Category Archive: 8b.) Economic History

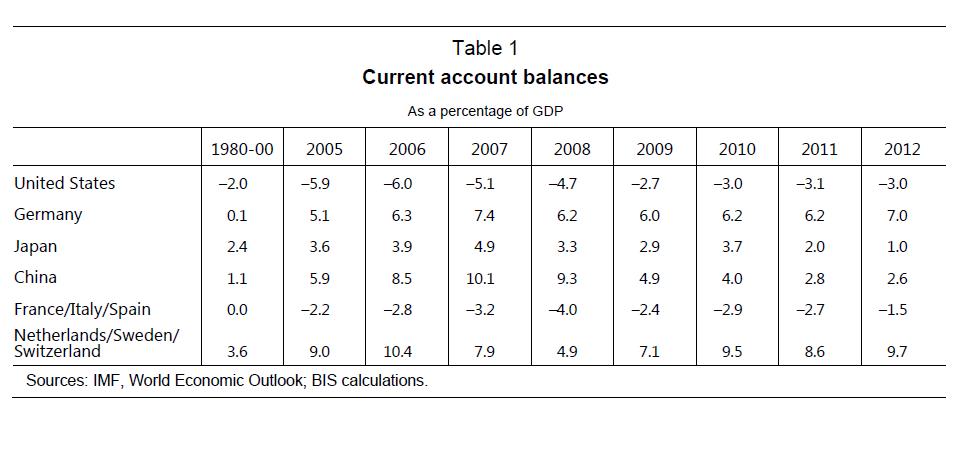

Overlending and Global Imbalances in Current Accounts

Some extracts from BIS Working Papers No 419 Caveat creditor: The Bank for International Settlement stresses the importance of getting "overlending" under control.

Read More »

Read More »

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »

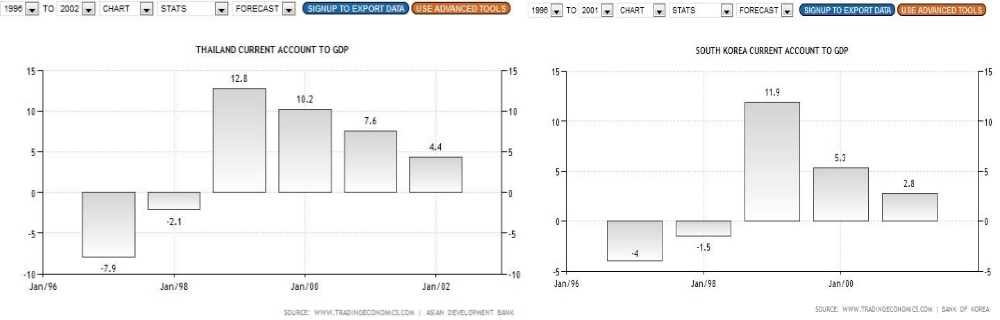

Strong Dollar: the Parallels Between Now, the 1980s and 1998-2002, Part 1: Austerity

We examine the relationship between strong dollar phases and austerity in other parts of the world. Between 1983 and 1985 one reason for the strong dollar were high real interest rates in the U.S. after the defeat of the Great Inflation period, the enforced austerity in Southern America and cheap commodity prices caused by generally …

Read More »

Read More »

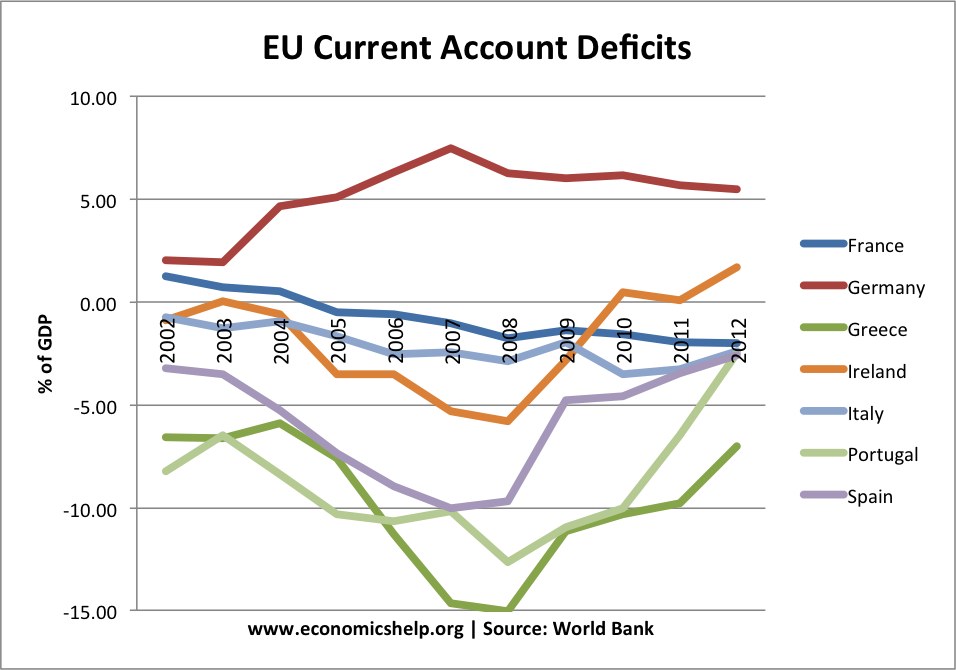

History: The Lost 1980s Decade in Latin America

Peripheral Europe is going to follow step and step the Mexican and the resulting Latin American debt crisis of the 1980s.

Read More »

Read More »

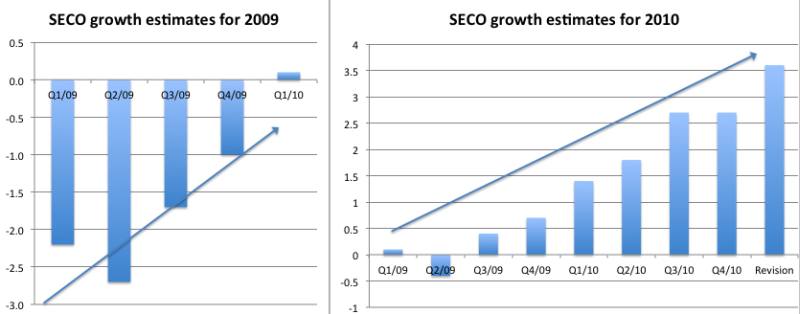

SNB Monetary Policy Assessment Outlook

On Thursday, December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to …

Read More »

Read More »

Order the Full Report on the S&P Critique

In the full report we explain in detail how one can analyze the balance sheet of the Swiss National Bank (SNB) based on several sources of information, for example the monthly bulletin, which shows the changes of the SNB balance sheet and the quarterly distribution of the SNB assets including the information about FX … Continue reading...

Read More »

Read More »

How former central bankers stepped up against the central banks

There are already three former European central bankers who criticize more or less openly the European Central Bank (ECB).

Read More »

Read More »

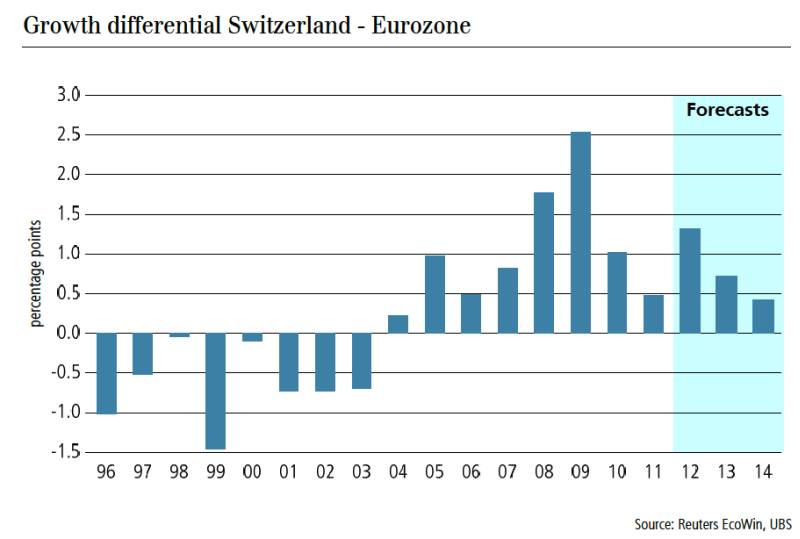

Swiss Franc at record highs (May 2011)

May. 27th 2011 Extracts from the history of the Swiss franc (May 2011) This month, the Swiss Franc touched a record high against not one, but two currencies: the US dollar and the Euro. Having risen by more than 30% against the former and 20% against the latter, the franc might just be the world’s … Continue reading »

Read More »

Read More »

EUR/CHF: A History of Interventions, April 2010

April 2010 Quick Look At The Order Books AUD/USD: stops below .9135 and again below .9070 USD/JPY: solid bids 92.70, stops below 92.40, heavy semi-official bids expected at 91.50 ( I’m hearing of “massive” stops below 90.50 so if market gets on a roll lower keep this level in mind) EUR/USD: looks like the order … Continue reading »

Read More »

Read More »

EUR/CHF A History of Interventions: October 2009

A market view history of the EUR/CHF from the website ForexLive October 2009 Cue The Jaws Music EUR/CHF is trading below 1.5100, presently at 1.5090, very nearly at 1.5o80 where the SNB is last said to have intervened………. More Signs Of US And Global Recovery The US GDP number was yet another sign of a global economic recovery … Continue reading...

Read More »

Read More »

Recent History of the Swiss franc: May 2009

A market view history of the EUR/CHF from the website ForexLive May 2009 BIS And SNB Expected To Be Buying EUR/CHF On 1.50 Handle Dealers expect to see bids appearing from either the Swiss National Bank or the Bank for International Settlements if EUR/CHF dips back towards 1.5050. By Sean Lee || May 28, 2009 at 04:03 … Continue reading »

Read More »

Read More »