Category Archive: 5.) Charles Hugh Smith

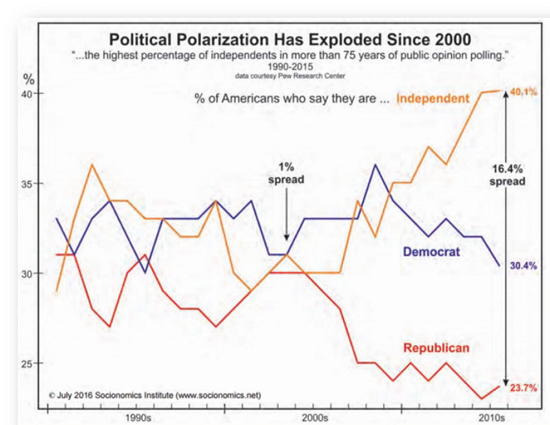

While the Nation Fragments Socially, the Financial Aristocracy Rules Unimpeded

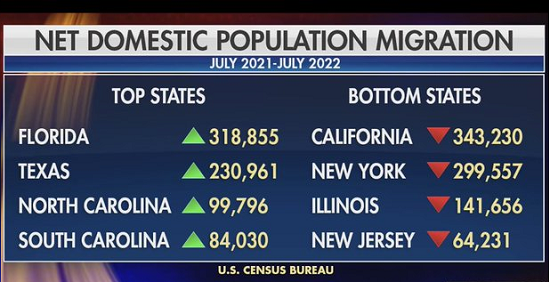

If there is one central irony in American history, it is this: the citizenry that broke free of the chains of British Monarchy, the citizenry that reckoned everyone was equal before the law, the citizenry that vowed never to be ruled by an aristocracy that controlled the government and finance as a means of self-enrichment, is now so distracted by social fragmentation that the citizenry is blind to their servitude to a new and formidably informal...

Read More »

Read More »

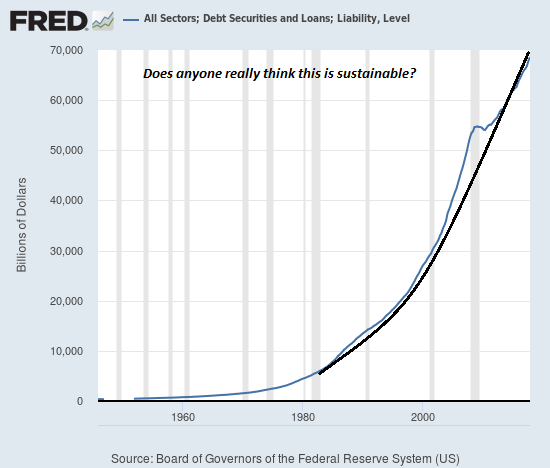

The Coming Crisis the Fed Can’t Fix: Credit Exhaustion

Having fixed the liquidity crisis of 2008-09 and kept a perversely unequal "recovery" staggering forward for a decade, central banks now believe there is no crisis they can't defeat: Liquidity crisis? Flood the global financial system with liquidity. Interest rates above zero? Create trillions out of thin air and use the "free money" to buy bonds. Mortgage and housing markets shaky?

Read More »

Read More »

What Sort of “Democracy” Do We Have If Everyone’s Goal Is Maximizing Their Government Swag?

A democratic republic is a government in which power flows from citizens to their elected representatives. The American revolutionaries did not make a big distinction between republic and democracy, for in the context of the late 1700s, the dominant political structure was monarchy, and democracy meant the people have the final say via elections.

Read More »

Read More »

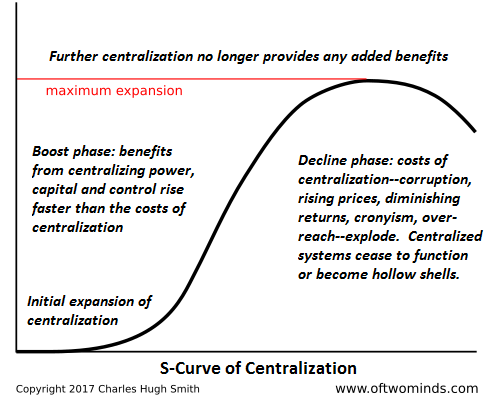

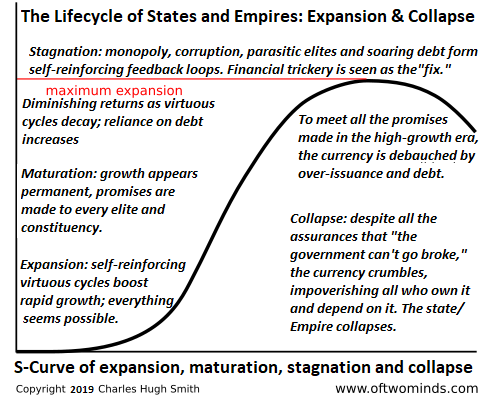

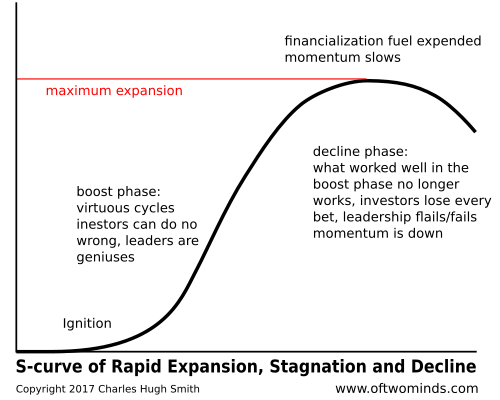

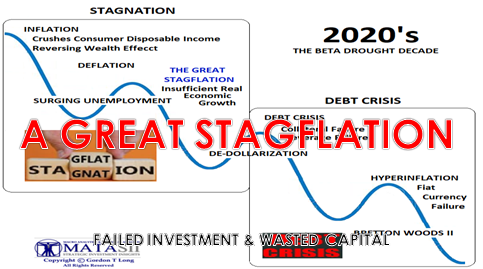

How States/Empires Collapse in Four Easy Steps

There is a grand, majestic tragedy in the inevitable collapse of once-thriving states and empires: it all seemed so permanent at its peak, so godlike in its power, and then slowly but surely, too many grandiose, unrealistic promises were made to too many elites and constituencies, and then as growth decays to stagnation, the only way to maintain the status quo is to appear to meet all the promises by creating money out of thin air, i.e. debauching...

Read More »

Read More »

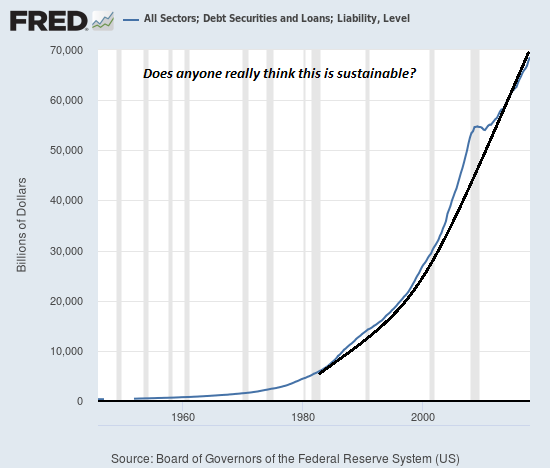

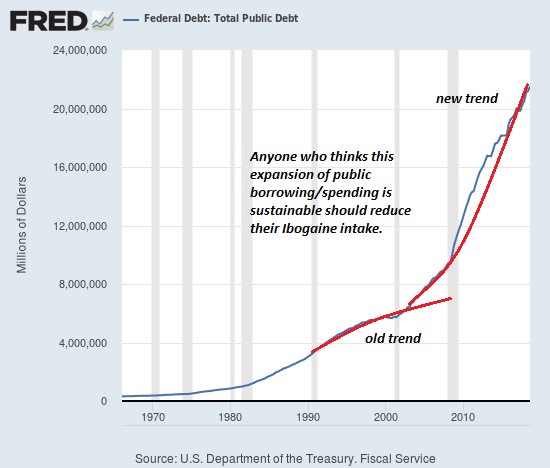

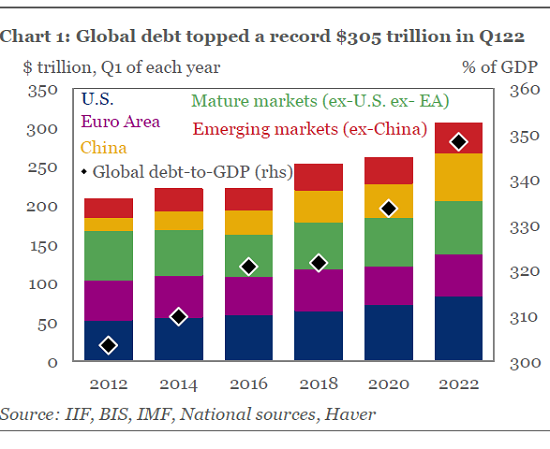

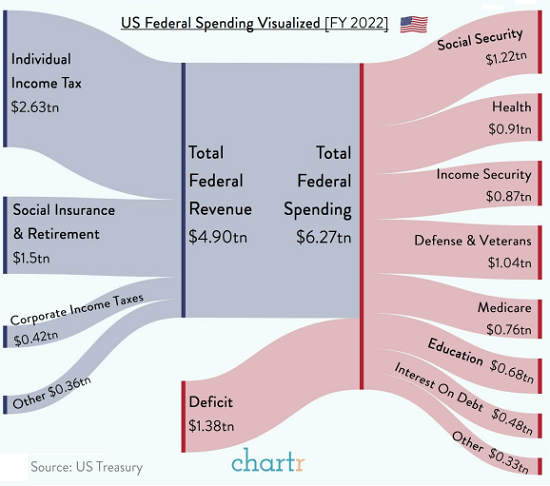

Charles Hugh Smith The World is Awash in Debt and Can’t Raise Interest Rates & Trump May Not Run

If interest rates rise to normal historical levels then this will collapse the everything bubble. So the central banks will try to lower interest rates into negative territory to try and maintain their ability to maintain debt servicing which are taking more and more of the pie of what’s received in tax revenues. For example …

Read More »

Read More »

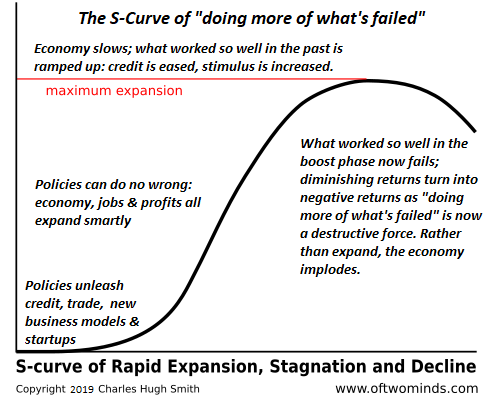

Here’s The Problem: The Pie Is Shrinking

Scrape away the churn and distraction and the problem is simple: the pie of prosperity is shrinking, and the "fixes" are failing. The status quo arrangement is based on the endless expansion of "growth" and debt, which is the monetary fuel of more, more, more of everything: money, energy, resources, goods, services, jobs, wealth and income, all of which make up the elixir of prosperity.

Read More »

Read More »

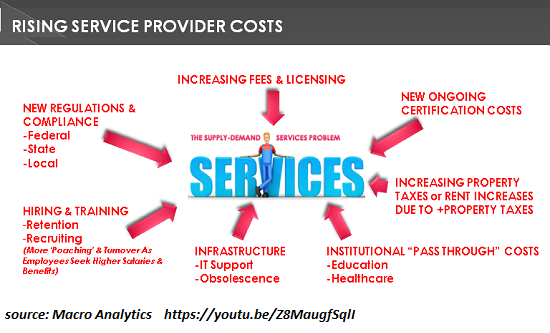

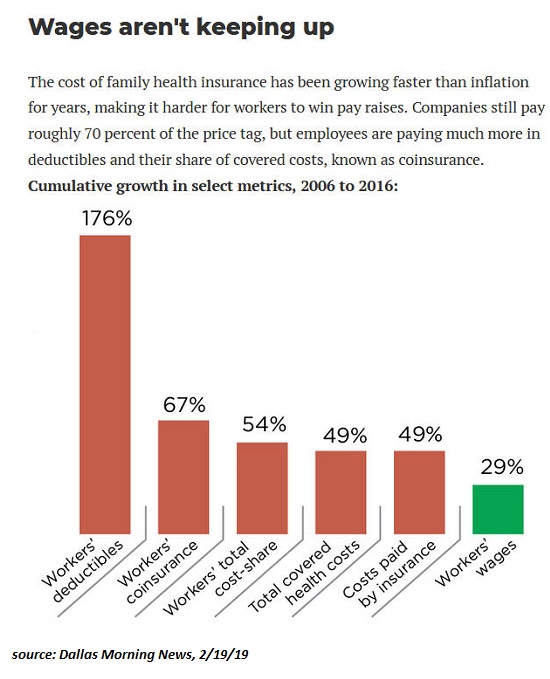

The Source of Killer Inflation: Services

The soaring cost of services is driven by a number of factors. What will the future bring: fire (inflation) or ice (deflation)? The short answer: both, but in very different doses. Goods that are tradeable and exposed to technologically driven commodification will decline in price (deflation) while untradeable services that are difficult to commoditize will increase in price (inflation), generating a self-reinforcing feedback loop of wage-price...

Read More »

Read More »

What If Politics Can’t Fix What’s Broken?

This is the politics of decline and collapse. The unspoken assumption of the modern era is that politics can fix whatever is broken: whatever is broken in society or the economy can be fixed by some political policy or political process-- becoming more inclusionary, seeking non-partisan middle ground, etc.

Read More »

Read More »

CHARLES HUGH SMITH: ELITE DUMBING DOWN MIDDLE-CLASS INTO DUST!

http://www.portfoliowealthglobal.com/Smith MUST-READ FOR INVESTORS: LP(S) – Attack LP(S) – Bear LP(S) – Drama Shelter your Portfolio from the Bonds COLLAPSE: http://www.PortfolioWealthGlobal.com/Bonds Get Immediate Access to our Exclusive Report on the Coming STOCK MARKET CRASH: http://www.portfoliowealthglobal.com/crash/ Download Our Top 5 Cryptocurrencies for 2018 AT: http://www.portfoliowealthglobal.com/top5/ The Gold Bull...

Read More »

Read More »

Charles Hugh Smith On Debt & Demographics Leading To Government Crisis and Financial Repression

Click here for the full transcript: http://financialrepressionauthority.com/2019/03/01/the-roundtable-insight-charles-hugh-smith-on-debt-demographics-leading-to-government-crisis-and-financial-repression/

Read More »

Read More »

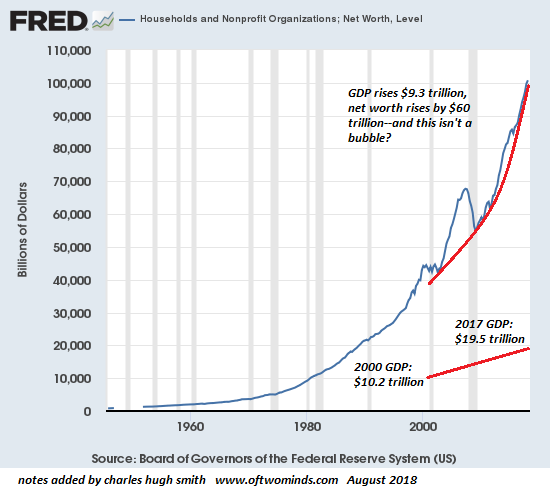

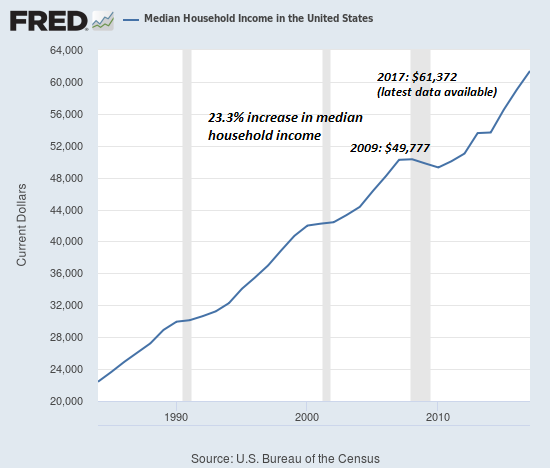

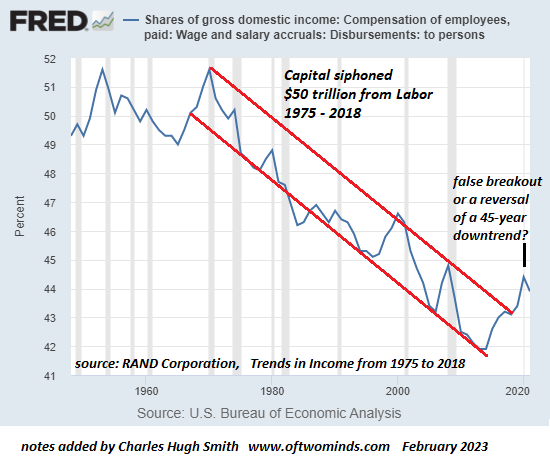

The Fed’s “Wealth Effect” Has Enriched the Haves at the Expense of the Young

The Fed is the mortal enemy of the young generations, and thus of the nation itself. The wealth effect" generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn't Target The Market, Eh?

Read More »

Read More »

What Killed the Middle Class?

Rounding up the usual suspects won't restore a vibrant middle class. What killed the middle class? The answer may well echo an Agatha Christie mystery: rather than there being one guilty party, it may be that each of the suspects participated in the demise of the middle class.

Read More »

Read More »

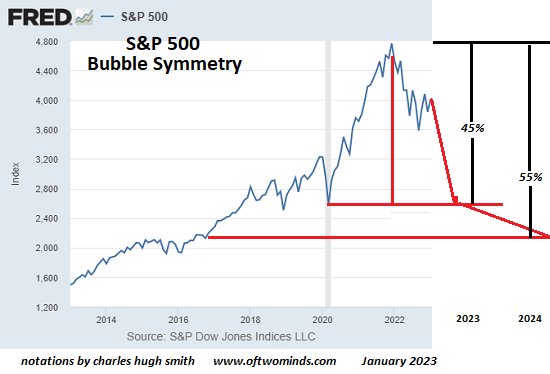

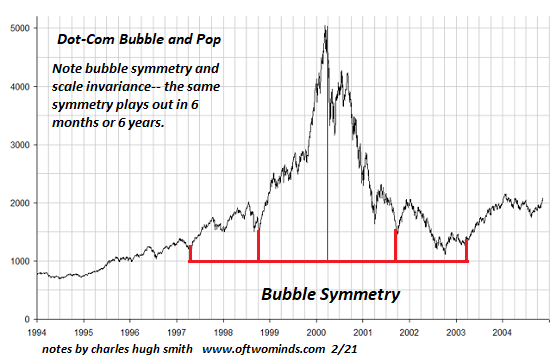

The Doomsday Scenario for the Stock and Housing Bubbles

It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy. The Doomsday Scenario for the stock and housing bubbles is simple: the Fed's magic fails. When dropping interest rates to zero and flooding the financial sector with loose money fail to ignite the economy and reflate the deflating bubbles, punters will realize the Fed's magic only worked the first three times: three bubbles...

Read More »

Read More »

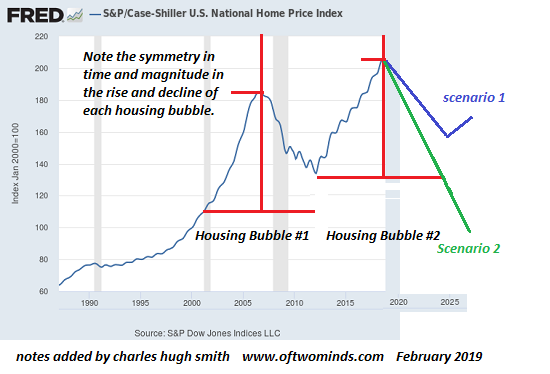

Now that Housing Bubble #2 Is Bursting…How Low Will It Go?

There are two generalities that can be applied to all asset bubbles: 1. Bubbles inflate for longer and reach higher levels than most pre-bubble analysts expected. 2. All bubbles burst, despite mantra-like claims that "this time it's different".

Read More »

Read More »

Homeless Encampments and Luxury Apartments: Our Long Strange Boom

It's been a long, strange economic boom since the nadir of the Global Financial Meltdown in 2009. A 10-year long boom that saw the S&P 500 rise from 666 in early 2009 to 2,780 and GDP rise by 43% has been slightly more uneven for most participants.

Read More »

Read More »

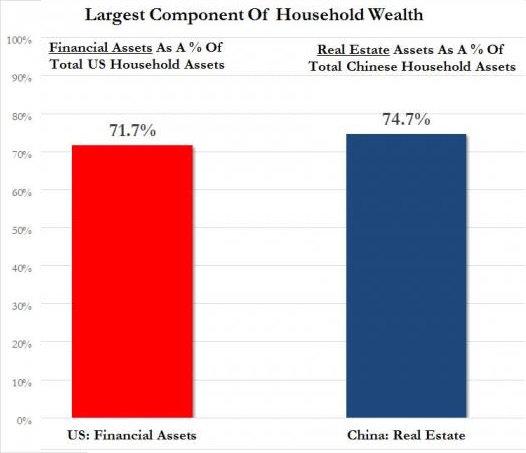

Credit Exhaustion Is Global

Europe is awash in credit exhaustion, and so is China. The signs are everywhere: credit exhaustion is global, and that means the global growth story is over: revenues and profits are all sliding as lending dries up and defaults pile up.

Read More »

Read More »

?Charles Hugh Smith It’s Fraud and Theft,The Central Banks Get Special Set Of Laws To Steal Our Wea

?Charles Hugh Smith It’s Fraud and Theft,The Central Banks Get Special Set Of Laws To Steal Our Wea ?Charles Hugh Smith It’s Fraud and Theft,The Central Banks Get Special Set Of Laws To Steal Our Wea ?Charles Hugh Smith It’s Fraud and Theft,The Central Banks Get Special Set Of Laws To Steal Our Wea

Read More »

Read More »

What Happens When More QE Fails to Reverse the Recession?

The smart money is liquidating assets, paying off debt and moving capital into collateral that isn't impaired by debt or speculative valuations. The Federal Reserve's sudden return to "accommodative" dovishness in response to the stock market's swoon telegraphs its intent to fire up QE once the recession kicks into gear.

Read More »

Read More »

SpokenTome Audiobooks: Charles Hugh Smith Episode 2

SpokenTome.Media’s Mark E. Jeftovic catches up with Charles Hugh Smith. Topics ranged from PropOrNot’s anonymous, unsourced hit piece on …pretty well everybody, to populism, Yellow Vests, so-called “Democratic Socialism” and a new unicorn farm called “MMT”. Since our last episode we’ve released three more CHS audiobooks.

Read More »

Read More »

What Caused the Recession of 2019-2021?

As I discussed in We're Overdue for a Sell-Everything/No-Fed-Rescue Recession, recessions have a proximate cause and a structural cause. The proximate cause is often a spike in energy costs (1973, 1990) or a financial crisis triggered by excesses of speculation and debt (2000 and 2008) or inflation (1980).

Read More »

Read More »