Category Archive: 5.) Charles Hugh Smith

Vested Interests in Charge = Guaranteed Failure

It boils down to two very simple principles: accredit the student, not the institution and teach every student how to rigorously learn on their own. Vested interests have every incentive to maintain the status quo: specifically, those who currently own the assets, income streams and power will continue to own the assets, income streams and power.

Read More »

Read More »

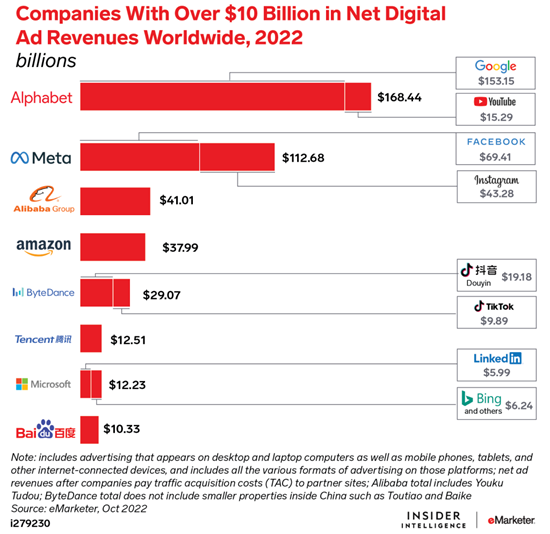

What’s Left to Monetize?

What's left to monetize? It appears the answer is "very little." Advertising has always monetized consumers' time and attention, what we call engagement today. Newspapers and periodicals publish advertisements, radio/TV networks and stations air adverts, movie theaters run trailers/ads, billboards occupy our mental space while driving and websites and apps post adverts.

Read More »

Read More »

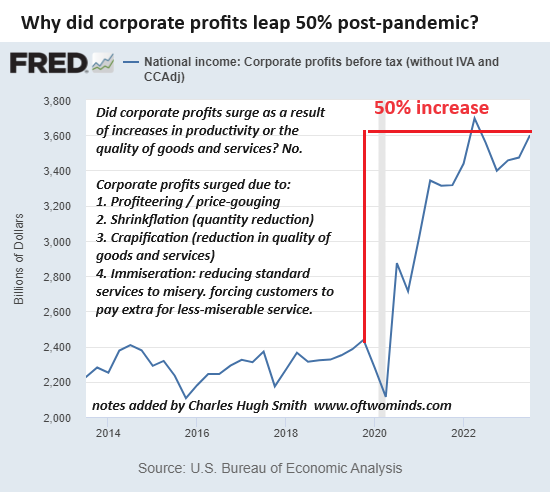

America’s Concealed Crisis: Fifty Years of Economic Decline, 1969 to 2019

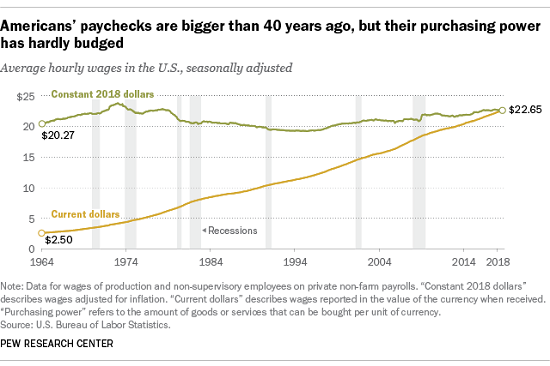

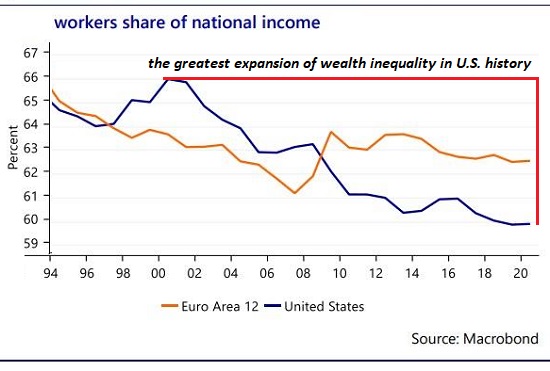

If we consider the long term, it's clear America's economy and society have been declining for the average household for 50 years. What if the "prosperity" of the past 50 years is mostly a statistical mirage for the bottom 80% of households?

Read More »

Read More »

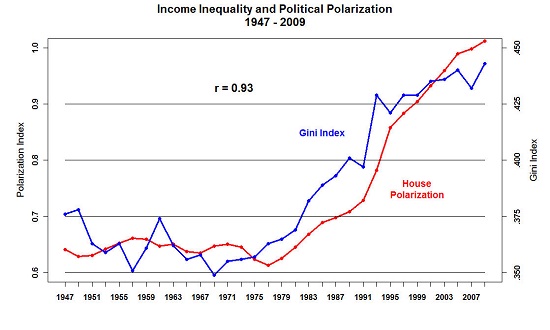

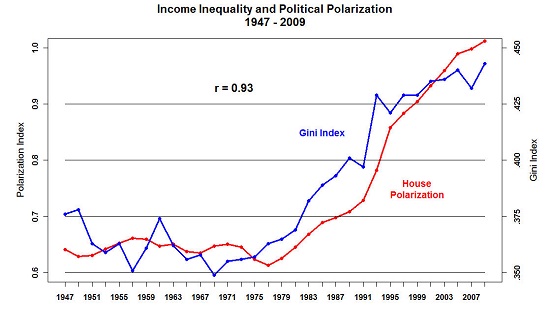

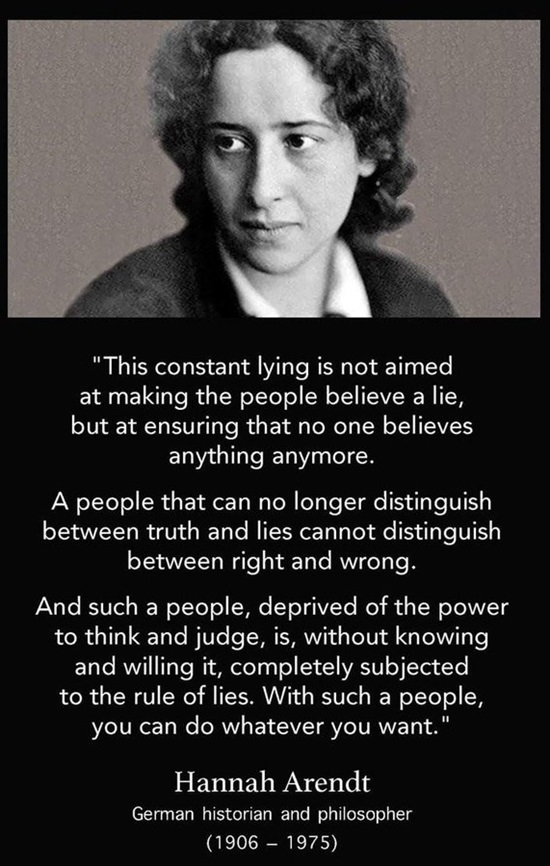

Following in Rome’s Footsteps: Moral Decay, Rising Inequality

Here is the moral decay of America's ruling elites boiled down to a single word. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, what's mine is mine and what's yours is mine, too.

Read More »

Read More »

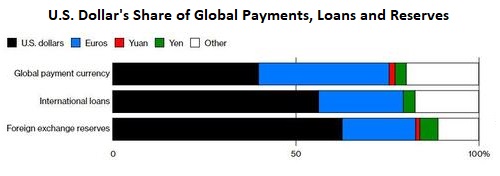

Could a Cryptocurrency Become a Global Reserve Currency?

Could a non-state cryptocurrency like bitcoin become a global reserve currency? I first proposed the idea back in November 2013, long before bitcoin's rise to $19,000, decline to $3,200, recent ascent to $13,000 and current retrace.

Read More »

Read More »

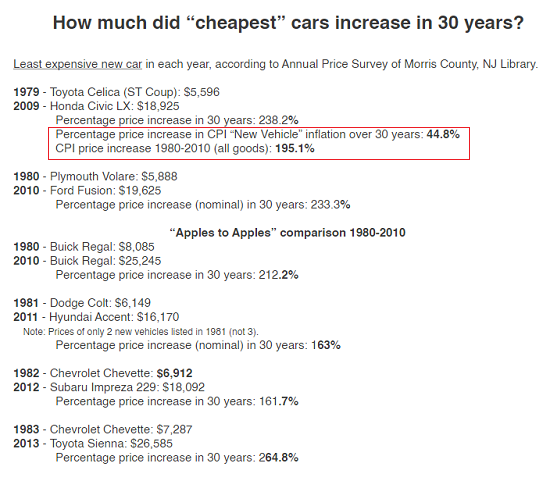

No, Autos Are Not “Cheaper Now”

According to the BLS, inflation in the category of "New Vehicles" has been practically non-existent the past 21 years. Longtime readers know I've long turned a skeptical gaze at official calculations of inflation, offering real-world analyses such as The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) and Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43% from 2001 (May 31, 2018).

Read More »

Read More »

Local Government Is an Engine of Inflation

Insolvency isn't restricted to private enterprise; governments go broke, too. One reason the economy is so much more precarious than advertised is inflation has pushed households and small businesses to the edge--and one engine of that inflation is local government. This is not to dump on local government, which is facing essentially unlimited demands from the public for more services while mandated cost increases in government union employee wages...

Read More »

Read More »

The Human Cost of “Recovery”: We’re Burning Out

The asymmetries are piling up and we're cracking under the weight. Judging by the record-high stock market and the record-low unemployment rate, the "recovery" has reached new heights of prosperity. Academics and think-tankers viewing the global economy from 40,000 feet are brimming with policies to bring the remaining laggards into the booming economy.

Read More »

Read More »

The Lessons of Rome: Our Neofeudal Oligarchy

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. The Inheritance of Rome: Illuminating the Dark Ages 400-1000 is not an easy, breezy read; its length and detail are daunting. The effort is well worth it, as the book helps us understand how the power structures of societies change over time in ways that may be largely invisible to those living through the changes.

Read More »

Read More »

The Fed’s Casino Is Giving Away Free Gambling Chips (But Only to the Super-Rich)

The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst. The news that the Federal Reserve Casino is giving away free gambling chips triggered a frenzied rush that trampled the bears, including poor Yogi:

Read More »

Read More »

Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

The political moment when the "losers" connect their discontent and decline with central bankers is approaching. The Ruling Elites' Chattering Classes still haven't absorbed the key lesson of the 2016 U.S. presidential election.

Read More »

Read More »

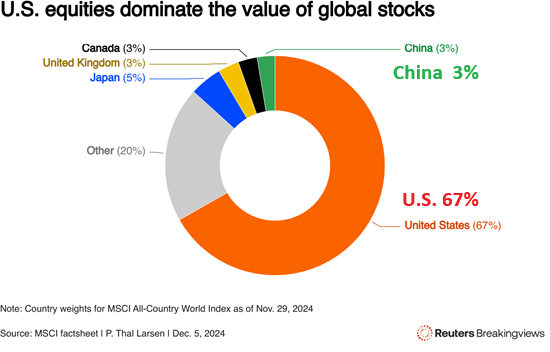

How Much of Your “Wealth” Is Hostage to Bubbles and Impossible Promises?

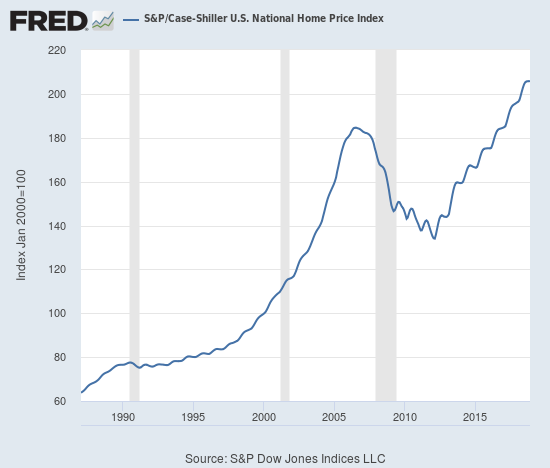

All asset "wealth" in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to "wealth" in a bubble economy: it only remains "wealth" if the owner sells at the top of the bubble and invests the proceeds in an asset which isn't losing purchasing power.

Read More »

Read More »

Misplaced Pride: Most of the “Middle Class” Is Actually Working Class

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as "middle class" by the metrics described below. The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification.

Read More »

Read More »

Charles Hugh Smith CONFIRMED?THE CRASH IS COMING! 100% Global RESET in Jun 2019

Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/ Contact advertising :[email protected]

Read More »

Read More »

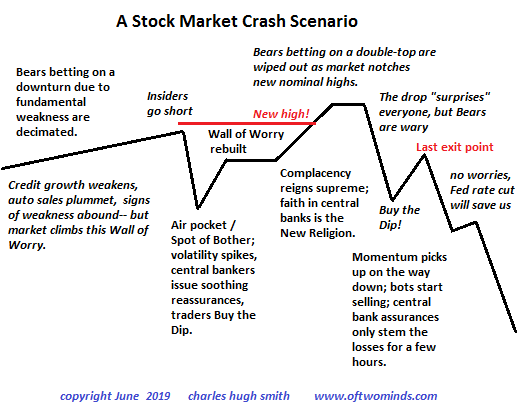

A Stock Market Crash Scenario

Herds get spooked and run. That's the crash scenario in a nutshell. We have all been trained by a decade of central bank saves to expect any stock market swoon will soon be reversed by central bank sweet talk and/or rate cuts.

Read More »

Read More »

What Would It Take to Spark a Rural/Small-Town Revival?

Recent research supports the idea that this under-the-radar migration is already under way. The decline of rural regions and small towns is a global phenomenon, and the causes are many but boil down to two primary dynamics: 1. Cities and megalopolises (aggregations of cities, suburbs and exurbs) attract capital, infrastructure, markets and talent, and these are the engines of job creation.

Read More »

Read More »

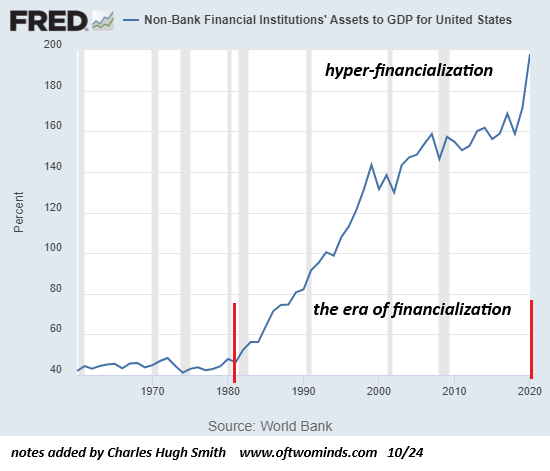

Is the Tech Bubble Bursting?

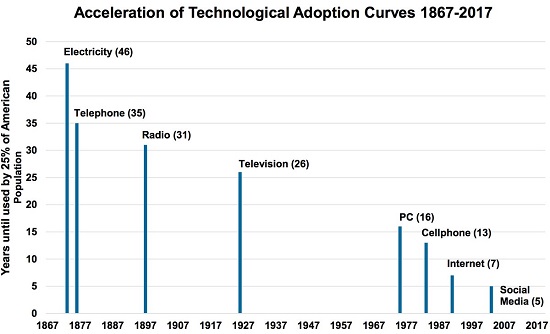

There are two other trends that don't attract quite the media attention that soaring profits do. Is the decade-long tech bubble finally popping? Tech bulls are overlooking the fundamental reality that the drivers of Big tech's phenomenal growth--financialization and expansion into mobile telephony-- are both losing momentum.

Read More »

Read More »

A Quiet Revolution Is Brewing

Politics as practiced in a bygone era of stability no longer offers any solutions to these profound disruptions. I recently read a fascinating history of the social, political and economic context of the American Revolution: The Radicalism of the American Revolution by Gordon Wood.

Read More »

Read More »

Why Being a Politician Is No Longer Fun

As a society, we are ill-prepared for the end of "politics is the solution." It's fun to be a politician when there's plenty of tax revenues and borrowed money to distribute, and when the goodies get bipartisan support. An economy that's expanding all household incomes more or less equally is fun, fun, fun for politicians because more household income generates more income tax revenues and more spending that generates other taxes.

Read More »

Read More »

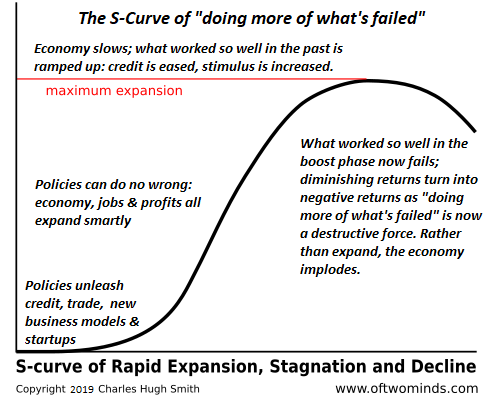

Lesson of the S-Curve: Doing More of What’s Failed Will Fail Spectacularly

I often refer to the S-Curve because Nature so often tracks this curve of ignition, rapid expansion, stagnation and decline. One lesson of the S-Curve is that the human bias to keep doing more of what worked so well in the past leads to doing more of what failed even as results turn negative.

Read More »

Read More »