Category Archive: 5.) Emerging Markets

Emerging Market Preview: Week Ahead

The Brexit vote is a game-changer for EM. While the direct impact on EM is limited, the damage to market sentiment is undeniable. And to make matters worse, there will be a protracted period of uncertainty as the UK and the EU negotiate the divorce proceedings.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week under pressure. With two potentially disruptive events (FOMC meeting and Brexit vote) still in play, we think that EM softness should carry over into this week.

Read More »

Read More »

Emerging Markets: What has Changed

China granted US asset managers a CNY250 bln ($38 bln) quota under the existing QFII system

Bank of Korea surprised the market by delivering a 25 bp rate cut to 1.25%

Oman issued its first global ...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

Russian central bank meets Friday and is expected to keep rates steady at 11.0%. However, the market is split. Of the 25 analysts polled by Bloomberg, 13 see no move and 12 see a 50 bp cut to 10.5%. The central bank has been on hold since the last...

Read More »

Read More »

Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term

The incoming Philippine government is signaling looser fiscal policies ahead

Read More »

Read More »

Emerging Market Preview

EM ended last week on a soft note. The icing on the cake was Yellen’s speech Friday afternoon, which confirmed the more hawkish stance seen in the FOMC minutes and other recent official comments. We warn tha...

Read More »

Read More »

Emerging Markets: What has Changed

Korea will extend trading hours for stock and FX markets by 30 minutes effective August 1 The Monetary Authority of Singapore said it will withdraw BSI Bank’s license for breaches of money-laundering rules The US lifted a decades-old arms embargo on Vietnam The Nigerian central bank said it would allow “greater flexibility” in the FX …

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM had another rocky week, but managed to end on a slightly firmer note Friday. Market repricing of Fed tightening risk was the big driver last week, and that could carry over into this week. There are several Fed speakers in the days ahead, capped...

Read More »

Read More »

Emerging Markets: What has Changed

The Philippine central bank moved to an interest rate corridor Saudi Arabia is preparing to sell its first global bond ever Transport Minister Yildirim, a close ally of President Erdogan, will become Turkey’s new Prime Minister The new Brazil cabinet continues to take shape with a market-friendly bias In the EM equity space, South Africa …

Read More »

Read More »

Emerging Markets Preview: Week Ahead

EM ended last week on a soft note, and that weakness seems likely to carry over into this week. Dollar sentiment turned more positive after firm retail sales data on Friday, though US rates markets have yet to reflect any increase in Fed tightening expectations. Over the weekend,

Read More »

Read More »

EM FX Technical Picture

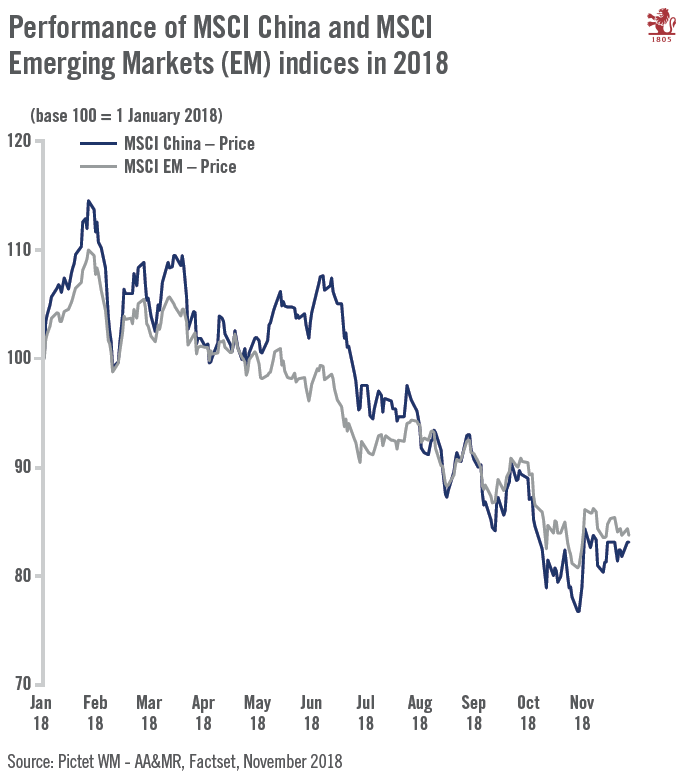

Note that MSCI EM fell 21% from November 4 to January 21. It then rallied 25% to challenge the November highs, but it has since fallen back. MSCI EM has now retraced about a quarter of this year's rally. Major retracement objectives come in near 7...

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM ended the week on a firm note, which should carry over into this week. The biggest near-term risk to EM is the US jobs data on Friday, as the weekly claims data points to another strong gain. Otherwise, the global liquidity backdrop remains EM-supportive. Thailand reported April CPI earlier today. It rose 0.07% year-over-year. …

Read More »

Read More »

FX Daily April 25: Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the … Continue reading...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a soft note. Perhaps the main driver was rising US yields, as markets become wary of a more hawkish Fed this Wednesday. Perhaps it was technical, as the EM rally became over-extended. Wh...

Read More »

Read More »

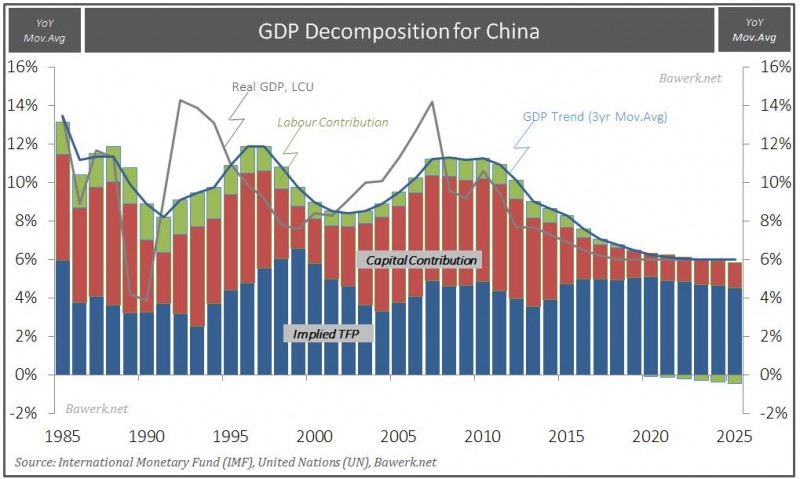

Chinese Dragon: Breathing Credit Fumes

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate.

Read More »

Read More »

Emerging Markets: What has Changed

(from my colleague Dr. Win Thin)China’s central bank may be leaning less dovish

Turkey has a new central bank governor

Argentina issued external debt for the first time since it defaulted 15 years ago

Brazil's lower house voted to impeach Preside...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a firm note. Given the absence of any Fed-specific risks or any major US data releases, that firmness could carry over into this week. The failure to reach an agreement in Doha by oil pro...

Read More »

Read More »

Weekly Emerging Markets: What has Changed

Bank Indonesia will use the 7-day reverse repo rate as its new benchmark policy rate The ruling party in South Korea unexpectedly lost parliamentary elections The Monetary Authority of Singapore eased monetary policy to recession settings Turkey has nominated its next central bank chief The Brazilian special lower house committee voted 38-27 in favor of …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed?...

Read More »

Read More »

Weekly Emerging Markets: What has Changed

Bank Indonesia signaled it may pause its easing cycle. Senior Deputy Governor Adityaswara said “We want to see the impact on growth and inflation before we do the next cut.” Elsewhere, Governor Martowardojo said that the central bank must be carefu...

Read More »

Read More »