Category Archive: 4.) Marc to Market

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

Busy Week for the UK

The UK reports inflation, employment and retail sales this week. The BOE meets but will keep rates steady. The US 2-year premium over the UK is the highest since at least 1992 today.

Read More »

Read More »

FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers' currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso.

Read More »

Read More »

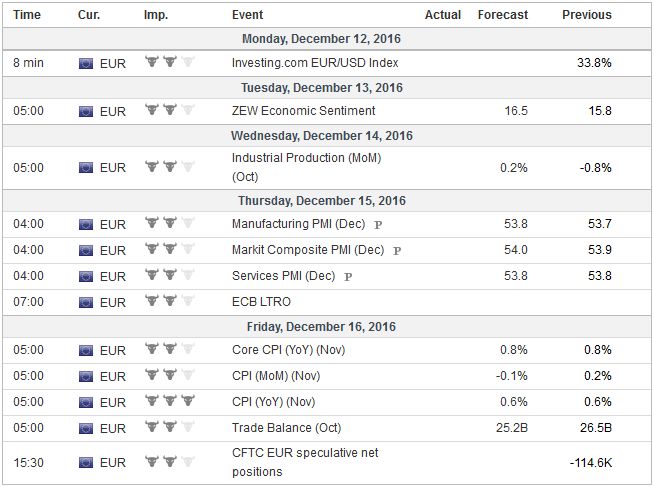

FX Weekly Preview: What the FOMC Says may be More Important than What it Does

FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM.

Read More »

Read More »

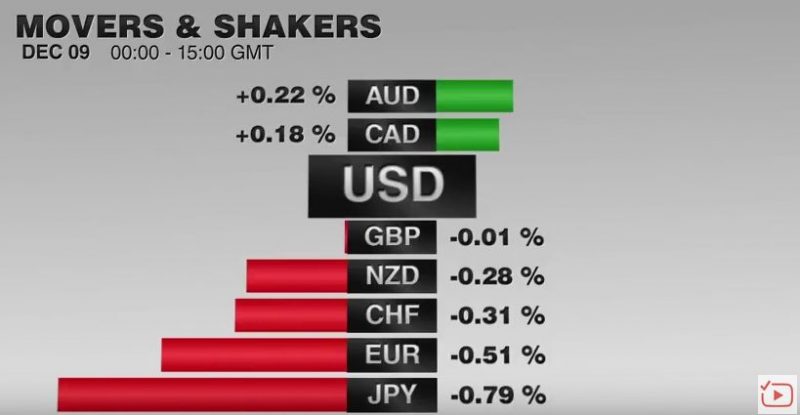

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

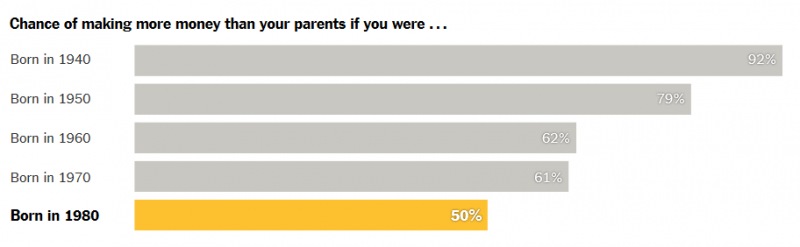

Great Graphic: Another Look at the Reproduction Problem

In order for a society to be sustained social relations have to be reproduced. Yet now neither the middle class nor capital are able to reproduce themselves. This may be the single greatest challenge our society faces.

Read More »

Read More »

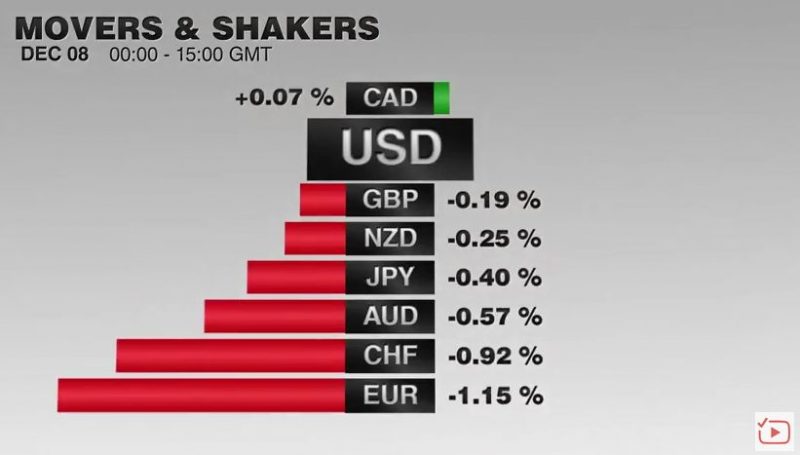

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

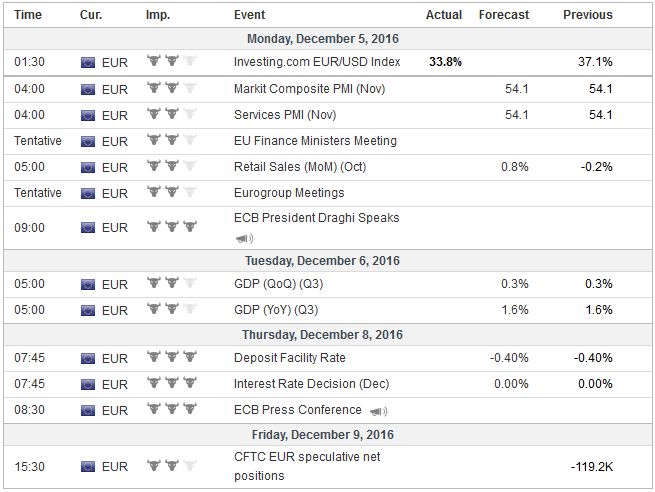

ECB: Dovish Taper or Hawkish Ease?

Purchases increased for longer but at a lower level; overall, more purchases than anticipated. Euro spiked higher on the announcement, but has subsequently dropped 2 cents. Lower inflation forecast for 2019 shows scope for a further extension.

Read More »

Read More »

Cool Video: Discussing the ECB on Bloomberg TV

Tired of reading what analysts are saying? Here is a 4.3 minute video clip of my discussion earlier today on Bloomberg TV about the outlook for tomorrow's ECB meeting. The discussion covers various aspects of the ECB's decision.

Read More »

Read More »

ECB and the Future of QE

ECB will likely extend asset purchases in full. It may modify the rules by which it buys securities. It may adjust the rules of engagement for its securities lending program.

Read More »

Read More »

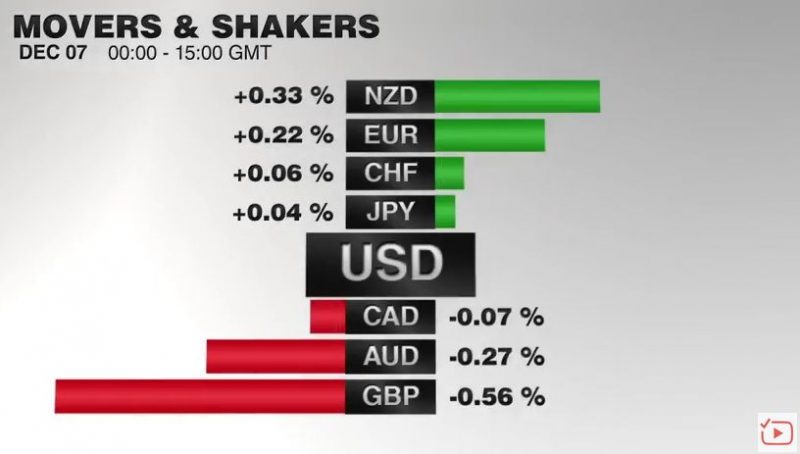

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

Greek Bonds may Soon be Included in ECB Purchases

The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece's debt is sustainable, but the IMF disagrees.

Read More »

Read More »

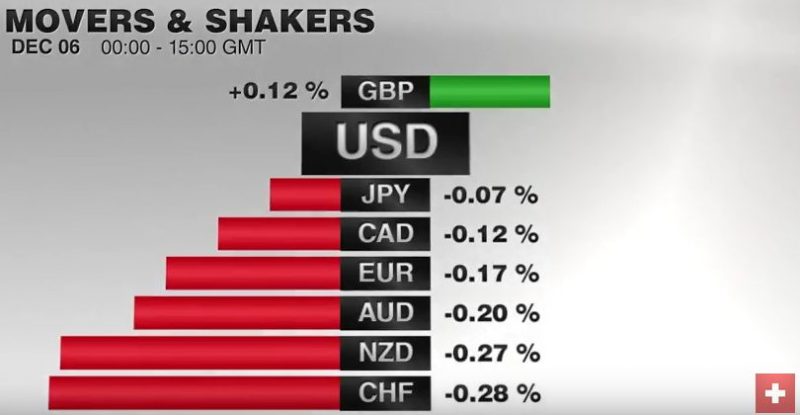

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

Yen and US Yields

Dollar-yen has been driven by the sharp rise in US bond yields. There are some (dollar) bearish divergences in the JPY/USD technicals. US 10-year yields may also be putting in a near-term top.

Read More »

Read More »

Great Graphic: Dollar Index Update

The Dollar Index's technical tone has deteriorated. It is corresponding to the easing of US rates and a narrowing differential. The risk is that the correction can continue in the coming days.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »

What Would Make This Dollar Bull Nervous

USD had a large rally in November. We had been looking for a short and shallow pullback. Here are thoughts about what would signal an outright correction.

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. The unemployment rate dropped to 4.6%, the lowest since 2007.

Read More »

Read More »