Category Archive: 5.) Alhambra Investments

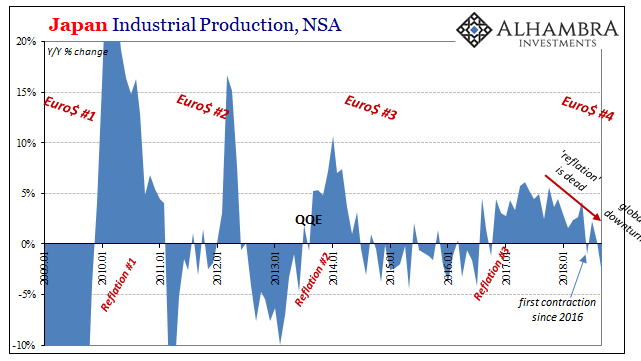

China Now Japan; China and Japan

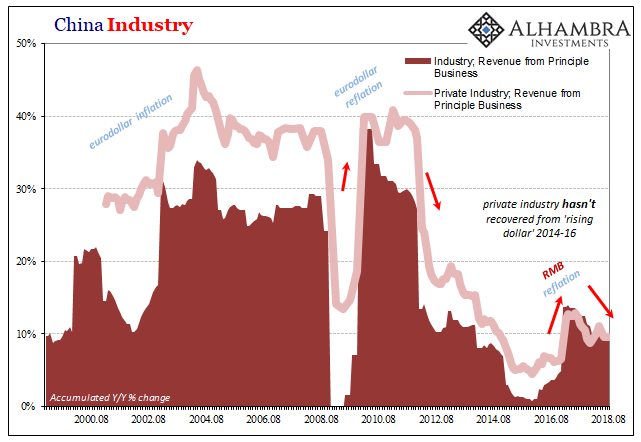

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

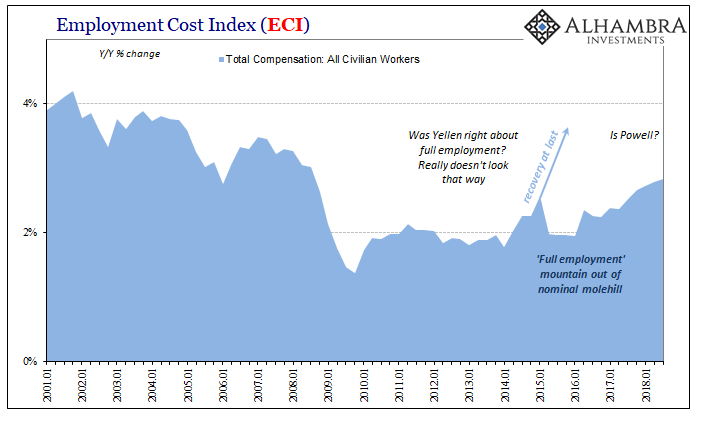

Another ‘Highest In Ten Years’

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers.

Read More »

Read More »

No Such Thing As An 80 percent Boom

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such.

Read More »

Read More »

Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly.

Read More »

Read More »

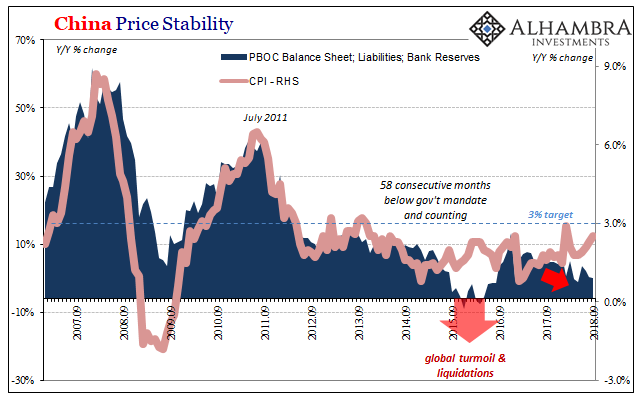

Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm.

Read More »

Read More »

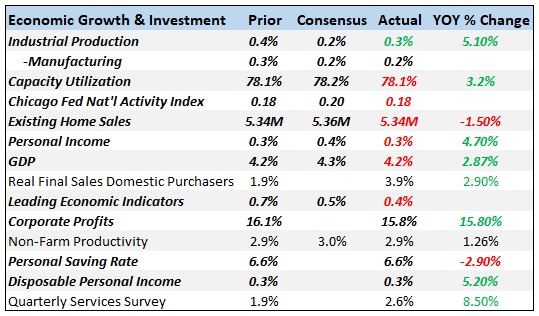

Just The One More Boom Month For IP

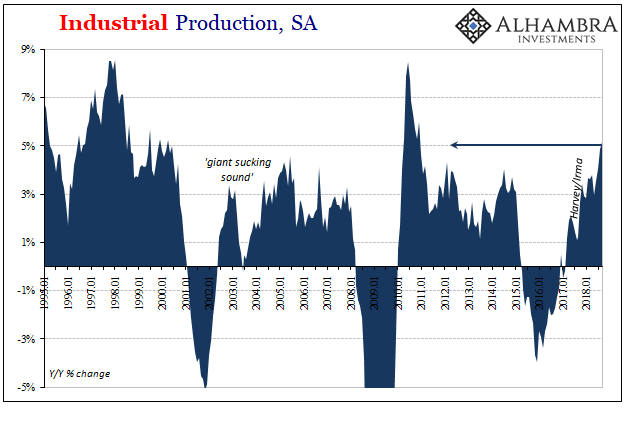

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010.

Read More »

Read More »

Now Back To Our Regularly Scheduled Economy

The clock really was ticking on this so-called economic boom. A product in many economic accounts of Keynesian-type fantasy, the destructive effects of last year’s hurricanes in sharp contrast to this year’s (which haven’t yet registered a direct hit on a major metropolitan area or areas, as was the case with Harvey and Irma) meant both a temporary rebound birthed by rebuilding as well as an expiration date for those efforts.

Read More »

Read More »

Special Edition: Markets Under Pressure (VIDEO)

What does Alhambra Investments think about the 1300 point drop in the Dow Jones Average this week? Alhambra CEO Joe Calhoun has some thoughts.

Read More »

Read More »

A Few Questions From Today’s BOND ROUT!!!!

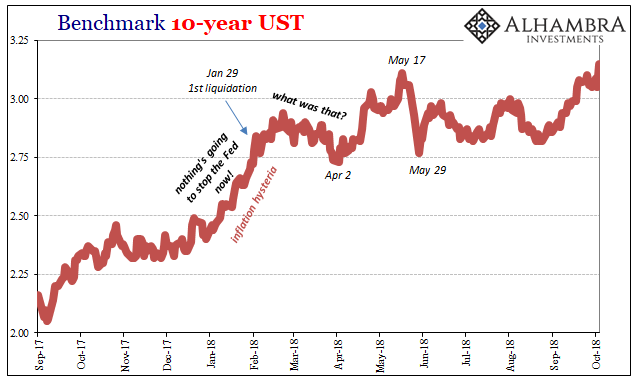

On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates.

Read More »

Read More »

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

Make Your Case, Jay

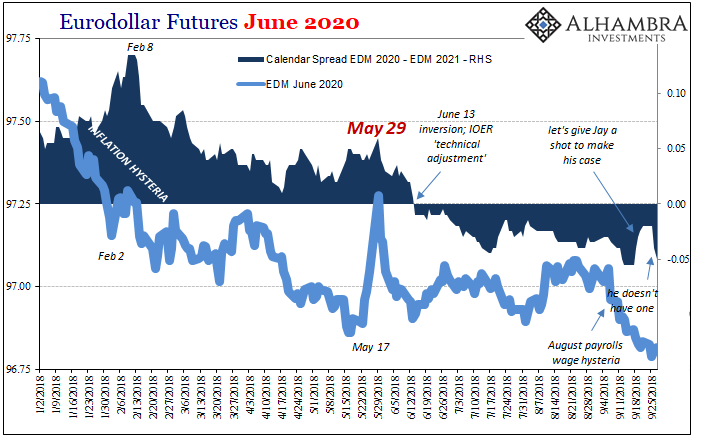

June 13 sticks out for both eurodollar futures as well as IOER. On the surface, there should be no bearing on the former from the latter. They are technically unrelated; IOER being a current rate applied as an intended money alternative. Eurodollar futures are, as the term implies, about where all those money rates might fall in the future. Still, the eurodollar curve inverted conspicuously starting June 13. That was the day of the prior “rate...

Read More »

Read More »

Eurodollars & Global Deflation Risk W/ Jeff Snider | Expert View | Real Vision™

Is the global economy poised to enter another deflationary cycle? Jeff Snider, head of global research and chief investment strategist at Alhambra Partners, believes that we have never enjoyed a true recovery from the global financial crisis – but instead, have merely bounced between cycles of deflation and reflation. In this piece, Snider unpacks the …

Read More »

Read More »

Monthly Macro Monitor – September 2018

Alhambra Investments CEO Joe Calhoun shares his opinions of the economy and market based on the most recent economic reports.

Read More »

Read More »

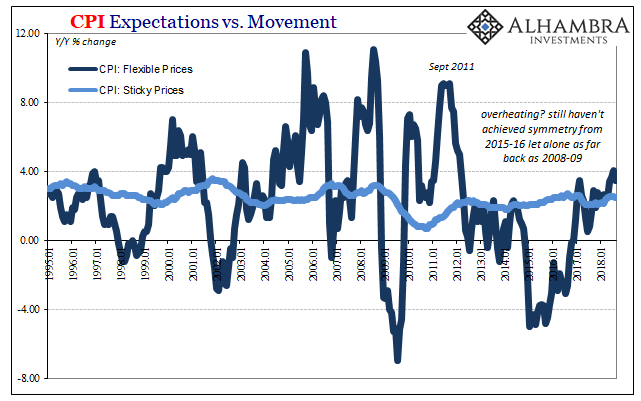

Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains.

Read More »

Read More »

ECB (Data) Independence

Mario Draghi doesn’t have a whole lot going for him, but he is at least consistent – at times (yes, inconsistent consistency). Bloomberg helpfully reported yesterday how the ECB’s staff committee that produces the econometric projections has recommended the central bank’s Governing Council change the official outlook. Since last year, risks have been “balanced” in their collective opinion.

Read More »

Read More »

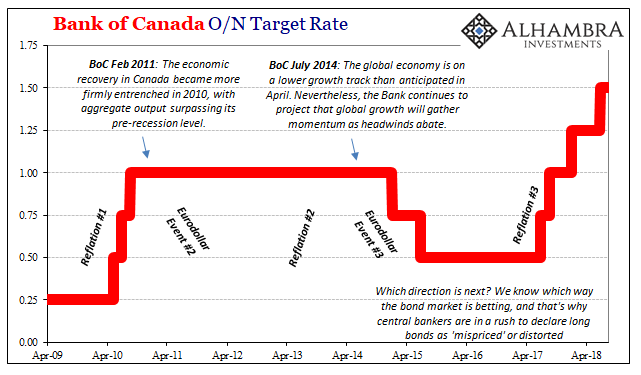

Europe Starting To Reckon Eurodollar Curve

We’ve been here before. Economists and central bankers become giddy about the prospects for success, meaning actual recovery. For that to happen, reflation must first attain enough momentum. If it does, as is always forecast, reflation becomes recovery. The world then moves off this darkening path toward the unknown crazy.

Read More »

Read More »

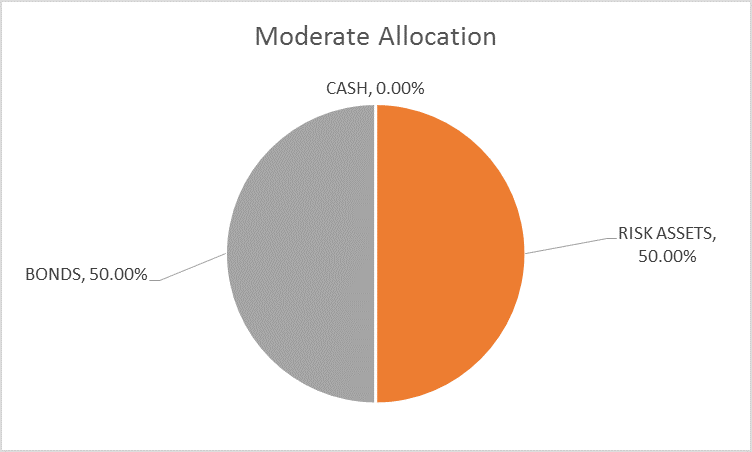

Global Asset Allocation Update – September 2018

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is 50/50. Decoupling anyone? That’s what the market is whispering right now, that the recent troubles in foreign economies is contained and won’t affect the US. The most obvious example of that trend is the performance of US stocks versus the rest of the world.

Read More »

Read More »

‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

Anticipating How Welcome This Second Deluge Will Be

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

Read More »

Read More »