Category Archive: 5.) Charles Hugh Smith

03-05-13-Macro Analytics – The Global End Game – with Charles Hugh Smith

Charles Hugh Smith’s recent article The Global End Game in Fourteen Points is the basis for this discussion on the traditional Business Cycle, the Credit Cycle

Read More »

Read More »

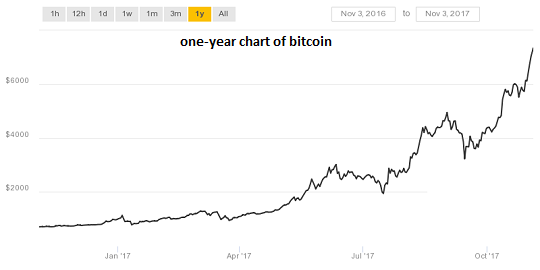

How Will Bitcoin React in a Financial Crisis Like 2008?

Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other cryptocurrencies are in a tulip-bulb type bubble, while the other camp is equally confident that we ain't seen nuthin' yet in terms of bitcoin's future valuation.

Read More »

Read More »

Let’s Clear Up One Confusion About Bitcoin

If bitcoin can be converted into fiat currencies at a lower transaction cost than the fiat-to-fiat conversions made by banks and credit card companies, it's a superior means of exchange. One of the most common comments I hear from bitcoin skeptics goes something like this: Bitcoin isn't real money until I can buy a cup of coffee with it. In other words, bitcoin fails the first of the two core tests of "money": that it is a means of exchange and a...

Read More »

Read More »

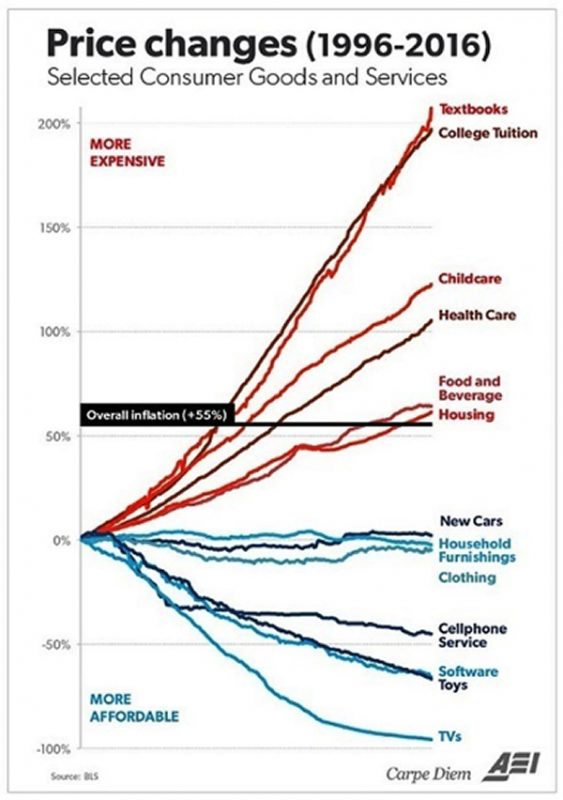

The Big Reversal: Inflation and Higher Interest Rates Are Coming Our Way

This interaction will spark a runaway feedback loop that will smack asset valuations back to pre-bubble, pre-pyramid scheme levels. According to the conventional economic forecast, interest rates will stay near-zero essentially forever due to slow growth. And since growth is slow, inflation will also remain neutral.

Read More »

Read More »

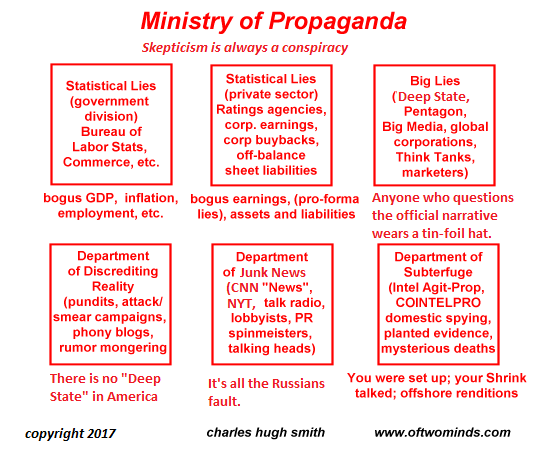

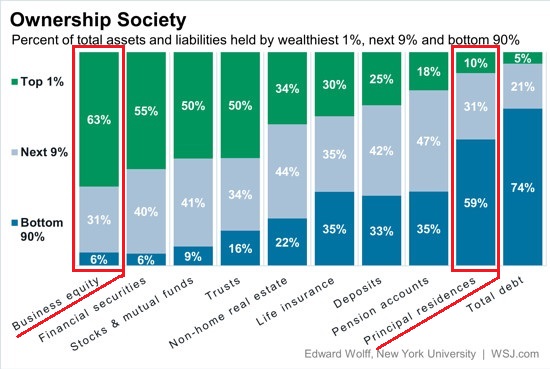

What’s Driving Social Discord: Russian Social Media Meddling or Soaring Wealth/Power Inequality?

The nation's elites are desperate to misdirect us from the financial and power dividethat has enriched and empowered them at the expense of the unprotected many. There are two competing explanatory narratives battling for mind-share in the U.S.: 1. The nation's social discord is the direct result of Russian social media meddling-- what I call the Boris and Natasha Narrative of evil Russian masterminds controlling a vast conspiracy of social media...

Read More »

Read More »

What the Kennedy Assassination Records Reveal: Uncontrollable Incompetence

One way to interpret the intelligence community's reluctance to let all the Kennedy assassination archives become public is that the archives contain evidence of a "smoking gun": that is, evidence that the intelligence agencies of the United States of America were complicit in the assassination of the President.

Read More »

Read More »

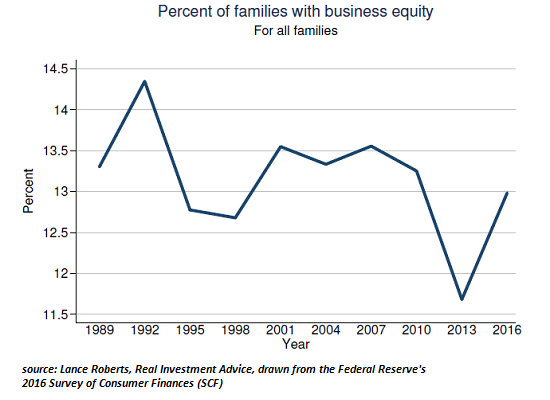

Observations on Wealth-Income Inequality (from Federal Reserve Reports)

There's a profound difference between assets that produce no income and those that produce net income. To those of us nutty enough to pore over dozens of pages of data on wealth and income in the U.S., the Federal Reserve's quarterly Z.1 reports and annual Survey of Consumer Finances (SCF) are treasure troves, as are I.R.S. tax and income reports.

Read More »

Read More »

Where To Invest When (Almost) Everything’s in a Bubble

Many things that are scarce and thus valuable cannot be bought on the global marketplace. Now that almost every asset class is in a bubble, the question of where to invest one's capital has become particularly vexing. The ashes of wealth consumed by the 2008-09 Global Financial Meltdown are still warm, at least to those who never recovered, and so buying assets at nosebleed valuations in the hopes of earning another 5% aren't very compelling to...

Read More »

Read More »

What Could Pop The Everything Bubble?

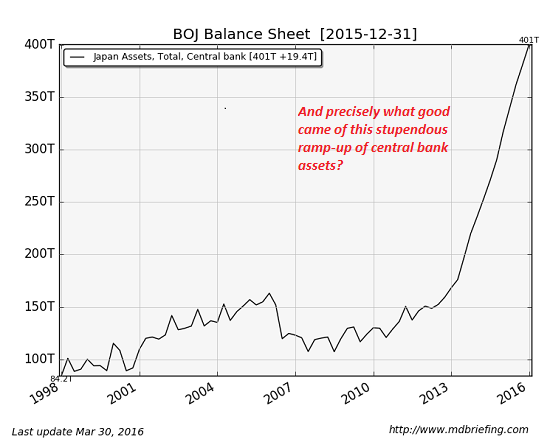

As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop.

Read More »

Read More »

Stagnation Nation: Middle Class Wealth Is Locked Up in Housing and Retirement Funds

The majority of middle class wealth is locked up in unproductive assets or assets that only become available upon retirement or death. One of my points in Why Governments Will Not Ban Bitcoin was to highlight how few families had the financial wherewithal to invest in bitcoin or an alternative hedge such as precious metals.

Read More »

Read More »

Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class.

Read More »

Read More »

Charles Hugh Smith Will The Private Sector Grow Fast Enough To Meet The Demands Of The Public Sector

Click here for the full summary: http://financialrepressionauthority.com/2017/10/27/the-roundtable-insight-charles-hugh-smith-on-will-the-private-sector-be-able-to-grow-fast-enough-to-meet-the-demands-of-the-public-sector/

Read More »

Read More »

RMR: Exclusive Interview with Charles Hugh Smith (10/23/2017)

Charles Hugh Smith – Of Two Minds Blog joins “V” to discuss the move away from central banks utilizing cryptocurrency, how economic gain is realized by only by the top 1% and how blockchain could transform the internet for the good of society. We are political scientists, editorial engineers, and radio show developers drawn together …

Read More »

Read More »

Which Rotten Fruit Falls First?

I predict the current investigations will widen and take a variety of twists and turns that surprise all those anticipating a tidy, narrowly focused denouement. The theme this week is The Rot Within. To those of us who understand the entire status quo is rotten and corrupt to its core, the confidence of each ideological camp that their side will emerge unscathed by investigation is a source of amusement.

Read More »

Read More »

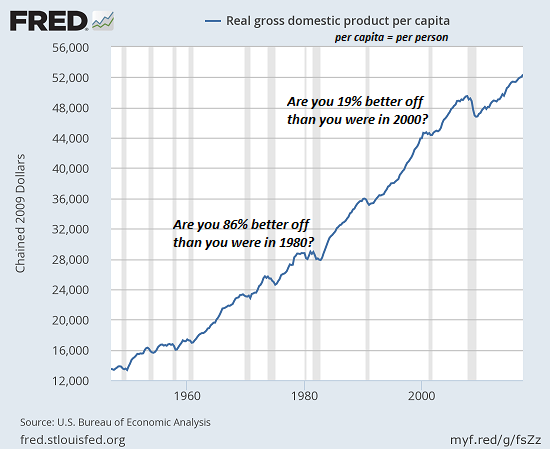

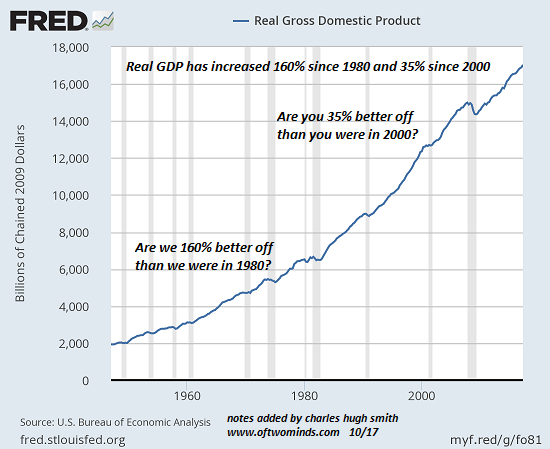

GDP Is Bogus: Here’s Why

The rot eating away at our society and economy is typically papered over with bogus statistics that "prove" everything's getting better every day in every way. The prime "proof" of rising prosperity is the Gross Domestic Product (GDP), which never fails to loft higher, with the rare excepts being Spots of Bother (recessions) that never last more than a quarter or two.

Read More »

Read More »

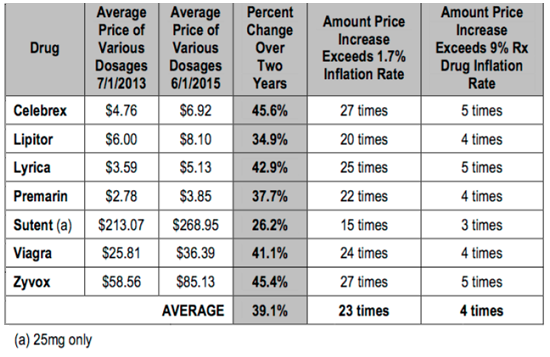

Fraud, Exploitation and Collusion: America’s Pharmaceutical Industry

The rot within manifested by the pharmaceutical industry almost defies description.The theme this week is The Rot Within. America's Pharmaceutical industry takes pride of place in this week's theme of The Rot Within, as the industry has raised fraud, exploitation and collusion to systemic perfection. What other industry can routinely kill hundreds of thousands of Americans and suffer no blowback? Only recently has the toll of needless deaths from...

Read More »

Read More »