Category Archive: 4.) Marc to Market

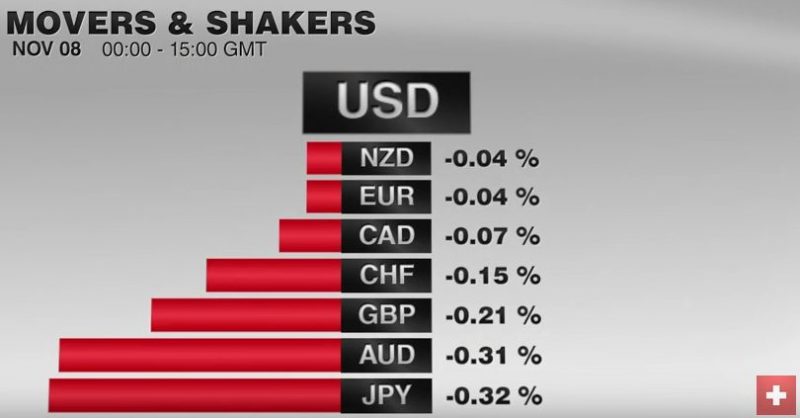

FX Daily, November 08: Consolidation Featured as Market Catches and Holds Breath

The equity markets snapped their losing streak yesterday and are consolidating today. The US dollar is narrowly mixed. The euro and sterling are slightly firmer, but well within yesterday's ranges. The dollar-bloc is a bit lower, and once again the Australian dollar is struggling to sustain moves above $0.7700.

Read More »

Read More »

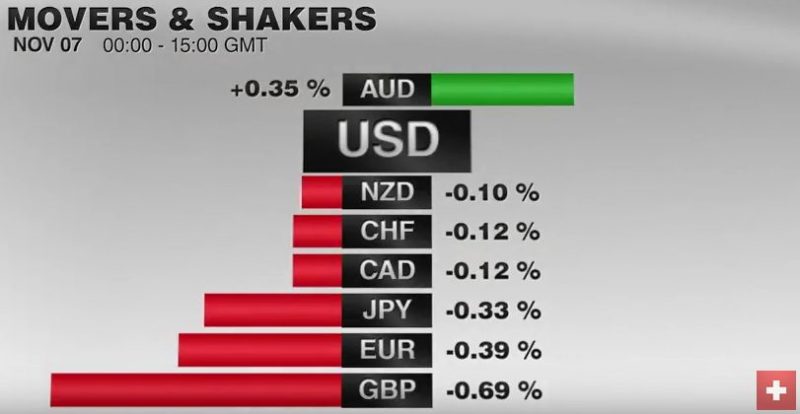

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »

FX Weekly Preview: The US Election is The Driver in the Week Ahead

Neither the Mexican peso's performance nor the fed funds futures seem to show that investors think the election is very close. Not all poll analysis showed what the Financial Times called "knife-edge". None of the poll analysis showed Trump winning, and many appear to have stabilized over the last couple of days.

Read More »

Read More »

Carney’s Tenure: Brief Thoughts

Not only is Carney not resigning, but he agreed to stay a year longer than initially agreed. He will stay for the two years that Brexit is negotiated. Sterling rallied, but did not challenge last week's highs.

Read More »

Read More »

FOMC Says Little New, December Hike Remains Likely Scenario

Fed does not expand much on Sept. statement. Bar to December hike seems low. There were two rather than three dissents.

Read More »

Read More »

Sterling High Court Decision on Parliament’s Right to Vote on Brexit

The UK High Court defends Parliament's right to vote before Article 50 is triggered. The decision will be appealed. Sterling approached an important resistance as it extended its rally for the fifth session.

Read More »

Read More »

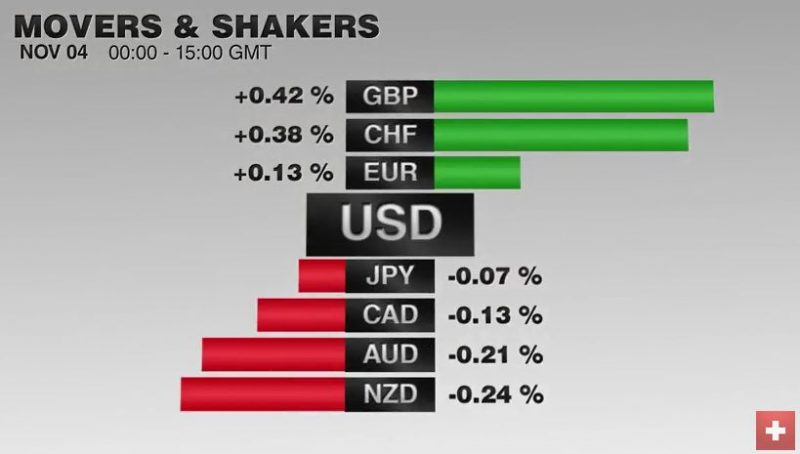

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

Did Carney Really Open the Door to a Rate Hike?

Sterling's recovery began before today and went through technical levels that accelerated the advance. The interest rate market did not change sufficiently to indicate a change in policy expectations. The High Court decision will be appealed.

Read More »

Read More »

US Jobs Data Maintains Fed Hike Expectations

US jobs data was largely in line or better than expected. The stronger earnings growth may be more important than the headline. Canada's data was mostly disappointing.

Read More »

Read More »

FX Daily, November 03: Political Angst Drives Markets

GBP/CHF rates are trading below 1.20 on the exchange, providing those clients holding CHF with some of the best rates they’ve seen in the past six years. The Pounds woes have been well documented but with a key day of economic data releases ahead, is it all about to change?

Read More »

Read More »

US Political Anxiety Stems Bond Sell-Off

Bond yields have been rising in the US and Europe since the summer. There are some country-specific considerations and some generalized factors. Anxiety over US politics has helped bonds recover some lost ground.

Read More »

Read More »

FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

The single biggest driver in the capital markets is the continued narrowing of the US election polls. The prospect of a Trump presidency and the dramatic changes that could entail is rattling investors and spurring position squaring.The dollar is broadly lower as are stocks. The surge in global yields has been arrested.

Read More »

Read More »

EC Pushes Back on (8) Draft Budgets

Long before the UK referendum, many argued that monetary union was undermining the European Union. Many had expected Greece to be forced out not once but twice. There is a cottage industry of books forecasting the demise of EMU.

Read More »

Read More »

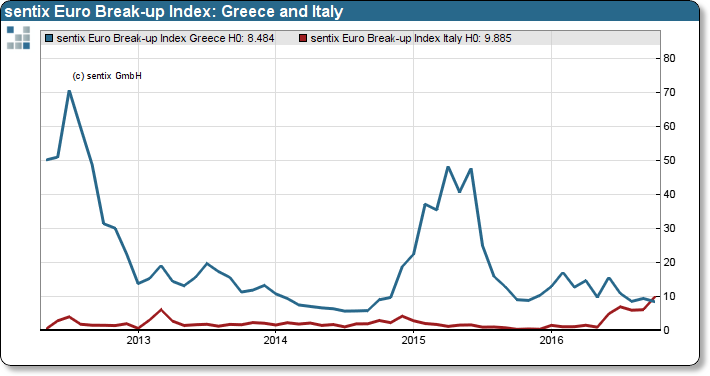

Great Graphic: Sentix Shows a Shift

The risk that the eurozone implodes over the next year has risen, but is still modest. Italy has surpassed Greece as the most likely candidate. The December referendum is the second part of Renzi's political reforms.

Read More »

Read More »

FX Daily, November 01: Dollar and Yen Slip in Quiet even if Eventful Turnover

The US dollar is posting minor losses against most of the major currencies today.The Japanese yen is the exception, as the greenback continues to straddle JPY105. There have been several developments today, and the US also has a full economic calendar today. The most important of the developments was the upbeat message from the Reserve Bank of Australia.

Read More »

Read More »

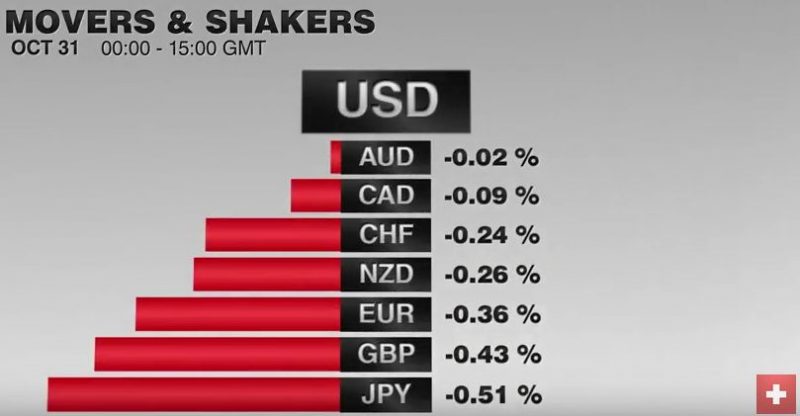

FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

he latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump's fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton's emails and the national polls have narrowed.

Read More »

Read More »

Are Foreign Investors Done Selling Japanese Equities?

Foreign investors have sold more than JPY8 trillion of Japanese equities through September. Nikkei technicals have improved and the yen has softened. Foreign investors have been net buyers for the past four weeks.

Read More »

Read More »

FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical.

Read More »

Read More »

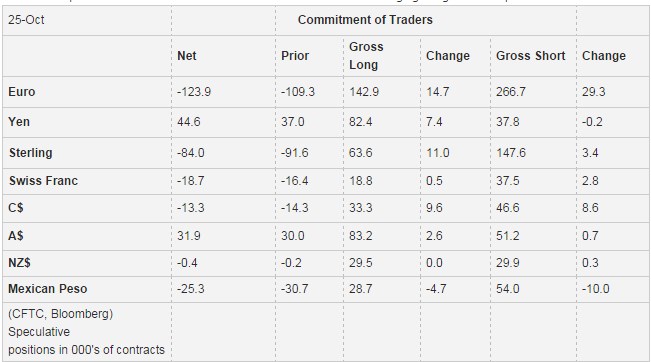

Weekly Speculative Positions: Bottom-Picking Sterling, Swiss Franc Even More Net Short

Speculators increased their Short Swiss Francs to Net 18K contracts. While they started to bottom-pick Sterling.

Not everyone is convinced that sterling will bounce. The bears extended their gross short sterling position by 3.4k contracts to 147.6k. On the eve of the UK referendum, the gross short position was around 94k contracts.

Again speculators, both bulls and bears have rapidly expanded their exposure in recent weeks. In the most...

Read More »

Read More »

Riksbank and Norges Bank Policy Meetings

Six major central banks meeting over the next six sessions. Sweden's Riksbank is the most likely ease policy of these central banks, but it is not particularly likely. Norway is decisively on hold, as fiscal policy does some of the heavy lifting.

Read More »

Read More »