Category Archive: 4.) Marc to Market

FX Daily, June 1: Swiss SVME PMI strongest PMI

The Swiss SVME PMI was the strongest PMI in this data release. It is driven by machinery and electronics industry. They strongly compete with the Germans, and got shocked by the end of the peg.

Surprisingly they have outperformed in recent months.

Read More »

Read More »

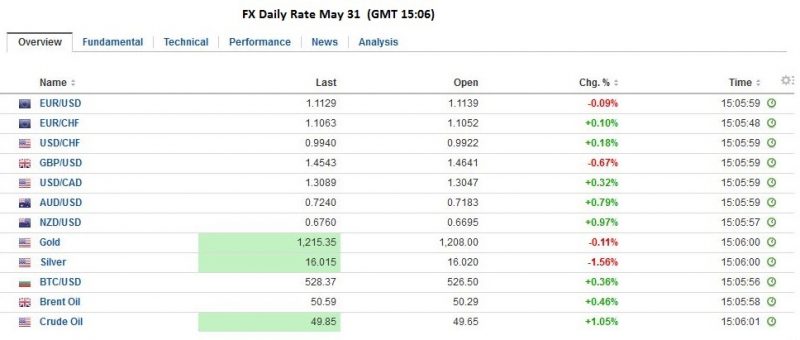

FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data...

Read More »

Read More »

FX Weekly Preview

The US dollar bottomed against nearly all the major currencies on May 3. The hawkish April FOMC minutes that began swaying opinion about the prospects for a summer rate hike were not published until two weeks later, and the confirmation by NY Fed President Dudley was not until May 19. Nevertheless, the shift in expectations for …

Read More »

Read More »

Weekly Speculative Positions: Speculators Slash Yen and Aussie Longs, Net CHF nearly unchanged

Speculators remain Long CHF against USD. The figure is nearly unchanged at 4.0 k CHF contracts. For CHF, both shorts and longs increased.

This weeks major change was in the yen and in AUD. Speculators strongly reduced their longs.

Read More »

Read More »

FX Review May23 to May28: Dollar Set to Snap Three-Month Decline

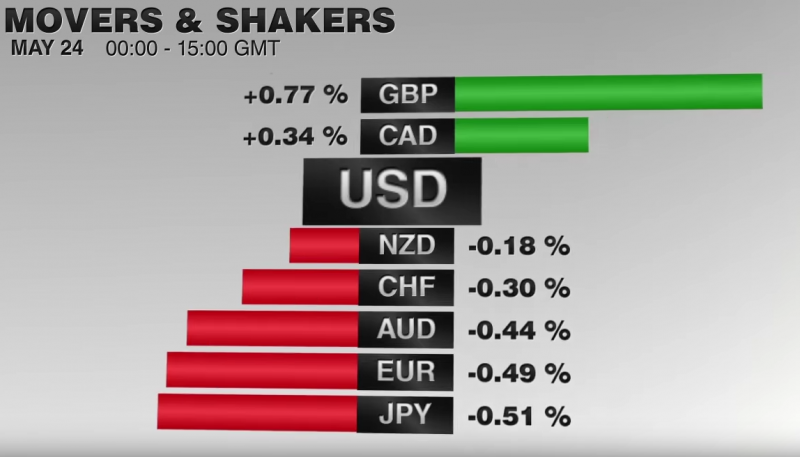

Many linked sterling's outperformance (+0.8%) to a growing sense that the UK will vote to remain in the EU, despite angst reflected in the elevated cost of insurance (one-month options). The Canadian dollar (+0.7%) was helped by oil's flirtation wit...

Read More »

Read More »

First Skirmishes in Long Battle

For various reasons, well beyond the scope of this short note, China has amassed huge industrial capacity, well beyond its ability to absorb. In part, that is one of the challenges that the “One Belt One Road” addresses. Export the spare capacity by building infrastructure, networking east and central Asia (included parts of the former …

Read More »

Read More »

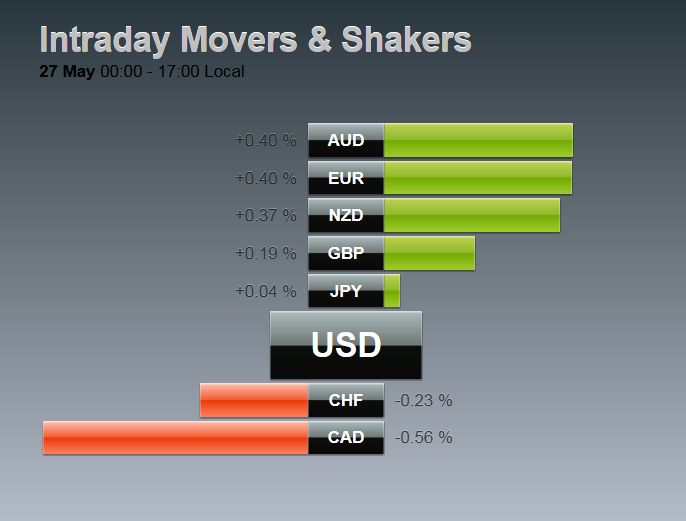

FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday's ranges while sterling and the Canadian dollar pushing through yesterday's lows.

Asian ...

Read More »

Read More »

Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account.

It can be a store of value, but the price fluctuates compared with other form...

Read More »

Read More »

G7 Summit: Risk of a Global Crisis, Maritime Disputes and the Dollar

The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the … Continue...

Read More »

Read More »

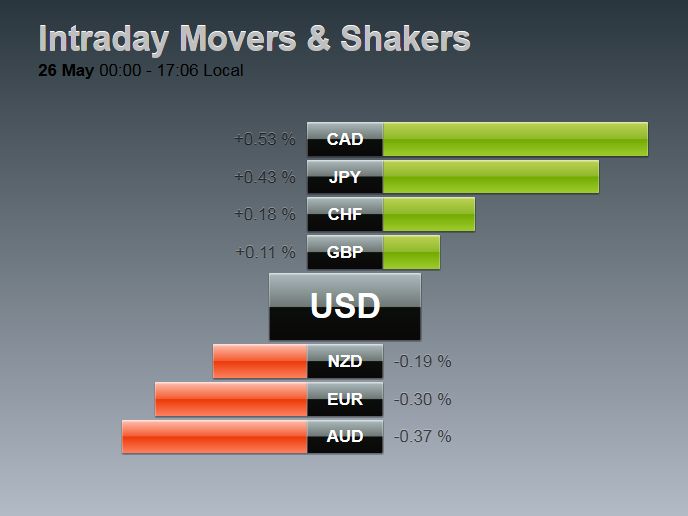

FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the …

Read More »

Read More »

What the Greek Deal Does and Does Not Do

For investors, the most important thing about the successful review of Greece’s implementation of last year’s agreement is that it effectively removes it from the list of potential disruptive factors in the coming quarters. There will be no repeat of last year’s drama. Assuming Greece resolves a few outstanding issues in the next few days, …

Read More »

Read More »

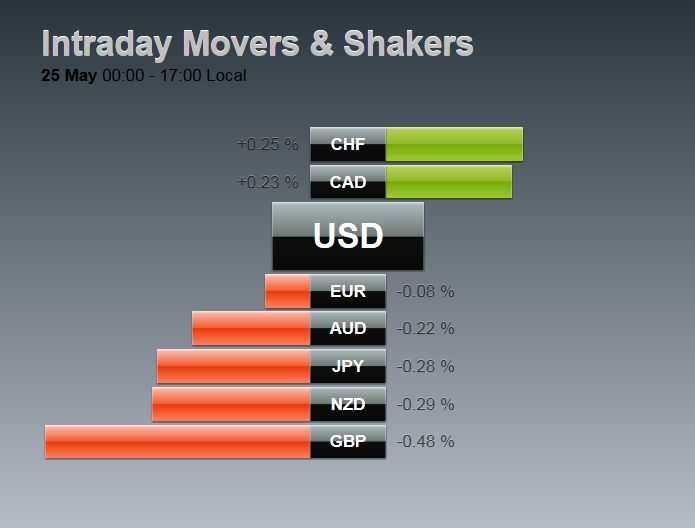

FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds …

Read More »

Read More »

The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that …

Read More »

Read More »

LIBOR Alternatives Taking Shape

Since the LIBOR scandal erupted, US officials have been working toward an alternative benchmark. In 2014, the Fed set up a working committee that includes more than a dozen large banks and regulators Before the weekend the committee (Alternative Reference Rates Committee) proposed two possible replacements for LIBOR. There reportedly was some consideration of …

Read More »

Read More »

FX Daily, May 24: Dollar Regains Momentum, Sterling Resists

The US dollar lost momentum yesterday but has regained it today. The euro has been pushed through last week's lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday te...

Read More »

Read More »

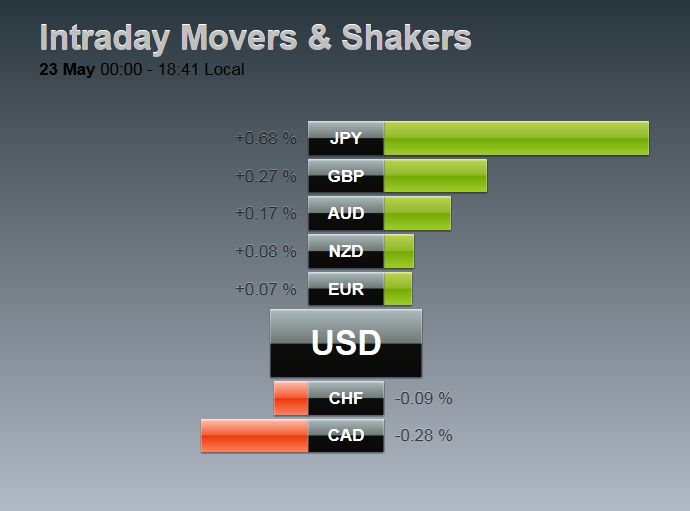

Great Graphic: Dollar Pushes Back Below JPY110

The yen is the strongest of the major currencies. It has gained about 0.65% against the dollar. It has been grinding lower throughout the Asian and European session and has remained in narrow ranges near its highs in the US morning. Japan still seems isolated in terms of it desire to intervene. Ahead of the … Continue reading...

Read More »

Read More »

Cool Video: Bloomberg Surveillance: Dollar to trend higher

Returning from a two-week business trip to Asia, I was invited to appear on Bloomberg Surveillance with Tom Keene and Francine Lacqua. Check out the video clip here. Key Points My key points include,the driver now is changing perceptions of the trajectory of Fed policy and the reemergence of divergence. I suggest that “real news” …

Read More »

Read More »

FX Daily May 23

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week.

The US dollar is...

Read More »

Read More »

FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning.

Read More »

Read More »

Sentiment Shift Evident in Speculative Adjustment in Currency Futures

Speculative positioning in the currency futures began to adjust before the latest signals from the Federal Reserve about the prospects for a summer hike and the widening of interest rate differentials. In the CFTC reporting week ending May 17, the day before the FOMC minutes were released speculators mostly reduced gross long currency positions and added …

Read More »

Read More »