Category Archive: 4) FX Trends

The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

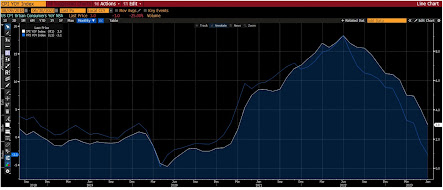

Overview: The deluge of Treasury supply is nearly

over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year

bonds to finish the quarterly refunding. The sales will come after the July CPI

print that is expected to see the first year-over-year increase since last June.

The market is going into the report with about a 15% chance of a Fed hike next

month discounted. Meanwhile, September crude oil extended its recover from $80

seen...

Read More »

Read More »

EURJPY pushes against ceiling area. Key area for both buyers and sellers in the pair.

Join us as we delve into the intriguing movements of the EURJPY, which is currently testing a critical ceiling area spanning from 157.90 to 158.046. This week's price action has brought the pair closer to this significant resistance, raising questions about a potential breakout. Discover the historical context of this level and its implications for traders. We explore scenarios for both bullish and bearish outcomes, shedding light on the dynamics...

Read More »

Read More »

AUDUSD sellers in control. Find out why in this technical video analysis.

Dive into the dynamics of the AUDUSD as sellers approach August lows and grapple with a significant daily chart swing area dating back to September 2022. Join us as we dissect the factors influencing the bearish bias and explore the potential catalysts that could impact the currency pair's future direction. Uncover the critical levels to watch and gain valuable insights into the evolving market sentiment.

Read More »

Read More »

The GBPUSD bias is more bearish short term, but more bullish long term. What next and why?

Join us as we dissect the intricate relationship between the upcoming US CPI report and its influence on GBPUSD. Delve into the contrasting short-term bearish bias and the technically bullish stance on the daily chart. Discover the crucial levels that will shape the market's future direction and gain insights into potential trading opportunities that lie ahead.

Read More »

Read More »

It is time to get ready for the US CPI. What levels are key for the EURUSD?

Join us for an insightful analysis of the ongoing battle between buyers and sellers as the current price action toggles above and below the critical 100/200 hour Moving Averages (MAs). Gain valuable insights into the dynamics at play and uncover potential trading opportunities in this intriguing market scenario.

Read More »

Read More »

USDJPY ticks to a new high and moves away from a key swing area in the process

Explore the USDJPY's impressive 3-day consecutive rise and its potential implications in this comprehensive analysis. Discover how the price has surged above a critical swing area ranging from 143.44 to 143.54, establishing a new risk level for traders. Staying above this level could signal a more bullish sentiment, while a move below may trigger a downside retracement following the break.

In anticipation of the upcoming US CPI release, where...

Read More »

Read More »

After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well

received, with the three-year note being scooped up by investors, driving the

yield below it was trading in the when-issued market. Today, the Treasury sells

$38 bln 10-year notes, whose auctions have been less than stellar recently. The

US 10-year yield reached 4.20% last week and is now straddling 4%. Italian

bonds are also firm as the Italian government clarifies the

new tax on banks' windfall...

Read More »

Read More »

WTI Crude Oil Technical Analysis

Here's a quick technical analysis on WTI Crude Oil with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

AUDUSD sellers are more in control. Close risk is the 61.8% on daily and 100 hour MA

Uncover the crucial levels shaping the AUDUSD's trading landscape in this insightful analysis. Learn how the 61.8% Fibonacci retracement of the range from the 2022 low, located at 0.65468, and the 100-hour moving average at 0.6552 play a pivotal role in influencing the AUDUSD's direction.

Stay tuned as we delve into the implications of staying below these levels, potentially leading to a more bearish sentiment for the AUDUSD.

Read More »

Read More »

GBPUSD trades between its 100 and 200 hour MAs.

Dive into the intricate dynamics of the GBPUSD trading pair in this comprehensive analysis. Explore the current situation where GBPUSD is positioned between its 100 and 200-hour moving averages, resulting in a neutral technical bias in the short term.

Read More »

Read More »

The USDJPY buyers need to break above 143.54 to increase the bullish bias. Watch to understand why.

Join us as we delve into the dynamics of the USDJPY trading pair. In this video, we analyze the crucial resistance level at 143.54 that USDJPY buyers need to breach to strengthen the bullish momentum. Discover the factors behind this pivotal point and gain insights into the potential impact on the pair's future price movements.

Read More »

Read More »

For the EURUSD in trading today it is above the 100 hour MA above and the 100 day MA below

Dive into the latest developments of the EURUSD trading pair with our comprehensive analysis. In today's trading session, the EURUSD is positioned above the 100-hour moving average (MA) and below the 100-day MA. While short-term sellers retain some influence, the focus remains on the critical 100-day MA as a potential turning point.

Read More »

Read More »

Risk Appetites Squashed by Weak Chinese Imports/Exports and Moody’s Downgrade of 10 US Banks

Overview: The combination

of falling Chinese imports and exports, Moody's downgrade of ten US small and

medium-sized banks is serving to squash risk appetites. Equities are weak, but

bond markets are strong despite the surprise tax on Italian banks announced

yesterday and the kick-off of the US $103 bln refunding today. Outside of Japan

and Australia, Asia Pacific equity markets were lower led by a 1.8% drop in the

Hang Seng and a nearly 2.2% loss...

Read More »

Read More »

EURUSD Technical Analysis

Here's a quick technical analysis on EURUSD with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Canada was on holiday on Monday but that did not stop the USDCAD from reaching a key level

While Canada observed a holiday on Monday, the USDCAD managed to reach a significant milestone by testing its 100-day moving average (MA). The currency pair encountered willing sellers at this crucial level, resulting in a price retreat. Now, the question arises: What lies ahead for the USDCAD?

In this analysis, we closely examine the USDCAD's price action, discuss the implications of the test of the 100-day MA, and explore potential scenarios for...

Read More »

Read More »

Forex quick look at the EURUSD, USDJPY, GBPUSD and AUDUSD to start the Asian session

As the Asian trading session begins, join us for a rapid yet insightful overview of key levels and trends in some major currency pairs. We focus on the EURUSD, USDJPY, GBPUSD, and AUDUSD, highlighting the technical levels that are poised to influence these currency pairs as they head into the new trading day.

In this quick analysis, we discuss support and resistance levels, potential breakout points, and market sentiment cues. Stay informed and...

Read More »

Read More »

Dollar Comes Back Bid

Overview: The US dollar is recovering today

after it was sold following the jobs report before the weekend. It is enjoying

a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring

best, while the Scandis are off close to 0.5%. Most emerging market currencies

are also softer, with only a few Asian currencies edging higher today,

including the South Korean won, Indian rupee, and Taiwanese dollar. With a

stronger dollar and...

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

AUDUSD buyers are making a play with a test of the 100 hour MA

The AUDUSD is currently experiencing a dynamic tug-of-war as buyers make a notable play by testing the 100-hour moving average (MA). The pivotal question arises: Can buyers successfully drive the price above the MA and maintain their position, or will sellers exert their influence and push the pair back lower?

In this analysis, we closely examine the ongoing battle between buyers and sellers in the AUDUSD, discuss the significance of the 100-hour...

Read More »

Read More »

The biggest mover to start the week is the USDCHF. What technical levels are in play?

Kicking off the trading week, the USDCHF takes the spotlight as one of the most significant movers. Presently, the currency pair is navigating between critical hourly moving average (MA) levels, shaping its price action dynamics.

In this analysis, we closely examine the USDCHF's performance, discuss the importance of the key hourly MA levels, and explore potential scenarios for the currency pair's movements as the week unfolds.

Stay informed and...

Read More »

Read More »