Category Archive: 5.) Charles Hugh Smith

About Those “Hedonic Adjustments” to Inflation: Ignoring the Systemic Decline in Quality, Utility, Durability and Service

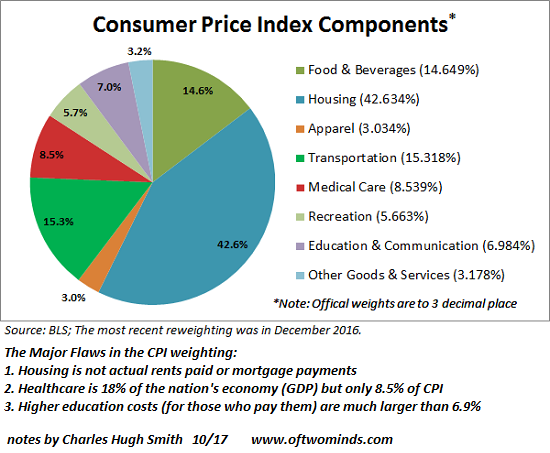

The quality, durability, utility and enjoyment-of-use of our products and services has been plummeting for years. One of the more mysterious aspects of the official inflation rate is the hedonic quality adjustments that the Bureau of Labor Statistics makes to the components of the Consumer Price Index (CPI). The basic idea is that when innovations improve the utility (and pleasure derived from) a product, the price is adjusted to reflect this...

Read More »

Read More »

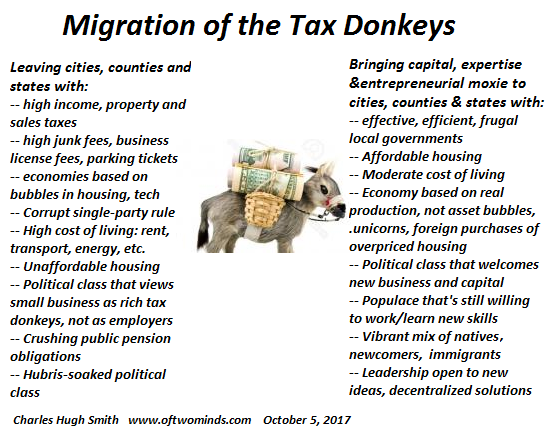

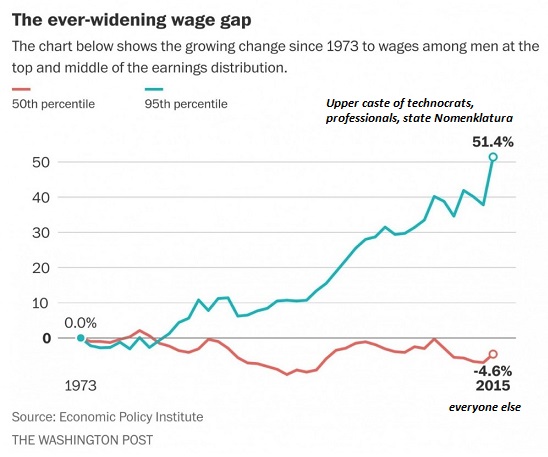

Migration of the Tax Donkeys

Dear local leadership: here's the formula for long-term success. A Great Migration of the Tax Donkeys is underway, still very much under the radar of the mainstream media and conventional economists. If you are confident no such migration of those who pay the bulk of the taxes could ever occur, please consider the long-term ramifications of these two articles.

Read More »

Read More »

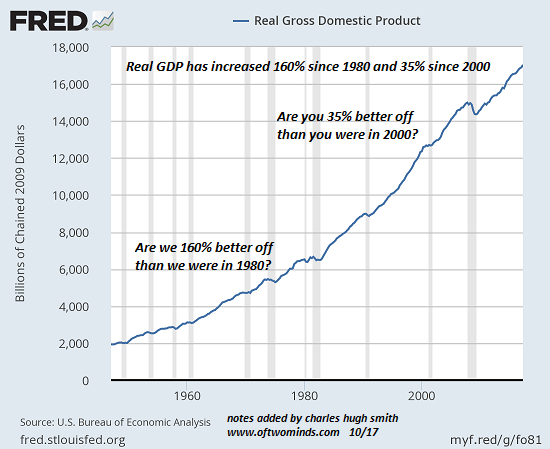

Are You Better Off Than You Were 17 Years Ago?

We tend to measure what's easily measured (and supports the status quo) and ignore what isn't easily measured (and calls the status quo into question). If we use gross domestic product (GDP) as a broad measure of prosperity, we are 160% better off than we were in 1980 and 35% better off than we were in 2000. Other common metrics such as per capita (per person) income and total household wealth reflect similarly hefty gains.

Read More »

Read More »

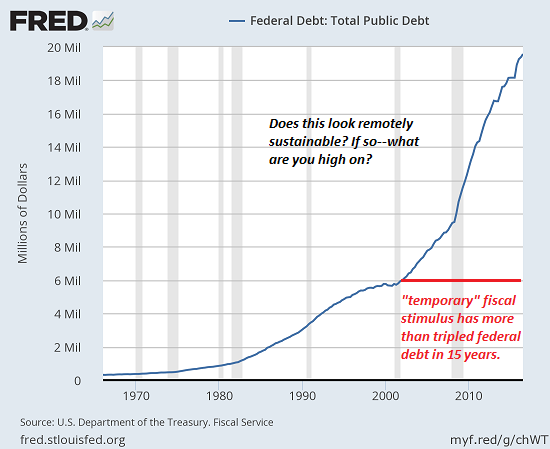

The Consent of the Conned

Every single line item in our entire Bernie Madoff scam of a system is cooked. My theme this week is The Great Unraveling, by which I mean the unraveling of our social-political-economic system of hierarchical, centralized power. Let's start by looking at how the basis of governance has transmogrified from consent of the governed to consent of the conned.

Read More »

Read More »

Be Careful What You Wish For: Inflation Is Much Higher Than Advertised

What the Federal Reserve is actually whining about is not low inflation--it's that high inflation isn't pushing wages higher like it's supposed to. It's not exactly a secret that real-world inflation is a lot higher than the official rates--the Consumer Price Index (CPI) and Personal Consumption Expenditures PCE).

Read More »

Read More »

What If the Tax Donkeys Rebel?

I would hazard a guess that an increasing number of tax donkeys are considering dropping out as a means of increasing their happiness and satisfaction with life. Since federal income taxes are in the spotlight, let's ask a question that rarely (if ever) makes it into the public discussion: what if the tax donkeys who pay most of the tax rebel? There are several likely reasons why this question rarely arises.

Read More »

Read More »

Surprise! The Rules Will Change (But Not to Your Benefit)

These expedient fixes end up crippling the mechanisms that are needed to actually solve the systemic sources of the crisis. We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes. Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states (governments).

The Core Imperative...

Read More »

Read More »

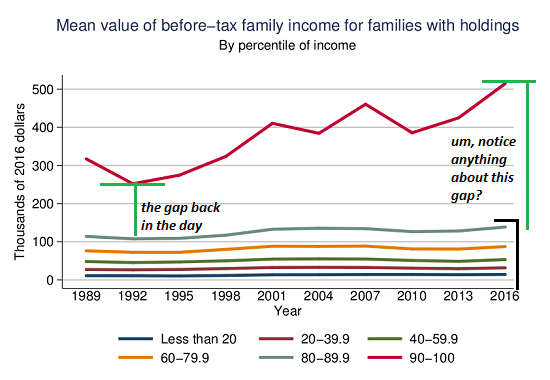

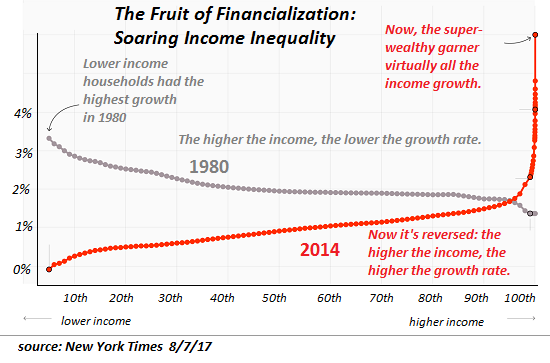

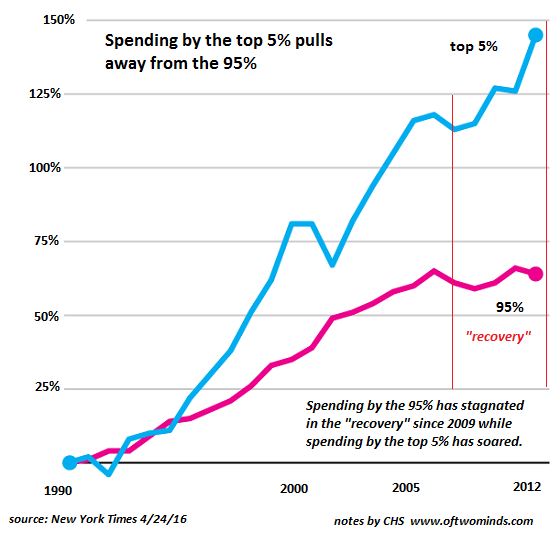

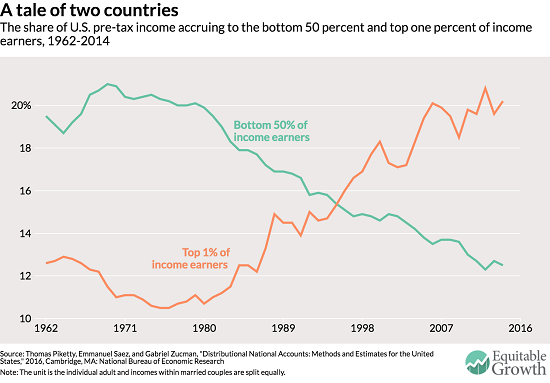

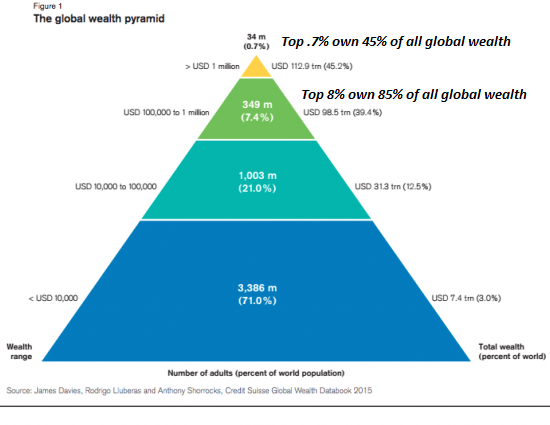

This Chart Defines the 21st Century Economy

There is nothing inevitable about such vast, fast-rising income-wealth inequality; it is the only possible output of our financial and pay-to-play political system. One chart defines the 21st century economy and thus its socio-political system: the chart of soaring wealth/income inequality. This chart doesn't show a modest widening in the gap between the super-wealthy (top 1/10th of 1%) and everyone else: there is a veritable Grand Canyon between...

Read More »

Read More »

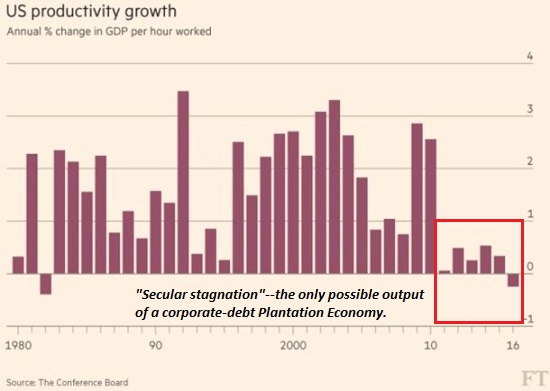

Stagnation Is Not Just the New Normal–It’s Official Policy

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they've embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms.

Read More »

Read More »

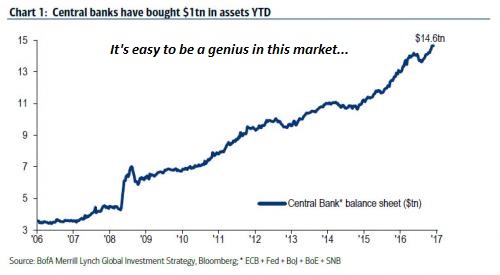

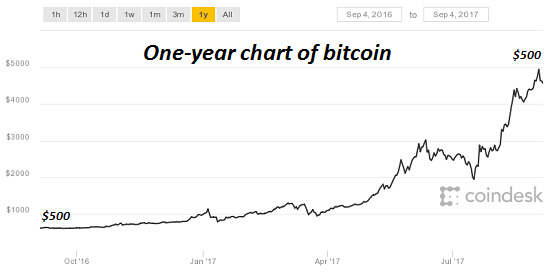

Dear Jamie Dimon: Predict the Crash that Takes Down Your Produces-Nothing, Parasitic Bank and We’ll Listen to your Bitcoin “Prediction”

This is the begging-for-the-overthrow-of-a-corrupt-status-quo economy we have thanks to the Federal Reserve giving the J.P. Morgans and Jamie Dimons of the world the means to skim and scam the bottom 95%. Dear Jamie Dimon: quick quiz: which words/phrases are associated with you and your employer, J.P. Morgan?

Read More »

Read More »

Yes, This Time It Is Different: But Not in Good Ways

Yes, this time it's different: all the foundations of a healthy economy are crumbling into quicksand. The rallying cry of Permanent Bulls is this time it's different. That's absolutely true, but it isn't bullish--it's terrifically, terribly bearish. Why is this time it's different bearish going forward? The basic answer is that nothing that is structurally broken has actually been fixed, and the policy "fixes" have fatally weakened the global...

Read More »

Read More »

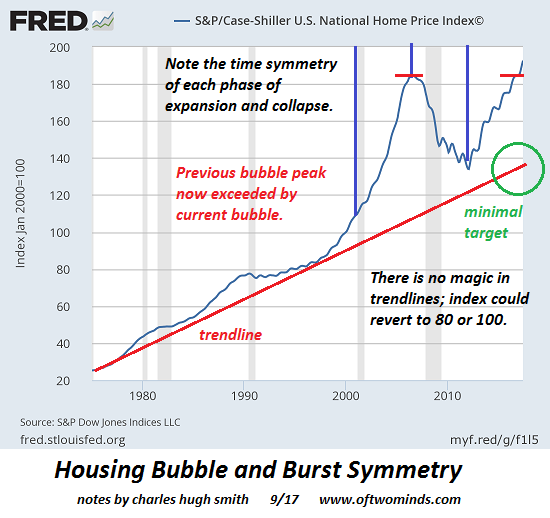

Housing Bubble Symmetry: Look Out Below

Housing markets are one itsy-bitsy recession away from a collapse in domestic and foreign demand by marginal buyers. There are two attractive delusions that are ever-present in financial markets:One is this time it's different, because of unique conditions that have never ever manifested before in the history of the world, and the second is there are no cycles, they are illusions created by cherry-picked data; furthermore, markets are now...

Read More »

Read More »

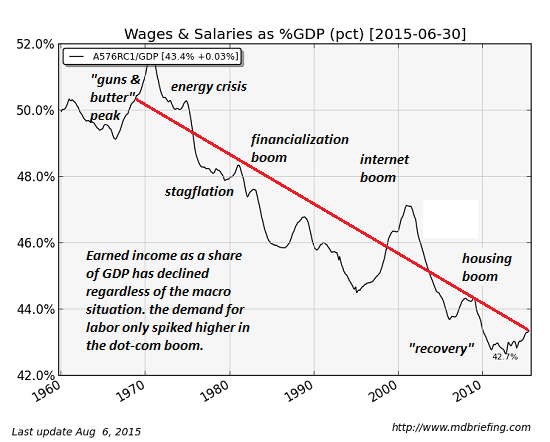

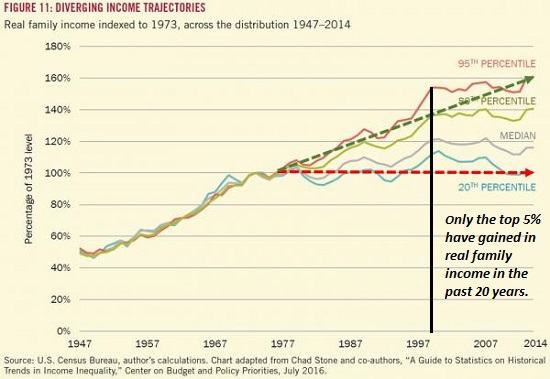

The Real Reason Wages Have Stagnated: Our Economy is Optimized for Financialization

Labor's share of the national income is in freefall as a direct result of the optimization of financialization. The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed...

Read More »

Read More »

Is the High Cost of Housing Crushing Wages?

The authors' thesis doesn't explain the 47-year downtrend of labor's share of the economy. A provocative essay, Don't Blame the Robots, makes the bold claim that "Housing Prices and Market Power Explain Wage Stagnation." (Foreign Affairs) In other words, the stagnation of the bottom 95% of wages isn't caused by automation or offshoring, but by the crushingly high cost of housing:

Read More »

Read More »

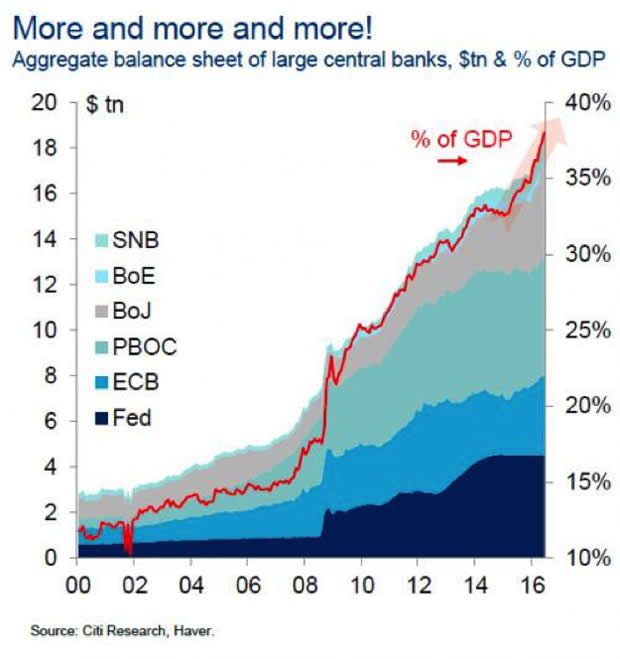

The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don't keep pace with inflation will have lost a third...

Read More »

Read More »

Why We’re Doomed: Stagnant Wages

The point is the present system cannot endure. Despite all the happy talk about "recovery" and higher growth, wages have gone nowhere since 2000--and for the bottom 20% of workers, they've gone nowhere since the 1970s. Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend.

Read More »

Read More »

Bitcoin, Sour Grapes and the Institutional Herd

The point is institutional ownership of bitcoin is in the very early stages.

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I'd be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious:

Read More »

Read More »

Why Wages Have Lost Ground in the 21st Century

One of the enduring mysteries for conventional economists is why wages aren't rising for the bottom 95% even as unemployment is low and hiring remains robust. According to classical economics, the limited supply of available workers combined with strong demand for workers should push wages higher.

Read More »

Read More »

The 5 Steps to World Domination

You don't need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income.

Read More »

Read More »

Did the Economy Just Stumble Off a Cliff?

This is more intuitive than quantitative, but my gut feeling is that the economy just stumbled off a cliff. Neither the cliff edge nor the fatal misstep are visible yet; both remain in the shadows of the intangible foundation of the economy: trust, animal spirits, faith in authorities' management, etc.

Read More »

Read More »