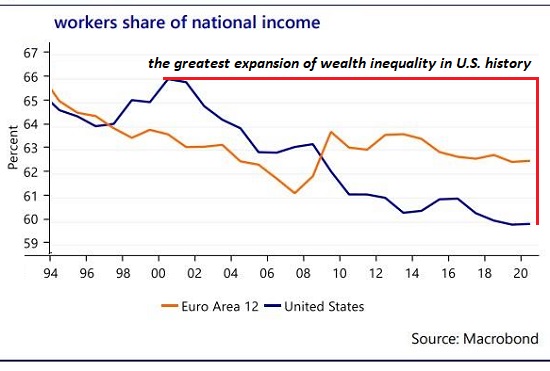

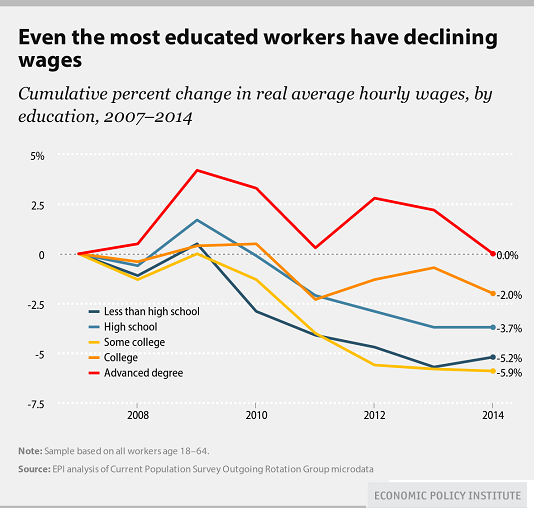

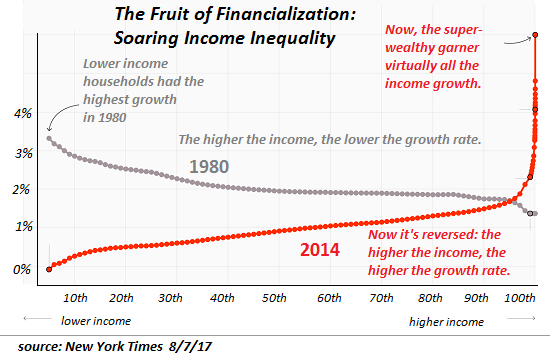

Downward Mobility Matters More Than Liberal-Conservative Labels

The real heresy here is the American economy is now rigged for downward mobility. In the conventional narrative, one's economic class is overshadowed by one's political belief structure: liberal, conservative, libertarian, etc. In terms of economic class, the conventional narrative divides people into their ideological beliefs about economic ideologies: free market capitalism, socialism, etc.

Read More »

Read More »

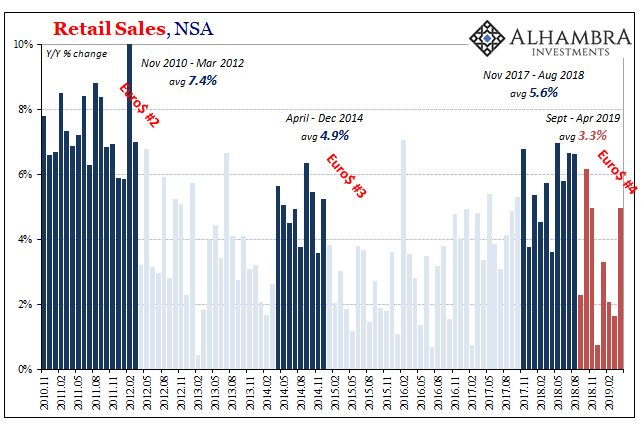

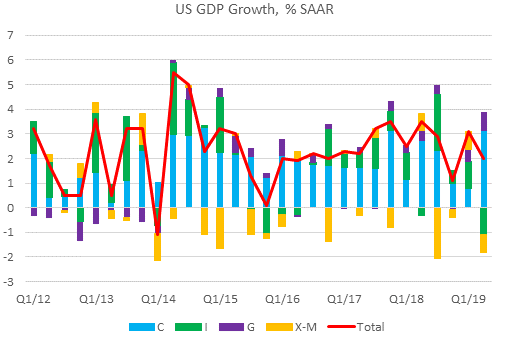

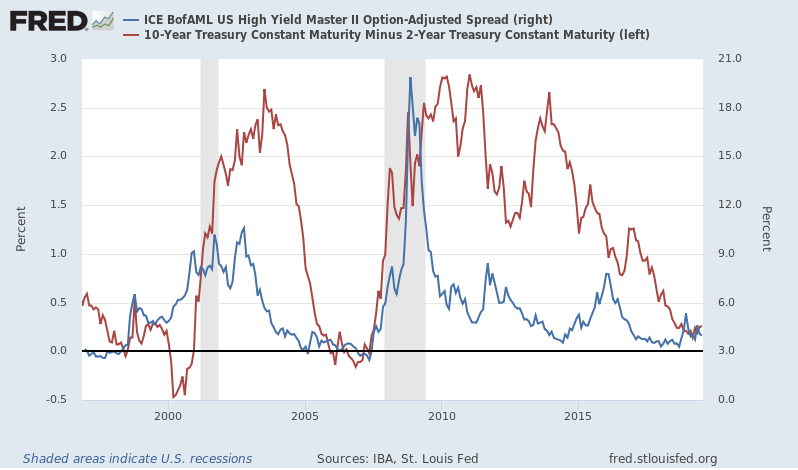

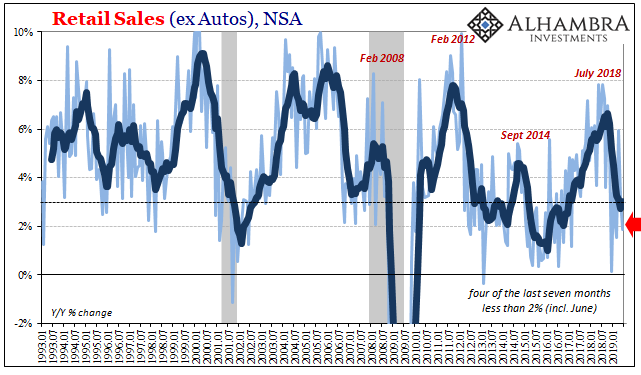

Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough.

Read More »

Read More »

Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so straightforward.

Read More »

Read More »

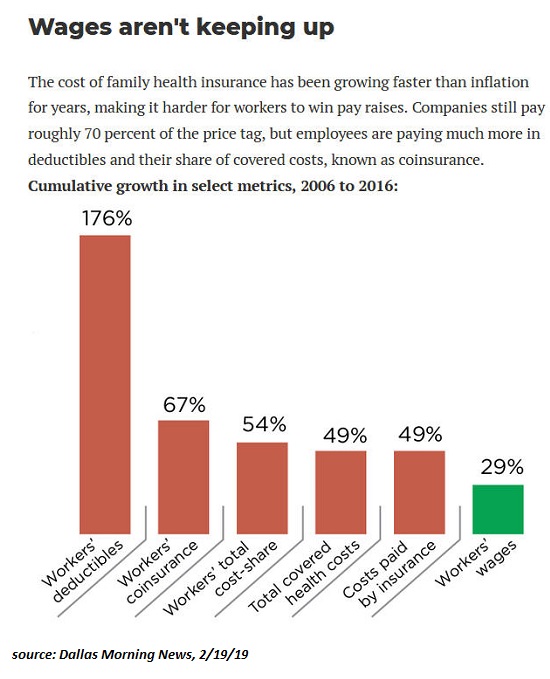

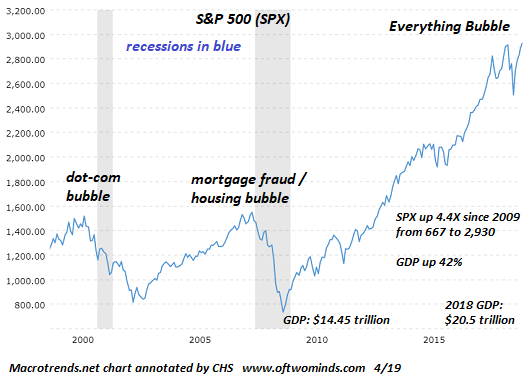

The Economy Has Fundamentally Changed in the 21st Century–and Not for the Better

The net result is we have an economy that's supposedly expanding smartly while our well-being and financial security are collapsing. Gross Domestic Product (GDP) and other metrics of economic activity don't measure either broad-based prosperity or well-being. Elites skimming financialization profits by expanding corporate debt and issuing more loans to commoners while spending more on their lifestyles boosts GDP quite nicely while the security and...

Read More »

Read More »

Burnout Nation

A number of recent surveys reflect a widespread sense of financial stress and symptoms of poor health in America's workers, particularly the younger generations. There's no real mystery as to the cause of this economic anxiety:

Read More »

Read More »

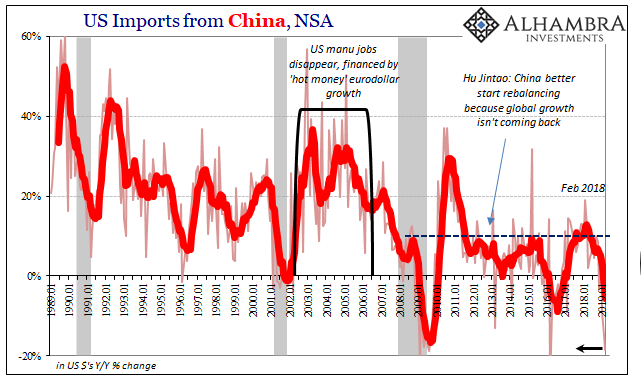

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

Unrealistically Great Expectations

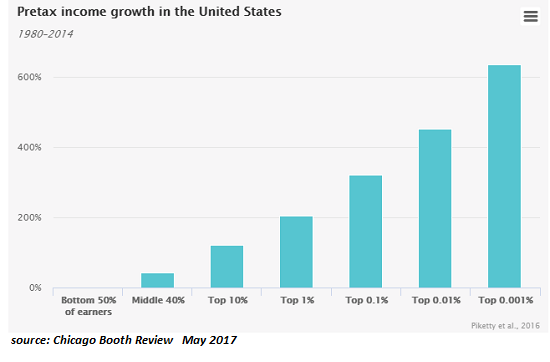

Let's see if we can tie together four social dynamics: the elite college admissions scandal, the decline in social mobility, the rising sense of entitlement and the unrealistically 'great expectations' of many Americans. As many have noted, the nation's financial and status rewards are increasingly flowing to the top 5%, what many call a winner-take-all or winner-take-most economy.

Read More »

Read More »

The Great Unraveling Begins: Distraction, Lies, Infighting, Betrayal

There are two basic pathways to systemic collapse: external shocks or internal decay. The two are not mutually exclusive, of course; it can be argued that the most common path is internal decay weakens the empire/state and an external shock pushes the rotted structure off the cliff.

Read More »

Read More »

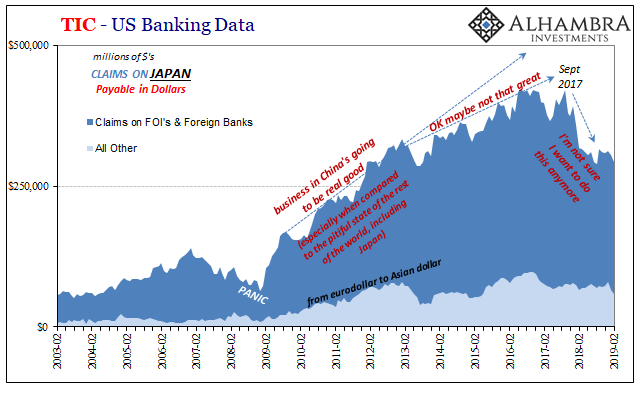

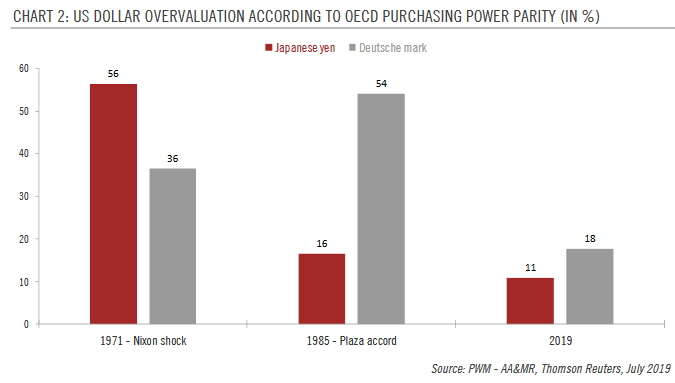

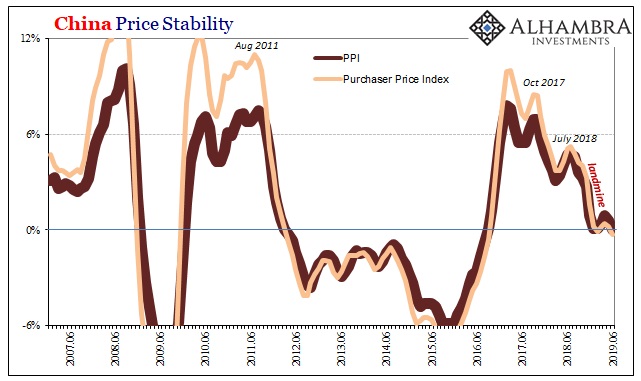

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

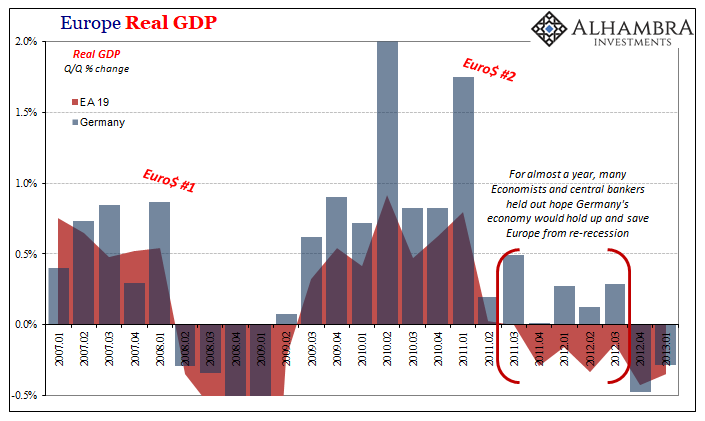

What’s Germany’s GDP Without Factories

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of crisis and economic weakness...

Read More »

Read More »

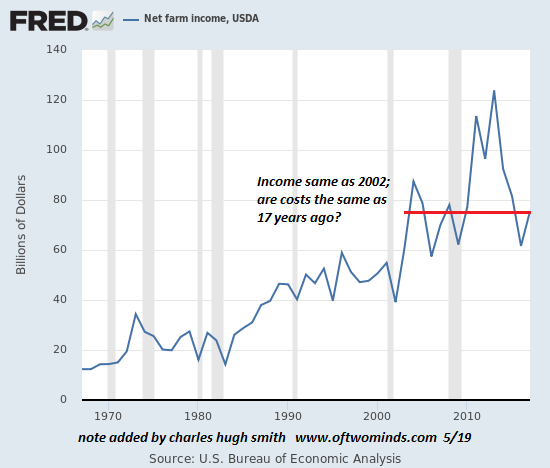

What Would It Take to Spark a Rural/Small-Town Revival?

There are many historical models in which the spending/investing of wealthy families drives the expansion of local economies. The increase in farm debt while farm income declines is putting unbearable financial pressure on American farmers, who must be differentiated from giant agri-business corporations. This is placing immense pressure on farmers, pressure which manifests in rising suicide rates.

Read More »

Read More »

Good Riddance to a “Nothing-Burger” Trade Deal

China has expanded its domestic debt to fund its growth, much of which qualifies as malinvestment, creating financial vulnerabilities its government is anxious to mask. As I noted in Trade Deal Follies: The U.S. Has Embraced the World's Worst Negotiating Tactics (April 8, 2019), the trade deal was a Nothing-Burger for the U.S. Without any consequences for violating trade deals, China violates all trade deals, starting with the WTO.

Read More »

Read More »

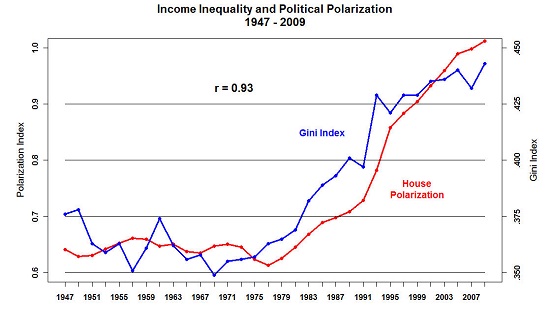

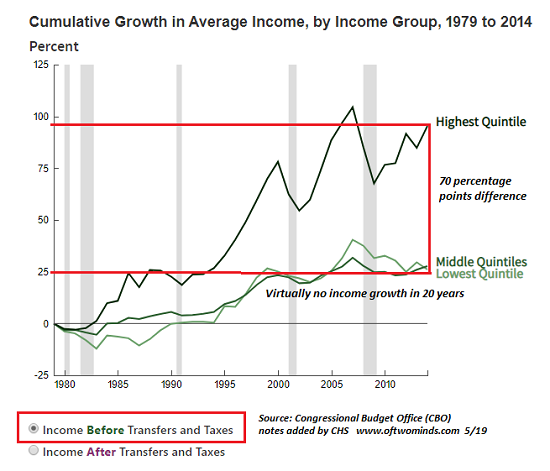

Income Inequality and the Decline of the Middle Class in Two Charts

These two charts of average incomes of U.S. households by quintile (bottom 20%, middle 60% (20%+20%+20%) and top 20%) have both good news and bad news. (Charts are from the non-partisan Congressional Budget Office -- CBO).

Read More »

Read More »

The Accelerating Decay of the Middle Class

Ironically, their ample compensation allows them to avoid the poor-quality services they've designed for everyone below them. If we define middle class by the security of household income and what that income can buy rather than by an income level, what do we conclude?

Read More »

Read More »

What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective.

Read More »

Read More »

The Erosion of Everyday Life

Working hard and doing what you're told is no longer yielding the promised American Dream of security, agency and liberty. Volume One of Fernand Braudel's oft-recommended (by me) trilogy Civilization & Capitalism, 15th to 18th Century is titled The Structures of Everyday Life. The book describes how life slowly became better and freer as the roots of modern capitalism and liberty spread in western Europe, slowly destabilizing and obsoleting the...

Read More »

Read More »