Category Archive: 5.) Charles Hugh Smith

Where are Europe’s Fault Lines?

Beneath the surface of modern maps, numerous old fault lines still exist. A political earthquake or two might reveal the fractures for all to see. Correspondent Mark G. and I have long discussed the potential relevancy of old boundaries, alliances and structures in Europe's future alignments.Examples include the Holy Roman Empire and the Hanseatic League, among others.

Read More »

Read More »

Our Culture of Rape

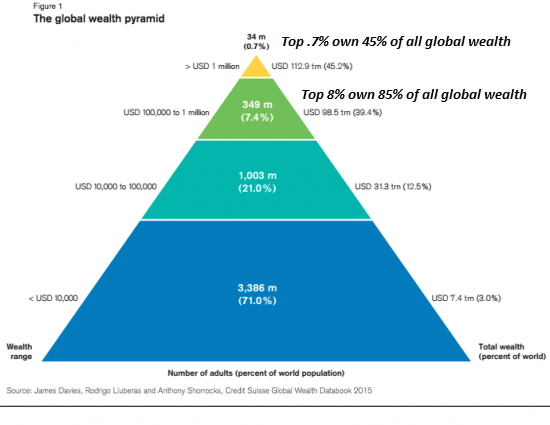

These are the poisoned fruits of a neofeudal system in which power, wealth and political influence are concentrated in the apex of the wealth-power pyramid. Stripped of pretense, ours is a culture of rape. Apologists for the system that spawned this culture of rape claim that this violence is the work of a few scattered sociopaths. The apologists are wrong: The system generates a culture of rape.

Read More »

Read More »

03-23-13-Macro Analytics – Market Clearing Event – Charles Hugh Smith

QUESTIONS ON THE TABLE 1- How Large can Central Bank’s Balance Sheets actually get before too much is too much? 2- Is Public Debt Monetization A

Read More »

Read More »

09 15 15 MACRO ANALYTICS – Its Getting Ugly out there! w/ Charles Hugh Smith

with Charles Hugh Smith & Gordon T Long 28 Minutes – 21 Slides Charles Hugh Smith and Gordon T Long discuss the US Equity Market Technicals.

Read More »

Read More »

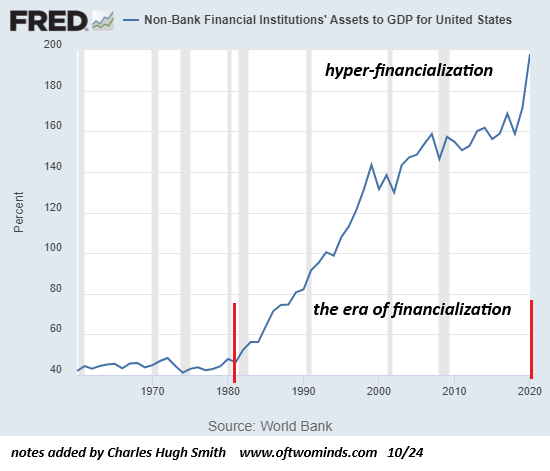

MACRO ANALYTICS – 07 14 17 – The Road to Financialization w/ Charles Hugh Smith

Anyone interested in how we got to where we are today will enjoy this tutorial discussion of the chronology of US & Global Monetary Events regarding the

Read More »

Read More »