Category Archive: 5) Global Macro

Jeff Snider on Federal Reserve art ofJawboning markets about U.S. dollars Part 2 investing in gold

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??http://www.ko-fi.com/aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

Jeff Snider on the Federal Reserve Jawboning

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

All About The Eurodollar , Repo Markets, Gold and Volatility with Jeff Snider.

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

19.2 A Foreign Plot to Dump the Dollar?

America's dollar is said to be the global reserve currency. Might there be hostile nations scheming furiously to undermine the US dollar? Is there a USD Pearl Harbor ahead? No. Precisely the opposite. It's the reserve currency - the EURODOLLAR - that holds everyone hostage, including the USA!

Read More »

Read More »

All About The Eurodollar , Repo Markets, Gold and Volatility with Jeff Snider PART 2

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

All About The Eurodollar , Repo Markets, Gold and Volatility with Jeff Snider PART 1

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

??https://www.patreon.com/Aminray

#markets #investing #trading #economy #money #currency #stocks #robinhood

Eurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar...

Read More »

Read More »

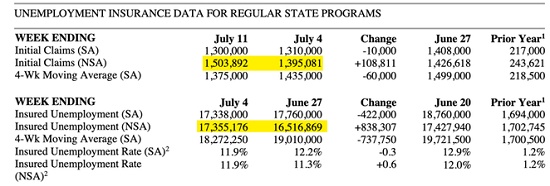

The (Other) Shoe Of Unemployment

After raising the specter of a rebound stall, the idea before limited to Japan and Germany was abruptly given further weight today by US jobless claims numbers. For the first time since the peak at the end of March, the weekly tally of initial filings increased from the prior week.

Read More »

Read More »

Stockmarket v economy: the impact of covid-19 | The Economist

American stockmarkets have enjoyed a record-breaking streak, even though the country’s economy faces the deepest recession in living memory. Why is stockmarket performance so seemingly cut off from current events, and what does this tell us about how the economy works? Read more here: https://econ.st/2OUT5rH

Further reading:

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/31E02VY

Sign up to The Economist’s daily...

Read More »

Read More »

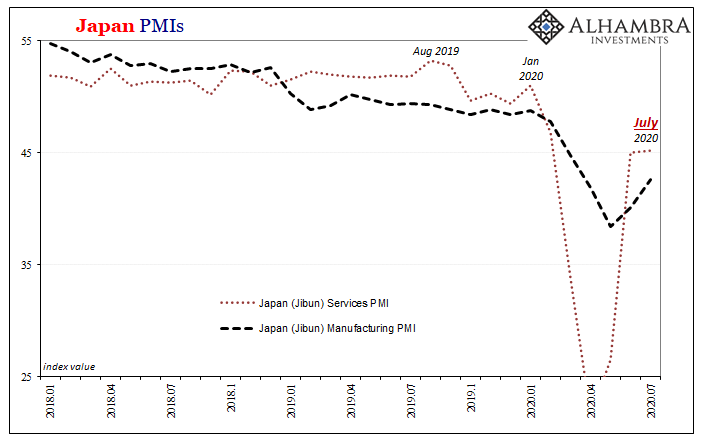

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

Inflation/Deflation: The Economy Is an Elephant

This is the key dynamic of the economy going forward: defaults on debt, declining wealth as assets are relentlessly repriced lower and sharp declines in income due to layoffs and debt defaults. The economy is like an elephant surrounded by blindfolded economists and pundits: what each blindfolded person reports about the elephant depends on what part they happen to touch.

Read More »

Read More »

Deflation/Inflation, Money Printing, Free Market vs. Socialism, Yield Curve Control

?THE REBEL CAPITALIST SHOW WILL HELP YOU ? learn more about Macro, Investing, Entrepreneurship AND Personal Freedom.

Read More »

Read More »

Jeff Snider (Deflation/Inflation, Money Printing, Free Market vs. Socialism, Yield Curve Control)

?THE REBEL CAPITALIST SHOW WILL HELP YOU ? learn more about Macro, Investing, Entrepreneurship AND Personal Freedom.

For more content that'll help you build wealth and thrive in a world of out of control central banks and big governments check out these videos!

? Subscribe for more free YouTube tips: https://www.youtube.com/channel/UCpvyOqtEc86X8w8_Se0t4-w

Do you wanna see another video as incredible as this?

Watch Peter Schiff (Economist,...

Read More »

Read More »

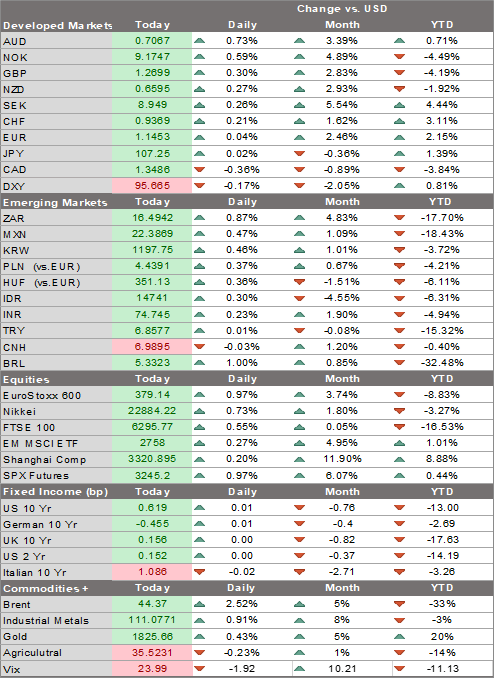

Market Sentiment Boosted by Stimulus Outlook

Today, it’s all about the stimulus; the dollar remains under pressure. Mnuchin and Pelosi kick off the first round of talks for the next stimulus package this afternoon; it’s another quiet day in terms of US data; Canada reports May retail sales

EU finalized its recovery package; UK reported June public sector net borrowing; Hungary is expected to cut rates 15 bp to 0.60%.

Read More »

Read More »

The Real Unemployment Rate is 21 percent and Heading Higher

As businesses, agencies and organizations recalibrate to the reality that the V-shaped recovery was nothing but a brief fantasy, 6 million additional jobs lost may be a best-case scenario rather than the worst-case scenario.

Read More »

Read More »

What Capitalism Can Do When Allowed, And Communism Never Will

Mikhail Sergeyevich Gorbachev was awarded the Nobel Peace Prize in 1990 “for his leading role in the peace process which today characterizes important parts of the international community.” Maybe, but it sure didn’t start out that way.

Read More »

Read More »

Of Incomplete Plans and Recoveries

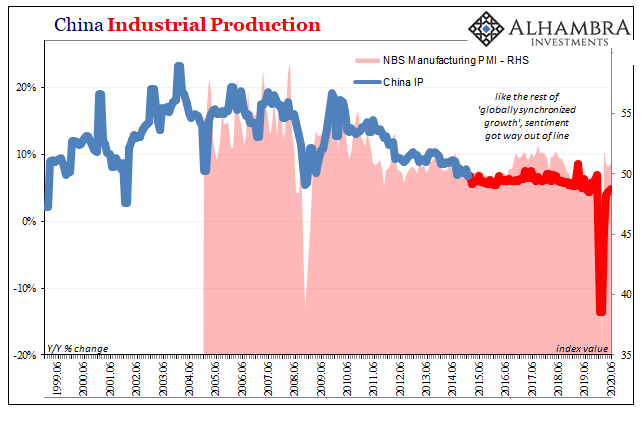

At the monthly press conference China’s National Bureau of Statistics (NBS) now regularly gives whenever the Big Three economic accounts are updated (this time along with quarterly GDP), spokesman Liu Aihua was asked by a reporter from Reuters to comment on how the global economic recession might impact the Communist government’s long range goal of reaching its assigned GDP target.

Read More »

Read More »

Welcome to the Crazed, Frantic Demise of Finance Capitalism

The cognitive dissonance required to ignore the widening gap between the real economy and the fraud's basic machinery--speculation funded by "money" conjured out of thin air--has reached a level of denial that can only be termed psychotic.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was mixed last week, with most risk assets continuing to fight a tug of war between improving economic data and worsening virus numbers. Sentiment may be hurt early this week over lack of consensus in the EU and the US regarding further fiscal stimulus. Three of the four EM central banks meeting this week are expected to cut rates.

Read More »

Read More »

This Is a Financial Extinction Event

The lower reaches of the financial food chain are already dying, and every entity that depended on that layer is doomed. Though under pressure from climate change, the dinosaurs were still dominant 65 million year ago--until the meteor struck, creating a global "nuclear winter" that darkened the atmosphere for months, killing off most of the food chain that the dinosaurs depended on.

Read More »

Read More »

Transitory, The Other Way

After a record three straight months of decline for the seasonally-adjusted core CPI March through May 2020, it turned upward again in June. Buoyed by a partially reopened economy, the price discounting (prerequisite to the Big D) took at least one month off.

Read More »

Read More »