Category Archive: 4) FX Trends

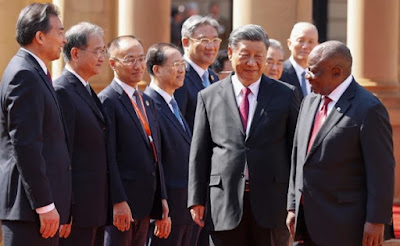

BRICS to Expand a Little, USD Steadies after Yesterday’s Retreat, Attention Turns to Jackson Hole

Overview: Strong Nvidia's earnings after the US

markets closed yesterday helped lift Asia Pacific markets today. All the large

bourses were higher but India. Hong Kong, South Korea, and Taiwan indices rose

more than 1%. Europe's Stoxx 600 is higher for the fourth consecutive session

and US index futures are higher, led by the NASDAQ. European benchmark bond

yields have extended yesterday's PMI-induced decline and are mostly 1-2 bp

lower. The...

Read More »

Read More »

Dow Jones Technical Analysis

Here's a quick technical analysis on the Dow Jones with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

The USDCHF falls to moving averages support on the 4 hour chart and is stalling.What next?

Looking at the USDCHF, the 100 bar moving average on the 4-hour chart comes in at 0.8771. That level is so far holding support, and remains a key barometer for buyers and sellers in the short term..

Read More »

Read More »

USDCAD moves higher after Canadian retail sales data. What are the charts telling traders nOw?

Canadian core retail sales weaker than expectations sends the USDCAD higher on the day and above a swing area between 1.3564 and 1.3585. Buyers making a play.

Read More »

Read More »

Euro and Sterling Slump on Poor PMI

Overview: Poor European flash PMI pushed on open

door, giving the market a new reason to do what it was doing and that buying the

dollar. The euro has approached important support around $1.08 and sterling is

approaching the lower end of its two-cent trading range (~$1.26-$1.28). The

greenback is consolidating against the yen and holding above JPY145. The

Chinese yuan is little changed while the Mexican peso is extending yesterday's

gains. Despite...

Read More »

Read More »

WTI Crude Oil Technical Analysis

Here's a quick technical analysis on WTI Crude Oil with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

NVIDIA: A technical look at Nvidia as the market gears up for key earnings tomorrow

Nvidia shares are lower today after trading to a new all time high earlier in the session. What key levels will be in play through the earnings release tomorrow?

Read More »

Read More »

A technical look at the USDCAD, AUDUSD and NZDUSD for the US trading session.

The technicals that are driving the commodity currency pairs on August 22, 2023. Including is a look at the USDCAD, AUDUSD and the NZDUSD.

Read More »

Read More »

Dollar Eases, Stocks and Bonds Advance

Overview: For the first time in more than a week,

North American dealers will take to their posts with the dollar softer against

all the G10 and most of the emerging market currencies. Despite stepped up

efforts by Chinese officials and a firmer yen, the yuan remains on the

defensive and is one of the handful of emerging market currencies softer on the

day. Stocks and bonds are mostly higher too. The yuan might not be benefitting

from a softer...

Read More »

Read More »

EURUSD Technical Analysis

Here's a quick technical analysis on EURUSD with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

S&P index trades above and below unchanged today

The low price in the S&P index today took the index down -9.42 points. The high price took the index up 25.88 points

Read More »

Read More »

EURUSD buyers and sellers taking their shots and missing. What next?

Buyers above the 100 hour MA failed. Sellers on the move back below the 100 hour MA failed too. What next?

Read More »

Read More »

The sellers are in control in spot gold. Can sellers keep control going forward?

What levels are key for both the sellers and buyers in spot gold now? Sellers are in more control.

Read More »

Read More »