Category Archive: 5.) Emerging Markets

Latin America – Seven Ugly Sisters in Deep Political Trouble

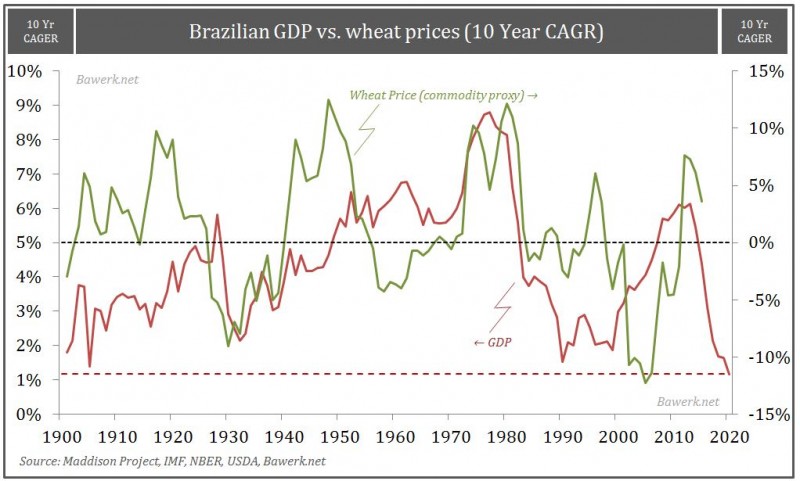

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended the week on a mixed note after posting strong post-FOMC gains. The bounce in risk seems likely to continue this week, with little on the horizon to derail it. Specific country risk remains in play, however, with heightened political concerns in Brazil and South Africa. Taiwan reports February export orders Monday, which are …

Read More »

Read More »

Weekly Emerging Markets: What has Changed?

China press is reporting that policymakers are drafting rules for a so-called Tobin tax on yuan transactions. This would seem to go against China’s efforts at making the yuan more accessible and liquid. While it could deter speculative activity, th...

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM enjoyed an extended rally last week, and it should carry over to the early part of the week. The Wednesday FOMC meeting poses a risk to EM, especially if markets continue to price in a more hawkish Fed. The dot plots and press conference will be very important. BOE and the Norges Bank also … Continue reading »

Read More »

Read More »

Emerging Markets Preview: Week Ahead

(from my colleague Dr. Win Thin)Risk sentiment ended last week on a strong note, and that should carry over into this week. The global liquidity backdrop remains positive for EM, with the ECB widely expected to add more stimulus on Thursday. I...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, Brazil (+17.8%), Singapore (+7.1%), and India (+6.4%) have outperformed this week, while Qatar (+0.6%), Poland (+1.1%), and Malaysia (+1.7%) have underperformed. To put this in better context, MSCI EM rose 6.8% this week whil...

Read More »

Read More »

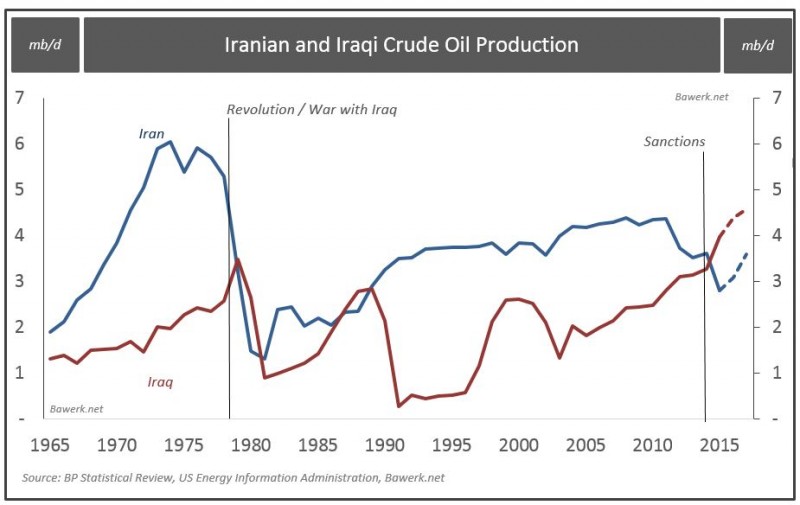

Revolutionary Guards: The Way of the Iranian Future

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for Pres...

Read More »

Read More »

Emerging Market Preview, First Week of March

EM ended last week on a soft note, due to a variety of both external and internal factors. Firm US data continue to support our call for resumed Fed tightening, and this gave the dollar a bit of a bid. With the dollar gaining against the majors, this spilled over into generalized dollar gains … Continue reading »

Read More »

Read More »

Emerging Market Preview: Week Ahead

(from my colleague Dr. Win Thin)

We think that it’s still too early to say whether Friday's price action was simply profit-taking ahead of the weekend, or the resumption of overall negative market sentiment. We think the global backdrop rem...

Read More »

Read More »

Weekly Emerging Markets: What has Changed?

In the EM equity space, Colombia (+0.3%), Chile (+0.2%), and Poland (-0.6%) have outperformed this week, while India (-6.6%), Czech Republic (-5.5%), and Hong Kong (-5.0%) have underperformed. To put this in better context, MSCI EM fell -3.9% this w...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

Czech Republic reported disappointing December industrial (0.7 vs 5.9% y/y consensus). It reported a small trade surplus rather than the expected deficit. It will report January CPI on Friday, and is expected to rise 0.5% y/y vs. 0.1% in December. ...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, UAE (+6.2%), Indonesia (+4.0%), and Qatar (+1.8%) have outperformed this week, while Hong Kong (-2.0%), Czech Republic (-1.9%), and Hungary (-1.2%) have underperformed. To put this in better context, MSCI EM fell -0.1% this w...

Read More »

Read More »

Emerging Market Preview: Week Ahead

As we suspected, the current EM bounce still has some legs. The BOJ’s surprise easing helped EM and risk end on last week on a strong note, and we expect that to carry over into this week. Within EM, we will start to see the first readings for January. The biggest risk perhaps is the … Continue reading »

Read More »

Read More »

Emerging Market Preview: Week Ahead

Singapore reports December CPI Monday, and is expected at -0.7% y/y vs. -0.8% in November. It then reports December IP Tuesday, and is expected at -6.8% y/y vs. -5.5% in November. Q4 unemployment will be reported Thursday. With deflation risks per...

Read More »

Read More »

Emerging Markets: What has Changed

(from my colleagues Dr. Win Thin and Ilan Solot)

1) Mauricio Macri, the mayor of Buenos Aires, won the Argentine presidential election with 52% of vote

2) The latest political developments in Brazil rocked asset prices

3) The Brazilian cent...

Read More »

Read More »

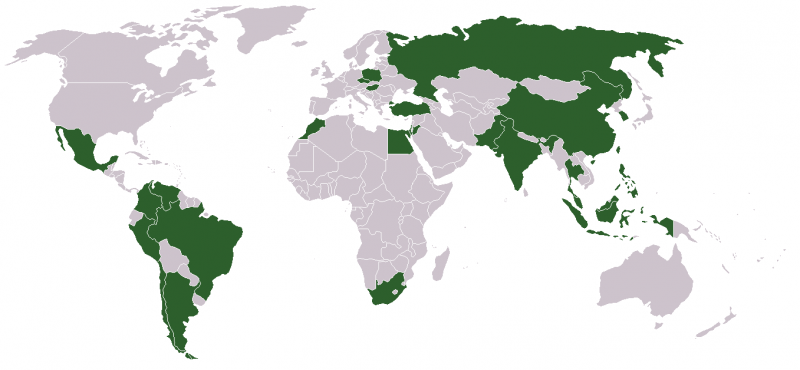

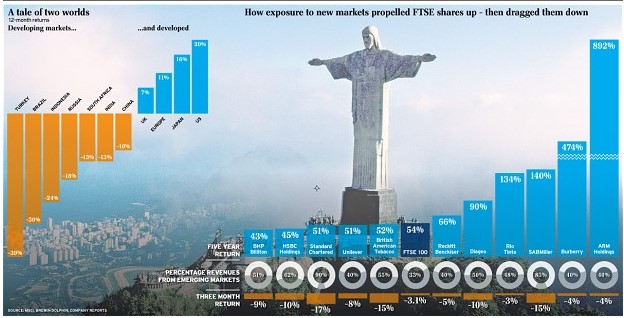

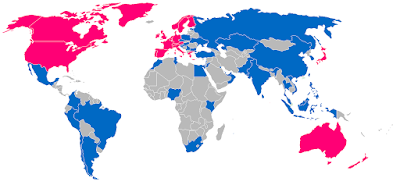

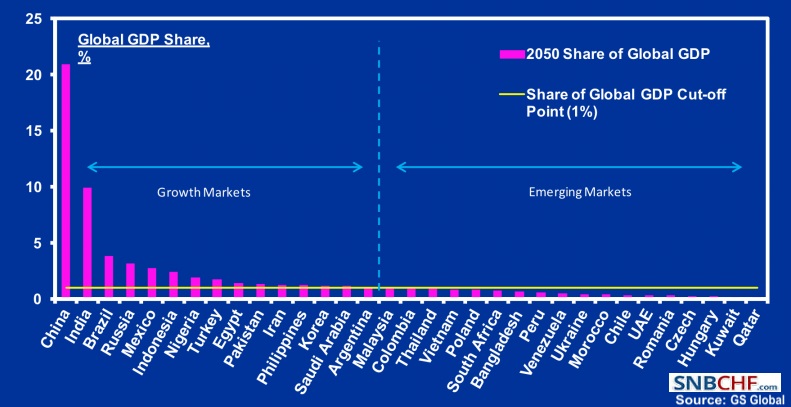

Stock Indices and Exposure to Emerging Markets

Monetary policy is and remains tight in Emerging Markets, in particular since many of their currencies collapsed in summer 2013. This created inflation and led to lower spending. We want to find out which stock indices in the developed world have which exposure to Emerging Markets.

Read More »

Read More »

Last Week’s Sell-Off: More on the Discrepancy between Developed and Emerging Markets

Last week’s decline in stock markets was probably caused by the HSBC manufacturing PMI for China that contracted for the first time in months, and possibly also by the rapid fall of UK unemployment rates and Bank of England’s response to it. As the rising gold price showed, Fed “tapering fears” were not at the …

Read More »

Read More »

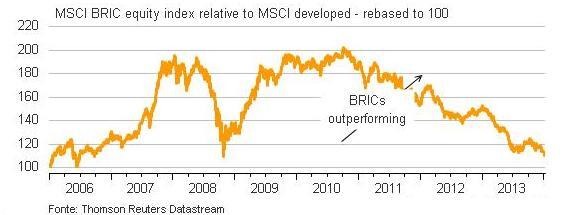

Our March 2013 Analysis: “Volcker Moment Redux”: Upcoming Weakness of Emerging Markets

The 2010 QE2 is a reason why many emerging markets started to slow considerably in the course of 2012. We reckon that this weakness will continue. Bizarrely QE2 helped to reduce global imbalances.

Read More »

Read More »