Category Archive: 4) FX Trends

Crude Oil Technical Analysis

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:44 Technical Analysis with Optimal Entries.

1:51 Upcoming Economic Data....

Read More »

Read More »

Heading into the new trading day, the GBPUSD is trying to hold above a key floor.

The GBPUSD is facing intense selling pressure, with the price breaking below key support levels. Traders are closely watching the crucial 1.2602-1.26137 floor, which will determine the direction of the pair in the upcoming trading session.

Read More »

Read More »

USDJPY moves to new session highs and in doing so, moves closer to a key technical target

USDJPY gains momentum as it approaches the 100-day moving average and 61.8% retracement, setting sights on resistance at 147.45. Traders anticipate potential correction after recent upward movement.

Read More »

Read More »

Greenback Surges as Rates Back Up

Overview: The US dollar is bid across the board and posting its best session of the month. It is up between about 0.5% (Canadian dollar) to almost 1.0% (Australian dollar) among the G10 currencies. Among the emerging market currencies, only the Russian ruble is holding its own.

Read More »

Read More »

USDJPY Technical Analysis

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for USDJPY. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

2:24 Technical Analysis with Optimal Entries.

3:50 Upcoming Economic Data....

Read More »

Read More »

What levels are in play for the major currency pairs to start the new trading week?

EURUSD and GBPUSD trade between 100/200 hour MAs, while USDJPY faces resistance near midpoint of downward move. Technical analysis for the week ahead as Martin Luther King Day ends.

Read More »

Read More »

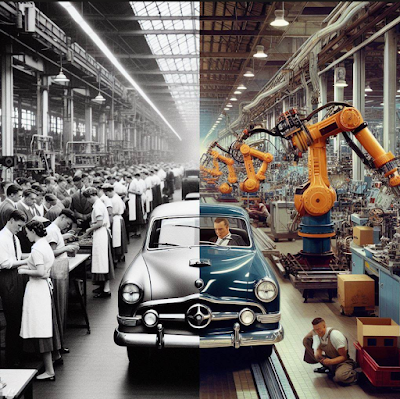

The playbook for 2024 trading

The big picture the question is: Will we return to a 2010s style regime of low inflation and low rates? Last week's CPI data showed that we are and I think that's a big tailwind for all risk assets.

The focus right now is on central banks but waiting longer to cut rates probably won't be bullish for risk-sensitive currencies because headwinds are mounting, particularly due to housing and immigration.

LET'S CONNECT!

Facebook ► / forexlive...

Read More »

Read More »

Gold Technical Analysis

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:37 Technical Analysis with Optimal Entries.

2:18 Upcoming Economic Data....

Read More »

Read More »

Week Ahead: Real Economy

Given the world's turmoil, including the escalation, and

broadening of the conflict in the Middle East and China's continued aerial

harassment of Taiwan ahead of the election, the capital and commodity markets

have remained firm. February WTI fell about 1.7% last week and March Brent

slipped around 0.65%. Shipping costs are rising as the Rea Sea is avoided

and supply chain disruptions are threatened. Still the MSCI index of developed

equity market...

Read More »

Read More »

ForexLive Video

Despite closing the week with a bearish bias, the AUDUSD shows potential for a reversal as it hovers near key support and resistance levels. Traders should watch for a breakout above the swing level at 0.6738 or a breakdown below the swing area at 0.6676 for further confirmation of direction.

Read More »

Read More »

EURJPY tests cluster of technical levels creating a low risk opportunity to buyers/sellers

Swing level, moving averages, and Fibonacci retracement converge, providing low-risk/high-reward possibilities in EURJPY trading.

Read More »

Read More »

The ups and down in the USDCAD continue. The buyers are shifting toward more control again.

Amid a volatile trading week, the USDCAD is making a comeback as buyers regain control. The price surged above swing areas and returned to sellers, but is now back above the 100 hour moving average. To increase the bullish bias, a move above the swing area is needed.

Read More »

Read More »

China Data Dump Keeps Market Looking for a Rate Cut Next Week

Overview: The mostly consolidative week for the US dollar

continues. Most for the G10 currencies are +/- about 0.25% today and only a

slightly wider range for the week. The odds of a Fed rate cut in March is

virtually unchanged on the week at around 75%. The JP Morgan Emerging Market

Currency Index is practically flat on the day and week. The Russian ruble and

Mexican peso lead today's advancers, while eastern and central European

currencies are...

Read More »

Read More »

Buyers in the USD, tilts the USDCHF technicals to the upside. What would upset the bias?

Recent data boosts USD and pushes USDCHF higher, but key resistance levels and potential downside support levels need to be monitored closely. Buyers gain confidence if support holds at 0.8528-0.8537, while breaking below 0.85185 could weaken the bias. Traders should also watch for the 100 and 200 hour MAs as additional support targets.

Read More »

Read More »

USDCAD trades within up and down ranges, but with a bullish tilt

Discover how the USDCAD is experiencing up and down movements, but with a favorable lean towards buyers. Learn why holding support against the 100 hour MA is crucial and how surpassing key resistance levels could strengthen the bullish bias. Watch the video for an in-depth analysis of the technicals and what it takes for buyers to maintain and expand control.

Read More »

Read More »