Category Archive: 4) FX Trends

The forex market reacts modestly to the better US data dump today

In this Forex technical currency report, we take a look at the EURUSD, USDJPY, and GBPUSD. The US dollar has rebounded a bit due to a better-than-expected data dump in the US. We analyze the movements of the EURUSD, USDJPY, and GBPUSD and what traders should be watching for in the coming days.

Read More »

Read More »

Poor US Data Cast Doubts on New Found Hopes of a Soft-Landing

Overview: Yesterday's string of dismal US economic

data delivered a material blow to those still thinking that a soft-landing was

possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad

economic news weighed on US stocks. The honeymoon of New Year may have ended

yesterday. The US 10-year yield fell below 3.40% for the first time since the

middle of last September. The Atlanta...

Read More »

Read More »

The US retail sales/PPI pushed the USD lower. What has that done to the bias/risk levels?

Stay ahead of the market with our in-depth analysis of the EURUSD, USDJPY, and GBPUSD. Learn about the impact of weaker US PPI and retail sales on the dollar, as well as key technical levels and biases for each currency pair. Discover the risks and next targets to watch.

Read More »

Read More »

The BOJ Surprises by Standing Pat

Overview: The BOJ defied speculation and stuck to its

current policy, which saw the yen sell-off sharply. The dollar rallied about

3.4 yen before falling back. The greenback is broadly lower against the other

G10 currencies. However, for the fifth consecutive session, the euro has

stalled around $1.0870. While UK headline inflation softened, mostly due to fuel,

core prices were unchanged, and this may have helped sterling extend its recent

gains to...

Read More »

Read More »

The morning forex technical report for January 17, 2023

In this video, we'll take a closer look at some of the major currency pairs such as EURUSD, USDJPY, GBPUSD and USDCAD.

This is the latest morning forex technical report for January 17, 2023.

We'll cover the levels that are currently in play, as well as the technical bias for each pair.

This report will provide valuable insights into the current market trends to help you make more informed decisions.

Read More »

Read More »

With Trepidation, the Market Awaits the BOJ

With the market nearly ruling out a 50 bp hike by the Federal Reserve on February 1, the interest rate adjustment appears to have largely run its course. This may be helping to ease the selling pressure on the greenback.

Read More »

Read More »

Bitcoin technical analysis @ ForexLive

In our previous video ( -Mek ), when BTC was at $16700, I called Bitcoin's upcoming rise and now we are over 27% above that in less than 2 weeks, a staggering rise.

Now BTC is dancing around $22,000 and I lay out a tripple resistance area, close to $23k (see video for more specifics, and you are also welcome to draw the lines and patterns shown, on your chart).

Watch the full analysis at...

Read More »

Read More »

Monday and Beyond

Monday Ranges: Euro: $1.0802-$1.0874JPY/$: JPY127.23-JPY128.87GBP: $1.2172-$1.2289CAD/$: CAD1.3353-CAD1.3418AUD: $0.6941-$0.7019MXN/$: MXN18.7313-MXN18.8566Rumors of an emergency BOJ meeting sent the dollar to its lows in Tokyo, slightly below the pre-weekend low (~JPY127.46). The on-the-run (most current) 10-year yield settled above the 0.50% cap and the generic 10-year bond has not traded below the 0.50% level since January 5. The market...

Read More »

Read More »

On Our Radar Screen for the Week Ahead

The week ahead is chock full of data, including Japan, the UK, and Australia's CPI. The UK and Australia report on the labor market. The US, UK, and Canada also report retail sales. The early Fed surveys from New York and Philadelphia for January will be released.

Read More »

Read More »

It is Friday the 13th. The morning forex technical report will help guide you through…

A technical look at the major currency pairs.

In the morning forex report, Greg Michalowski of Forexlive looks at the EURUSD, USDJPY, GBPUSD, and USDCAD to kickstart the Friday the 13th trading day.

Read More »

Read More »

Dollar Index Gives Back Half of 21-Month Gains in 3 1/2 Months

Overview: The continued easing of US price pressures

has strengthened the market's conviction that the Federal Reserve will further

slow the pace of rate hikes and that the terminal rate will be near 5.0%. The

decline in US rates has removed a key support for the US dollar, which has

fallen against all the G10 currencies this week. The Dollar Index has now retraced half of what it gained since bottoming on January 6, 2021. Meanwhile, there are...

Read More »

Read More »

Is it Too Easy to Think the Market Repeats its Reaction to a Soft US CPI?

The market expects a soft US CPI print today, which has recently been associated with risk-on moves. The US 10-year yield is holding slightly above 3.50%, the lowest end of the range since the middle of last month. The two-year yield is a little above 4.20%, also the lower end of its recent range. Most observers see the Federal Reserve slowing the pace of its hikes to a quarter point on February 1.

Read More »

Read More »

Tips on using the MACD indicator in technical analysis

See the tips at https://www.forexlive.com/Education/5-useful-tips-for-using-the-macd-indicator-in-technical-analysis/

Read More »

Read More »

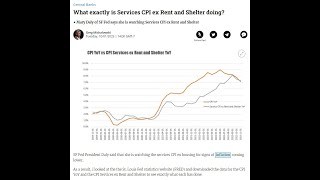

Get the day started by reviewing the major currency pairs from a technical perspective

The morning forex technical report for January 11, 2023.

The US CPI will be released at 8:30 AM ET tomorrow with the focus on things like the services CPI ex shelter as per Feds Daly. See post https://www.forexlive.com/centralbank/what-exactly-is-cpi-ex-rent-and-shelter-doing-20230110/ discussing that measure of inflation.

Additionally, Greg Michalowski of Forexlive looks at the technical levels driving the EURUSD, USDJPY, GBPUSD, USDCHF and...

Read More »

Read More »

Greenback Consolidates Near Recent Lows Ahead of Tomorrow’s US CPI

Overview: Fed Chair Powell did not push against the easing of US financial conditions when he ostensibly had an opportunity yesterday. This coupled with expectations of another decline in the US CPI, which will be reported tomorrow, has kept the greenback mostly consolidating the losses seen last Friday and Monday.

Read More »

Read More »

Kickstart your trading day. A technical look at the EURUSD, USDJPY, GBPUSD and USDCAD

Get a view from the technicals and the price action from Greg Michalowski of Forexlive.com.

Kickstart your day by watching the morning technical video. In this video, I review the EURUSD, USDJPY, GBPUSD and USDCAD to get the ball rolling.

Fed's Powell is speaking on a panel, but it will be the CPI data on Thursday which will be key event this week. Fed's Daly, told us yesterday that it is not only the CPI, but the service CPI ex housing which...

Read More »

Read More »

Consolidative Tone in FX

Overview: After sharp losses yesterday, the US dollar has stabilized today arguably ahead of Fed Chair Powell's speech at the Riksbank symposium. Yesterday's Fed speakers stuck to the hawkish rhetoric, and this seemed to help reverse the equity market gains, though the greenback remained soft.

Read More »

Read More »

Forex Quick Look: The GBPUSD is trading higher and away from 200 day MA level in the process

The GBPUSD is making a run to the upside in early NY trading and in doing so, is running away from the 200 day MA below. That has the buyers more in control. What next technically for the currency pair?

Read More »

Read More »

VIDEO: USDJPY finds sellers near the 50% retracement. What next?

A forex quick look at the USDJPY from a technical perspective. The USDJPY has seen a rotation lower in the first few hours of trading in the US session, and in the process, stayed below the 50% midpoint of the 2022 trading range at 132.70.

Read More »

Read More »

Greenback’s Sell-off may Stall Ahead of Powell Tomorrow

Overview: Don't fight the Fed went the manta as the

market took the US two-year yield back up to 4.50% in the aftermath of the FOMC

minutes last week, the highest in over a month. The minutes warned of a

premature easing of financial conditions. And then bam, softer than expected

hourly earnings and a weak service PMI and bonds and stocks rallied, and the

dollar was sold. This is a key part of the backdrop for this week, for which

several Fed...

Read More »

Read More »