Category Archive: 4.) Marc to Market

Taper, No Tantrum

Overview: The market's reaction to the FOMC statement was going according to our script, with the dollar backing off on a buy rumor sell the fact type of activity until Powell provided an end date for the tapering (mid-2022) before providing a start date (maybe next month). This spurred a dollar rally.

Read More »

Read More »

What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%.

Read More »

Read More »

Ever Grand

Overview: Coming into yesterday's session, the S&P 500 had fallen in eight of the past ten sessions. It closed on its lows before the weekend and gapped. Nearly the stories in the press blamed China and the likely failure of one of its largest property developers, Evergrande.

Read More »

Read More »

Risk Appetites Didn’t Return from the Weekend

Overview: Investors' mood did not improve over the weekend, and the lack of risk appetites are rippling through the capital markets today. Equities have tumbled, yields have backed off, and the dollar is well bid. Hong Kong and Australia led the sell-off in the Asia Pacific region, off 3.3% and 2.1%, respectively.

Read More »

Read More »

The Dollar is Aided by Speculation of a Hawkish Fed, Will It Sell-off on the Fact or Disappointment?

The US dollar continued to trend higher last week, helped by the unexpectedly strong retail sales report. Despite disappointing August jobs growth and the moderation in consumer prices, the Fed has no compelling reason not to move forward with plans to taper before the end of the year.

Read More »

Read More »

FX Daily, September 15: China Disappoints, but the Yuan Remains Strong

The sixth decline of the S&P 500 in the past seven sessions set a negative tone for equity trading in the Asia Pacific region, and the poor Chinese data did not help matters. News that China's troubled Evergrande would miss next week's interest payment weighed on sentiment too.

Read More »

Read More »

Is it Really all about US CPI?

Overview: The markets are in a wait-and-see mode, it appears, ahead of the US CPI figures, as it absorbs bond supply from Europe and monitors the potential restructuring of China's Evergrande. A new storm may hit US oil and gas in the Gulf before recovering from the past storm and helping to underpin prices.

Read More »

Read More »

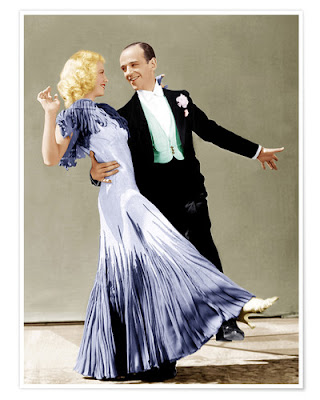

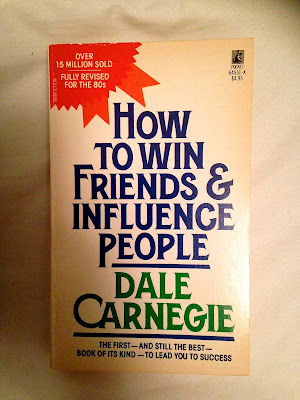

How (Not) to Win Friends and Influence People

Overview: There are two big themes in the capital markets today. The first is the ongoing push of the Chinese state into what was the private sector. Today's actions involve breaking Ant's lending arms into separate entities, with the state taking a stake. This weighed on Chinese shares and Hong Kong, where many are lists. On the other hand, Japanese markets extended their recent gains.

Read More »

Read More »

Don’t Resist the Dollar’s Pull Ahead of the FOMC Meeting

The US dollar enjoyed a firmer bias last week despite the disappointing jobs growth reported on September 3. The Norwegian krone was the only major currency that gained against the greenback. Brent was less than a quarter of a dollar firmer, so the likelihood of the central bank raising rates later this month offers a more compelling explanation.

Read More »

Read More »

Don’t Make a Fetish Out of What may be a Minor Change in the Pace of ECB Bond Buying

Overview: Yesterday's retreat in US indices was part of and helped further this bout of profit-taking. The MSCI Asia Pacific Index ended an eight-day advance yesterday and fell further today. Japanese indices, which had set multiyear highs, fell for the first time in nine sessions. Hong Kong led the regional slide with a 2.3% decline as China's crackdown on the gaming industry continued.

Read More »

Read More »

The Greenback Continues to Claw Back Recent Losses

Overview: The US dollar continues to pare its recent losses and is firm against most major currencies in what has the feel of a risk-off day. The other funding currencies, yen and Swiss franc, are steady, while the euro is heavy but holding up better than the Scandis and dollar-bloc currencies. Emerging market currencies are also lower, and the JP Morgan EM FX index is off for the third consecutive session.

Read More »

Read More »

Risk Appetites Return from Holiday

Overview: After an ugly week, market participants have returned with strong risk appetites. Equities are rebounding, and the greenback is paring recent gains. Bond yields are firm, as are commodities. Asia Pacific equities got the ball rolling with more than 1% gains in several large markets, including Japan, China, Hong Kong, and Taiwan.

Read More »

Read More »

Consolidative Mood Grips Markets

Overview: The dollar is consolidating yesterday's advance and is confined to fairly narrow ranges in quiet turnover. Most of the major currencies are within 0.1% of yesterday's close near midday in Europe. The $1.1700-level held in the euro.

Read More »

Read More »

FX Daily, August 17: Antipodeans and Sterling Bear Brunt of Greenback’s Gains

Overview: Concern about the economic impact of the virus and new efforts by China to curb "unfair" competition among online companies has triggered a dramatic response by investors. A lockdown in New Zealand and the Reserve Bank of Australia signaling it will respond if the economic fallout increases sent the Antipodean currencies sharply lower.

Read More »

Read More »

Dollar Rally Stalls on Softening Rates and Dramatic Drop in Consumer Confidence

Profit-taking on long dollar positions was seen ahead of the weekend. The yield on the December 2022 Eurodollar futures slipped to finish unchanged on the week that saw CPI and PPI reports.

Read More »

Read More »

Markets Look for Direction, Currencies in Narrow Ranges

Overview: The global capital markets are subdued today as investors wrestle with the rising virus, the shifting stance of several central banks, and a more tense geopolitical backdrop. Equity markets are struggling today.

Read More »

Read More »

Rising Rates Underpin the Greenback

Overview: The US dollar remains firm ahead of the July CPI release, and even though Chicago Fed Evans demurred from the hawkish talk, the market is getting more comfortable with the idea of a rate hike next year.

Read More »

Read More »

Gold’s Flash Crash and Limited Follow-Through Greenback Gains

Overview: A flash crash saw gold drop more than $70 an ounce in early Asia. Silver was dragged lower too. The precious metals have stabilized at lower levels, but it signals a rough adjustment to a higher interest rate environment as a hawkish BOE and strong US employment data suggest peak monetary stimulus is at hand.

Read More »

Read More »

The Greenback Reversed Higher in the Middle of Last Week and the Jobs Data Provided an Accelerant

The second consecutive monthly surge in US non-farm payrolls of more than 900k ensured that the five-week decline in the 10-year yield was over and sent the dollar to new highs for the week against most of the major currencies.

Read More »

Read More »

US Employment Data is Important but for the Millionth Time, Don’t Exaggerate It

Overview: Record high closes yesterday for the S&P 500 and NASDAQ have done little to help global equities today. Most of the Asia Pacific region markets, but Japan and Australia slipped ahead of the weekend while still holding on to gains for the week.

Read More »

Read More »