Category Archive: 5.) Alhambra Investments

Seriously, Good Luck Dethroning the (euro)Dollar

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y.

Read More »

Read More »

The Financial System Is Broken (w/ Jeff Snider)

Jeff Snider, head of global research at Alhambra Investment Partners, has been covering the repo market breakdown since May 2018. With the recent spike in repo rates, it seems like the rest of the market has finally started to take notice. Snider explains why this problem is not coming up out of the blue and breaks down why he views recent market moves as a sign that the banks are telegraphing their knowledge of major threats to the monetary...

Read More »

Read More »

All-Stars #78 Jeff Snider : Market complacency is misplaced!

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »

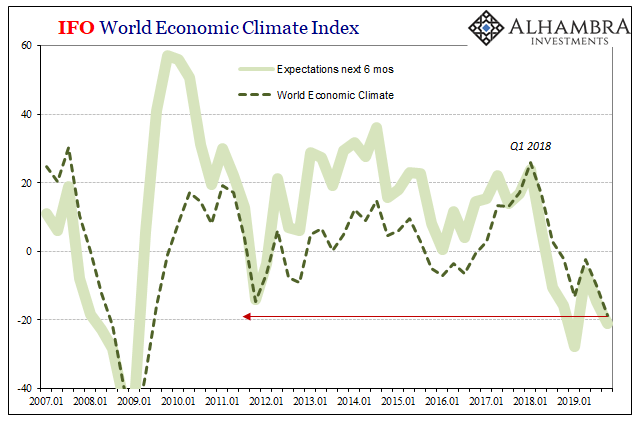

QE’s and Rate Cuts: Two Very Different Sets of Sentiment Drawn From Them

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work.

Read More »

Read More »

Jeff Snider: “Global Growth Slowing & The U.S. Dollar Liquidity Shortage” (Hedgeye Investing Summit)

***This webcast originally aired live at the Hedgeye Investing Summit on Hedgeye.com on October 15, 2019***

Get access to Hedgeye's world-class investing research here: https://hedgeye.com/research

Read More »

Read More »

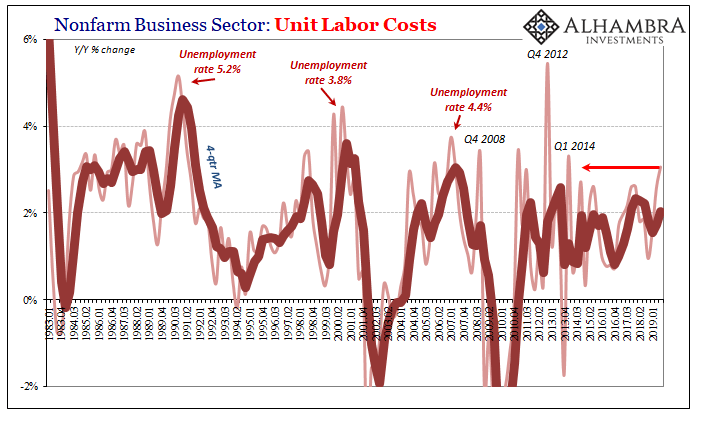

For Labor And Recession, The Bad One

There’s a couple of different ways that Unit Labor Costs can rise. Or even surge. The first is the good way, the one we all want to see because it is consistent with the idea of an economy that is actually booming. If workers have become truly scarce as macro forces sustain actual growth such that all labor market slack is absorbed, then businesses have to compete for them bidding up the price of marginal labor.

Read More »

Read More »

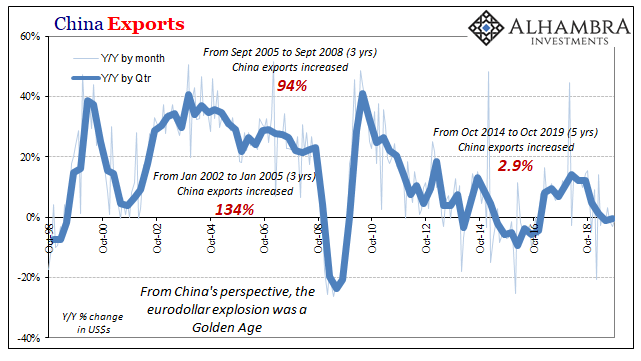

The Real Boom Potential

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving.

Read More »

Read More »

Red Flags Over Labor

Better-than-expected is the new strong. Even I’m amazed at the satisfaction being taken with October’s payroll numbers. While you never focus too much on one monthly estimate, this time it might be time to do so. But not for those other reasons.

Sure, GM caused some disruption and the Census is winding down, both putting everyone on edge. The whisper numbers were low double digits, maybe even a negative headline estimate.

Read More »

Read More »

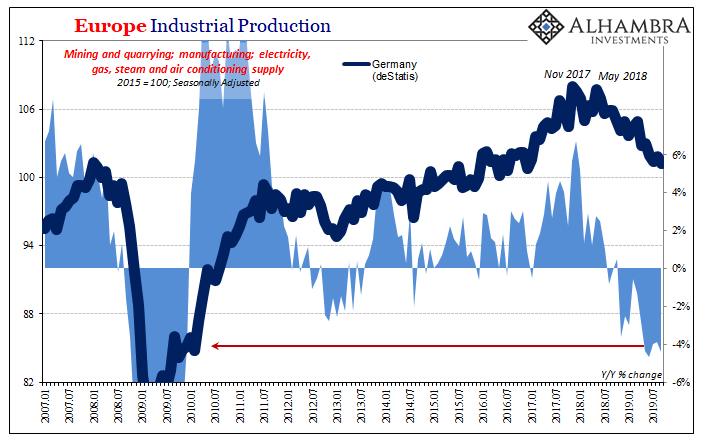

A Perfect Example of the Euro$ Squeeze

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate.

Read More »

Read More »

Still Stuck In Between

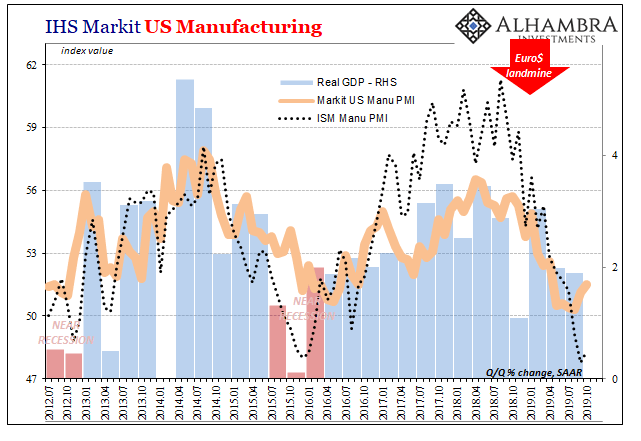

There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior

Read More »

Read More »

The Sudden Need For A Trade Deal

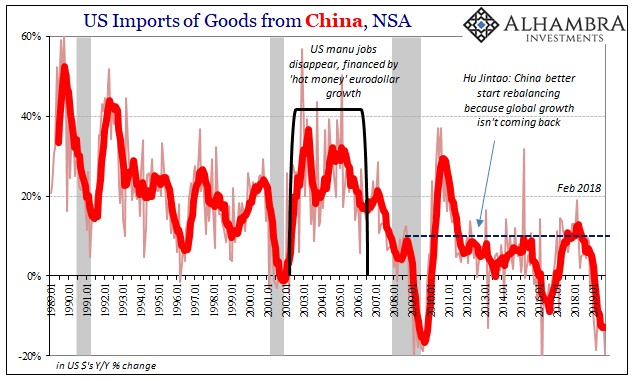

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018?

Read More »

Read More »

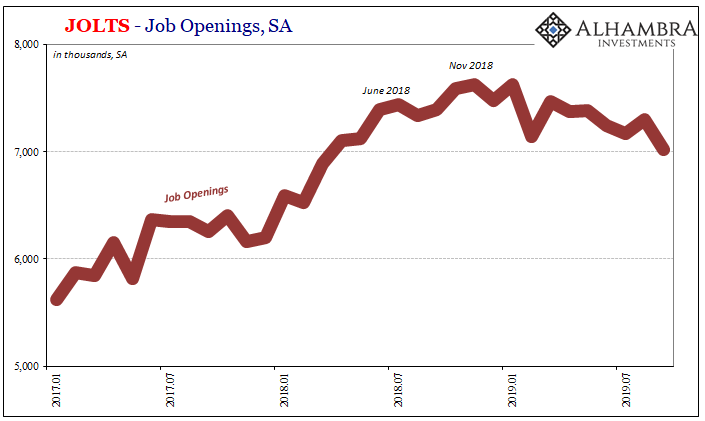

From Friends to Nemeses: JO and Jay

It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.”

Read More »

Read More »

You Have To Try Really Hard Not To See It

In early September, the Institute for Supply Management (ISM) released figures for its non-manufacturing PMI that calmed nervous markets. A few weeks before anyone would start talking about repo, repo operations, and not-QE asset purchases, recession and slowdown fears were already prevalent.

Read More »

Read More »

More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus.

Read More »

Read More »

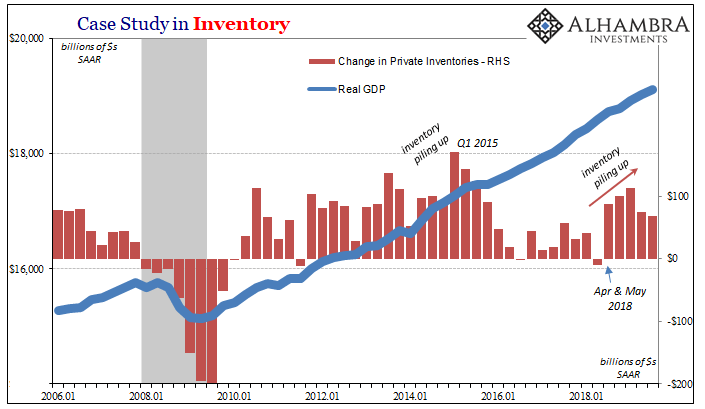

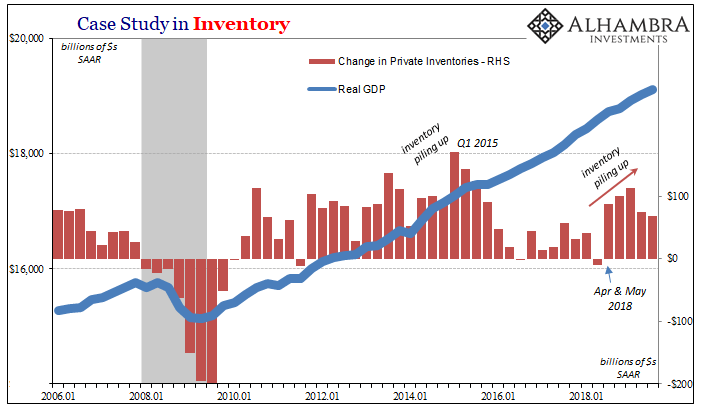

The Inventory Context For Rate Cuts and Their Real Nature/Purpose

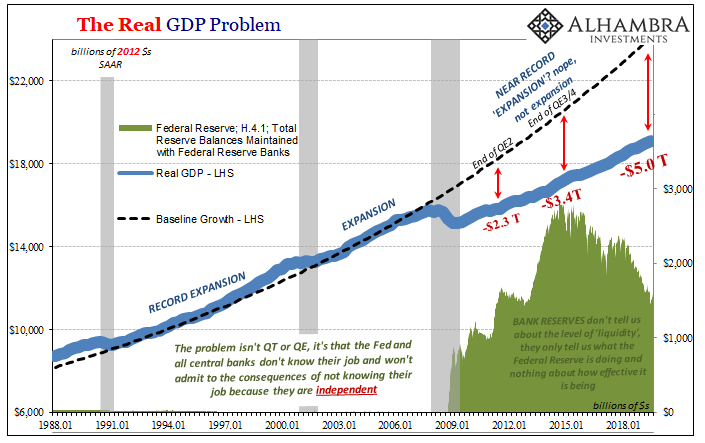

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process.

An economy for whatever reasons slows down.

Read More »

Read More »

Three (Rate Cuts) And GDP, Where (How) Does It End?

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them.

Read More »

Read More »

The Inventory Context For Rate Cuts And Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process.

Read More »

Read More »

The Big Risks Left (and Right) In Europe

Another local election in Germany, another stunning defeat for the ruling center. How many more of these does anyone need before they realize the electorate is going to keep migrating toward the poles? And it all stems from the one reason; there is no and has been no economic growth. But because the so-called establishment has insisted the economy is booming, or it was, people are doing what people always do.

Read More »

Read More »

Monthly Macro Monitor: Market Indicators Review

Is the recession scare over? Can we all come out from under our desks now? The market based economic indicators I follow have improved since my last update two months ago. The 10 year Treasury rate has moved 40 basis points off its low. Real interest rates have moved up as well but not quite as much. The difference is reflected in slightly higher inflation expectations.

Read More »

Read More »

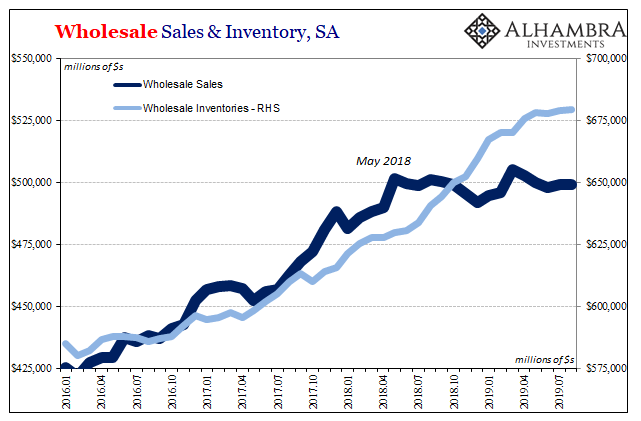

More Points For, And Pointing To, The Midpoint

It’s not surprising that the Census Bureau would report another weird sideways trend in wholesale sales. After all, the agency has already produced that kind of pattern in the related data for durable goods. For reasons that aren’t going to be explained, economic activity across the supply chain from producers to consumers has been curtailed. That hasn’t mean outright shrinking in seasonally adjusted forms, but it also doesn’t mean growth,...

Read More »

Read More »