Category Archive: 5.) Charles Hugh Smith

Market Huddle Episode 41: Harry McLovin (guest: Charles Hugh Smith)

To receive our emails with the charts and links each week, please register at: https://markethuddle.com/ In episode #41, Patrick Ceresna and Kevin Muir welcome Charles Hugh Smith to the show to talk about negative interest rates and Charles explains why the past is not a guide. Then more on the hot topic: GE fraud. Fast …

Read More »

Read More »

Charles Hugh Smith Parallels Between The Decline of the Roman Empire and America

Here’s an excellent analysis for any history enthusiast on the comparison between the Roman empire in decline and the American empire.

Read More »

Read More »

The Internal War in the Deep State Claims Its High Profile Casualty: Jeffrey Epstein

The "traditionalist" Neocons are going to have to decide to fish or cut bait. I've been writing about the fracturing Deep State for the past five years: The conflict has now reached the hot-war stage where bodies are turning up, explained away by the usual laughable covers: "suicide," "accident" and "heart attack." That Jeffrey Epstein's death in a secure cell is being labeled "suicide" tells us quite a lot about the desperation of the faction...

Read More »

Read More »

The Gulag of the Mind

Befuddled and blind, we wander toward the cliff without even seeing it, focusing on our little screens of entertainment and self-absorption. There are no physical barriers in the Gulag of the Mind--we imprison ourselves, and love our servitude. Indeed, we fear the world outside our internalized gulag, because we've absorbed the narrative that the gulag is secure and permanent.

Read More »

Read More »

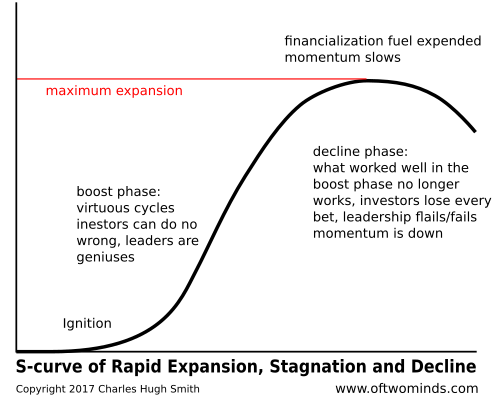

Nothing Is Guaranteed

There are no guarantees, no matter how monumental the hubris and confidence. The American lifestyle and economy depend on a vast number of implicit guarantees-- systemic forms of entitlement that we implicitly feel are our birthright. Chief among these implicit entitlements is the Federal Reserve can always "save the day": the Fed has the tools to escape either an inflationary spiral or a deflationary collapse.

Read More »

Read More »

Charles Hugh Smith ? Economic Collapse Confirmed! – The Collapse of the American Empire?

Charles Hugh Smith ? Economic Collapse Confirmed! – The Collapse of the American Empire? Charles Hugh Smith ? Economic Collapse Confirmed! – The Collapse of the American Empire? ——————————————————————————————————— ? Subscribe To...

Read More »

Read More »

Charles Hugh Smith – The American Empire Will Fall In 2019

Channel Not Monetized If you have any issue about their copyright, please contact me by email: [email protected] . Thank you ! Thank

Read More »

Read More »

Charles Hugh Smith – Parallels Between The Decline of the Roman Empire and America

SBTV spoke with Charles Hugh Smith, author and the editor of the Of Two Minds blog, about the startling parallels (e.g. debasing of currency, lack of strong leadership, move towards populism, etc.) between the decline of the Roman Empire and America. Follow Charles Hugh Smith’s on his blog: https://www.oftwominds.com/blog.html Discussed in this interview: 07:33 Central …

Read More »

Read More »

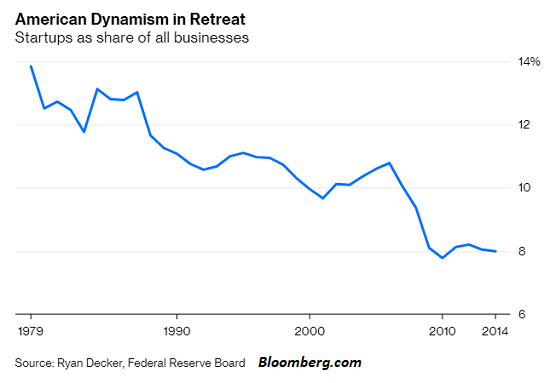

Main Street Small Business on the Precipice

As a generality, the average employee (including financial pundits) has no real experience or understanding of what it takes to start and operate a small business in the U.S. Government employees in the agencies that oversee and enforce regulations on small businesses also generally lack any experience in the businesses they regulate.

Read More »

Read More »

Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now!

Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now! Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now! Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now!...

Read More »

Read More »

Why Is What Was Once Affordable to Many Now Only Affordable to the Wealthy?

Let's start with an excerpt from a recent personal account by the insightful energy/systems analyst Ugo Bardi, who is Italian but writes his blog Cassandra's Legacy in English: Becoming Poor in Italy. The Effects of the Twilight of the Age of Oil.

Read More »

Read More »

It’s Not Just the News That’s Fake–Everything’s Fake

What do we mean when we say corporate media is fake? We mean it's a carefully crafted con, a set of narratives, cherry-picked data and heavily massaged statistics (the unemployment rate, etc.) designed to instill the reader's confidence in a narrative that serves the interests not of the citizenry but of a select few pillaging the citizenry.

Read More »

Read More »

Our Ruling Elites Have No Idea How Much We Want to See Them All in Prison Jumpsuits

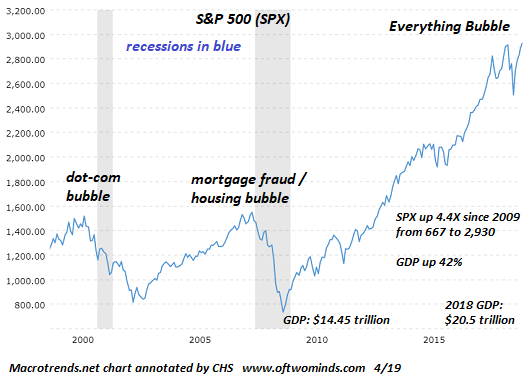

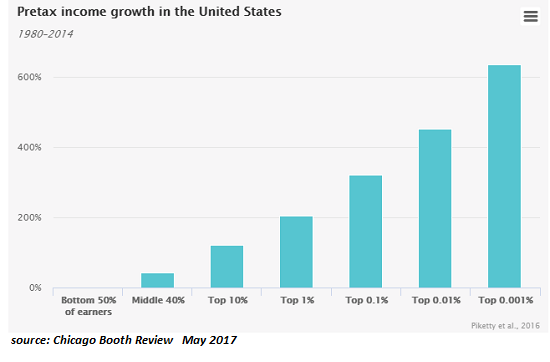

Even the most distracted, fragmented tribe of the peasantry eventually notices that they're not in the top 1%, or the top 0.1%. Let's posit that America will confront a Great Crisis in the next decade. This is the presumption of The Fourth Turning, a 4-generational cycle of 80 years that correlates rather neatly with the Great Crises of the past: 1781 (Revolutionary War, constitutional crisis); 1861 (Civil War) and 1941 (World War II, global war).

Read More »

Read More »

Home Prices Could Crash to 2003 Levels, Housing Bubble Prediction – Charles Hugh Smith

USA housing bubble could get ugly. Please subscribe to our main channel here: https://www.youtube.com/channel/UCXuldJPtmI0x0DVQFsB9cSg This is the back-up channel for Bull-Boom-Bear-Bust financial/economic/investing news channel.

Read More »

Read More »

Charles Hugh Smith on the Market’s Obsession with the Federal Reserve

Click here for the relevant charts and full written transcript: http://financialrepressionauthority.com/2019/07/16/fra-the-roundtable-insight-charles-hugh-smith-on-the-markets-obsession-with-the-federal-reserve/

Read More »

Read More »

Charles Hugh Smith on the Market’s Obsession with the Federal Reserve

Click here for the relevant charts and full written transcript: http://financialrepressionauthority.com/2019/07/16/fra-the-roundtable-insight-charles-hugh-smith-on-the-markets-obsession-with-the-federal-reserve/

Read More »

Read More »

WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare

WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare...

Read More »

Read More »

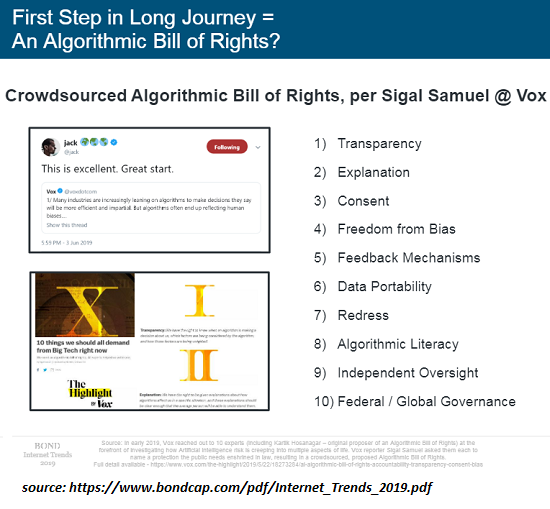

“Alexa, How Do We Subvert Big Tech’s Orwellian Internet-of-Things Surveillance?”

Convenience is the sales pitch, but the real goal is control in service of maximizing profits and extending state power. When every device in your life is connected to the Internet (the Internet of Things), your refrigerator will schedule an oil change for your car--or something like that--and it will be amazingly wunnerful.

Read More »

Read More »

Predatory “Green Capitalism” Is Monetizing the Air, and It’s Going to Cost You

You want to reduce CO2? Then trigger a global depression that reduces global consumption of everything by 50% and destroys 95% of the phantom wealth owned by the global elites trying to monetize the air. I recently asked What's Left to Monetize?, and longtime correspondent Mark G. provided the answer: the air we breathe, via carbon taxes and markets for trading carbon credits, i.e. financializing / monetizing Nature to benefit the few at the...

Read More »

Read More »

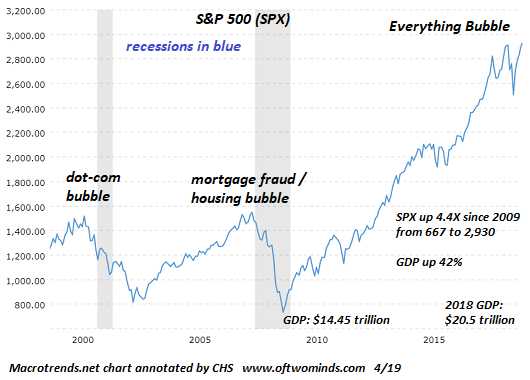

When Everything from Bat Guano to Quatloos Is Soaring, Speculative Euphoria Has Reached an Extreme

The more extreme the speculative euphoria, the greater the risks of a reversal. One sentence sums up the speculative euphoria gripping markets: January and June of this year are the only months in the last 150 which have seen all assets post a positive total return. (Zero Hedge)

Read More »

Read More »