Category Archive: 5.) The United States

Maybe Deep Dissatisfaction Has A Point

To complete a trifecta, maybe someone could interview Alan Greenspan about rational exuberance. The last of the latest Fed Chairmen, Janet Yellen, purports today that the next financial crisis will not be in “our lifetimes.” The issue, however, isn’t even crisis so much as credibility. Given that she and the rest of them had no idea about the last one until it was almost over, we might be forgiven for rejecting her thesis outright – and it having...

Read More »

Read More »

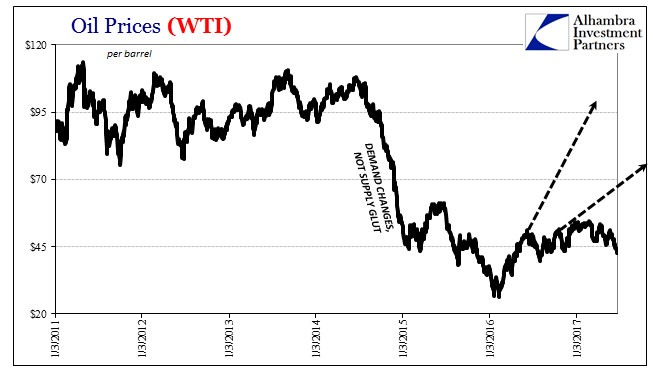

Oil Prices and Manufacturing PMI: No Backing Sentiment

When the price of oil first collapsed at the end of 2014, it was characterized widely as a “supply glut.” It wasn’t something to be concerned about because it was believed attributable to success, and American success no less. Lower oil prices would be another benefit to consumers on top of the “best jobs market in decades.”

Read More »

Read More »

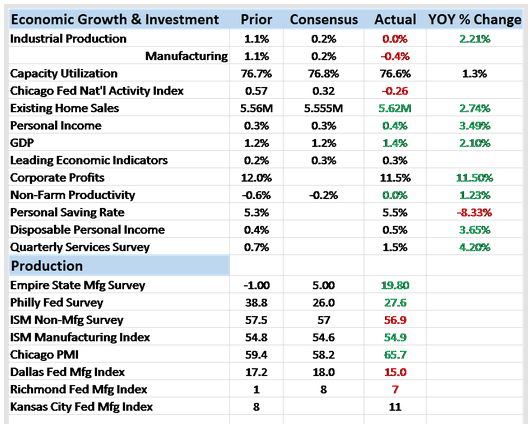

Bi-Weekly Economic Review: Draghi Moves Markets

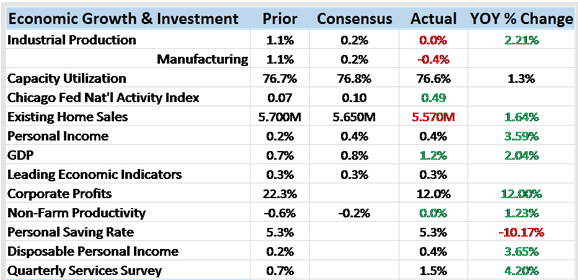

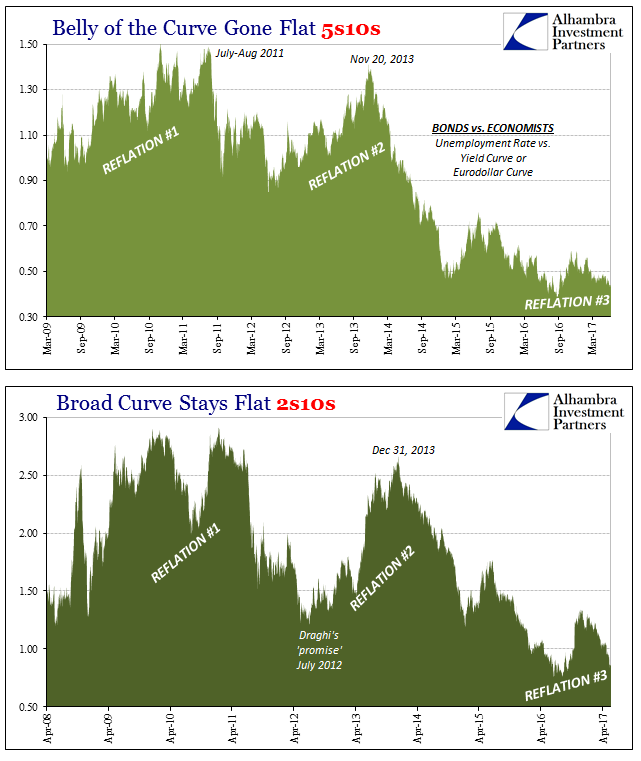

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

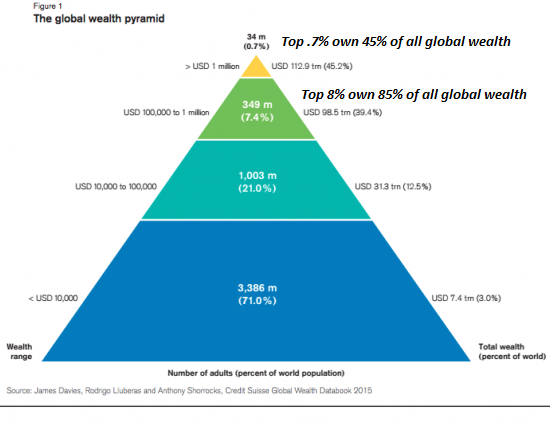

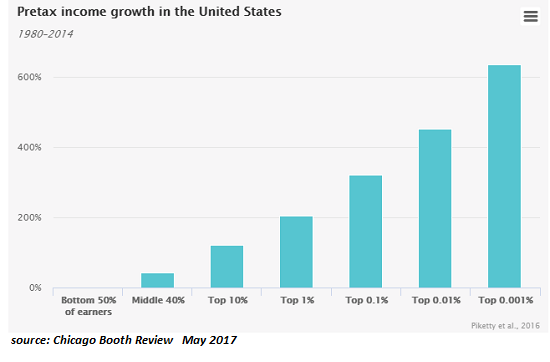

If We Don’t Change the Way Money Is Created, Rising Inequality and Social Disorder Are Inevitable

Centrally issued money optimizes inequality, monopoly, cronyism, stagnation and systemic instability. Everyone who wants to reduce wealth and income inequality with more regulations and taxes is missing the key dynamic: central banks' monopoly on creating and issuing money widens wealth inequality, as those with access to newly issued money can always outbid the rest of us to buy the engines of wealth creation.

Read More »

Read More »

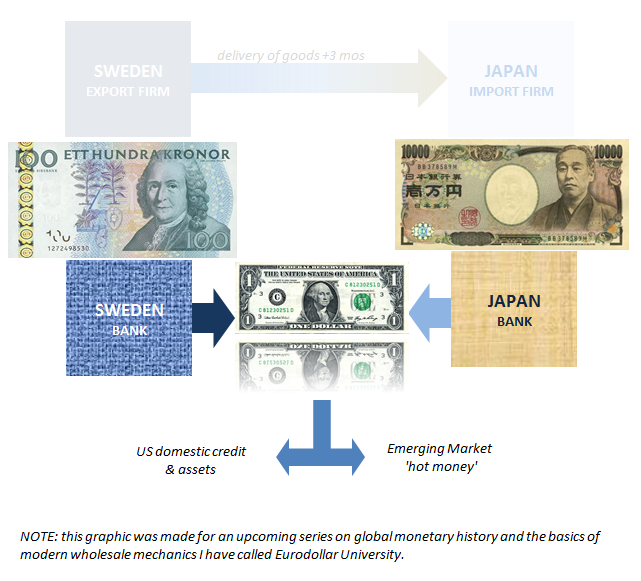

Brazil’s Reasons

Brazil is another one of those topics which doesn’t seem to merit much scrutiny apart from morbid curiosity. Like swap spreads or Japanese bank currency redistribution tendencies, it is sometimes hard to see the connection for US-based or just generically DM investors. Unless you set out to buy an emerging market ETF heavily weighted in the direction of South America, Brazil’s problems can seem a world away.

Read More »

Read More »

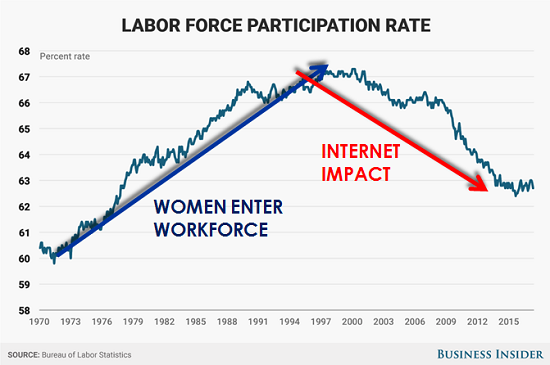

Automation’s Destruction of Jobs: You Ain’t Seen Nothing Yet

Automation--networked robotics, software and processes--has already had a major impact on jobs. As this chart from my colleague Gordon T. Long illustrates, the rise of Internet technologies is reflected in the steady, long-term decline of the labor force participation rate-- the percentage of the populace that is actively in the labor market.

Read More »

Read More »

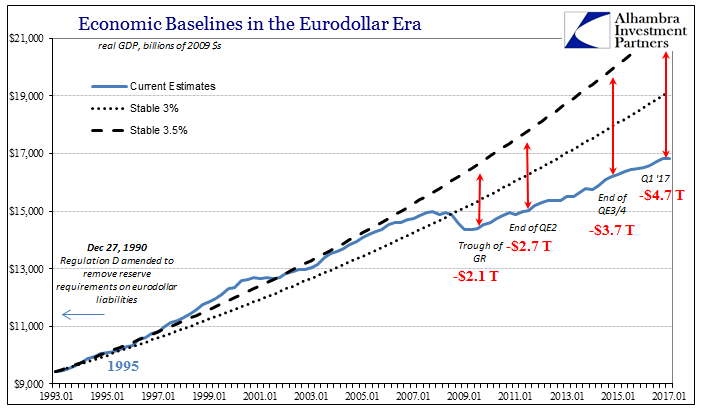

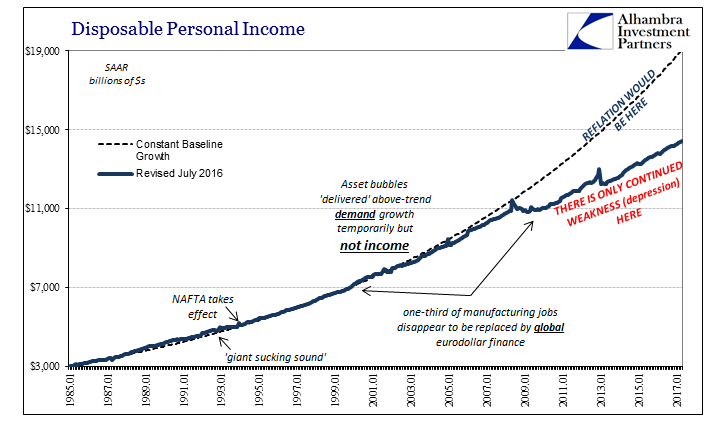

Fading Further and Further Back Toward 2016

Earlier this month, the BEA estimated that Disposable Personal Income in the US was $14.4 trillion (SAAR) for April 2017. If the unemployment rate were truly 4.3% as the BLS says, there is no way DPI would be anywhere near to that low level. It would instead total closer to the pre-crisis baseline which in April would have been $19.0 trillion. Even if we factor retiring Baby Boomers in a realistic manner, say $18 trillion instead, what does the...

Read More »

Read More »

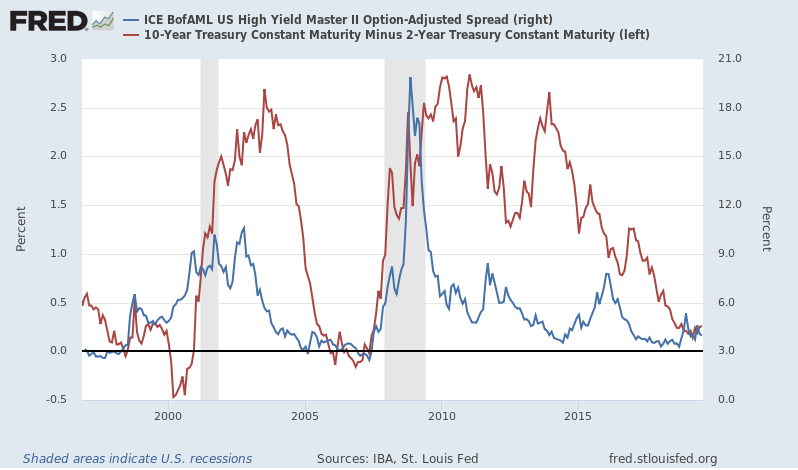

Now China’s Curve

Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Read More »

Read More »

More Pieces of Impossible

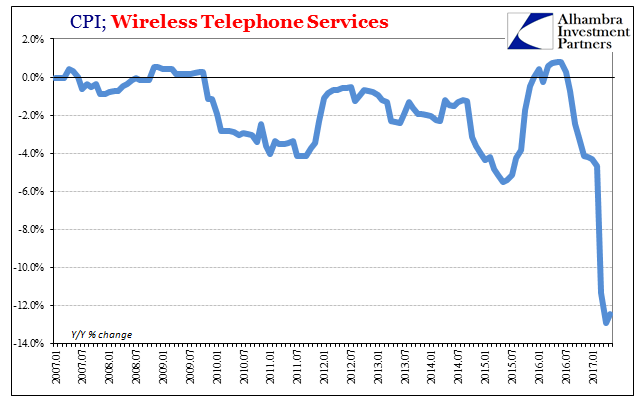

On his company’s earnings conference call back on Valentine’s Day, T-Mobile CEO John Legere was unusually feisty. Never known for shyness, Legere had reason behind his bluster. T-Mobile had practically built itself up on price, being left the bottom tier of the wireless space practically to itself. That all changed, however, as both Verizon and Sprint were set to escalate the wireless price war.

Read More »

Read More »

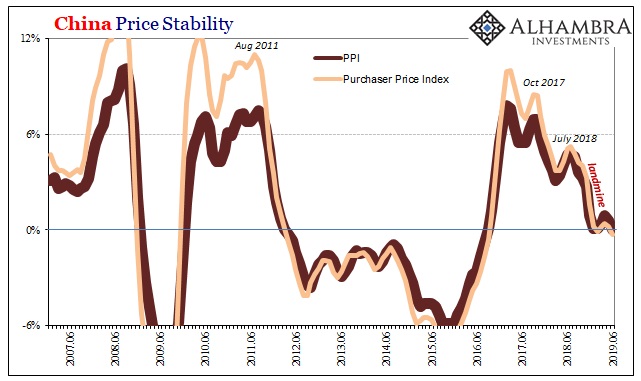

Chinese Basis For Anti-Reflation?

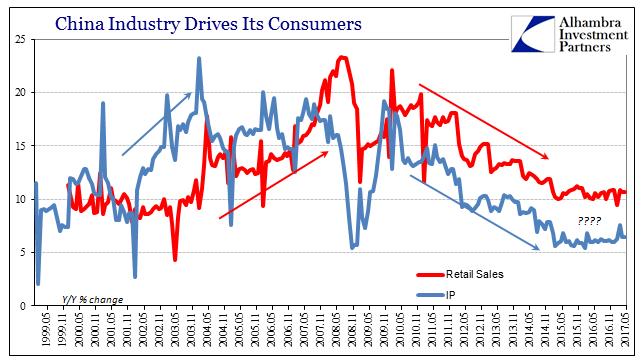

Yesterday was something of a data deluge. In the US, we had the predictable CPI dropping again, lackluster US Retail Sales, and then the FOMC’s embarrassing performance. Across the Pacific, the Chinese also reported Retail Sales as well as Industrial Production and growth of investments in Fixed Assets (FAI). When deciding which topics to cover yesterday, it was easy to leave off the Chinese portion simply because much of it didn’t change.

Read More »

Read More »

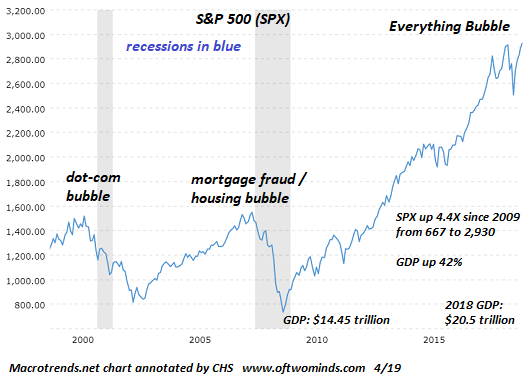

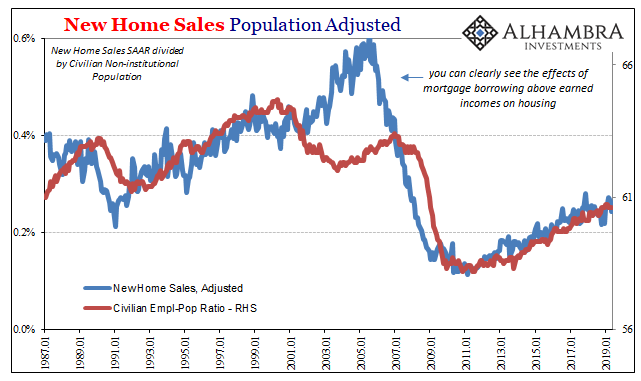

Can We See a Bubble If We’re Inside the Bubble?

If you visit San Francisco, you will find it difficult to walk more than a few blocks in central S.F. without encountering a major construction project. It seems that every decrepit low-rise building in the city has been razed and is being replaced with a gleaming new residential tower.

Read More »

Read More »

Defying Labels

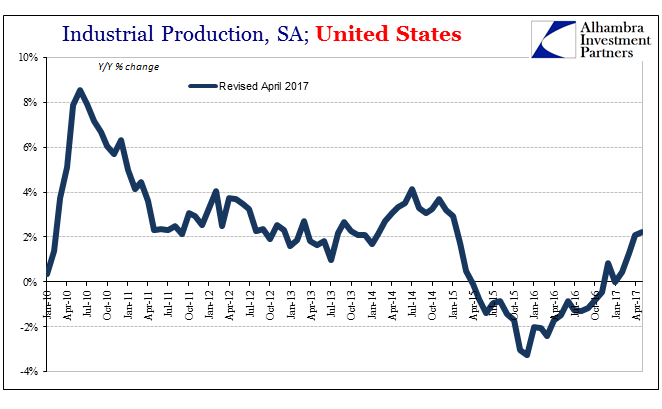

Last month US Industrial Production rose rather quickly. Gaining more than 1.1% month-over-month, it might have appeared that the US economy once dragged into downturn by manufacturing and industry was finally about to experience its belated upturn. But frustration is how it has always gone, not just in this latest phase but for all phases since around 2011. Each good month is followed immediately by a disappointing one. What should be...

Read More »

Read More »

Global Asset Allocation Update:

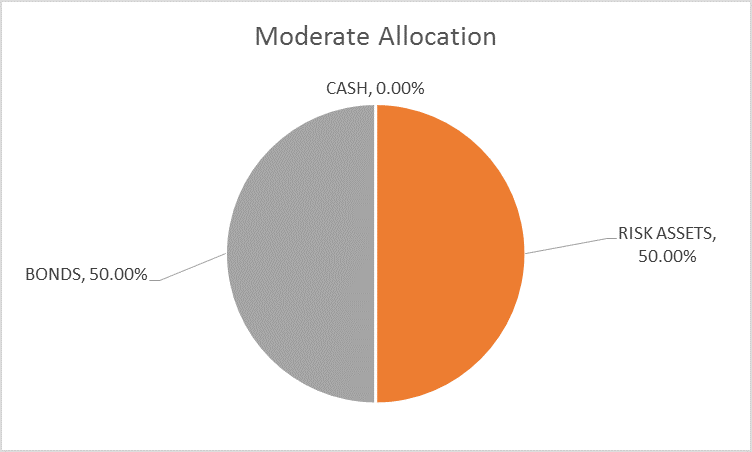

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »

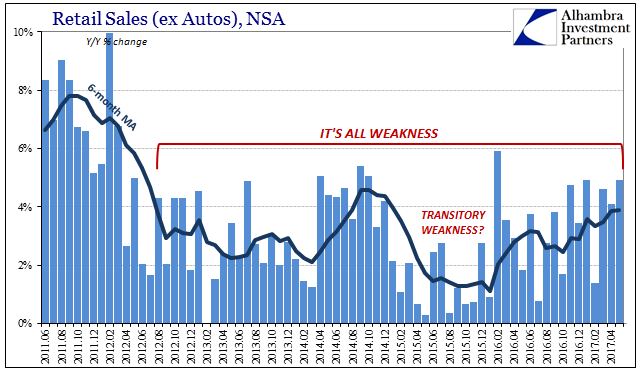

Repeat 2015; An Embarrassing Day For The Fed

Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

Read More »

Read More »

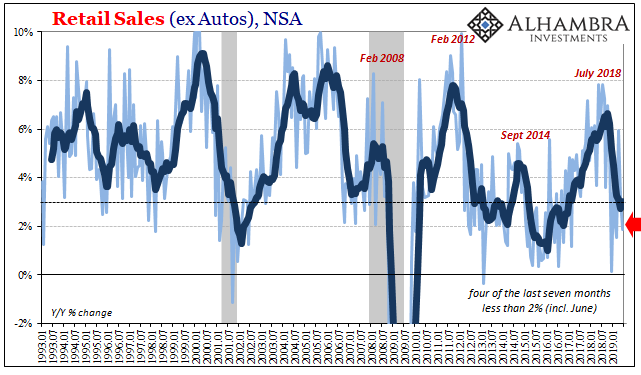

Retail Sales Weren’t All That Bad, Meaning They Were The Worst

Taken in comparison to the last few years, today’s retail sales report wasn’t that bad. Total sales for May 2017, including autos, grew by 5.17% year-over-year (NSA). That was the highest growth rate since last February. The 6-month average is now just shy of 4%, the best since early 2015. It is clear the US economy has shrugged off the effects of last year’s downturn.

Read More »

Read More »

Repeat 2014: Praying Again To The God of ‘Global Growth’

One of the more troubling aspects of mainstream commentary in 2014 was its blandness. Statements were made with a purpose but also purposefully avoiding specifics. It was common to hear or read “the economy is improving” without being shown why or how in convincing fashion. After suffering a second bout of weakness in 2012 and 2013, unexpected of course, everyone simply believed those words because why not.

Read More »

Read More »

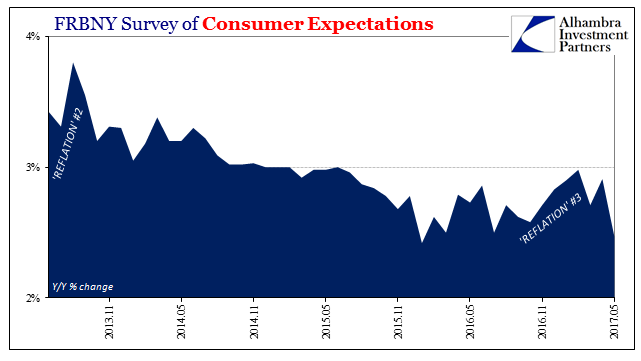

American Expectations, Chinese Prices

The Federal Reserve Bank of New York has for the past almost four years conducted its own assessment of consumer expectations.Though there are several other well-known consumer surveys, FRBNY adding another could be helpful for corroborating them. Unfortunately for the Fed, it has.

Read More »

Read More »

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

Deciphering Curves

What is the yield curve supposed to look like? It’s a simple question that doesn’t actually have an answer. And because it doesn’t, there is a whole lot of confusion about bond yields.

Read More »

Read More »

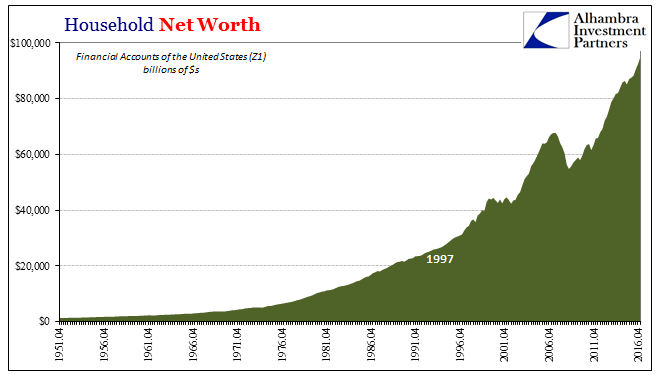

Wealth Paradox Not Effect

US Household Net Worth rose to a record $94.8 trillion in Q1 2017. According to the Federal Reserve’s Financial Accounts of the United States (Z1), aggregate paper wealth rose by more than 8% year-over-year mostly as the stock market shook off the effects of “global turmoil.” It was the best rate of expansion since the second quarter of 2014 just prior to this “rising dollar” interruption.

Read More »

Read More »