Category Archive: 4) FX Trends

Trade Like A Pilot and You Will Never Crash

My favorite question to ask new traders is this: What do you do when you make a mistake in trading? The answer to that question tells you everything you need to know whether they’re going to make money. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

The euro and sterling were sold through yesterday's lows in Asia, but rebounded in Europe, with the help of mildly constructive data in the form of the German IFO and details of UK Q1 GDP. The IFO climate measure matched the April reading and thereby snapped a five-month slide. The expectations component slipped, but the current assessment improved.

Read More »

Read More »

FX Daily, May 24: Greenback Pushes Lower

The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the Canadian dollar. It is also softer against most of the emerging market currencies. The chief exception is the Turkish lira. Yesterday's 300 bp rate hike could only stem the rot momentarily and the lira's 2.3% decline today, wipes out 2/3 of the annual rate increase.

Read More »

Read More »

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »

Great Graphic: Euro-Swiss Shows Elevated Systemic Risk

The Swiss National Bank's decision in January 2015 to remove the cap on the Swiss franc (floor on the euro) that it has set at CHF1.20 is seared into the memory of a generation of foreign exchange participants. It is not exactly clear where the euro bottomed in the frenzied activity that followed the SNB's surprise move. Bloomberg records the euro's low near CHF0.8520.

Read More »

Read More »

Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

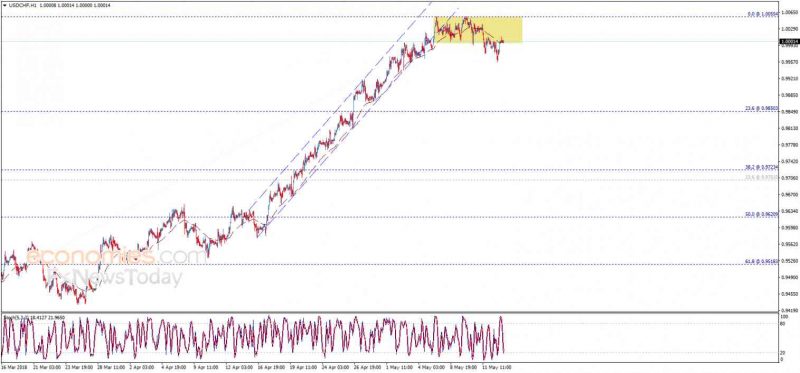

The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally upwards to breach 1.0055 level and...

Read More »

Read More »

Italy Defies Gravity and Risk to Fiscal Rectitude

Italian asset markets continue to fare better than many expected. The political uncertainty following the March election has been followed by confidence that the Five Star Movement and the (Northern) League will be able to put together a government in the coming days. If so, Italy would have taken half the time Germany did to cobble a government together after inconclusive elections.

Read More »

Read More »

FX Weekly Preview: Dollar Power

There are several trends in the capital markets at a high-level. The euro and yen's decline has coincided with sustained rallies in European and Japanese equity benchmarks. Emerging market equities and currencies have been trending lower.

Read More »

Read More »

Marc Chandler Says Fed Has Little Choice But to Continue to Hike Rates

May.21 — Marc Chandler, senior vice president at Brown Brothers Harriman, discusses currencies, Federal Reserve monetary policy and the outlook for markets. He speaks with Tom Keene and Francine Lacqua on “Bloomberg Surveillance.”

Read More »

Read More »

FX Daily, May 18: EUR/CHF Continues the Collapse

The US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765.

Read More »

Read More »

FX Daily, May 17: US Rates Edge Higher, while Dollar Turns Mixed

The Britsh pound was a cent from yesterday's lows on a press report that claimed the UK cabinet had agreed on seeking to stay in the customs union with the EU beyond the two-year transition period. The report suggested that the UK wanted to still negotiate other trade deals, which would seem to be a Trojan Horse.

Read More »

Read More »

FX Daily, May 16: US Yields Soften After Yesterday’s Surge

The US dollar is mixed today after the Dollar Index rose to new 2018 highs yesterday. It is being driven by rising US rates, which also punishes short dollar positions. The US 10-year yield rose seven basis points yesterday to nearly 3.10%. It is consolidating near 3.06% now. Many see the yield rising toward 3.20%, which would match the mid-2011 high.

Read More »

Read More »

FX Daily, May 15: Firm US Rates Underpin Greenback

US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a three-day advance. China and India were able to buck the regional move. China's economic data was mostly softer than expected and is consistent with a gradual turn in the cycle as the Lunar New effect fades.

Read More »

Read More »

Weekly Technical Analysis: 14/05/2018 – USD/JPY, EUR/USD, EUR/JPY, GBP/USD, USD/CHF

The USDCHF pair provided positive trading yesterday to test 1.0000 level and settles around it, and as long as the price is below this level, our bearish overview will remain valid, noting that our next target is located at 0.9900, while breaching 1.0000 followed by 1.0055 levels represent the key to regain the main bullish trend again. Expected trading range for today is between 0.9920 support and 1.0055 resistance.

Read More »

Read More »

FX Daily, May 14: US Dollar Slips in Quiet Turnover

The US dollar is sporting a softer profile against most of the major and emerging market currencies to start the new week. It already seemed to be tiring in the second half of last week. With today's mild losses, Dollar Index is off for a fourth consecutive session, the longest losing streak in over a month. The US and China appear to have taken measure to diffuse the trade tensions between the world's two largest economies.

Read More »

Read More »

FX Weekly Preview: Fed Can Look Through the Data Easier than the ECB and BOJ

Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem.

Read More »

Read More »

FX Daily, May 11: Dollar Momentum Sapped, Near-Term Pullback Likely

The US dollar pulled back following yesterday's slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor consumer prices are accelerating. There is little reason in the recent string of data or official comments to suggest a more hawkish path for monetary policy (e.g., four rate hikes this year).

Read More »

Read More »

Why oil doesn’t affect the Canadian dollar like it used to

Adam Button from ForexLive speaks to BNN about the dynamics in the oil market that have left the Canadian dollar at far lower levels than you would expect with $70 oil.

Read More »

Read More »

FX Daily, May 10: Kiwi Tumbles on Dovish RBNZ, While Sterling Goes Nowhere Ahead of BOE

The US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback's consolidation is giving it a heavier bias against most of the major currencies. The recently strong upside momentum has stalled, but the losses are modest and the euro and sterling are inside yesterday's ranges.

Read More »

Read More »

FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro's losses. The euro dipped below $1.1825. The single currency is off a cent this week after falling nearly two last week. A 38.2% retracement of the euro's gains since the beginning of last year is found a little above $1.1700 and...

Read More »

Read More »