Category Archive: 4.) Marc to Market

Yen Slumps on Cautious BOJ

Overview: The market took a dovish message away from

the Bank of Japan and sent the dollar above JPY136, its best level since March

10 and spurred a sharp rally in JGBs. Japanese equities led the rally among the

Asia Pacific markets. Europe has not been able to follow suit. It disappointed

with Q1 GDP (0.1% rather than 0.2%). The Stoxx 600 is of about 0.3%, leaving it

off about 1.3% this week, its first weekly loss since the middle of March. US...

Read More »

Read More »

Markets Becalmed Ahead of Key Data and BOJ Meeting Outcome

Overview: Some regional bank earnings were weighing

on investor sentiment but reports that the FDIC is running out of patience with

First Republic Bank to strike a private deal and could decide to downgrade its

assessment. This could lead to limits on its ability to use the Fed's emergency

facilities. Other reports said that the bank's advisers are securing

commitments to buy a new stock as part of a broader restructuring. Still, while

the KBW bank...

Read More »

Read More »

Bank Stress Hobbles the Dollar, while Dissents Make the 50 bp Hike by Sweden less than Hawkish

Overview: The re-emergence of bank stress

reverberated through the US markets yesterday, downgrading the perceived

chances of a Fed hike next week and sending the US 2-year yield sharply lower. The

yield settled 13 bp lower, the largest drop in three weeks. The risk-off sent

the US dollar higher against most of the major and emerging market currencies. Follow-through

US dollar gains today has been mostly limited to the Australian dollar, where...

Read More »

Read More »

Risk-Off Mood Dominates

Overview: Perhaps it was the extent of First Republic

Bank's loss of deposits that were reported with earnings yesterday, but risk

appetites dried up today. Asia Pacific equities were trounced outside Japan

today. Hong Kong and mainland shares that trade there set the tone today

falling 1.7%-1.9%. China's CSI 300 fell for the fifth consecutive session. Taiwan

and South Korean markets fell more 1.4%-1.6%. Europe's Stoxx 600 is off almost

0.5%,...

Read More »

Read More »

Yen: Short Overview

The yen is off about 1% this month to bring the year-to-date

decline to about 2.4%. It fell by 12.2% in 2022 and 10.3% in 2021. The yen

rallied against the dollar for the five preceding years. Over that five-year

period the dollar fell from around JPY124 to JPY99, but it was all done in H1

16, and after a rally at the end of 2016 and very early 2017 (to about

JPY118.65), the dollar ground down around JPY101.

This year’s dollar low was set in...

Read More »

Read More »

The Dollar Begins New Week mostly Softer

Overview: The dollar is mostly lower, led by the Swiss

franc and euro. However, despite softer US rates and a victory for the LDP in

local Japanese elections, the yen is trading with a softer bias. Japanese

stocks recovered from the pre-weekend profit-taking seen after the Nikkei make

new highs for the year. Most other large bourses in the region except Taiwan

and India also moved lower. Note that China's CSI 300 fell for the fourth

consecutive...

Read More »

Read More »

Ueda Chairs First BOJ Meeting, and US and EMU Provide First Estimate of Q1 GDP: The Week Ahead

As

April draws to a close, the systemic stress in the banking sector continues to

subside, and the market is turning its attention to likely rate hikes by

Federal Reserve and European Central Bank in early May. Although, as in March,

the market sees the May hike to 5.25% to be the last Fed hike. Before the bank

stress, the swap market had been leaning to a 5.75% terminal rate. It is still

early to fully appreciate the magnitude and duration of the...

Read More »

Read More »

Equities Retreat while the Dollar is Confined to Narrow Ranges

Overview: Equities are mostly lower, while bonds have risen. The

dollar is trading in narrow ranges and mixed against the G10 currencies and

emerging markets. Most Asian bourses were lower. The Nikkei (though not the

Topix) and Hong Kong were the chief exceptions. Europe's Stoxx 600 is off for

the second consecutive day, in what looks like the first back-to-back loss

since early this month. US equity futures are lower, with the NASDAQ, which

eked...

Read More »

Read More »

The Dollar Comes Back Bid

Overview: It has taken some time, but the dollar has

found better traction. It traded above JPY135 for the first time since

mid-March and yesterday's setback has been mostly recouped against the other

G10 currencies. Sterling is the most resilient after higher-than-expected

inflation. Equities are lower. Japan's Nikkei snapped an eight-day advance and

most of the other large bourses in the region (except Australia and South

Korea) fell. Europe's...

Read More »

Read More »

Dollar Pares Gains but is Poised to Recover in North America

Overview: A rise in US yields, with the

two-year Treasury closing yesterday at its best level in more than three weeks

help fuel follow-through dollar buying yesterday after an upside reversal at

the end of last week. Key levels were approached, like $1.09 in the euro,

$1.2345 in sterling, and JPY135 held, and the dollar has consolidated in Asia

and Europe. The euro and sterling recouped around half of the losses seen from

the Friday's high to...

Read More »

Read More »

Firm US Dollar as Market is Feeling More Comfortable with May Hike

Overview: The dollar fell most of last week

but reversed higher before the weekend. It has seen some follow-through gains,

albeit limited against most of the G10 currencies today. Despite some seemingly

dovish comments by a few Fed officials last week, the Fed funds futures is

pricing in the greatest chance for a hike at the early May meeting since the

banking stress erupted last month. The greenback is also trading with a firmer

bias against most...

Read More »

Read More »

The Dollar Bounces but is it Sustainable? The Week Ahead

Investors and businesses are

wrestling with conflicting impulses. On the one hand, economic growth seems

sufficiently strong to allow the Federal Reserve, European Central Bank, and

the Bank of England to continue to counter elevated price pressures. They are

set to hike rates next month. On the other hand, last month's banking stress is

seen translating to a lower and sooner peak in policy rates.

Before the bank stress emerged, the

market had...

Read More »

Read More »

Hawkish ECB Comments Boost Risk of a 50 bp Hike Next Month

Overview: The 0.5% decline in US March producer

prices pushed on the door opened by the softer-than-expected CPI on Wednesday.

The Fed funds futures market sees the year end rate to a 4.33%, while still

pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled

to new lows for the year against the euro, sterling, and Swiss franc. The

Dollar Index made a new low for the year today, a few hundredths of an index

point below the low...

Read More »

Read More »

US Dollar Slumps and China Surprises with Twice the Expected Trade Surplus

Overview: The market took US short-term rates and

the dollar lower after the CPI data, which was largely in line with

expectations. On the one hand, the odds of a quarter-point hike next month

increased slightly (73.6% vs. 71.6%) to 5.25%, but it reinforced that sense

that it is last hike and that the Fed will unwind this hike and more before the

end of the year. The year-end implied policy rate fell by about six basis points to

4.33%. The dollar...

Read More »

Read More »

US CPI is Unlikely to Tell Us Anything We Don’t Already Know

Overview: Today's highlight is the March US

CPI, and while everyone is talking about it, it is unlikely to tell us anything

we do not already know. Headline price pressures are easing but the core rate

is sticky, and despite comments from the Chicago Fed president about the need

for patience, the odds of a hike next month have crept up. Understanding the

Fed's reaction function, it seems clear that for most officials, inflation is

remains too high...

Read More »

Read More »

Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites

have returned. Equities and yields are mostly higher. The dollar is seeing

yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese

stocks, with the Nikkei advancing 1%. Several other markets in the region also

gained more than 1%, including Australia and South Korea. China's CSI was an

exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6%

through the European...

Read More »

Read More »

The Extended Holiday Makes for Subdued Price Action

Overview: The holiday continues. In the Asia Pacific

region, Hong Kong, Australia, and New Zealand, and the Philippines markets were

closed. The regional bourses advanced but China. European markets remain

closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is

off nearly three basis points to about 3.36%. The dollar is trading quietly

mostly within ranges seen before the weekend. It is slightly softer against

most of the...

Read More »

Read More »

US and Chinese Inflation Highlight the Week Ahead, While the Bank of Canada Stands Pat

Bank

shares rose in Japan and Europe for the second consecutive week, but the KBW US

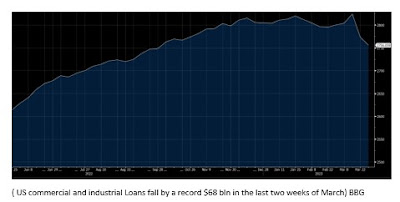

bank index fell nearly 2% after increasing 4.6% in the last week of March. Emergency borrowing from the Fed remains elevated ($149 bln vs. $153 bln). Bank lending has fallen sharply (~$105 bln) in the two weeks through March 29. This appears to be a record two-week decline. Commercial and industrial loans had fallen a little in the first two months of the year...

Read More »

Read More »

Good Friday

Overview: Activity throughout the capital markets remains

light as most financial centers in Europe are closed for the Easter celebration.

Hong Kong, Australia, New Zealand, and Indian markets were closed as well. Still,

most of the equity markets in Asia Pacific advanced, led by South Korea's

Kospi's nearly 1.3% advance. The market responded favorably to news that

Samsung would cut its production of memory chips and shrugged off its smaller

than...

Read More »

Read More »

Fragile Calm Casts a Pall over the Capital Markets

Overview: There is a fragile calm in the capital

markets today ahead of the long holiday weekend for many. The poor US economic

data yesterday and third consecutive decline in the KBW bank index weighed on

risk sentiment. Most of the large bourses in the Asia Pacific region fell, with

Hong Kong and India notable exceptions. In Japan, the Topix bank index fell

1.1% after a 1.9% decline yesterday and is now lower on the week. Europe's

Stoxx 600 is...

Read More »

Read More »