Category Archive: 5.) Alhambra Investments

Powell Would Ask For His Money Back, If The Fed Did Money

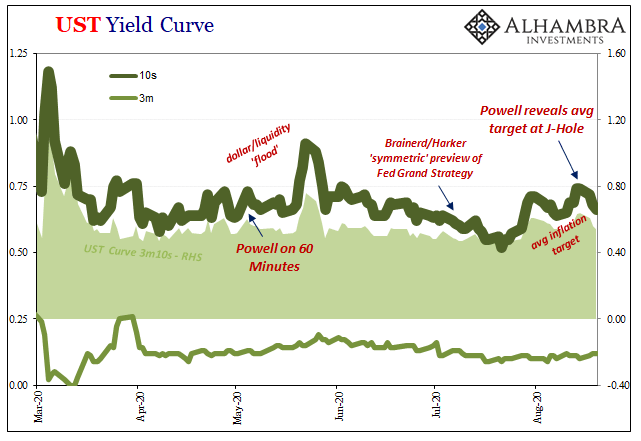

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!!

Read More »

Read More »

Eurodollars & Global Deflation Risk W/ Jeff Snider | Expert View | Real Vision™

Is the global economy poised to enter another deflationary cycle? Jeff Snider, head of global research and chief investment strategist at Alhambra Partners, believes that we have never enjoyed a true recovery from the global financial crisis - but instead, have merely bounced between cycles of deflation and reflation. In this piece, Snider unpacks the importance of Eurodollars as a key to understanding where the global economy is headed next....

Read More »

Read More »

Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic.

Read More »

Read More »

Jeff Snider talks INFLATION, DEFLATION (RCS Ep75)

Interview original date: July 22nd, 2020

Topics: Jeff’s definition of Deflation, Inflation. Monetary Deflation. Consumer behavior and its effect on prices. Production, wages/income, labor market, labor market destruction. UBI, demand, unemployment, supply, spending, savings, credit. 1930s and destruction of deflation, 1800s and deflation then. Did the Long Depression really exist? Gold Standard after the Civil War, fixed money supply, silver...

Read More »

Read More »

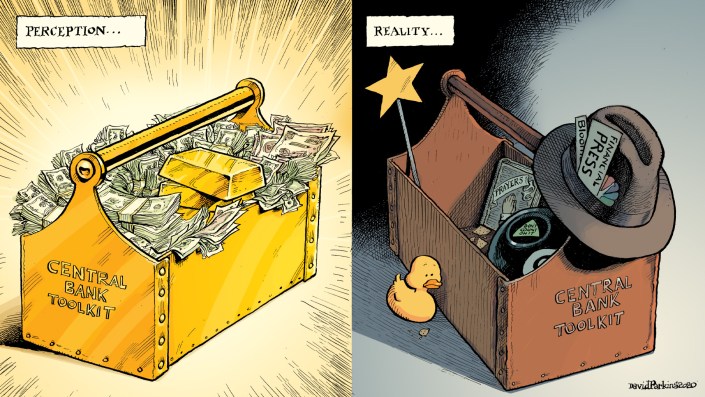

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

Not This Again: Too Many Treasuries?

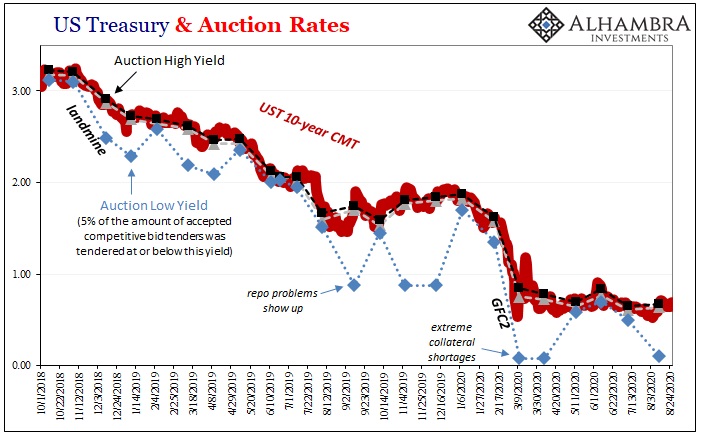

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

Fed Watch – “Banking in The Shadows with Jeff Snider” – FED 20

Today, we have the privilege to sit down with Head of Global Research at Alhambra Investments Jeff Snider. We run through the basics of the eurodollar system, why people get it wrong when talking about the Fed, and where we are going from here. Of course, we finish up getting Jeff to talk about bitcoin, and what he says might surprise you!

Alhambra Investments: https://alhambrapartners.com/commentaryanalysis/

Alhambra Youtube:...

Read More »

Read More »

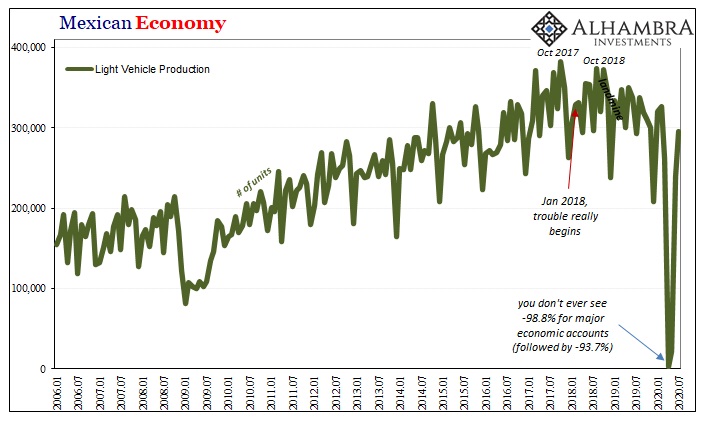

Meaning Mexico

It took some doing, and some time, but Mexico has managed to bring its car production back up to more normal levels. For two months, there had been practically zero automaking in one of the biggest auto-producing nations. Getting back near where things left off, however, isn’t exactly a “V” shaped recovery; it’s only halfway.

Read More »

Read More »

Dollar University with Jeff snider, is the Dollar really going down? #finance

Subscribe here for more : http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

Support! ;) http://www.ko-fi.com/aminray

#fed #reserve #trade #economy #dollar #bloomberg #neworldorder #finance #bitcoin

Dollar University with Jeff snider, is the Dollar really going down? #finance

Read More »

Read More »

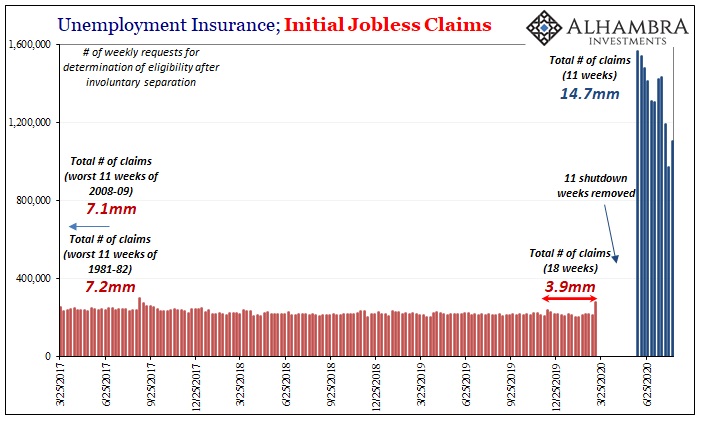

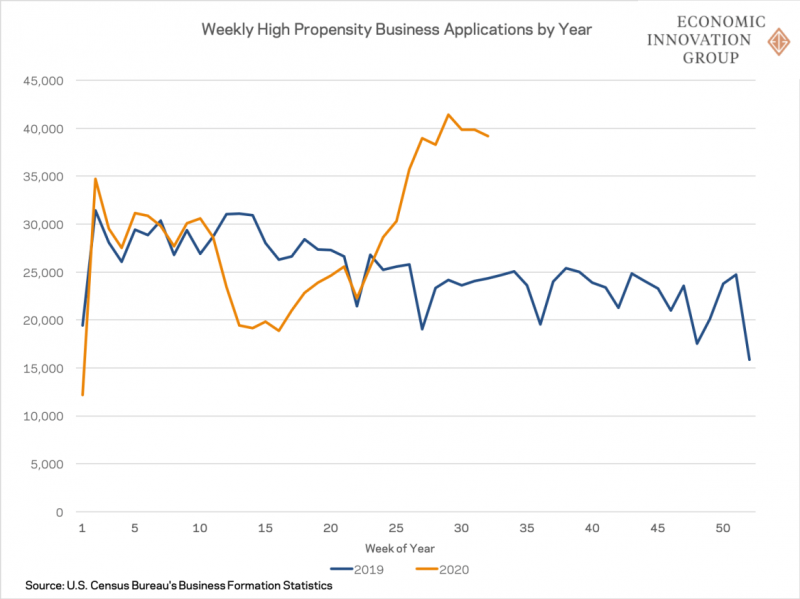

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

There is simply no way to spin these figures as anything good. Not just the usual ones were talking about here, but more so some new data that you probably haven’t seen before. Beginning with the regular, it doesn’t matter that the level of initial jobless claims has declined substantially over the past few weeks

Read More »

Read More »

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

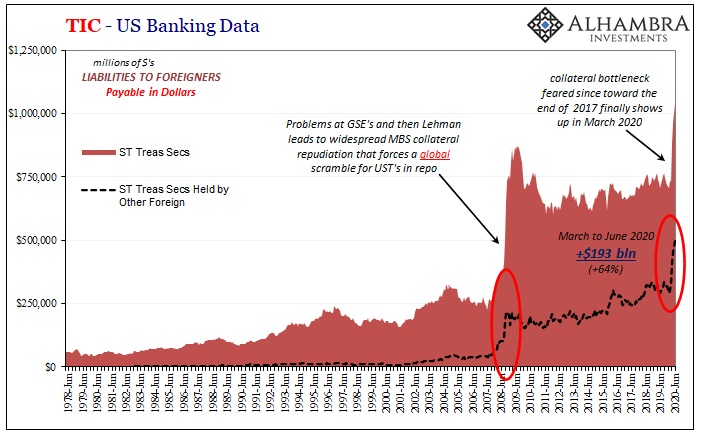

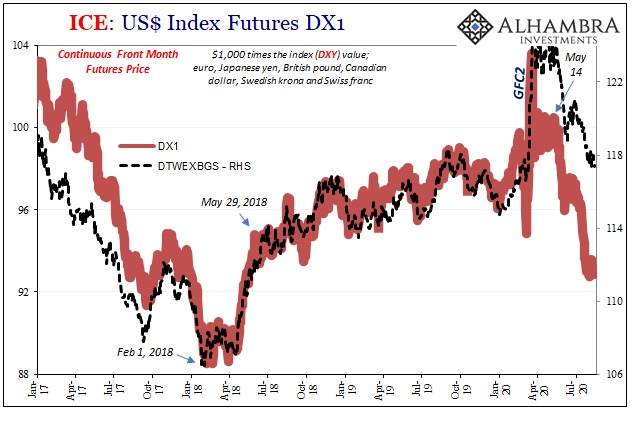

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

Part 1 of June TIC: The Dollar What

While the world is taking the smallest of baby steps in the right direction, mostly it’s been related to the part of the eurodollar system that everyone can see. Not bank reserves and the Fed’s “money printing”, though you can see them and we’re told to obsess about them those things don’t matter.

Read More »

Read More »

Case Study: Advances in Modular WWTP Design by Jeffrey Snider-Nevan, Newterra Decentralized Water

Webinar – Tuesday, August 18, 2020

With our many brands and vast water treatment technologies, we invite you to experience this online library of unique and informative presentations packed with valuable insight, new products & technologies, and product demonstrations relevant to today's water industry. Enjoy!

Newterra’s Reclaiming The World’s Water (A Virtual Expo by Newterra)

August 18 & 19, 2020

Read More »

Read More »

It Was Bad In The Other Sense, So Now What?

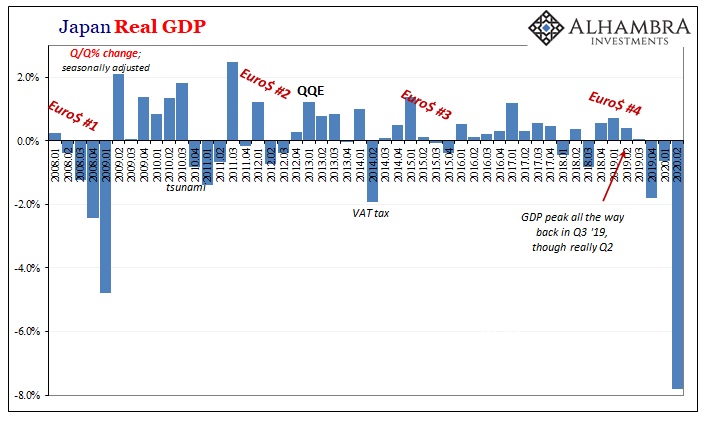

According to the latest figures, Japan has tallied 56,074 total coronavirus cases since the outbreak began, leading to the death of an estimated 1,103 Japanese citizens. Out of a total population north of 125 million, it’s hugely incongruous.

Read More »

Read More »

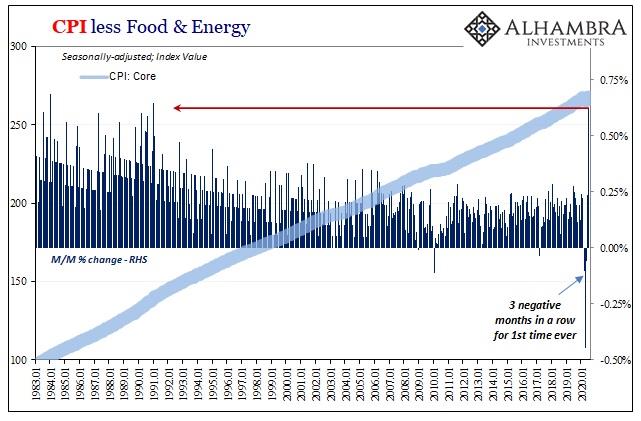

Fama 2: No Inflation For Old Central Banks

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level.

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

Science of Sentiment: Zooming Expectations Wonder

It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them. What would a “united” European system do to try and fill in this massive hole?The...

Read More »

Read More »

Shrinkflation, Hidden Inflation, and Jeff Snider

A certain faction (e.g. Jeff Snider, Jerome Powell, Paul Krugman) continues to beat home the idea that there is no inflation. If you remove everything that rises from the CPI and then fail to count substitutions or shrinkflation, you can come to that conclusion. But if you live in the real world, you know this is not reality. In this episode we cover hidden inflation and shrinkflation.

Read More »

Read More »