Category Archive: 5.) Charles Hugh Smith

FOMO Is Loco

We can also posit a general rule that those who inherit wealth and succumb to FOMO are eventually less wealthy while those who are wealthy and take a pass on FOMO / hoarding at the top of the manic frenzy increase their wealth.

Read More »

Read More »

Fed to Treasury Dealers and Congress: We Can’t Count On You, We’re Taking Charge

The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient "saves" of a system that is unraveling due to its fragility and brittleness.

Read More »

Read More »

Charles Hugh Smith on the Era of Accelerating Expropriations

Http://financialrepressionauthority.com/2021/05/20/the-roundtable-insight-charles-hugh-smith-on-the-era-of-accelerating-expropriations/

Read More »

Read More »

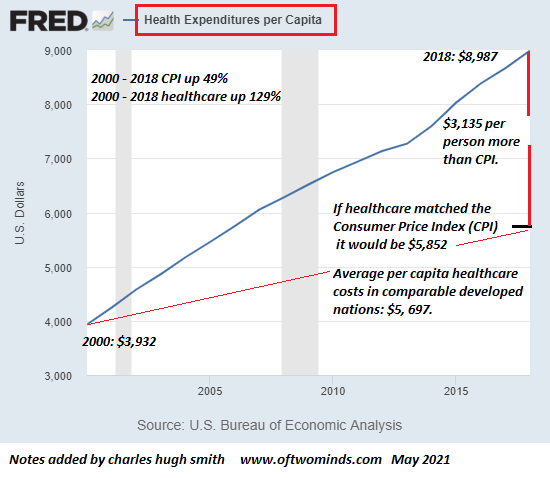

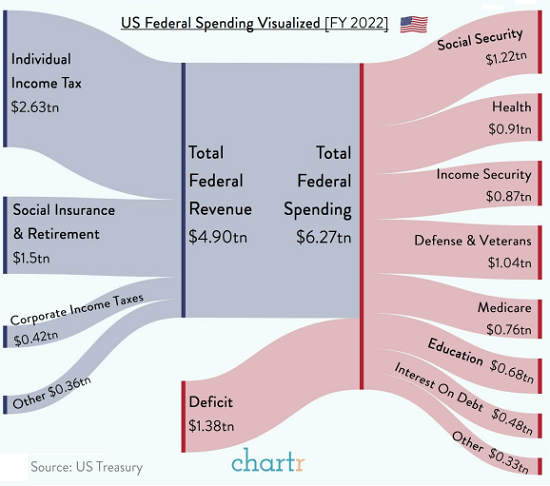

Sickcare is the Knife in the Heart of Employment–and the Economy

We need to change the incentives of the

entire system, not just healthcare, but if we don't start with healthcare, that financial

cancer will drag us into national insolvency all by itself.

American Healthcare is a growth industry in the same way cancer is a growth industry:

both keep growing until they kill the host, which in the case of healthcare is the U.S. economy.

While a great many individuals in the system care about improving the...

Read More »

Read More »

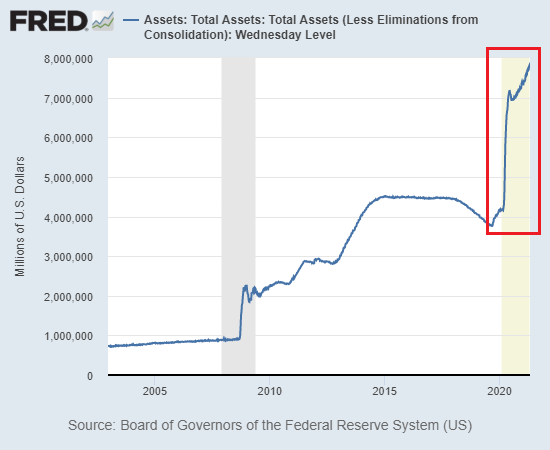

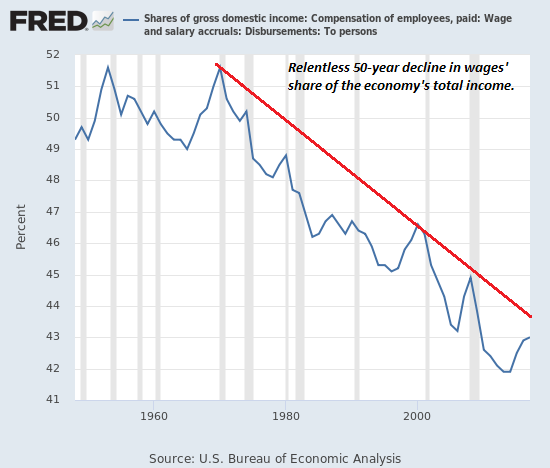

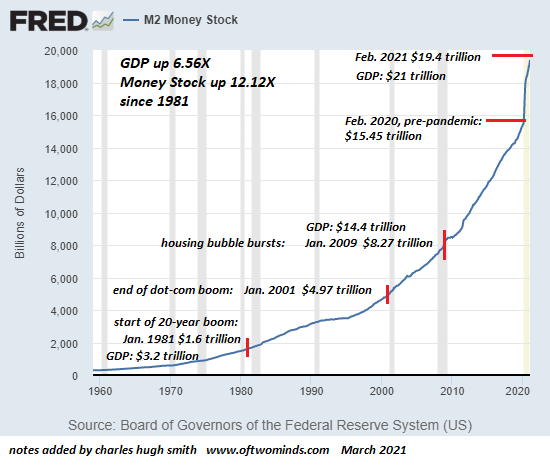

Why Wage Inflation Will Accelerate

The Fed has created trillions out of thin air to boost the speculative wealth of Wall Street, but it can't print experienced workers willing to work for low wages. The Federal Reserve is reassuring us daily that inflation is temporary, but allow me to assure you that wage inflation is just getting started and will accelerate rapidly.

Read More »

Read More »

The ‘Take This Job and Shove It’ Recession

So hey there Corporate America, the Fed and your neofeudal cronies: take this job and shove it. This time it really is different, but not in the way the Wall Street shucksters are claiming.

Read More »

Read More »

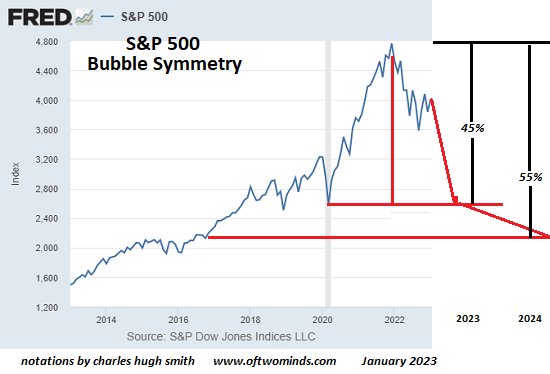

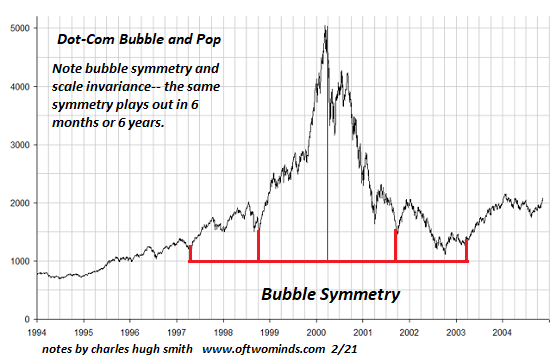

Here’s How ‘Everything Bubbles’ Pop

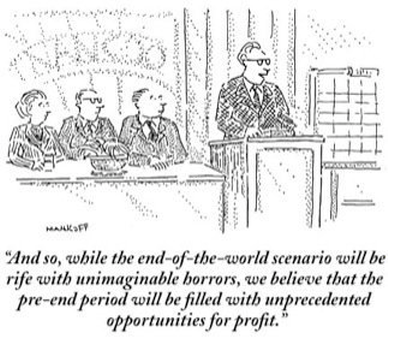

At long last, the moment you've been hoping for has arrived: you're pitching your screenplay to a producer. Your agent is cautious but you're confident nobody else has concocted a story as outlandish as yours. Your agent gives you the nod and you're off and running:

Read More »

Read More »

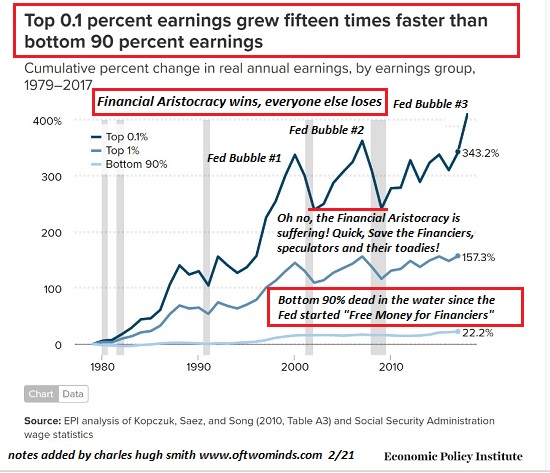

Hey Fed, Explain Again How Making Billionaires Richer Creates Jobs

Despite their hollow bleatings about 'doing all we can to achieve full employment',

the Fed's policies has been Kryptonite to employment, labor and the bottom 90%--and most especially

to the bottom 50%, the working poor that one might imagine most deserve a leg up.

As wealth and income inequality soar to new heights thanks to the Federal Reserve's policies

of zero interest rates, money-printing and financial stimulus, the Fed says its goal...

Read More »

Read More »

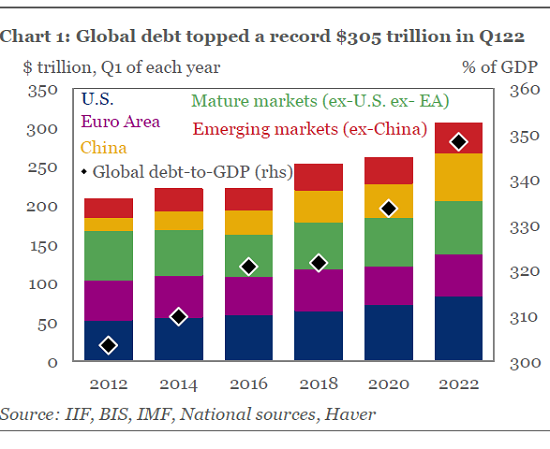

What’s Yours Is Now Mine: America’s Era of Accelerating Expropriation

The takeaway here is obvious: earn as little money as possible and invest your surplus labor in assets that can't be expropriated. Expropriation: dispossessing the populace of property and property rights, via the legal and financial over-reach of monetary and political authorities.

Read More »

Read More »

The Only Way to Get Ahead Now Is Crazy-Risky Speculation

It's all so pathetic, isn't it? The only way left to get ahead in America is to leverage up the riskiest gambles. It's painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin?

Read More »

Read More »

Charles Hugh Smith on the Terminally Ill Economy

Http://financialrepressionauthority.com/2021/04/22/the-roundtable-insight-charles-hugh-smith-on-the-terminally-ill-economy/

Read More »

Read More »

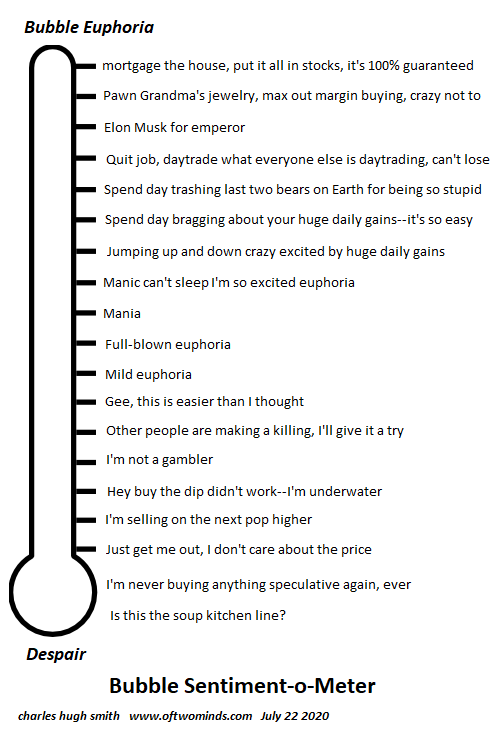

If You Don’t See Any Risk, Ask Who Will “Buy the Dip” in a Freefall?

Nobody thinks a euphoric rally could ever go bidless, but as Greenspan belatedly admitted, liquidity is not guaranteed. The current market melt-up is taken as nearly risk-free because the Fed has our back, i.e. the Federal Reserve will intervene long before any market decline does any damage.

Read More »

Read More »

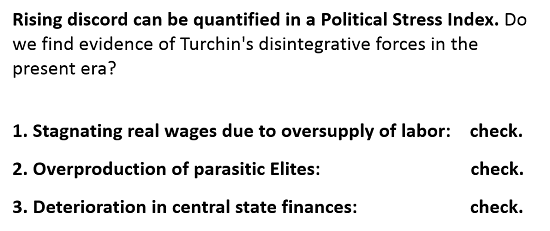

America’s Fatal Synergies

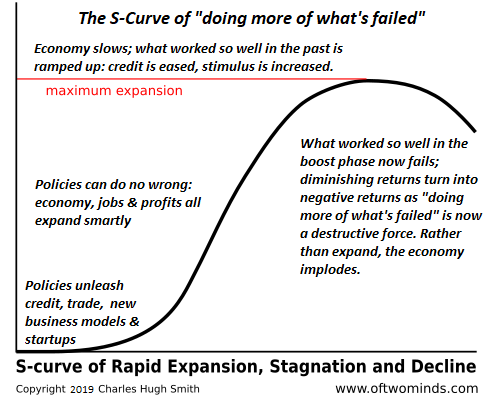

America's financial system and state are themselves the problems, yet neither system is capable of recognizing this or unwinding their fatal synergies. why do some systems/states emerge from crises stronger while similar

systems/states collapse?

Read More »

Read More »

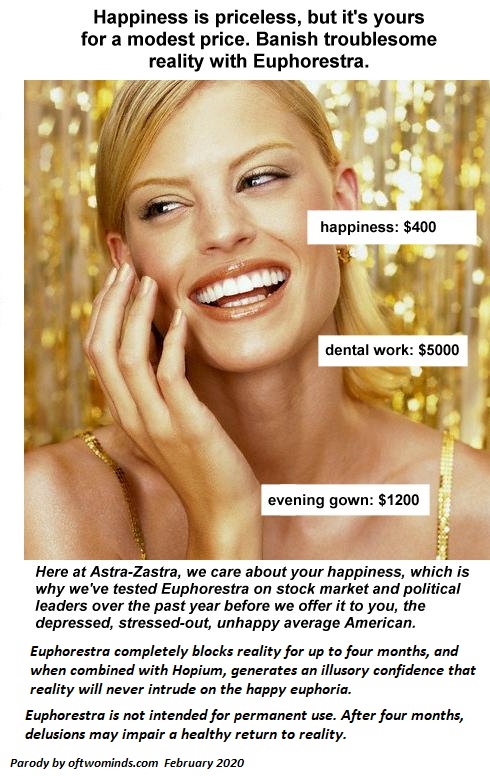

What’s Taboo? Everything Except Greed

OK, now I get it. Take a couple tabs of Euphorestra and Hopium, and stick to talking about making money in the market. Greed won't offend anyone. So I started to tell my buddy about my new screenplay idea: "There's a global pandemic, and when they rush a bunch of vaccines to market, then...."

Read More »

Read More »

The Middle Class Has Finally Been Suckered into the Casino

The Fed's casino isn't just rigged; it's criminally unstable. The decay of America's middle class has been well documented and many commentators have explored the causal factors. The bottom line is that this decay isn't random; the income of the middle class isn't going to suddenly increase at 15 times the growth rate of the income of the top 0.1%. (see chart below) The income of the top 0.1% grew 15 times faster than the incomes of the bottom 90%...

Read More »

Read More »

The “Helicopter Parent” Fed and the Fatal Crash of Risk

All the risks generated by gambling with trillions of borrowed and leveraged dollars didn't actually vanish; they were transferred by the Fed to the entire system. The Federal Reserve is the nation's Helicopter Parent, saving everyone from the

consequences of their actions.

Read More »

Read More »

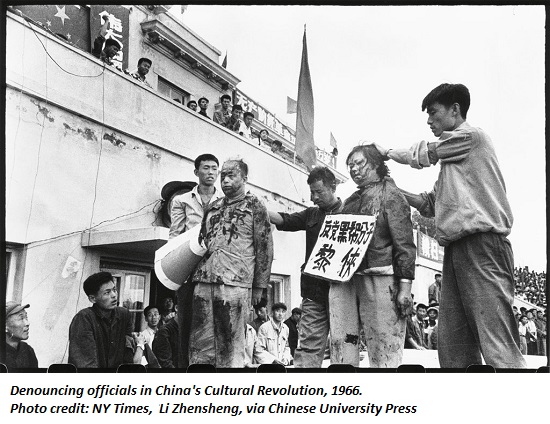

Is a Cultural Revolution Brewing in America?

The lesson of China's Cultural Revolution in my view is that once the lid blows off, everything that was linear (predictable) goes non-linear (unpredictable). There is a whiff of unease in the air as beneath the cheery veneer of free money for

almost everyone, inequality and polarization are rapidly consuming what's left of common ground in America.

Read More »

Read More »

What’s Changed and What Hasn’t in a Tumultuous Year

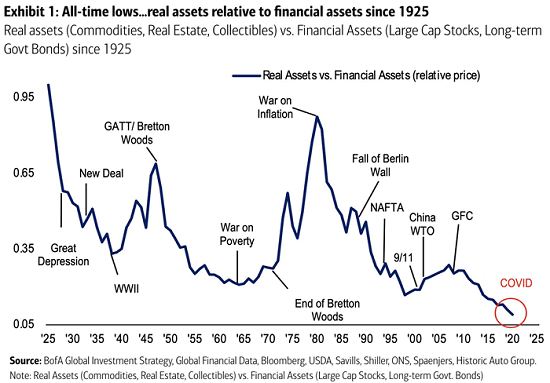

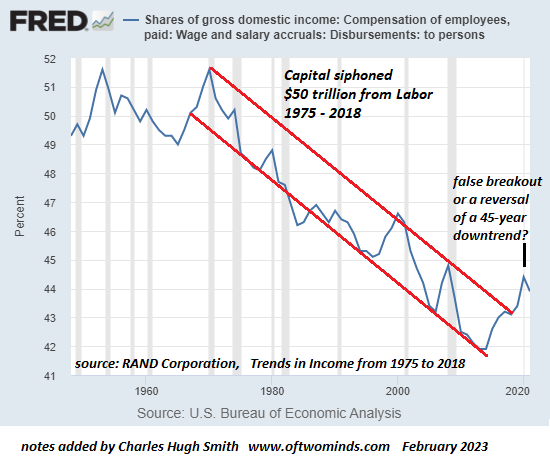

Inequality is America's Monster Id, and we're continuing to fuel its future rampage daily. What's changed and what hasn't in the past year? What hasn't changed is easy: 1. Wealth / income inequality is still increasing. (see chart #1 below)

2. Wages / labor's share of the economy is still plummeting as financial speculation's share has soared. (see chart #2 below)

Read More »

Read More »

Our “Wealth”: Cloud Castles in the Sky

Buyers know there will always be a greater fool willing to pay more for an over-valued asset because the Fed has promised us it will always be the greater fool. I realize nobody wants to hear that most of their "wealth" is nothing more than wispy Cloud Castles in the Sky that will dissipate in the faintest zephyr, but there it is: that which was conjured out of thin air will return to thin air.

Read More »

Read More »

The UFO/Fed Connection

Perhaps the aliens' keen interest in Earth's central bank magic and its potential for destruction results from a wager. You've probably noticed the recent uptick in UFO sightings and video recordings from aircraft of the extraordinary flight paths of these unidentified objects.

Read More »

Read More »