Category Archive: 5.) Charles Hugh Smith

The Main Drivers of Economic Growth | Charles Hugh Smith

Financialization and Globalization have been the main drivers of economic growth in the last 40 years, keeping costs down through lower interest rates and cheaper production. However, these trends are no longer sustainable and have reached their limits, leading to the recent occurrence of inflation.

Charles Hugh Smith implies that new strategies may be needed to sustain economic growth in the future.

Watch more of this short video from Turmoil...

Read More »

Read More »

People Don’t Account For Wastish Growth Charles Hugh Smith

At Wealthion, we talked about the current state of copper mining and how it has changed over time. It mentions that boulders are no longer being mined and instead weaker dilute grades of copper are being targeted. TExtracting copper has become more expensive and difficult compared to the past. The Canyon Mine in Utah is used as an example of this.

Two drivers of growth in the last 40 years: financialization and globalization. Financialization...

Read More »

Read More »

China Is Trapped… Charles Hugh Smith

There are millions of empty apartments in China that developers and investors are buying as a way to store their wealth, which has disconnected the housing market from the needs of ordinary people. This is a result of entrenched legacy systems that make it difficult to make changes, even if they would benefit the country as a whole. China needs to break free from these systems to create a more sustainable and equitable future.

Watch more of this...

Read More »

Read More »

Whats The Best Way Forward Charles Hugh Smith

We are currently in the midst of a significant and complicated transition from one era to another. This transition is characterized by confusion and complexity because there are people who are benefiting from the current system and they will resist any change. Meanwhile, there are also forces of adaptation and evolution that are working to determine the best way forward.

Watch more of this short video from Turmoil Ahead As We Enter The New Era...

Read More »

Read More »

Charles Hugh Smith: Transitioning To The Global Era of Scarcity!

Explore the current global economic landscape with Charles Hugh Smith in this must-watch video! From increasing scarcity to the necessity of transitioning, Smith’s insights provide a thorough overview of what needs to be done to navigate the global era. He outlines practical ways for individuals and businesses to confront these complex challenges head-on and make positive change happen. Tune in now and learn how you can take advantage of this...

Read More »

Read More »

Charles Hugh Smith: Resisting Inflation Is Futile

In this fascinating video, Charles Hugh Smith joins us to discuss the inevitability of inflation. He discusses why fighting it is a losing battle, and how it can be used as an economic tool. Discover what he has to say about the long-term effects of inflation and learn strategies for protecting your finances in an inflating world. Don't miss out on Charles' valuable insights - watch now!

Read More »

Read More »

Entering an Era of Scarcity | Charles Hugh Smith

The world is entering a new era of scarcity, which is different from the previous 75 years of abundance. This scarcity is not only limited to resources but also affordability, as costs are rising for various reasons. This will impact the global economy, and the model of growth at any cost will no longer be sustainable.

Watch more of this short video from Turmoil Ahead As We Enter The New Era Of 'Scarcity' | Charles Hugh Smith

#shortvideo...

Read More »

Read More »

Charles Hugh Smith: Sailing the Uneasy Economic Waters.

Ride It Out.

Navigating the recent economic storm has been a challenge for many. In this video, Charles Hugh Smith offers expert insight and advice on how to weather the downturn. Learn his strategies for sustaining your finances and investments during these difficult times. Hear his tips on how to make sound decisions in turbulent markets and prepare yourself for whatever comes next. Don't miss out - watch this must-see video now to get valuable...

Read More »

Read More »

If We No Longer Pay Attention to Things We Don’t Control, What’s Left For Us to Focus On?

Our time is better invested in actually learning about trends that impact us directly. Imagine making this simple change in your life: whatever you don't control, you stop paying attention to it.

Read More »

Read More »

Turmoil Ahead As We Enter The New Era Of ‘Scarcity’ | Charles Hugh Smith

WORRIED ABOUT THE MARKETS? SCHEDULE YOUR FREE PORTFOLIO REVIEW with Wealthion's endorsed financial advisors at https://www.wealthion.com

As the old saying goes: "It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so."

It's easy for investors to fall into the traps laid by their belief systems. Whether to the bullish or bearish side, we all have our own biases that can warp the way we...

Read More »

Read More »

The New Normal: Death Spirals and Speculative Frenzies

There is an element of inevitability in play, but it isn't about central bank bailouts, it's about Death Spirals and the collapse of unsustainable systems. The vapid discussions about "soft" or "hard" landings for the economy are akin to asking if the Titanic'sencounter with the iceberg was "soft" or "hard:" either way, the ship was doomed, just as the global economy is doomed by The New Normal of Death Spirals and Speculative Frenzies.

Read More »

Read More »

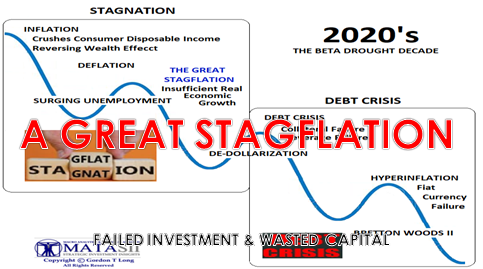

Prepare to Be Bled Dry by a Decade of Stagflation

Our reliance on the endless expansion of credit, leverage and credit-asset bubbles will have its own high cost. The Great Moderation of low inflation and soaring assets has ended. Welcome to the death by a thousand cuts of stagflation.

Read More »

Read More »

Seven Points on Investing in Treacherous Waters

What's truly valuable has no price and cannot be bought. If all investments are being cast into Treacherous Waters, our investment strategy must adapt accordingly. Once we set aside denial and magical thinking as strategies and accept that we're in treacherous waters, a prudent starting point is to discern the most consequential contexts of all decisions about where and how we invest our time, energy and capital.

Read More »

Read More »

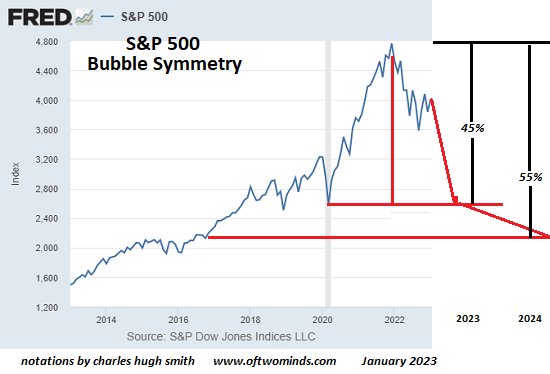

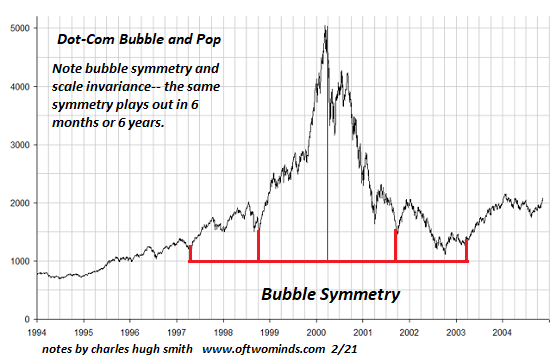

What Goes Up Also Comes Down: The Heavy Hand of Bubble Symmetry

Should bubble symmetry play out in the S&P 500, we can anticipate a steep 45% drop to pre-bubble levels, followed by another leg down as the speculative frenzy is slowly extinguished. Bubble symmetry is, well, interesting. The dot-com stock market bubble circa 1995-2003 offers a classic example of bubble symmetry, though there are many others as well.

Read More »

Read More »

Self-Reliance in the 21st Century By Charles Hugh Smith, Chapter by Chapter Preview

Hear it Here - https://adbl.co/3iJOonl

Just as no one was left unaffected by the rise of globalization, no one will be unaffected by its demise. The only response that reduces our vulnerability is self-reliance.

When Ralph Waldo Emerson wrote his famous essay Self-Reliance in 1841, the economy was localized and households supplied many of their own essentials. In our hyper-globalized economy, we’re dependent on distant sources for our...

Read More »

Read More »

Ep. 293: The State Episode with Doug Casey and Charles Hugh Smith with Michael Covel

My guests today are Doug Casey and Charles Hugh Smith.

Casey is the founder and chairman of Casey Research, a provider of paid subscription newsletter services espousing libertarian viewpoints as the justification for the purchase of highly speculative microcap stocks, precious metals, and other investments.

Smith is an American writer and blogger. He is the chief writer for the site “Of Two Minds”. Started in 2005, this site has been listed No....

Read More »

Read More »

Of Two Minds with Charles Hugh Smith, Ep #23

Today’s guest is Charles Hughes Smith, who’s been writing about socioeconomic and technology trends since 2005 on his blog, “Of Two Minds.” His blog hosts over 4,000 pieces of original content. His work is also on Patreon and ZeroHedge.

Charles seeks to understand why our sociopolitical and economic systems are failing and lays out alternative ways to find a sustainable way of living. His work doesn’t fit into an ideological box and he believes...

Read More »

Read More »

Self-Reliance in the 21st Century Audiobook Preview By: Charles Hugh Smith

Hear it Here - https://adbl.co/3iJOonl

Just as no one was left unaffected by the rise of globalization, no one will be unaffected by its demise. The only response that reduces our vulnerability is self-reliance.

When Ralph Waldo Emerson wrote his famous essay Self-Reliance in 1841, the economy was localized and households supplied many of their own essentials. In our hyper-globalized economy, we’re dependent on distant sources for our...

Read More »

Read More »

Want to Know Where the Economy Is Going? Watch The Top 10%

Should the wealth effect reverse as assets fall, capital gains evaporate and investment income declines, the top 10% will no longer have the means or appetite to spend so freely. Soaring wealth-income inequality has all sorts of consequences.

Read More »

Read More »