Category Archive: 4) FX Trends

The US employment cost data gives the USD a shove to the downside in early NY trading

Hopes for lower inflation helps stocks recover as well and sends yields lower.

The better US employment cost data has helped to lower the dollar, send stocks higher and yields lower in early NY trading.

In the morning forex technical report, I take a look at the EURUSD, USDJPY, GBPUSD and the AUDUSD as they show the impact from the lower dollar after the data.

Read More »

Read More »

Position Adjustments at Month-End and Ahead of FOMC Outcome Lifts the Greeenback

Overview: A combination of month-end adjustments and

positioning ahead of the outcome of tomorrow's FOMC meeting has taken the shine

off equities and has helped lift the dollar. On the heels of yesterday's sharp

decline on Wall Street, several large markets in the Asia Pacific region,

including China's CSI 300, the Hang Seng, and both South Korea's Kospi and

Taiwan's Taiex fell by more than 1%. Although the eurozone eked out a small

expansion in Q4...

Read More »

Read More »

S&P 500 futures technical analysis, ES is correcting, watch 4000 and 3992 next.

The S&P 500 futures market, symbolized as ES, is undergoing a correction phase. In this video, we'll be taking a technical look at key price levels to watch, specifically the levels of 4000 and 3992. Stay informed and up-to-date on the current market trends with this analysis.

Read More »

Read More »

The forex markets are mostly consolidating as the new trading week begins

The Forex Market Update: EURUSD makes a run while GBPUSD, USDJPY, and USDCAD see mixed price action. In this morning's forex report, we take a technical look at EURUSD, USDJPY, GBPUSD, and USDCAD. The EURUSD is pushing upwards and is back above its 100-hour MA. Can it sustain this trend?

Read More »

Read More »

Anti-Climactic Return of China

Overview: The re-opening

of China's mainland market amid reports of strong activity during the holiday,

was relatively subdued. The CSI 300 rose less than 0.5% and the Shanghai

Composite eked out less than a 0.2% gain. The 0.5% gain in the yuan was largely

in line with the performance of the offshore yuan. Indeed, it seems like a bit

like "buy the rumor sell the fact" type of activity as Hong Kong's

Hang Seng tumbled 2.75%, to give back...

Read More »

Read More »

Week Ahead Alchemy: Can Powell Turn a Quarter-Point Move into a Hawkish Hike?

The new year is still

young, but the week ahead may be one of the most important weeks of

the year. The divergence that the market has been anticipating will

materialize. The Federal Reserve will most likely hike by 25 bp on Wednesday,

followed by half-point moves by the European Central Bank and the Bank of

England the following day. On Friday, February 3, the US will report its

January employment situation. It could be the slowest job creation...

Read More »

Read More »

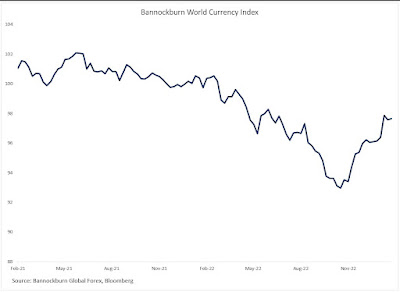

Bannockburn World Currency Index Recoups 50% of Loss since June 2021 High, with Golden Cross

The Bannockburn’s World Currency Index (BWCI) is a

GDP-weighted currency basket representing the currencies of the top 12

economies, with the eurozone counted as one.

The US is the world’s largest economy and the dollar’s share

of the index is almost 31%. China is the second-largest economy and has a

nearly 22% weight.

The euro is next with a 19% weight, followed by Japan with

about a 7.5% weight. After that, the weights drop off to less than 5%...

Read More »

Read More »

Subdued Ending to a Quiet Week, Ahead of Next Week’s Fireworks

Overview: Leaving aside the Australian dollar, which

is benefiting from the optimism over China's re-opening and a reassessment of

the trajectory of monetary policy after a stronger than expected inflation

report, the other G10 currencies traded quietly this week and are +/- less than

0.5%. The risk-on honeymoon to start the year remains intact. The MSCI Asia

Pacific Index has risen every day this week and index of mainland shares that

trade in...

Read More »

Read More »

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

An eye opening forecast for the stock market in 2023 aided by volume profile analysis @ForexLive.com

Learn about the powerful technique of Volume Profile and how it can give you insight into the market's future direction. See how @Forexlive expert Itai Levitan uses it to predict the stock market by identifying key levels of support and resistance. Understand how volume activity at different price levels can indicate market sentiment and potential price movements.

Don't miss out on this valuable information and visit ForexLive.com for more...

Read More »

Read More »

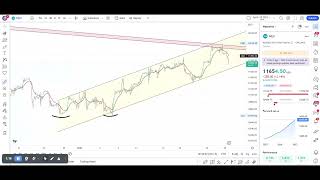

Nasdaq technical analysis for 26 Jan 2023

The market reaction to Tesla's earnings release will be closely watched today. See how Nasdaq futures respond and if the uptrend is sustained. Learn about key resistance zones and what it means for bulls and bears.

Stay informed with expert analysis on ForexLive.com

Read More »

Read More »

Nasdaq technical analysis with the bearish MSFT earnings reversal

Learn how to spot key technical levels and potential bearish patterns in the market. Watch the video to see the next junctions to watch and the importance of the EMA20 on the daily chart. Stay ahead of the market with expert analysis.

Read More »

Read More »

The Bank of Canada rate decision is the key event today. All you need to know to be prepared.

Get ahead of the game with the latest market insights for the Bank of Canada's rate decision. Tune in to find out what's expected, potential surprises, and key technical levels to watch. Plus, a quick look at the EURUSD and USDJPY to start your trading day off right. Don't miss out, watch now!

Read More »

Read More »

Bank of Canada may say Pause, but the Market Hears Finished

Overview: Amid sharp losses in the US equity futures, the US dollar is mostly firmer against the G10 currencies. The notable exception is the Australian dollar, where high-than-expected inflation boosts the risk of a more aggressive central bank.

Read More »

Read More »

Nasdaq futures update after MSFT reversed in afterhours. Bears have the ball now. Next target is….

Learn about the impact of Microsoft's cloud business forecast on the stock market and how it affected the index. See how the stock trended during after-hours and what key levels to watch for. Don't miss out on expert analysis and stay informed with the latest market updates.

Read More »

Read More »

ES, S&P 500 Futures, post MSFT earnings, what’s next?

Stay ahead of the game with the latest update on MSFT's post-market performance and what it means for the ES index. Get expert insights and analysis on the impact of Microsoft's earnings report. Tune in now and visit ForexLive.com for more perspectives.

Read More »

Read More »

The EURUSD is trying to stay in the “Red Box”. This technical story &more in the AM video.

In this morning's technical forex report, we take a closer look at the EURUSD and its attempts to remain within a key "Red Box" level. We also analyze the USDJPY, GBPUSD, and USDCHF and their current trends.

Join us as we delve into the latest market movements and what they could mean for your trades.

Read More »

Read More »

No Follow-Through Euro Buying while S&P Holds Yesterday’s Breakout

Overview: A quiet consolidative session has been recorded

so far today as North American leadership is awaited. The preliminary PMI

readings are mixed. Japan and the eurozone look somewhat better, but Australia

and the UK disappointed. The dollar is trading with a mostly firmer bias,

but largely confined to yesterday's ranges. The markets seem to be looked

ahead toward next week's Fed, ECB, and BOE meetings, and the return of China

from this...

Read More »

Read More »

Done with the Nasdaq Bear Market for Good? Watch this Strong Technical Hint

Are you tired of the Nasdaq bear market? Want to know when it's time to make a move? Watch this video to learn about a powerful technical hint that may indicate a market attitude shift.

Weekly candle charts in technical analysis can reveal key support and resistance levels, patterns, and successive candles that can assist traders in making better decisions. Don't miss this opportunity to improve your profit potential.

Watch now!

Read More »

Read More »