Category Archive: 4) FX Trends

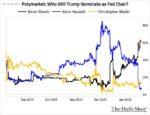

Trial Balloon to Fire Powell went over like a Lead Zeppelin

Overview: A natural experiment of sorts unfolded yesterday. Heightened speculation, fanned in part by the White House itself, that after several threats, President Trump was going to fire Fed Chair Powell. Short-term rates fell but the curve steepened, the greenback sold off sharply, and stocks skidded lower. The main narrative is that seeing the carnage, …

Read More »

Read More »

Gold Technical Analysis – The rangebound price action continues

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:35 Technical Analysis with Optimal Entries.

1:35 Upcoming Catalysts....

Read More »

Read More »

The USD is little changed ahead of the PPI data after yesterday’s run higher. What next?

In the video, I take a technical look at the 3 major currency pairs, the EURUSD, the USDJPY and the GBPUSD. What is the bias? What are the risk levels? What are the targets?

Read More »

Read More »

USD Steadies after Yesterday’s Surge, but Does it have Legs?

Overview: The dollar has steadied today after yesterday's jump. Asia and Europe do not seem to be as enthusiastic about the dollar as North America seemed to be yesterday. President Trump indicated that sectoral tariffs on semiconductor chips and pharmaceuticals could be announced as early as August 1. He also said that there will be …

Read More »

Read More »

USDJPY Technical Analysis – Is this a breakout or just a fakeout?

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:24 Technical Analysis with Optimal Entries.

2:43 Upcoming Catalysts...

Read More »

Read More »

US CPI will kickstart the US trading day. The USD is mostly lower to start the day

What are the key technical levels in play for the EURUSD, USDJPY and GBPUSD ahead of the key CPI data?

Read More »

Read More »

Greenback Slips Ahead of June CPI

Overview: The US dollar is trading somewhat heavier against the G10 currencies but the Scandis today, ahead of the US CPI report. Most emerging market currencies are also firmer. The last few CPI readings were softer than expected, but economists continue to look for firmer price pressures. Late yesterday, the US announced a 17% tariff …

Read More »

Read More »

Gold Technical Analysis – All eyes on the US CPI

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:42 Technical Analysis with Optimal Entries.

1:56 Upcoming Catalysts....

Read More »

Read More »

A Message from our Editors: ForexLive is becoming InvestingLive.

Our editors have a big announcement to make 🎤

You’ve trusted us for fast, accurate market news under the ForexLive name.

Now, it’s time for a bold move forward.

👉 ForexLive is becoming InvestingLive.

Why? Because markets don’t stand still, and neither do we.

Our editorial team is here to tell you what’s changing, what’s staying the same, and why this shift matters.

🔹 We’re going beyond forex to cover everything that moves the markets — from...

Read More »

Read More »

The USD is little changed versus the 3 major currency pairs to kickstart the trading week

A technical look at the EURUSD, USDJPY and GBPUSD and more to kickstart trading on Monday July 14

Read More »

Read More »

Market Recognizes US Tariff Threats as Negotiation Tactics and Sees Through New Front in Criticism of Powell

Overview: The market has taken the US threat of 30% tariffs on the EU and Mexico in stride. Both currencies wobbled a little but are little changed as the North American session is about to start. Participants seem to recognize the threat as a tactic meant to increase the pressure to negotiate (i.e., make new …

Read More »

Read More »

Week Ahead: US CPI and Import Prices may keep Fed’s Stand Pat Decision Unanimous amid Threats of a Higher Universal Tariff

The dollar rose against most of the G10 currencies last week. The Australian dollar and Swedish krona were the exceptions. The Aussie was helped by the central bank's surprise decision not to cut rates. The krona may have been helped by stronger than expected June inflation, with the key measure jumping to 3.3% from 2.5%), …

Read More »

Read More »

The USD moves higher as Trump tariff inflation risk increases

US stocks are lower. Yields are higher after Trump announces a 35% tariff on Canada goods

Read More »

Read More »

US Tariffs Unsettle the Markets while the UK’s May GDP Unexpectedly Contracted

Overview: The US 35% tariff on Canada and President Trump's threat to have a 15%-20% universal tariff rather than 10% provides today's disruption. A tariff letter for the EU is awaited but seeing how the US treated Canada and Brazil (with whom the US has a trade surplus) warns of the risk to Europe. That …

Read More »

Read More »

Gold Technical Analysis – The focus turns to the US CPI

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:39 Technical Analysis with Optimal Entries....

Read More »

Read More »

The Dollar’s Upside Correction Stalls

Overview: The continued release of US tariff announcements shapes the near-term considerations. Of the surprises, the 50% tariff on Brazil (10% on April's "Liberation Day") is among the most egregious. The US has a trade surplus with it and the letter made clear a personal animosity over the treatment of former President Bolsonaro. After having …

Read More »

Read More »

USDCAD might recover from lows | market outlook: forex trading | 09.07.2025

USDCAD is the symbol in focus this week as important data from Canada approach and there are signs of divergence in economic performance and monetary policy between Canada and the USA.

The price of dollar-loonie has failed twice to push below $1.355 since the middle of last month and now might start to show strength as the US dollar recovers. The loonie traditionally has among the strongest correlations with crude oil in forex trading, so oil's...

Read More »

Read More »

The USD is little changed to start the new trading day.

The RBNZ kept rates unchanged. The US treasury will auction 10 year notes and wholesale inventories are on the schedule today. US tariff news remains to be awaited.

Read More »

Read More »

Capital Markets Take US Tariffs and Threats in Stride

Overview: The US tariff saga continues. Yesterday, President Trump announced a 50% tariff copper, sending the red metal screaming higher (13%+), and threatening 200% tariffs on pharma. Other sectoral investigations are expected to wrap up toward the end of the month. There is a vigorous effort to check "transshipments," but it is not clear how …

Read More »

Read More »