Category Archive: 4) FX Trends

USDJPY Technical Analysis

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

2:06 Technical Analysis with Optimal Entries.

3:26 Upcoming Economic Data....

Read More »

Read More »

Unpacking GBP to JPY Rates | Awaiting BANK of ENGLAND next meeting | Market Outlook with Exness

In this week's Market Outlook with exness, we dive into the world of currency exchange and explore the intriguing dynamics of the pound to Japanese yen. With the Bank of England's next meeting just around the corner, could we see a major shift?

How has Japan's inflation rate played into the mix, and what does the GBP to yen chart whisper about what's to come? Plus, with market volatility peaking during pivotal financial updates, is now the time...

Read More »

Read More »

The EURUSD moved up and back down as the traders setup for the Fed decision. What now?

The price of the EURUSD has moved back to the 200 day MA at 1.0840 after a run to the upside could not reach the 100 bar MA on the 4-hour at 1.0892.

Read More »

Read More »

US Tech Sell-Off Challenges Risk Appetites Ahead of the FOMC

Overview: Ahead of the US Treasury's quarterly

refunding announcement and the outcome of the FOMC meeting, the dollar is

trading higher against all the G10 currencies. With US high-flying tech stocks

posting steep losses after disappointing earnings reports, the currencies most

sensitive to risk-appetites, the dollar bloc and the Norwegian krone are the

weakest. Emerging market currencies are mixed. The South African rand,

Philippine peso, and...

Read More »

Read More »

WTI Crude Oil Technical Analysis

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:53 Technical Analysis with Optimal Entries.

2:48 Upcoming Economic Data....

Read More »

Read More »

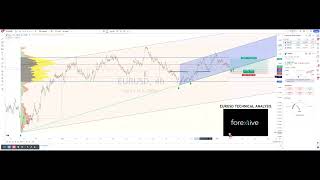

EURUSD struggles to sustain momentum above and key moving averages. What next?

The EURUSD attempted to break above its 200-day and 100-hour moving averages but failed to maintain the momentum. The next targets for downside movement are the swing area between 1.08083 and 1.0824, followed by the 50% retracement level at 1.07936.

Read More »

Read More »

USDCAD bounced off support but found willing sellers near a MA level

The 100 bar MA on the 4 hour chart stalls the rally in trading today. A swing area on the downside provides support.

Read More »

Read More »

The USDCHF is stuck between MA support and resistance defined by MAs and a key floor

The USDCHF is engaged in a tight battle between support and resistance, as it finds itself stuck between moving averages and a crucial floor level. The price is expected to break out of its narrow range soon, potentially leading to a surge in momentum.

Read More »

Read More »

Kickstart your FX trading for Jan. 30 w/ a technical look at the EURUSD, USDJPY and GBPUSD

The EURUSD is mixed. The GBPUSD is lower ahead of the BOE rate decision later this week. The USDJPY is up and down and up again.

Read More »

Read More »