Category Archive: 5.) The United States

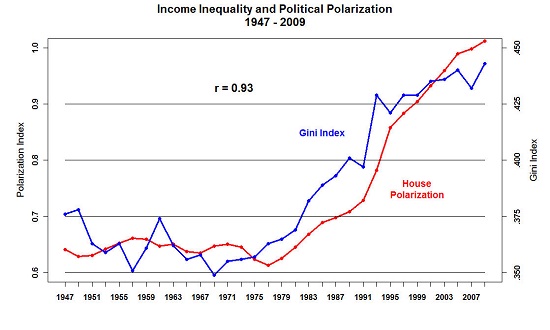

Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

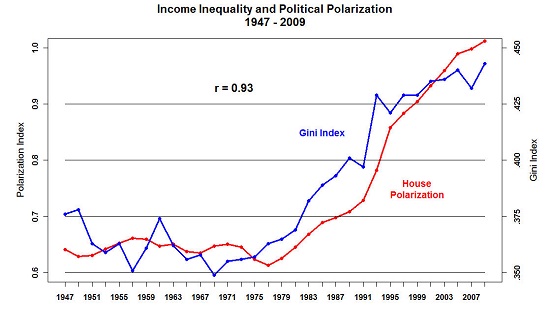

The political moment when the "losers" connect their discontent and decline with central bankers is approaching. The Ruling Elites' Chattering Classes still haven't absorbed the key lesson of the 2016 U.S. presidential election.

Read More »

Read More »

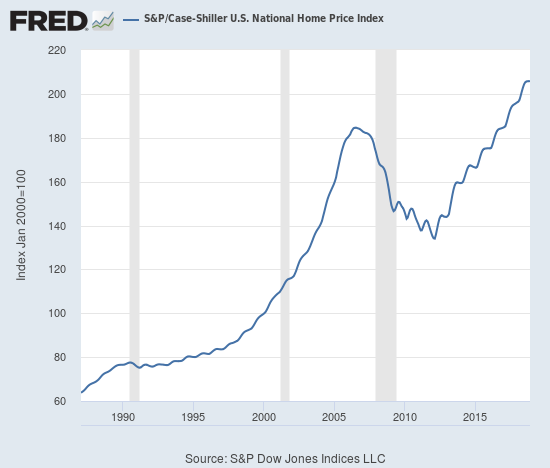

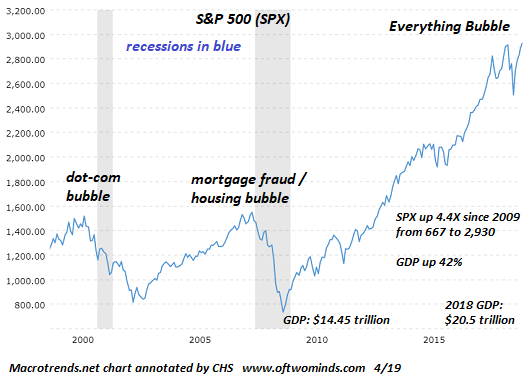

How Much of Your “Wealth” Is Hostage to Bubbles and Impossible Promises?

All asset "wealth" in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to "wealth" in a bubble economy: it only remains "wealth" if the owner sells at the top of the bubble and invests the proceeds in an asset which isn't losing purchasing power.

Read More »

Read More »

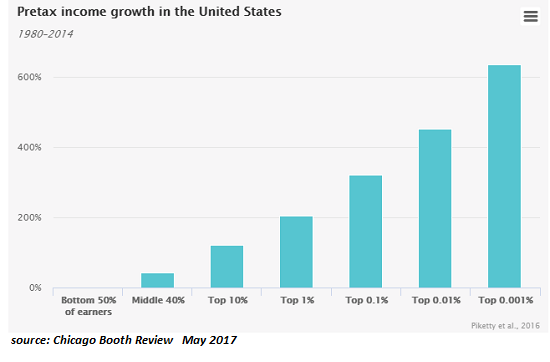

Misplaced Pride: Most of the “Middle Class” Is Actually Working Class

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as "middle class" by the metrics described below. The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification.

Read More »

Read More »

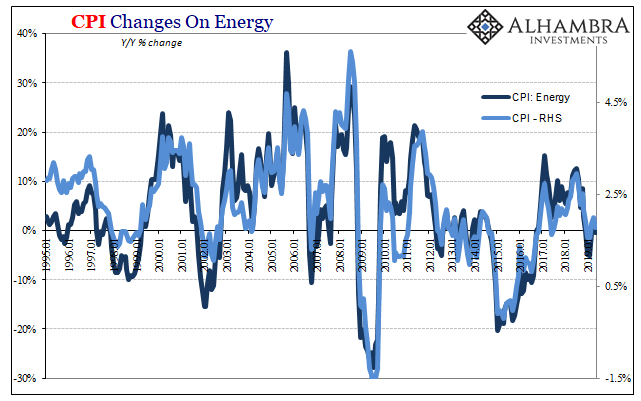

When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

Read More »

Read More »

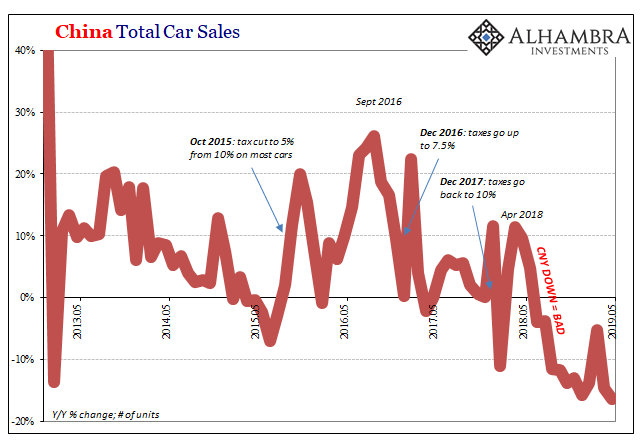

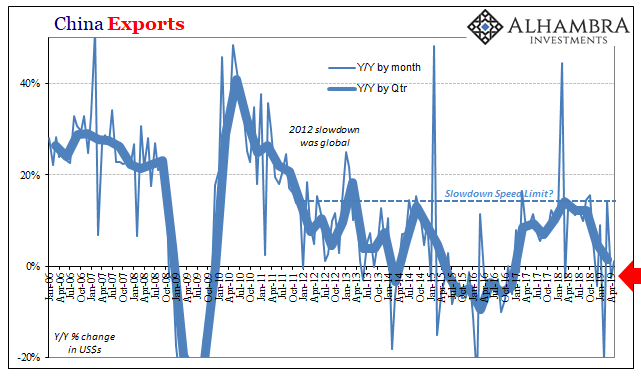

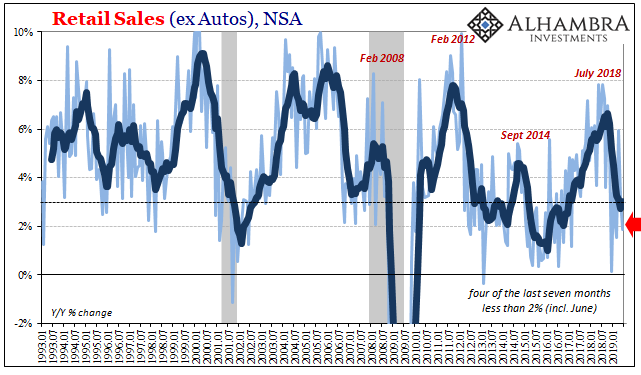

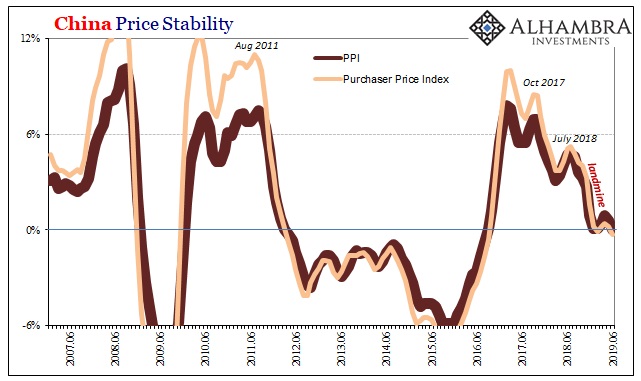

Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each.

Read More »

Read More »

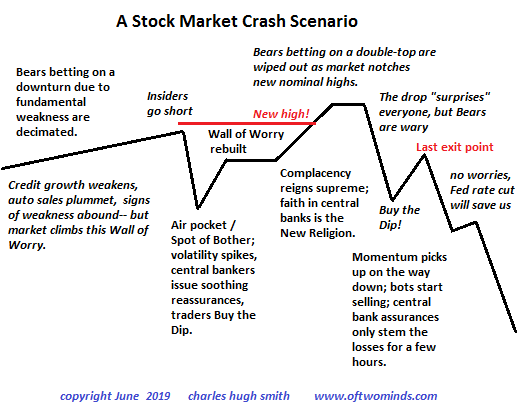

A Stock Market Crash Scenario

Herds get spooked and run. That's the crash scenario in a nutshell. We have all been trained by a decade of central bank saves to expect any stock market swoon will soon be reversed by central bank sweet talk and/or rate cuts.

Read More »

Read More »

Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016.

Read More »

Read More »

What Would It Take to Spark a Rural/Small-Town Revival?

Recent research supports the idea that this under-the-radar migration is already under way. The decline of rural regions and small towns is a global phenomenon, and the causes are many but boil down to two primary dynamics: 1. Cities and megalopolises (aggregations of cities, suburbs and exurbs) attract capital, infrastructure, markets and talent, and these are the engines of job creation.

Read More »

Read More »

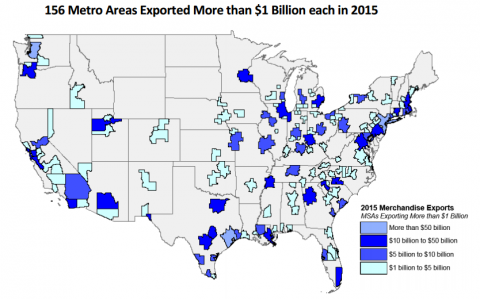

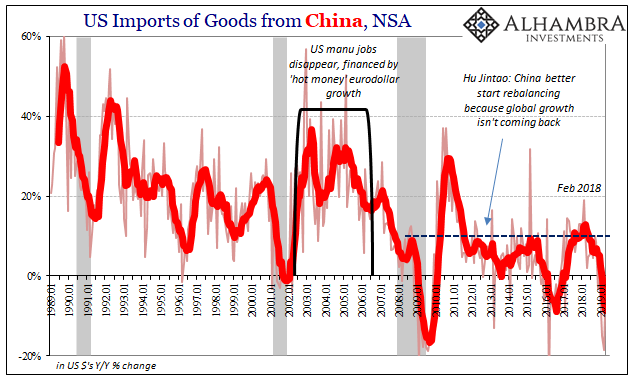

All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied.

Read More »

Read More »

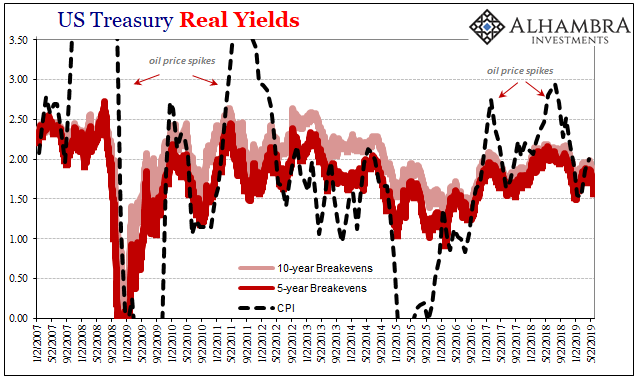

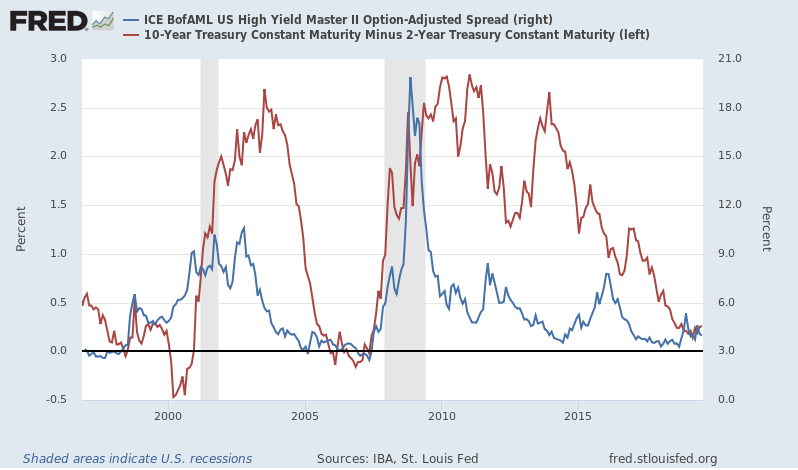

Janus Powell

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.”

Read More »

Read More »

Monthly Macro Monitor – June 2019 (VIDEO)

Alhambra Investments CEO reviews economic charts from the past month and his opinion of what they mean.

Read More »

Read More »

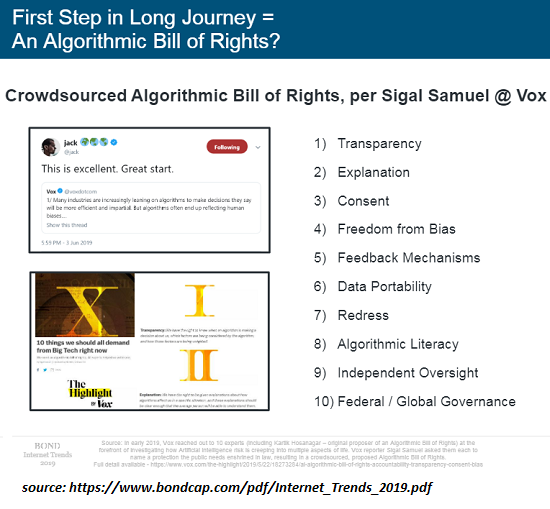

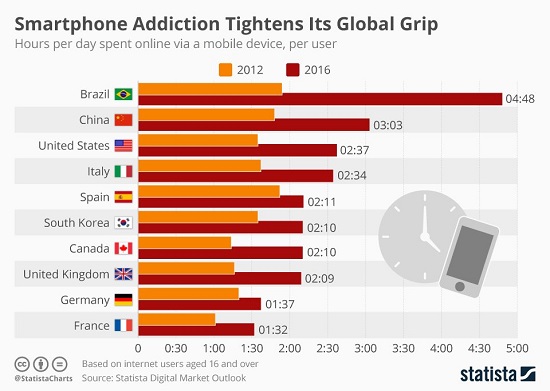

Is the Tech Bubble Bursting?

There are two other trends that don't attract quite the media attention that soaring profits do. Is the decade-long tech bubble finally popping? Tech bulls are overlooking the fundamental reality that the drivers of Big tech's phenomenal growth--financialization and expansion into mobile telephony-- are both losing momentum.

Read More »

Read More »

A Quiet Revolution Is Brewing

Politics as practiced in a bygone era of stability no longer offers any solutions to these profound disruptions. I recently read a fascinating history of the social, political and economic context of the American Revolution: The Radicalism of the American Revolution by Gordon Wood.

Read More »

Read More »

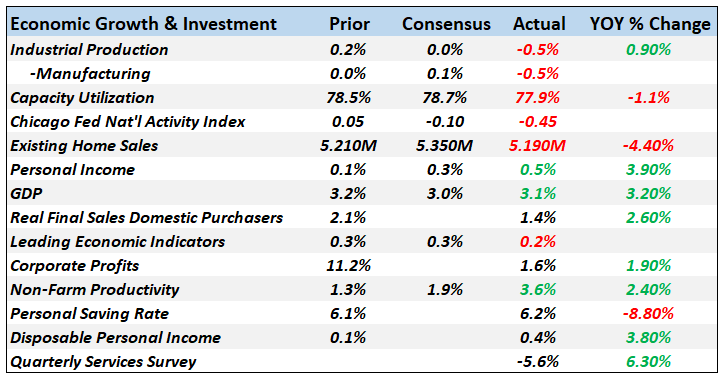

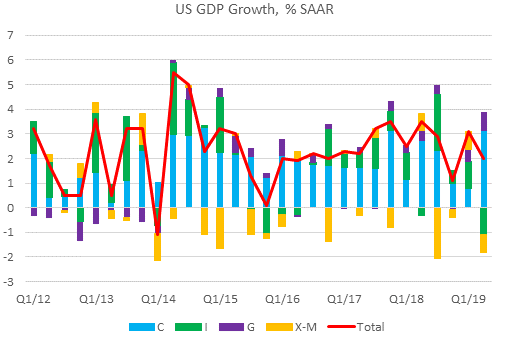

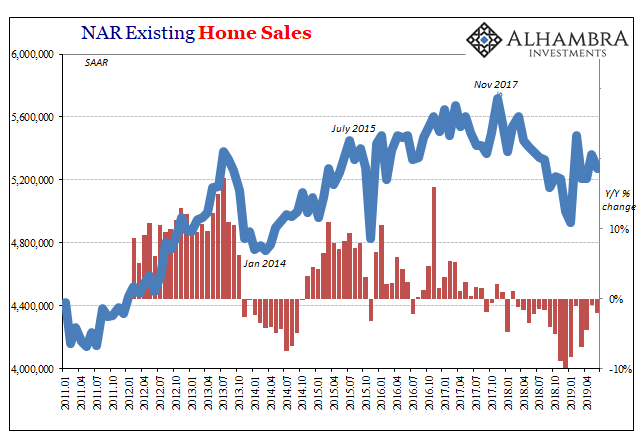

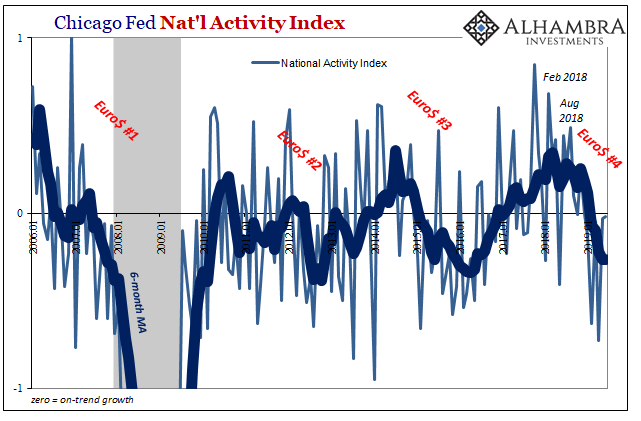

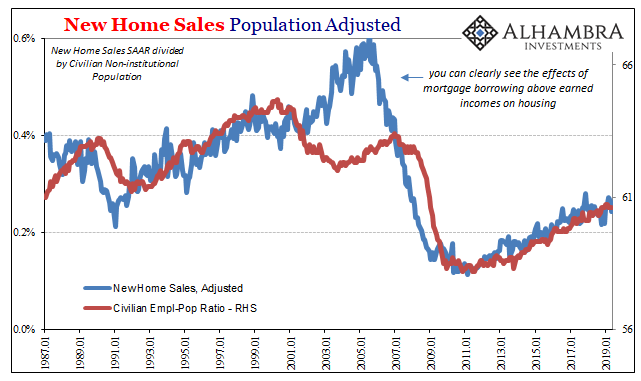

Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction.

Read More »

Read More »

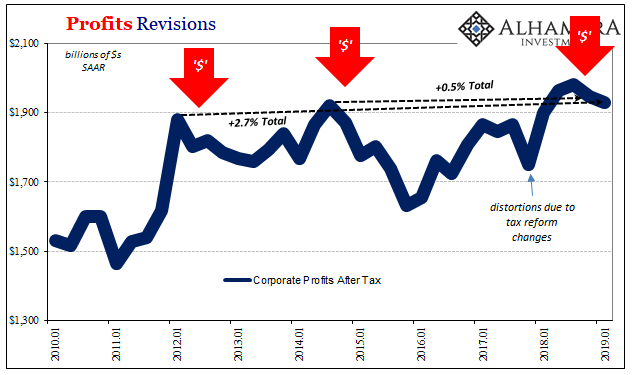

More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message.

Read More »

Read More »

Why Being a Politician Is No Longer Fun

As a society, we are ill-prepared for the end of "politics is the solution." It's fun to be a politician when there's plenty of tax revenues and borrowed money to distribute, and when the goodies get bipartisan support. An economy that's expanding all household incomes more or less equally is fun, fun, fun for politicians because more household income generates more income tax revenues and more spending that generates other taxes.

Read More »

Read More »

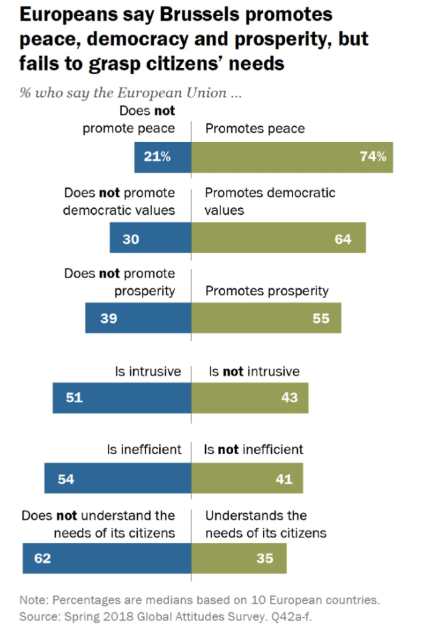

Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey.

Read More »

Read More »

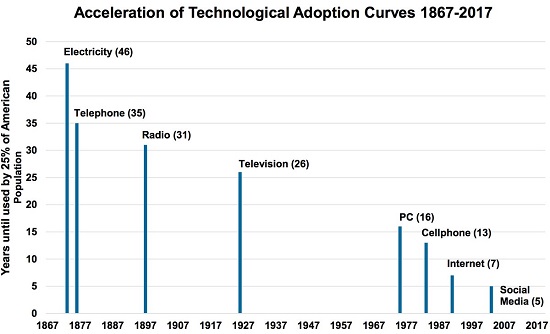

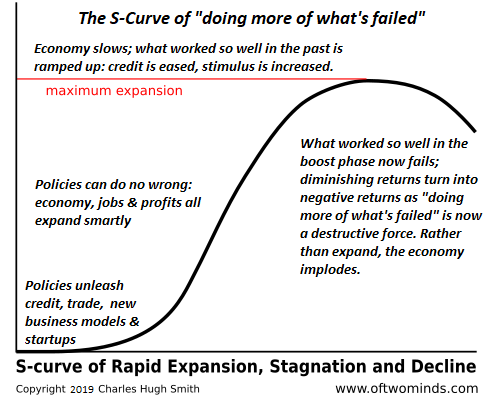

Lesson of the S-Curve: Doing More of What’s Failed Will Fail Spectacularly

I often refer to the S-Curve because Nature so often tracks this curve of ignition, rapid expansion, stagnation and decline. One lesson of the S-Curve is that the human bias to keep doing more of what worked so well in the past leads to doing more of what failed even as results turn negative.

Read More »

Read More »

Forget “Money”: What Will Matter Are Water, Energy, Soil and Food–and a Shared National Purpose

If you want to identify tomorrow's superpowers, overlay maps of fresh water, energy, grain/cereal surpluses and arable land. The status quo measures wealth with "money," but "money" is not what's valuable. "Money" (in quotes because the global economy operates on intrinsically valueless fiat currencies being "money") is wealth only if it can purchase what's actually valuable.

Read More »

Read More »

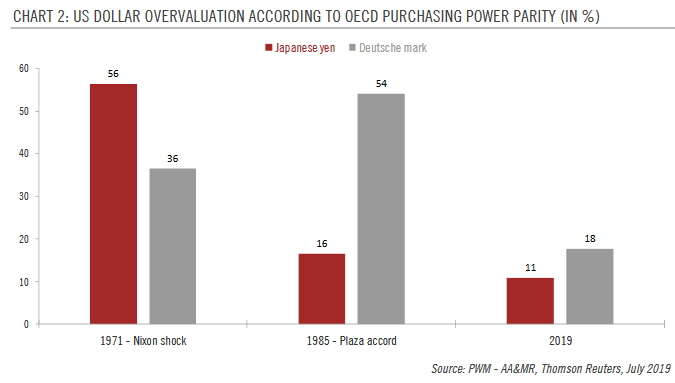

China’s Insurmountable Global Weakness: Its Currency

If China wants superpower status, it will have to issue its currency in size and let the global FX market discover its price. Quick history quiz: in all of recorded history, how many superpowers pegged their currency to the currency of a rival superpower? Put another way: how many superpowers have made their own currency dependent on another superpower's currency?

Read More »

Read More »