Category Archive: 4.) Marc to Market

US and Canada Jobs: Sill Strong Enough for a Rate Hike

The US grew 156k jobs in August, missing the median estimate by about 16k. The July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0% and 62.9% respectively. Hourly earnings rose 0.2% to lift the year-over-year rate to 2.6% from 2.4%. The average work week increased to 34.4 hours from 34.3.

Read More »

Read More »

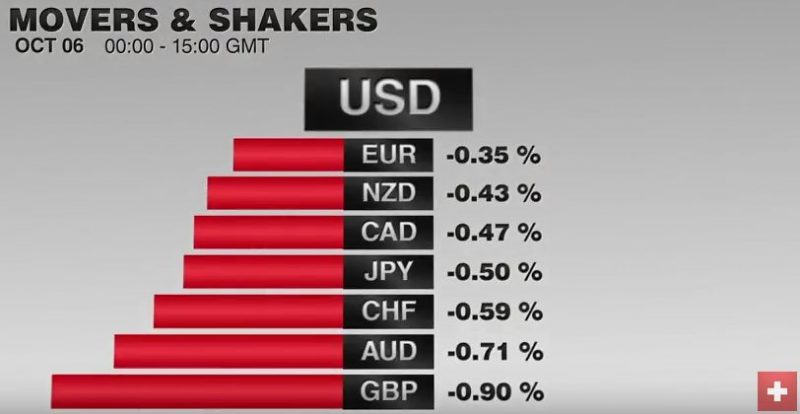

FX Daily, October 06: The Dollar is Firm in Quiet Market

The US dollar is advancing against the major and most emerging market currencies. Activity is subdued and ranges are narrow. We share four observations about the price action. First, the euro has been unable to sustain upticks even after Germany reported a jump in industrial orders three-times more than the median estimate (1.0% vs. 0.3%).

Read More »

Read More »

Canadian Dollar: A Little Less About Oil, a Little More about Rates

The Canadian dollar's link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly.

Read More »

Read More »

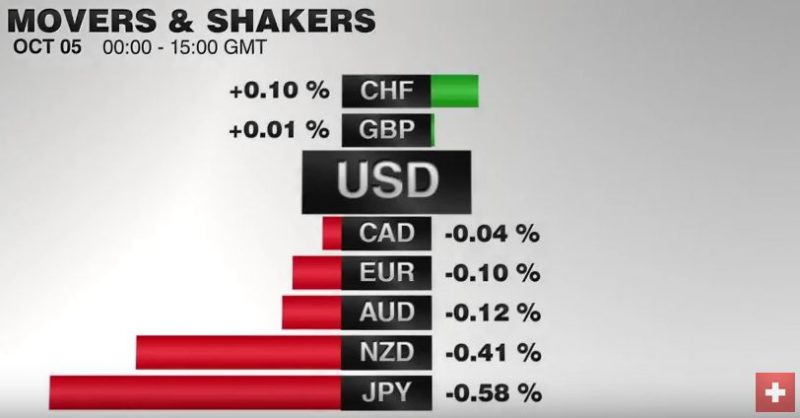

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

Why Portugal Matters

DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating.

Read More »

Read More »

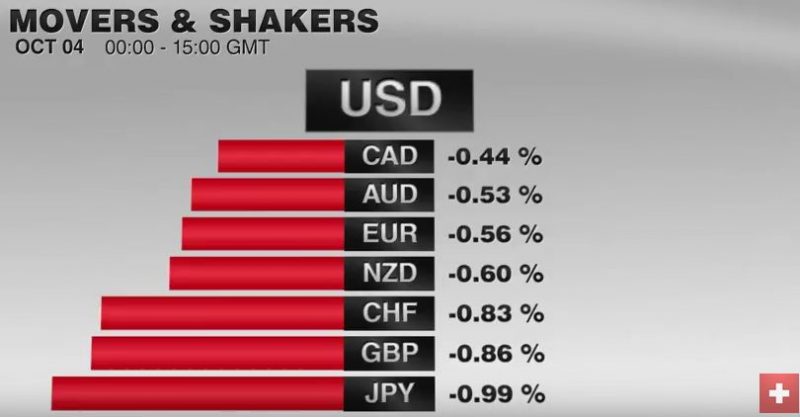

FX Daily, October 04: Sterling’s Slide Continues, EUR/CHF Soars Again

UK Prime Minister May's comments at the Tory Party Conference over the weekend played up the risk of what has been dubbed a hard Brexit and triggered a slide in sterling saw it fall to new 30-year+ low against the dollar just below $1.2760. The EUR/CHF has soared again. Later during the day, it has even achieved 1.0970.

Read More »

Read More »

Cool Video: Bloomberg TV-Dollar Supercycle and Brexit

I reiterated my long-standing view that the euro is going to retest its record lows before the Obama Dollar Rally is over. I warn that the UK's quest to regain sovereignty is an illusion. I announce that my new book will be published in early December or early January.

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »

FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

Read More »

Read More »

FX Weekly Preview: Next Week’s Two Bookends

The start of next week will likely be driven by Deutsche Bank's travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy.

Read More »

Read More »

Weekly Speculative Positions: Speculators Closing their CHF Longs

Marc Chandler speaks of the volatility of the CHF speculative positioning. For us this was window dressing by the SNB that wants to improve the quarterly results. Traders react to the strong market movement caused by the SNB and they close their long CHF positions. If it was really the SNB, we will see on Monday

Read More »

Read More »

Renzi and the Italian Referendum: Disruption Potential Minimized

Italian Prime Minister has set the date for the constitutional referendum as late as practically possibly. It will be held on December 4. The issue is the perfect bicameralism that gives as much power to the Senate as the Chamber of Deputies. Renzi's argument is that the political reform is necessary to make Italy governable. Italy has had 63 governments since the end of WWII. In order to address the economic challenges the country faces, political...

Read More »

Read More »

FX Daily, September 30: SNB Intervenes to Polish Q3 Results

True to its recent habit, the US dollar is finishing the week on a firm note. On the month, though, the greenback has fallen against most of the majors, but sterling, the Canadian dollar, and the Swedish krona. Global equities are trading heavily, and investors' angst is lending support to bond markets.

Read More »

Read More »

Divergence: Norway and Sweden

Sweden has one of the weakest of the major currencies this year. Norway has one of the strongest of the major currencies this year. The key driver is divergence of monetary policy and that divergence is likely continue into next year.

Read More »

Read More »

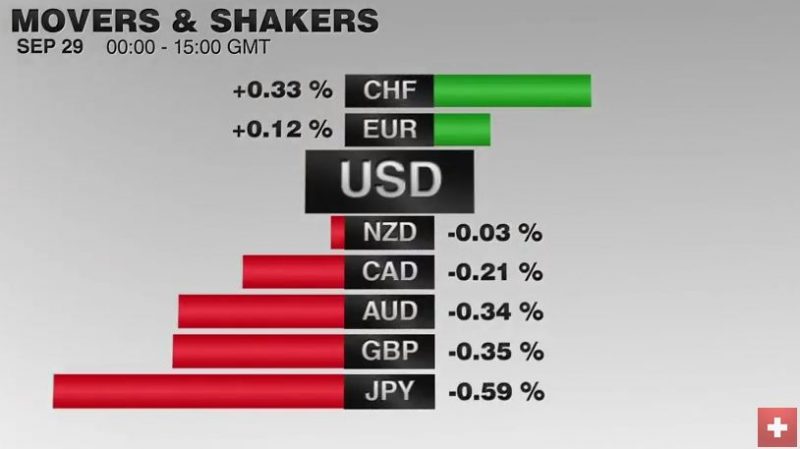

FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen's weakness. While the majors are mostly off marginally and now more than 0.3%, the yen is 0.75% lower. That puts the greenback at a six-day high (~JPY101.75) at its best.

Read More »

Read More »

Quick Look at Why the September Jobs Data will Likely Be Strong

There are several economic data points that suggest a healthy gain in jobs in September. College educated unemployment is 2.5% with high school graduate unemployment at 5.5%. The jobs report we expect is consistent with a Fed hike in December.

Read More »

Read More »

Great Graphic: Growth in Premiums of Employer-Sponsored Health Insurance

Upward pressure on US consumer prices is stemming from two elements. Rents and medical services. Due to the differences the composition of the basket of goods and services that are used, the core personal consumption deflator, which the Fed targets, typically lags behind core CPI.

Read More »

Read More »

FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee.

Read More »

Read More »

Great Graphic: Stocks and Bonds

The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015.

Read More »

Read More »

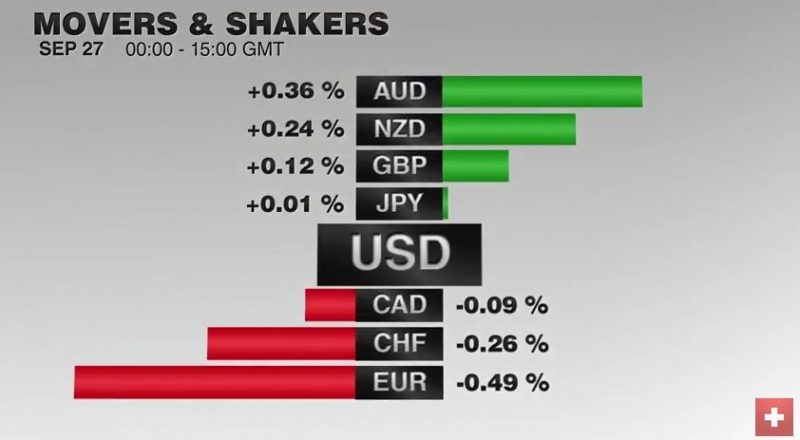

FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Since the monetary assessment meeting, the EUR/CHF is trending downwards. Sight deposits indicate that the SNB is intervening 0.9 bn per week. We emphasized that the preferred intervention corridor is between 1.08 and 1.0850. The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the...

Read More »

Read More »