Category Archive: 4) FX Trends

The USD continues its move to the downside. Central bank heads set to speak.

Powelll, BOE Bailey, ECB Lagarde, BOJ Ueda all expected to speak on a panel in Sintra today.

Read More »

Read More »

Dollar Drop Gains Momentum and US Rates Extend Decline

Overview: An accelerated run on the US dollar continues. The euro, sterling, Australian and New Zealand dollars have risen to new highs. The greenback has dropped to new lows since 2015 against the Swiss franc. Japan's efforts to protect its rice farmers triggered the ire of President Trump. The "reciprocal tariffs," which could come back …

Read More »

Read More »

The Greenback is Finishing the Month Quietly, while PBOC Fixes the Dollar at New Lows for the Year

Overview: The US dollar is consolidating in mostly narrow ranges against the G10 currencies. It is trading mostly softer against emerging markets currencies. The news stream features further progress of the US budget bill, which dropped the onerous "revenge tax" (Section 899), and there is talk of as many as a dozen trade framework agreements …

Read More »

Read More »

Crude Oil Pullback: Time to Trade Oil Short? | market outlook: oil trading | 25.06.2025

Crude oil trading is heating up again as prices retreat after a strong bullish push. With bearish signals still in play and geopolitical tension cooling off, is this the start of a deeper correction—or just a pause before another surge? This week’s Exness Market Outlook breaks down what matters, from key US data like GDP and the PCE index to Powell’s testimony. How will it all impact your strategy to trade oil? Watch now to stay ahead of the next...

Read More »

Read More »

July 2025 Monthly

The second half of 2025 begins not with optimism, but with fatigue. The global economy is not collapsing, but it is clearly bending under strain—economic, geopolitical, and institutional. What is taking shape is not a soft landing, but something more sobering: a slower, structurally weaker cycle in a more dangerous and fragile world.Three developments define …

Read More »

Read More »

Dollar Stabilizes after Yesterday’s Shellacking but Finds Little Traction

The US dollar has steadied today after yesterday's shellacking that saw it fall to new multiyear lows against the euro and sterling and 10-year lows against the Swiss franc. The news stream is somewhat more supportive today, with trade deals said to be in the works, in addition to the confirmation/clarification of an agreement with China.

Read More »

Read More »

Nasdaq Technical Analysis, think opposite of what most are thinking (they are bullish)

Watch why this spot may be attracting profit takers.

ForexLive.com will be evolving to investingLive.com later this year.

Read More »

Read More »

Dollar Pummeled on Risk to Fed’s Independence

The US dollar was weak yesterday, but it has been pummeled today. It is down against the G10 currencies and all but the Russian ruble and Turkish lira among emerging market currencies. The proximate trigger of today's sell-off were news reports that a successor to Fed Chair Powell could be announced in a few months.

Read More »

Read More »

Nasdaq Technical Analysis (do not short, yet)

This market is still grinding up. See why and where it might change.

ForexLive.com will be evolving to investingLive.com later this year.

Disclaimer: This is an AI-generated image of a real person. The quote is fictional and intended as a joke. Nothing shown here actually happened.

Read More »

Read More »

The EURUSD and GBPUSD failed after making new highs yesterday but the declines are modest

The USDJPY is higher today and corrects some of the sharp declines seen over the last few days.

Read More »

Read More »

Markets Enjoy A Calm Moment

Overview: After a volatile start to the week, the capital markets are quieter and the ceasefire between Israel and Iran appears to be holding. The Trump administration is challenging reports that claim the barrage of US bombs merely set back the Iranian nuclear project by a few months. No coup de grace was delivered. The … Continue...

Read More »

Read More »

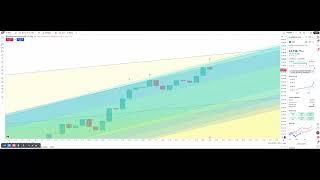

EURUSD is breaking to new highs for the year and going back to 2021. What next?

Close risk for the EURUSD is now at 1.1614 to 1.16297. That swing area is the highs from June.

Read More »

Read More »