Category Archive: 4.) Marc to Market

Great Graphic: UK Referendum–Turnout it Key

Younger age cohorts in the UK are more inclined to vote to stay in the EU than their elders. However, some suggested that this consideration is blunted by the fact that the younger people are less likely to vote.

Read More »

Read More »

European Politics Beyond the UK Referendum

Sterling is hovering around seven cents above last week’s lows as many short-term participants better position themselves for the UK to vote to say in the EU, even though many opinion polls show a statistical dead heat. The German Constitutional Court dismissed claims that the ECB’s Outright Market Transactions does not violate the German Constitution. …

Read More »

Read More »

Great Graphic: Age and Brexit

The betting and events markets have shifted more decisively than the polls in favor of the UK to remain in the EU. Sterling extended its rally from $1.4010 last Thursday to nearly $1.4785 today, as the market participants adjust positions. What is particular striking is that the asymmetrical perceptions of the personal impact of a … Continue...

Read More »

Read More »

If Sterling has Not Peaked, It has Come Pretty Close

Today's sterling rally is the largest since 2008.

The rally began with the murder of UK MP Cox.

Risk-reward favors a near-term pullback.

Read More »

Read More »

Bullard’s New Paradigm and the Federal Reserve

There is much to like in Bullard's new paradigm.

The problem is that it does not reflect the Federal Reserve's view or approach.

Policy emanates from the Fed's leadership, but be confused by the noise.

Read More »

Read More »

FX Weekly Preview: It is All about Europe

Major data this week:

German Constitutional Court ruling on OMT.

UK referendum.

EMU flash PMI.

ECB TLTRO II launch.

Yellen testifies before Congress, RBI Rajan to step down in early Sept.

Read More »

Read More »

Weekly Speculative Postion: After Jo Cox Speculators Bought Sterling Futures with Both Hands

In the days ahead of the murder of Jo Cox, a UK member of parliament, apparently for her support for remaining in the EU, speculators in the futures market scooped up sterling. While last week, speculators took long dollar positions against CHF, this barometer shifted this week towards long CHF.

Read More »

Read More »

FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal

and political tragedy. Her needless death provided an inflection

point. The suspension of the referendum campaigns and a steady stream of reports and speech...

Read More »

Read More »

How Germany Could Upset Europe before UK Referendum

The assassination of the Jo Cox has broken the powerful momentum in the markets. Investors recognize that the tragedy potentially injects a new element into consideration for the outcome of next week’s referendum. The campaigns will be resume over the weekend, and new polls will be available. Investors will place more weight on polls conducted …

Read More »

Read More »

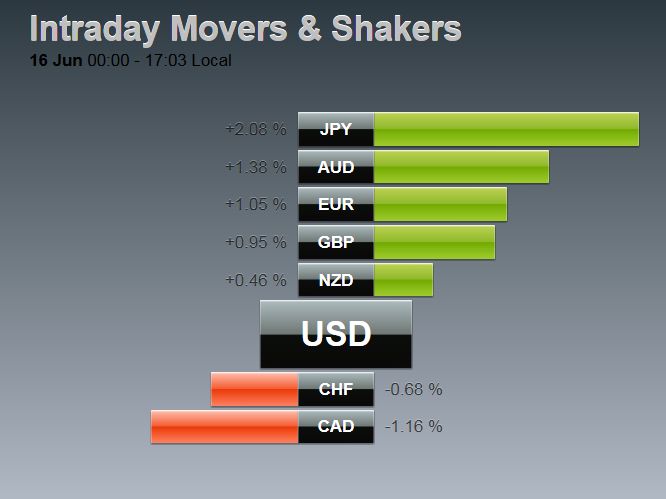

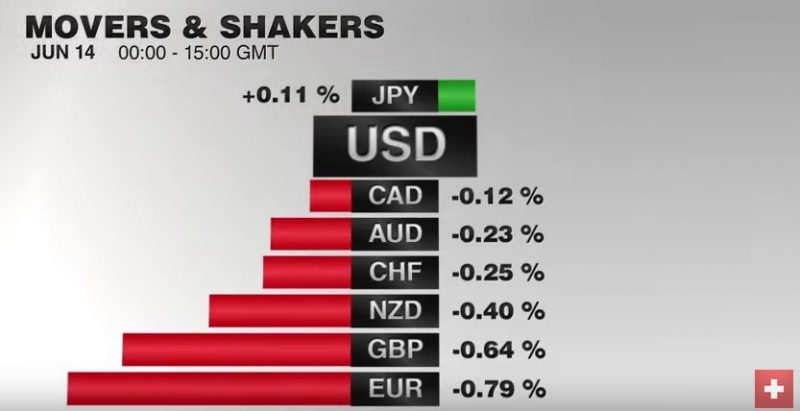

FX Daily, June 16: Markets are Anxious, Yen Soars

The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The...

Read More »

Read More »

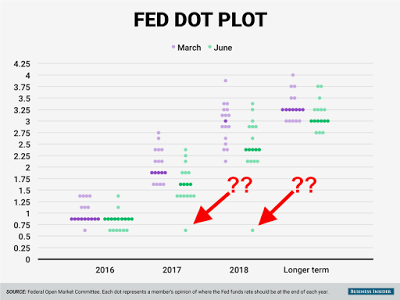

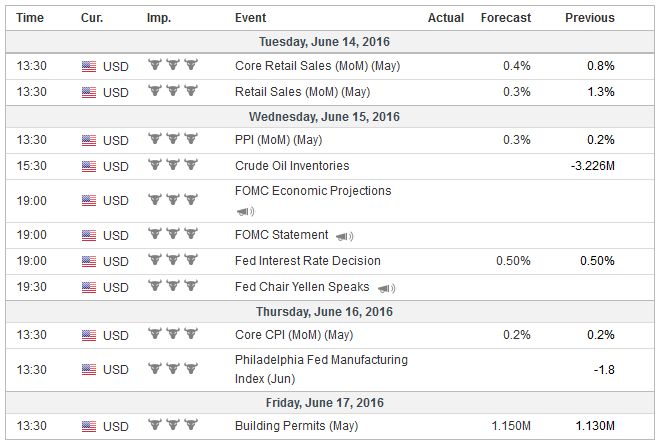

Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely …

Read More »

Read More »

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

Fed Softens Stance Slightly

The immediate reaction was driven by the Fed's dot plots. Although the median continues to expect two hikes this year, six officials now see only one hike. Only one official anticipated one hike this year in the last forecasts made in March. The m...

Read More »

Read More »

Kuroda and the BOJ

Following today's FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow.

The SNB will keep its powder dry to be able to respond to the results of the UK

referendum if needed. The Bank of England is als...

Read More »

Read More »

FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

"The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%". A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain.

Read More »

Read More »

Great Graphic: Oil Flirts with Four-Month Uptrend

The broader technical tone has weakened. The RSI has turned lower. The MACDs are also turning lower with a bearish divergence. The five-day moving average may move below the 20-day moving average for the first time since mid-April later this week....

Read More »

Read More »

US Election Infographic

This infographic was in the Wall Street Journal on the US election. It is important to remember that the US does not elect the President by direct popular vote. This makes the national polls a bit misleading. There are 538 electoral college votes. To be elected a candidate must secure a majority or 270 electoral … Continue reading...

Read More »

Read More »

FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. FX Rates The risk that the UK votes to leave the EU next … Continue reading »

Read More »

Read More »

Democratic Deficit: Is the UK Referendum the Tip of the Iceberg?

One of the most profound criticisms of the EU that it remains, even at

this late date, primarily an elite

project. The democratic deficit has grown, according to the latest

Pew Research multi-country poll.

The Pew Research sur...

Read More »

Read More »

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »